Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Given my PhD, my salary was far lower than it should have been for years.

As a postdoc in West Texas, my salary started at $31k, and it took 16 years and several “promotions” to get to $60k as a research scientist in Maryland.

Accounting for inflation, that was an underwhelming 1.7% average annual increase. Considering the 47% higher cost of living in Maryland compared to Lubbock, it was an average purchasing power decrease of 0.7% annually.

Not the most inspiring income track record.

Then, I left academia and got my first job in a company (my only such job because I started my own company when I was let go two years later). For the first time, my salary breached the sought-after “6-figure” status.

That’s when you might have thought I’d “made it,” financially. Surely, I was now rich, right?!

Does a High Income Translate to Wealth (or High Net Worth)?

Given how many of us strive for that 6-figure income, you’d think that (a) it’s a high income, and (b) it makes you wealthy, or at least financially independent.

- According to the DQYDJ income percentile calculator, if you work 40+ hours and earn $100k, your income is in the 71st percentile.

- You’d need $151k or more to make it to the top 10%.

- It would take over $460k to get to the top 1%.

So, no, a 6-figure income doesn’t equate to a high income, though it is a fair bit above the $58k median. At least if by “high” you mean the top percentile or even the top decile (10%).

That leads us to the second assumption that a 6-figure income makes you wealthy. And if it doesn’t, surely a top-percentile income gets you there, right?

Not necessarily.

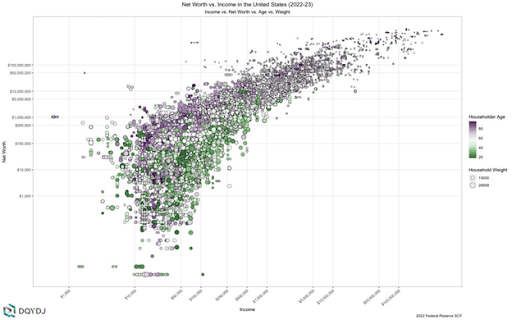

If you want the full statistical analysis, you can find it here. Here’s a graphic representation of what it looks like (note that people with zero or negative income or net worth don’t show up in this sort of log-log plot).

The short of it is that there is a relatively weak correlation between high income and high net worth. In plain English, people with a high income are a little more likely to be wealthy, but it’s far from a definite thing.

This is why, even after I started a successful consulting practice and began earning a very respectable income, for many years my net worth remained modest.

5 Scenarios Where a High Income Doesn’t Equal Being Wealthy

So many people conflate having a high income with being wealthy (some call it “rich,” as if that’s not just a synonym for wealthy).

However, there are at least 5 scenarios where that may not be so.

- Your income may have increased recently, so you haven’t yet had a chance to set aside and invest the larger amounts your newfound high income allows. It may take years to move that wealth needle enough to reach a high net worth.

- Related to the above, even after setting aside more for a while, your portfolio needs years of compounding to reach the point where your investment returns are higher than what you invest each year, so reaching a high net worth will, again, take many years.

- You may have just sold your home, racking up a large capital gain, which counts as a high income, but that doesn’t increase your net worth relative to what it was the year before when you owned the house but didn’t sell it.

- You may have received a financial windfall in the form of a bequest of, say, $250k. Along with your, say, $75k salary, you have a $325k income that year, placing you in the 98th income percentile — certainly high. However, even if you don’t spend a penny of that windfall, your net worth may be just that $250k, which would place you in the 55th percentile of net worth (assuming you don’t have much home equity) — hardly wealthy.

- Finally, you may have used most or all of the income increase to enhance your lifestyle, a.k.a. “lifestyle inflation.” When that happens, we see people making multi-6-figure incomes yet still living paycheck-to-paycheck.

While I’m all for spending 20–50% of income increases to enjoy your life more in the present, my advice is always to invest the remaining 50–80%.

Omar Morillo, Founder of Imperio Wealth Advisors, explains, “Financial prosperity is often misconceived as a direct result of high earnings. However, the true path to financial stability and growth lies not in one’s income but in the discipline of saving and investing a portion of that income.

“High earners can still face financial difficulties if they spend extravagantly, while modest earners can build substantial wealth over time through consistent saving and intelligent investing. This approach not only cultivates a mindset of financial prudence but also leverages the power of compound interest, turning even small savings into significant assets over time.”

Anthony Ferraiolo, Partner Advisor of AdvicePeriod, adds, “Working with newly wealthy tech professionals, I often see high earners with a low liquid net worth if they’re waiting for a liquidity event, or moderate earners who experienced a liquidity event that increased their net worth. I explain that liquid net worth excludes hard assets and that can translate into years they could go without income.

“Income is the fuel for your future, with every dollar saved/invested turning into multiple dollars you can use in the future. Understanding how much fuel you have influences longer-term decisions, whereas how much fuel you receive annually influences shorter-term and/or home-purchase decisions. Even if you feel rich on paper, you need to understand that the more you earn (and don’t save), the more you’ll need to accumulate to keep funding that lifestyle. Sure, a high income can support multiple homes, but knowing how much liquid net worth you have helps determine if that’s a good decision.”

4 Reasons Why You May Have a Low Income Despite Being Wealthy

It seems counter-intuitive, doesn’t it? If you’re wealthy and have a large portfolio, surely you have a high income, too, right? Not necessarily!

Because income isn’t defined in a way that reflects this intuitive expectation. Here are four examples:

- Say you own a profitable business but take a small salary and reinvest in the business (think Jeff Bezos building Amazon while taking a $1 salary). Your income is low, but the value of the business increases, so your net worth can become huge despite your low income.

- You had a high income for years, built up a large portfolio, and were then let go in a round of layoffs. Your income could be low (e.g., the realized capital gains when you sell shares), despite having a high net worth.

- You may have a multi-million-dollar portfolio, and you borrow against it (as some wealthy people do) to avoid paying income tax. Since you don’t sell, your capital gains aren’t realized and don’t count as income! Here, too, your income would be low or even zero despite having a high net worth and enjoying a lavish lifestyle.

- Finally, you may have built up a high net worth and retired. If you’re living off Social Security benefits and selling shares of stocks, your income will exclude the stocks’ basis (how much you paid for the shares over time), so it would be low despite your high net worth.

A Simple Way to Think About the Difference Between Income and Net Worth

Income is like the flow of water into a lake, net worth is like the water already in the lake, and your expenses are like the water flowing out of the lake.

Your lake could be huge, even with a slow-flowing stream feeding it, if that slow flow has been there for a long while and the outflow is even slower (i.e., you could be very wealthy with a small income if your expenses are lower than your income and you’ve been at it for a long time).

Or, you could have a fast stream feeding a tiny lake if the outflow is just as fast as the inflow (i.e., you could have an extremely high income but not much wealth if you spend every dollar that comes in).

As Ray Prospero, Partner Advisor, AdvicePeriod says, “A high income doesn’t always translate to accumulating a high net worth. It all comes down to living below your means and consistently saving money. I once met a very successful attorney who made well over $500k a year. That same week, I met a mechanic who never earned six figures. The mechanic was able to accumulate a higher net worth than the attorney by living below his means and consistently investing.”

Still, all other things being equal, for a given outflow, the faster the inflow, the greater the lake’s volume will soon become, which is why there’s a positive (if not high) correlation between income and net worth.

A Caveat Regarding the Stream and Lake Metaphor

One place this simplified metaphor breaks down is that water evaporates from a real lake, whereas, even if you have no income, the value of your portfolio will tend to grow due to unrealized capital gains as long as your spending rate is slower than that capital gain.

Are You Wealthy or Just Highly Paid?

Naively, many of us equate high income with being wealthy. That’s not completely baseless since there is some positive correlation between the two, but neither is it accurate.

The above offers 5 scenarios where you could have a high income and not be wealthy, 4 scenarios where you could be wealthy but have a low income and a simplified way of thinking about how income and net worth are different but related.

Understanding all this makes it easier to make good financial choices, whatever your income.

Have a Question to Ask a Financial Advisor?

When you’re uncertain about money matters, submit your question to Wealthtender, and it may be answered by a financial advisor in an upcoming article or in the Wealthtender Expert Answers Forum.

Need personalized help? Visit wealthtender.com to find the right financial advisor for your unique needs.

This article was originally published on Wealthtender and is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions. Wealthtender earns money from financial professionals, which creates a conflict of interest when these professionals are featured in articles over others. Read the Wealthtender editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor