To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Except for the very top one-tenth of one percent of us, it’s the rare person who can afford it all at once.

If you’re in that rarefied group, you don’t need to read any further.

If you’re not, this one’s for you.

Your Big Financial Goals

For most of us, here are the typical big financial goals we strive to achieve.

- Pay off debt (credit cards, student loans, auto loans, mortgage, etc.)

- Build your emergency fund

- Put your kids through school without overwhelming student-loan debt

- Buy a home

- Save and invest for retirement

Your specific mix of these will be different than mine. You probably have more or less debt than I do. You may have no savings for an emergency or you may already have set aside enough to cover more than a year of expenses. You may not have any kids or they may all have already graduated from college. You may still be staring at multiple hundreds of thousands of dollars in the full cost of college attendance for several kids in the coming years. You may not have bought your first home yet or you may already own it free and clear. You may have not yet started saving and investing for retirement or you may have already amassed all you need to cover your comfortable retirement.

However, if you’re still reading here, it’s a given that whatever the particular mix of financial goals you want to attain, you can’t fund all of them at once.

Prioritizing is the name of the game.

Prioritize

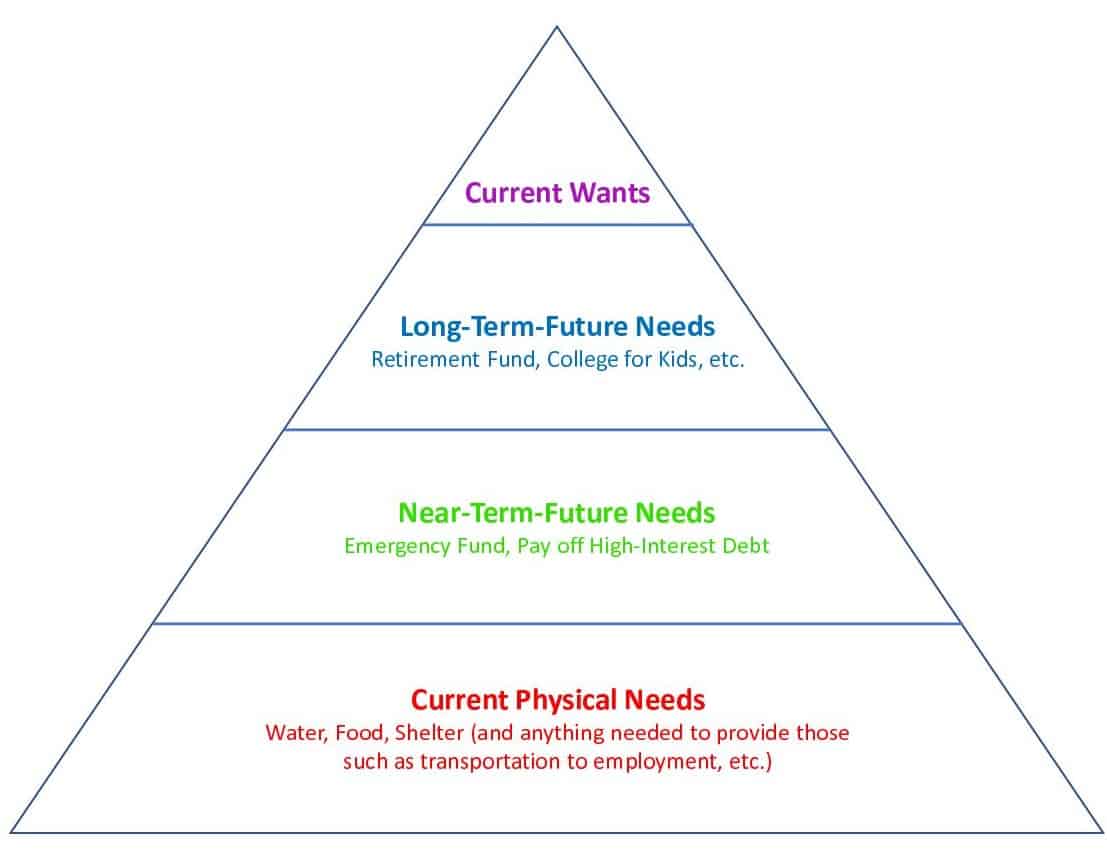

A famous psychological paradigm called Maslow’s Hierarchy of Needs is built like a pyramid. “Needs lower down in the hierarchy must be satisfied before individuals can attend to needs higher up.”

Maslow started with physiological needs: food, water, warmth, rest (if you’re an astronaut, you’d put air in front of all those). Next, safety needs: physical safety and personal security. Then Maslow proceeded to list psychological needs such as belonging and love, esteem, and self-actualization.

Similarly, when considering how to allocate your money, there are needs you must attend to first, then other needs, and only once all needs are attended to can you proceed to your wants.

Current Physical Needs

Your priorities start with making sure you survive today and tomorrow.

This includes not just food, water, and shelter, but also anything you have to pay for to be able to bring in the income that provides those. That could be a car if you must commute to work and public transportation isn’t a good option. It could also include equipment and supplies if you have to provide those (e.g., if you’re a freelancer).

Near-Term-Future Needs

Once that’s covered, your next batch of money can be allocated to building an emergency fund and paying off high-interest debt such as payday loans, credit cards (that don’t offer a 0% teaser rate), and private student loans. The emergency fund is so you don’t lose your ability to cover the first tier if something goes badly wrong and paying off high-interest debt is so you’re not constantly hemorrhaging money due to such high interest.

Your emergency fund size is determined by your minimum expenses, the stability of your income and how diversified it is, whether you have other resources (e.g., spouse’s income, parental safety net, etc.) and whether you have obligations that limit your flexibility (e.g., young kids make it harder to move to a less expensive part of town).

If you have access to enough credit, you could consider first paying off your credit cards and only then building an emergency fund. This is because the credit that becomes available as you pay down your debt could be used to cover an emergency. However, take into account that the credit card issuer(s) could decide to lower your credit limit if your income takes a big hit, leaving you with no emergency fund and no access to credit.

As another caveat, if your employer offers a 50% or better yet 100% match for your contributions to their retirement plan, consider funding that too up to the maximum match at this tier, even at the cost of taking longer to pay off credit cards. However, (a) this doesn’t apply to payday loans – those carry such insane interest rates that they must be eradicated first, and (b) try finding a 0% or low-interest offer from a new credit card or a consolidation loan so you reduce your cost of carrying that credit card debt.

Long-Term-Future Needs

Once you’ve handled your present and near-term needs, start allocating money to longer-term financial goals. Start with your retirement fund if you haven’t maxed out in the previous tier any match offered by your employer.

Once you’ve maximized any employer match, consider investing through a Health Savings Account (HSA) if your health plan is a high-deductible, HSA-compatible plan. HSA contributions are deductible, any returns from investments in such plans aren’t taxed until you withdraw them, and if you use withdrawals for health-related expenses (even if in retirement), those withdrawals are completely tax-free.

Next consider a Roth IRA, unless your tax rate is high and your income low enough to qualify for a deductible traditional IRS, in which case get the deduction and try using the tax savings for taxable investments that provide you more flexibility than retirement accounts. If you do this, try keeping tax-efficient investments in this account.

Once you’ve maxed out all the above, go back to your employer retirement plan and max out your non-matched contributions there.

Saving for kids’ college funds is important, but less so than saving for retirement. As they say, you can borrow for college, but borrowing for retirement is very hard (the only way to do that is a reverse mortgage, and that’s only available if you own your home).

You may be wondering why paying off your mortgage isn’t listed in any of these tiers. The answer is that it is, under shelter in the first tier. However, paying it off early isn’t, because that’s financially foolish and leaves you at greater risk of losing your home if you lose your income before that early payoff date, which is likely still over 15 years away.

How about auto loans? These should be included in the second tier if they charge high interest (my first auto loan came in at a whopping 10.4%!). However, if they’re low-interest (my most recent couple of auto loans were at 0% APR!), paying the regular payments is included in the first tier in enabling you to get to work. Paying it off early isn’t necessary, because a 5-year loan at say 3% would only cost you $78 per $1000 of original loan balance over the life of the loan.

Current Wants

Finally, you need to budget some money for your current wants. You don’t want to work hard for a lifetime to fund your retirement, never spending money on enjoying the present, only to die just before you retire. It’s also really hard to sacrifice decades of enjoyable experiences and not give up.

Thus, make sure your budget includes spending money for things you don’t need, but that you enjoy and value. These could include giving gifts to family and friends, vacations and other experiences, etc.

Another want is charity. If you tithe to your church or pay membership dues to your synagogue or another religious congregation, you may see this as a need. However, consider that making sure you provide for your family’s needs and avoiding a situation where you become a burden on them may need to take priority.

What to Do If You Run Out of Money Before You Cover All Four Tiers

If you find yourself in this unpleasant situation (this describes the first 16 years after I moved to the U.S.), you have two main options. Use either or preferably both.

Reduce Your Costs

Review your budget for the first tier and see if you can reduce costs by e.g. moving to a less expensive neighborhood, choosing a less-expensive car (research Edmunds.com to see the full cost of ownership and compare different options – sometimes owning a new car and driving it for over 10 years costs less in the long run than buying a used car and having to replace it earlier) or no car if you have good public transportation solutions, etc. See if you can find cheaper alternatives to cover other needs such as food (we ate lunch at a local hospital cafeteria for years because it was cheaper and healthier than even fast-food joints).

Increase Your Income

Try to find ways to make more money. This could be a side hustle, a promotion, moving to a different employer, taking in a renter for a spare room if you own your home, or subletting a room if you’re renting and your landlord agrees, etc.

The Bottom Line

There’s an almost infinite variety of things you can spend money on.

There’s a smaller, but still substantial list of things you can save for (or programs through which you can save and invest).

The above Maslow-like hierarchy of financial priorities can help you prioritize where your money goes first, second, third, etc.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor