To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

How do I get stacked rewards worth over 13% from a single credit card plus thousands more from others (despite Dave Ramsey’s rants)? And is it just me? Or do financial professionals play the credit card rewards game, too?

If you follow Dave Ramsey, you know he hates debt (he makes a grudging exception for 15-year fixed mortgages).

He especially despises credit cards.

Here’s a quote from one of the “Ramsey Solutions” blog posts:

“What’s the best kind of credit card? I’ll be honest with you: The best credit card is no credit card. It’s called Capital None, and it’s amazing. But seriously, there isn’t one.”

But how about rewards cards?

“Sure, there are plenty of shiny credit card rewards out there. But you usually have to use your credit card a lot and spend a lot to earn them. And high rewards cards tend to have higher interest rates and higher annual fees. So, by the time you get that free flight to New York, you’ve already handed over more than the cost of a plane ticket to the credit card company. Yeah, those freebies aren’t really free when you do the math.”

Now, let’s contrast hyperbolic rants with reality…

I Use Credit Cards. All. The. Time.

I use credit cards pretty much for anything I can.

I hardly ever use cash or debit cards. That’s for convenience, safety, security, and of course the rewards. And I never pay a dime in interest or fees.

How?

I only carry cards with no annual fees and always pay our balances in full each month.

I have nine cards, but I only use three regularly:

- Citi Double Cash Mastercard is my default card, with unlimited 2% cash rewards on everything.

- Amazon Prime is the card I use for Amazon purchases, with unlimited 5% rewards on Amazon.

- Shop Your Way (SYW) Mastercard is what I pull out at grocery stores, gas stations, and restaurants, with over 13% rewards (see below).

I use three other cards semi-regularly, one for international transactions (it doesn’t charge the typical 3% fee), one for individual rather than joint expenses, and one for Costco (this one pays 4% on gas and EV charging, 3% on restaurants, 2% at Costco, and 1% elsewhere).

If the SYW Mastercard didn’t pay higher rewards, I’d use my Costco card at gas stations and restaurants. On the flip side, if Costco accepted Mastercard rather than just Visa, I’d use my Double Cash card there instead.

But how do I score over 13% with the SYW card? Here’s how…

How I Get Over 13% Rewards from a Single No-Fee Credit Card

It’s simple, really.

This SYW issuer wants to “train me” to pull out their card as much as possible.

Even though they probably charge merchants 3%, they spend at least 10% above that to entice me to use their card. They probably hope I’ll forget to make a payment or get in over my head.

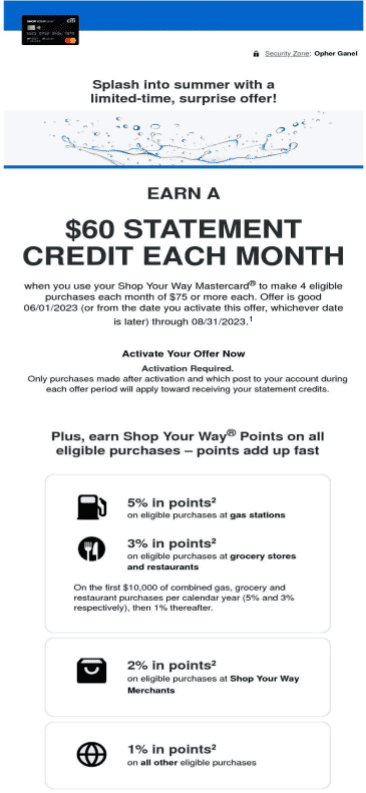

Yeah, good luck with that. In the 30+ years I’ve been in the US, I’ve missed exactly zero payments. Here’s a reward offer they sent me…

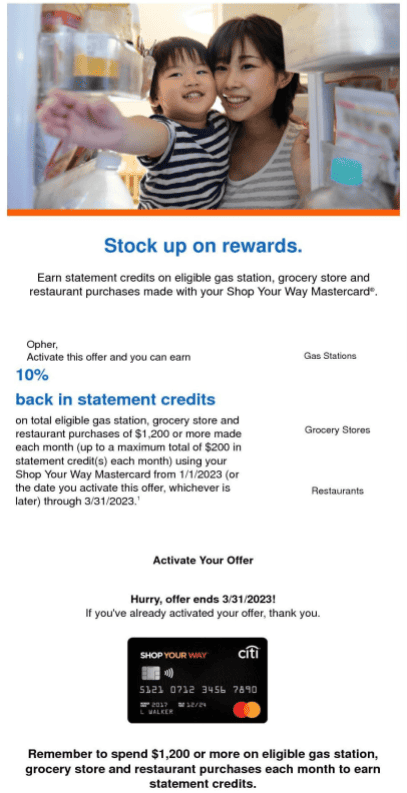

And here’s another offer…

Both offers are time-limited, but they get renewed each time they expire.

Here’s how it works…

Say I spend $1,200 a month at grocery stores, gas stations, and restaurants. I’m sure you’re not surprised to hear that we spend more than $75 a week on groceries, so each month we get $60 from the first offer.

Then, we get 10%, or $120, from the second offer, stacked on top of the $60.

Finally, assuming $100 a month is for gas, we get 500 points for that plus another 3300 points for the rest for a total of 3800 points. These points are only worth $0.001 each, so that’s $3.80 more.

Altogether, that’s $183.80 on $1,200 in charges or more than 15%!

Obviously, I keep using the card for those purchases beyond $1,200, usually close to the $2,000 maximum of the 10% offer. So, if I charge $100 for gas and $1,900 for restaurants and groceries, the math changes to $60 + $200 + $6.20 in points = $266.20 or 13.3% in rewards.

Am I Crazy, or Do Financial Pros Do the Same?

I asked financial pros if they use credit cards to get rewards too, or if they avoid credit cards.

Here’s what a couple of them said…

Jacob T. Rothman, CPA, CFA, CFP®, Portfolio Manager, Rothman Investment Management says, “I love using credit cards for rewards. Here are some examples. I once had a card that paid 5% cash back for the first 90 days, with no limit. It was near year-end, so I used the card for my trip home to see family, Christmas shopping, some purchases I’d been waiting to make, and then my year-end charitable giving. The only problem was that the card had a $2000 limit, so I simply went online and paid it off every week, sometimes twice per week. I earned about $1000 on that card. The World of Hyatt card is a great card for travel points because, while most hotel points are only worth about $0.007, Hyatt points can easily be worth over $.03. For example, a 60,000 point sign-up bonus with a modest minimum spending requirement could cover two nights at the Grand Hyatt Kauai (cash value $981/night). Plus, you can transfer Chase Ultimate Rewards points to Hyatt, making your credit card rewards go even further.

“I once took my wife to Hawaii for 10 days with credit card rewards points, mostly accrued with sign-up bonuses. Our points covered our flights, hotels (including five nights at the Waikiki Ritz Carlton!), rental cars, and even a couple of excursions.”

Cobin Soelberg, MD, JD, Founder and Principal Advisor, Greeley Wealth Management relates, “Like you, I love playing the credit card rewards game. I just wish I knew about it years before! I got serious around the time the Chase Sapphire Reserve first came out with their 100K-mile bonus. That started the game for me. Now we carry 10-12 cards at any given time. Some we use to get us to Hawaii – thank you Alaska Airlines card. Most of our spend is on Chase and AmEx due to their transferable currency. I grew up skiing in Utah and it’s been a dream for years to ski in Japan. Pre-COVID, I was able to fly my wife and me to Japan and back in business class for 55K miles (again, thanks to our Alaska miles). Japan Air business class is ridiculous! They have a bidet with a heated seat on the plane AND some great ramen.

“I’m most excited about an upcoming reward redemption to Australia. I saw nine(!!!) business-class award seats open up in United Polaris from the West Coast to Australia for 80K miles each. I was on call on the Labor and Delivery floor that evening. I hurriedly called my wife to confirm the dates. Then came the stressful part – transferring 320K Chase points to United and praying the seats would still be available. I was about to book and remembered my mother-in-law would be flying from Philadelphia, not Redmond, like the rest of us. I quickly changed the booking and grabbed our three seats from Redmond. Then, I booked the other ticket from Philadelphia to Sydney. The Polaris seats were still there…. I managed to snag four business-class seats to Australia for 320K points total!”

The Bottom Line

Dave Ramsey’s rants notwithstanding, the SYW Mastercard sends me over $1,500 a year in rewards without my paying any fees or interest, while our other cards send us thousands more in their rewards.

And since we don’t spend any more with credit cards than we would have anyway, this is free money that can cover, e.g., a nice annual vacation!

Now, does that sound like a bad deal to you?

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. An MSc in theoretical physics, a PhD in experimental high-energy physics, a postdoc in particle detector R&D, a research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started several other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. I draw on these diverse experiences to write about personal and small-business finance to help people achieve their personal and business finance goals.

Follow me on Medium (opher-ganel.medium.com).

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor