To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

If you’re like most of us (or at least most who read personal finance topics), knowing how much it takes to be wealthy is at least somewhat of interest to you.

Does a High Income Make You Wealthy?

First, we need to be clear on what counts as being wealthy.

High income, say 6 or even 7 figures, doesn’t count as being wealthy. Really.

Sure, having such a high income means you can afford to buy a lot of things. More importantly for our purpose here, it means you can save and invest a lot, which lets you build wealth far more easily than someone with a lower income. However, if you earn $1 million a year and spend $1.1 million, you’re destroying wealth rather than creating it.

Wealth isn’t determined by income, but rather by what you have set aside, and preferably invested. For a lucky few, wealth may also be inherited and passed down over multiple generations. Wealth is determined by your net worth or the difference between what you own and what you owe.

High income and wealth are somewhat correlated, but they’re not the same. In fact, it appears that other factors are at least as important. Things like age (you’ve had more time to invest), consistency (if you’ve earned a good income over a long time period, you’re more likely to be wealthy than someone who earns more now, but hasn’t earned more for most of her career), frugality (the less you spend, the more you can invest and build wealth), and luck (this could be having the luck to be born to a wealthy family and/or to have outsized investment returns as a result of taking high-risk investments that pan out).

Where Does Your Net Worth Put You in the American Wealth Distribution?

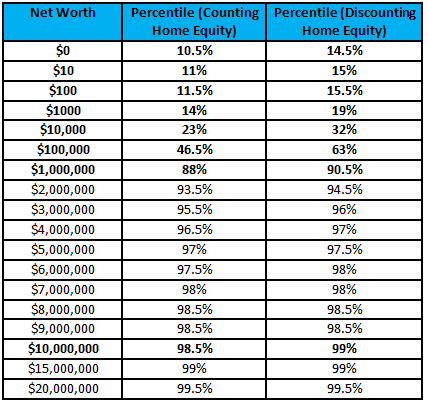

According to a nifty calculator at DQYDJ.com, here are the net worth percentiles in the US. These tell you what fraction of Americans has a lower net worth than the numbers in the left column. Home equity here means the value of your primary residence less any mortgage balance owed on that property.

What does this table teach us?

- Obviously, counting your home equity as part of your net worth generally increases the number, so the percentile for the same net worth without equity should be higher. The difference is if you’re “underwater” and have a negative equity (which most homeowners don’t).

- Nearly 1 in 9 Americans have a negative net worth.

- Nearly half of Americans have a net worth lower than $100,000.

- Being a millionaire doesn’t quite put you in the top 10% (unless you have a million beyond your home equity). According to research from 2020, there were 12.1 million American households with a net worth above $1 million (discounting home equity).

- To be in the top 5% requires more than $2 million.

- The top 1% have about $15 million counting home equity or $10 million discounting it.

- Increasing your net worth 10-fold makes the biggest difference between $100,000 and $1,000,000. This shouldn’t be surprising, since that’s a $900,000 increase which is far bigger than any of the lower tiers. Once you hit $1 million, there’s only 12% above you so you can’t go higher by more than that even if you get to a trillion dollars.

Is Wealth Solely a Matter of Your Net Worth?

In their highly regarded book, The Millionaire Next Door, Thomas J. Stanley and William D. Danko define a classification of Americans into three categories.

- Under accumulators of wealth (UAWs): Those who have less than half their expected net worth for their age and income according to the authors’ “Wealth Formula”

- Average accumulators of wealth (AAW): Those whose net worth is within a factor of 2 of their expected accumulation

- Prodigious accumulators of wealth (PAWs): Those who have a net worth that’s double (or more) what they “should have” accumulated.

This “Wealth Formula” simply takes your total income, multiplies it by your age, and divides it by 10. If you’re married, you’d take your joint income and the age of the older of the two of you.

For example, if John Smith earns $120,000 a year (including wages and investment returns), and is 45 years old, his expected net worth would be $120,000 x 45 / 10 = $540,000. If John has a net worth of less than $270,000, he’d be in the UAW category. If he accumulated over $1,080,000, he’d be a PAW. If his net worth is between $540,000 and $1,080,000, he’d be in the AAW category.

While all other things being equal, higher net worth makes you wealthier than someone with a lower net worth, you could have a lower net worth than someone else, but be considered wealthier because your income and/or age are lower.

For example, if 40-year-old Jack makes $600,000 a year and has $1 million net worth, he is less wealthy than 40-year-old Jane who makes $60,000 and has a net worth of $500,000. Despite Jack’s net worth being twice Jane’s, he’d be in the UAW category, while she’s a PAW.

The Bottom Line

Having a lot of money isn’t the only or even most important thing, but… As my wise grandmother used to say, “Money is the least important thing, as long as you have plenty of it.”

The above will show you where you stand relative to other Americans in terms of your net worth, either with or without counting your primary residence equity. Further, you’ll be able to figure out where you stand relative to where you “should be” based on your age and income.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor