To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

What jackpot sizes make the lottery worth playing?

You read or hear about it every once in a while. Some Jane or John Doe just won a ton of dough playing Mega Millions or Powerball.

You sit there and think, “Man, that could’ve been me! Had I only bought some tickets…”

The Odds of Winning (Anything) Playing Mega Millions

Straight from the horse’s mouth, the Mega Millions odds are shown in the following table.

Your odds against winning anything at all is 23.99 to 1.

That means that for every 24 tickets you buy ($48), you should win one prize, almost certainly $2 or $4.

Given the Odds, Is There Ever Any Point in “Playing” the Mega Millions?

To answer this question, we need to dip our toes into statistics. Specifically, the term “expectation value.”

Here, the expectation value is what you can expect to get back, on average, from every ticket you buy. The calculation is simple and fairly intuitive.

You multiply the value of each possible outcome by its likelihood; then you sum those up for all possible outcomes.

Here, your possible outcomes are:

- Winning nothing: value = $0, likelihood = 0.958316 (where certainty means a likelihood of 1.0)

- Value = $2, likelihood = 0.027027

- Value = $4, likelihood = 0.011236

- Value = $10, likelihood = 0.001443

- Value = $10, likelihood = 0.001650

- Value = $200, likelihood = 0.0000687

- Value = $500, likelihood = 0.0000258

- Value = $10k, likelihood = 0.00000107

- Value = $1 million, likelihood = 0.000000079

- Value = jackpot ($40 million minimum), likelihood = 0.0000000033

Summing these up, the expectation value per ticket (if the jackpot is the minimum of $40 million) is $0.38.

That’s what you get back, on average, for every $2 ticket.

Such a deal!

Not for you, though! For the state!

Clearly, it isn’t a good idea for you to buy even one ticket when the average return is negative 81%!

And no, you can’t make up the losses through volume, i.e., by buying more tickets.

At this point, you could object that the jackpot isn’t always a measly $40 million, and you’d be right. What if it’s far higher? At what point do we reach breakeven?

On its face, if the jackpot is over $530,527,283 your expectation value seems to be almost exactly $2.

However, three things would make that assumed breakeven point an overly optimistic number.

- Taxes

- The jackpot number is always given based on the total of annuity payments over 30 years.

- You may not be the only winner

Let’s start with the impact of taxes.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

Assuming your total marginal income tax bracket (federal, state, and local) should you win $1 million or more would be 45%, and if you win less than $100k it would be 30%.

Your after-tax winnings would lead to a $0.23 expectation value per $2 ticket for a $40 million jackpot, and $1.13 assuming the above-mentioned $530,527,284 — still far short of your $2 ticket cost.

To break even after taxes, you’d need to have the jackpot be at least $1,011,844,197. That’s over $1 billion with a “b”!

Next, let’s look at the lump sum vs. the annuitized amount.

According to Omni Calculator, if you win a nominal Mega Millions jackpot of $1,011,844,197, your lump-sum payout would only be about 52% of that, or $526,158,982.

This means that if you want to know the real breakeven here, you’d need to divide the nominal number by 0.52 (52%), which brings us to a breakeven point of $1,945,854,227.

This means the jackpot needs to be almost $1.95 billion for you to reach breakeven! And this assumes that if you win the jackpot, you’d be the only one to do so.

According to Mega Millions’ official website, “Since the game began in 2002, there have been 210 jackpots won by 236 individual tickets (21 jackpots have been shared by two or more winning tickets).” That seems to give you a 90% chance of being the sole winner.

However, far more tickets are sold when jackpots become huge.

Business Insider estimated your chance of being the sole winner of a massive jackpot (in the extraordinarily small chance you win it) is just 40%!

To translate that to a new breakeven number, we’d need to increase the jackpot size by a factor of 1.429 (the inverse of 70% = 40% if you win alone plus half of 60% if you share with one other winner - we’ll neglect the smaller likelihood of sharing with two or more other winners), for a final breakeven number of $2.78 billion!

That’s never happened yet (the highest ever was $1.57 billion), so playing Mega Millions is truly a sucker’s bet.

How About the Megaplier?

Mega Millions added a small wrinkle.

For an extra $1 per ticket, you can have all the non-jackpot prizes multiplied by a randomly chosen factor that can be 2, 3, 4, or 5. Given the likelihood of each of the factors, the average value of this play is a 3-fold increase in the non-jackpot prizes.

This changes the math a little, but not in your favor.

The expectation value of the Megaplier is just $0.49 before tax or about $0.35 after tax, and this value doesn’t improve when jackpots go up.

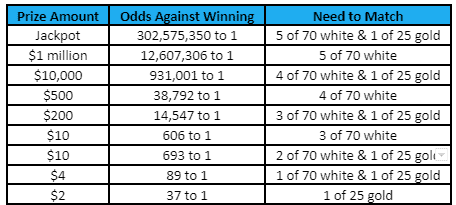

The Odds of Winning (Anything) Playing Powerball

Straight from the horse’s mouth again (just a different horse this time), the Powerball odds are shown in the following table.

The math is very similar, so we’ll run through it quickly…

Your odds against winning anything at all is 24.77 to 1.

That means that for every 25 tickets you buy ($50), you should win one prize, almost certainly $4.

Given the Odds, Is There Ever Any Point in “Playing” Powerball?

The expectation value per ticket (if the jackpot is the minimum of $40 million) is $0.35. That’s what you get back, on average, for every $2 ticket.

On its face, if the jackpot is over $ 486,447,951 your expectation value seems to be almost exactly $2. But after taxes that drops to about $1.14. To make up for taxes, the breakeven point grows to $944,698,852. Using Omni Calculator’s Powerball calculator, the lump-sum breakeven point grows to $1,816,728,561.

Assuming a similar 60% chance of sharing a massive jackpot with at least one other person, the final breakeven for Powerball is about $2.60 billion.

Slightly less bad than the Mega Millions’ $2.78 billion breakeven, but still a huge sucker’s bet considering that the largest Powerball jackpot was just over $2 billion.

And similar to the Megaplier, the Powerplay makes things worse, not better for you.

The Bottom Line

There’s a good reason why the lottery has been called a tax on the poor.

Only someone desperate enough (and/or financially illiterate) would hand over hard-earned money for the “privilege” of grasping at such an elusive straw.

The likelihood of winning the jackpot, about 1 in 300 million, is about 239× smaller than the one-in-1,222,000 risk of getting hit by lightning in the coming year (according to Weather.gov)! Winning the jackpot is as likely as getting struck by lightning in the US during an average 37-hour period, including any time you spend indoors and any time there isn’t a storm within a thousand miles!

To get a visceral sense of how unlikely winning the big one is, how likely do you think the winning numbers would be 1, 2, 3, 4, and 5 with a Powerball or Mega Millions gold ball number 6?

Sounds absolutely impossible, right?

Guess what?

That set of numbers has the exact same (near-zero) likelihood of winning the jackpot as any other possible set of numbers.

The only reason anyone should “play” in such an incredibly rigged game is for the entertainment you may get from fantasizing about a huge win. If that entertainment is worth a buck or two, go ahead.

Just don’t do it expecting to win.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. An MSc in theoretical physics, a PhD in experimental high-energy physics, a postdoc in particle detector R&D, a research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started several other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. I draw on these diverse experiences to write about personal and small-business finance to help people achieve their personal and business finance goals.

Follow me on Medium (opher-ganel.medium.com).

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

What to Read Next:

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor