To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Alas, the answer to the title question of this article is… it depends. I was tempted to say “yes” and make this a very quick read. However, I didn’t want to shatter anyone’s retirement dreams. As a Certified Financial Planner™ practitioner, my goal is to do the opposite of that. Really, the honest way to assess this question is to examine if a retiree’s financial resources are enough to last them their lifetime. Doing so will go a long way towards determining whether or not they should consider unretiring during a stock market crash.

What if you are on the wrong side of this equation, AND you can’t go back to work because your health or declining skillset won’t permit it? Perhaps it is better to avoid a market crash altogether. But isn’t that timing the market? That surely can’t be done. Many readers have probably heard the overused saying, “it’s not about timing the market, but time in the market.” What a CONVENIENT marketing tagline for asset managers that make money on people being invested in the market. If investors flee to a stable asset like cash, fund managers are unable to collect their fees (i.e., asset managers make money off of the expense ratios within their mutual funds or exchange-traded funds).

When considering this possible conflict of interest, I would challenge you to ask yourself, “is doing nothing really the best way to manage against a catastrophic loss in your retirement portfolio?” At Paragon Wealth Strategies, our response is “NO.” We will explain more about why that is later in this article.

Regrettably, many retirees living on a fixed income cannot afford to experience a 30% to 50% drop in their investment portfolios. When this happens, retirees are forced to withdraw a larger percentage of their nest egg to maintain their lifestyle. In other words, more shares of an index fund that you own need to be sold to provide the same level of retirement income to which you have grown accustomed.

The Great Recession Example

Let’s take a closer look at how this issue played out during the Great Recession and refer to the figure below – the share price history of the Vanguard balanced fund (VBIAX) measured over 2006 to 2016 – as we work through the example. Please note that this is not a recommendation to buy or sell this particular investment; it’s just an example of a low-cost holding almost any investor could purchase.

It’s the year 2007. Bob Jones just turned age 65 and has decided to retire. As a do-it-yourself investor and spending years following the markets, Bob believes low-cost index fund investing is all that is needed to have a successful retirement. To that end, he decided to go through Vanguard’s online questionnaire to determine his risk tolerance, and its algorithm determined he is a 60/40 stocks/bonds investor. This type of investment allocation is otherwise known as a BALANCED PORTOFLIO.

From there, Bob bought $1M of the Vanguard Balanced Index Fund (VBIAX) within his rollover IRA while it was trading at its peak on 10/12/2007 at $22.74/share. This meant that Bob would have owned 43,975 shares of VBIAX. Then Bob does some back-of-the-napkin math to determine that his annual income need from his $1M retirement portfolio is $50,000. If Bob sold shares at the peak share price of $22.74/share in 2007, the year he retired, Bob would need approximately 2,199 shares of VBIAX to fund his retirement income.

Fast forward to 2008 and 2009, when the stock market tanked. At least Bob owned a balanced 60/40 portfolio, right? Then again, the 40% of safer bond investments may NOT have provided enough protection. Here is why: VBIAX fell to as low as $14.67/share on 11/20/2008 and $14.10/share on 3/6/2009. The shares Bob needed to sell to come up with the $50,000 of retirement income in each respective year were 3,408 and 3,546.

Under the assumption that Bob had the worst possible timing with his withdrawal needs, he ended up liquidating 6,952 shares between 2008 and 2009, or 16% of his total portfolio. This is after his portfolio dropped 35% from peak to bottom. In other words, more than 50% of Bob’s portfolio may have been depleted between 2008-2009. Worse yet, he had to wait until 2/2/2012 to get back to his original starting share value of $22.74.

The Negative Side Effects of Passive Investing

Bob, who was no doubt looking forward to a prosperous retirement, was left with a dilemma. At this point, Bob’s $1M portfolio dropped to $500K. Conceivably, plan B for Bob might be to marry a young, rich sugar-mama. Unfortunately, the reality boils down to 2 decisions:

- Bob can reduce his withdrawals and therefore take a major step back in lifestyle.

- Bob goes back to work part-time, but now he has less time to do things he wanted in retirement.

Neither scenario is ideal. Hence, protecting his nest egg from such catastrophic losses in the first place is perhaps a better alternative. If Bob only had some type of market crash protection strategy in place to begin with…

How a Market Crash Protection Strategy Can Protect Your Retirement Nest Egg

Some of you might be wondering, “so what you are telling me is there is a way to ‘recession-proof my portfolio?’” The answer to that is a BIG FAT NO. Promising to recession-proof a portfolio is both misleading and impossible to guarantee.

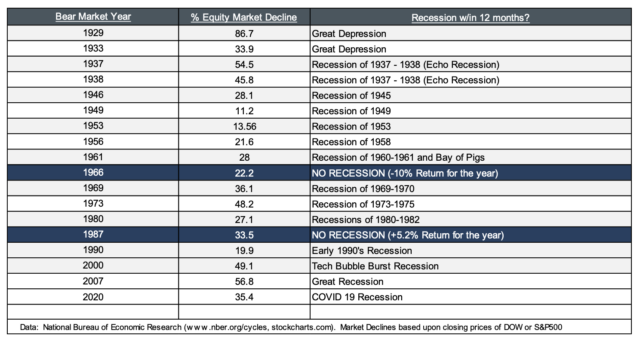

The goal of implementing a recession defense strategy is to avoid being invested in the market when a recession is imminent with the benefit being that you may avoid the steep market crash scenario that can ruin your retirement. We define a significant loss as a loss that exceeds 20%. This is more commonly referred to as a bear market. The rationale for using a recession as an indicator of a market crash is that recessions have a strong correlation to market crashes dating back to the last 100 years of bear market data, as noted in the table below.

History would suggest that the risk-reward tradeoff of being invested in the market during market crashes can lead to poor outcomes. On the other hand, to achieve meaningful growth in the stock market, the objective is to be invested during the bull cycle. Even when a bull market cycle is back in full force, investors must be willing to accept some level of temporary losses (i.e. volatility) in their portfolios. These temporary fluctuations are often referred to as “market corrections.” Normal market corrections are defined as a loss that is between 10% and 20%. According to a study from Charles Schwab, stock market corrections occur with regular frequency or about every two years.

Therefore, understanding your risk tolerance is paramount to controlling the degree of normal market volatility that is right for you. You can manage market risk by varying the percent of “risky” assets (i.e., stocks) versus “safer” assets (i.e., bonds). For example, if a portfolio owns 60% stocks and 40% bonds, and the market drops by 20%, your portfolio will likely drop around 12% for a short time. Since, according to Investopedia, over the long-term, stocks tend to outperform bonds, portfolios with more stocks historically have generated a higher return over time.

Other Benefits of a Market Crash Protection Strategy

Studies show – originally from Dr. Jeremy Siegel in 1991 and subsequently in 2016 from James Conover, David Dubofsky, and Marilyn Wiley – if you can avoid being invested during a bear market by following recession indicators, you may add a 2%-3% average annual return to your portfolio. This is meaningful if your time horizon exceeds 20 years, which is a reasonable expectation for someone retiring in their 60s because the average life expectancy for those that reach 65 is 86 for females and 83 for males.

To highlight the significance, let’s review another example:

Cindy Jones, Bob’s wife, has $500,000 invested in an after-tax brokerage account. She will not be adding any more money to or taking withdrawals from her account over her lifetime. Let’s assume she is getting the additional 2% per year referenced in the studies. So instead of earning 6% in a 60/40 portfolio, she will earn 8%. What is the extra value Cindy gets from the additional return over the next 20 years?

Answer: $726,911[1]

What You Can Do if You Are Retired or Considering Retiring

Let’s look at the present state of the year 2022. Inflation is wreaking havoc across the globe, the S&P 500 is down over 24% as of September 30, it’s the worst bond market since 1842, Russia invaded Ukraine, global currencies are getting decimated, and you made the decision to retire before any of this was fully known. You are now pondering your next move. Is it too late to get out of the market? What if the stock market has already bottomed? How do you know when it’s okay to get back in?

The answer to these questions is a giant ball of wax that must be unwound. The fact is that there is no magic bullet solution. If only… however, the ability to stay retired can be answered with a well-coordinated wealth management plan in concert with an asset management strategy that aims to protect your nest egg from the worst type of losses. If you are feeling uneasy about the current investing environment, check out this page to learn more.

[1] The $726,911 amount was computed using a financial calculator and comparing the difference in the future value of $500,000 compounded annually at 6% versus 8% over 20 years. At 6% the future value was $1,603,568 and at 8% it was $2,330,479.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Scott Snider

Scott is a Partner with PARAGON and works with the wealth management team. An entrepreneur at heart, Scott specializes in working with small business owners and corporate executives. Additional areas of expertise include retirement income planning, tax minimization strategies, and college planning.

View Scott’s Profile on Wealthtender | Visit Scott’s Website

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor