Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Busting another real-estate mogul’s proclamation that could cost you over $100k

Social media makes it far too easy for “gurus” to make proclamations that reach millions of people.

That wouldn’t be so bad if only their advice wasn’t so dangerous to our financial well-being!

Case in Point: Grant Cardone’s Recent Instagram Interview

In a June 2023 Instagram interview segment, Grant Cardone, entrepreneur and real estate investor reportedly worth $600 million, implied that 2/3 of Americans (US homeownership rate is 66%) are making a stupid mistake.

He said, “Buying a house — worst investment you’ll ever make in your entire life…

“Average house here is $576k… Now you need 12% for broker fees, let’s say you keep the house 10 years. You need 10% in maintenance fees, it’s 1% a year in maintenance fees. It’s about 2% in property taxes every year. That’s 20%… And it’s probably 7% to the bank, so that’s 70%… Total those up it’s 112%. A $576 home will have to be sold for $1.2 million in 10 years. You’re not going to sell it for that… To break even. Dead money. And you had to put $100k down to do this deal…

“They’re serving a master. They’ll borrow money from the Bank of America, and then if they can get some more money, they’ll have a little retirement account that funds Wall Street. This is a big game bro!

“Rather than buying one house, rent where you live, and take that $100k and go buy a piece of real estate where other people live. I just don’t need to own a home on the way up. I need to own assets that pay me on the way up.

“And once I have enough cash flow from the assets, then if I want to go buy a house, or a watch, or a car, I buy it out of the passive income.”

He isn’t the first real estate “guru” to dis the majority of us.

That questionable “honor” belongs to Australian real estate mogul Tim Gurner, who famously said Millennials can’t buy a house because they waste their money on “avocado toasts.”

Gurner has already faced widespread ridicule online for that.

Is it Cardone’s turn?

Dissecting Cardone’s Fuzzy Math

Since Cardone ignored inflation, so will we, and just fact-check his claims.

Home Price

Start with his $576k “average” home price.

According to the St. Louis Fed, the median home price at the end of March 2023 (the latest number when Cardone’s Instagram segment went live) was $429,000, and it had never been higher than $479,500, let alone anywhere near $576k.

Brokerage Fees

I’m not sure where Cardone gets 12% in brokerage fees. Maybe that’s true for investment properties, but not when buying and selling your primary residence.

When we bought our current house, our closing costs, including all taxes and fees, were 3.2%. The seller’s costs were 7.2%, bringing the total, relevant in Cardone’s scenario of buying and then selling 10 years later, to 10.4%, not 12%.

Maintenance Costs and Property Taxes

Next up, maintenance and property taxes.

My personal experience of 20-plus years points to 0.5% in maintenance costs. Still, Cardone’s 1% is in line with typical figures, so we’ll keep it.

The median property tax rate in the US is 1.11% however, not 2%.

Mortgage Interest

Finally, we get to mortgage interest, where Cardone claims that at 7%/year interest, you’d pay 70% of the home’s cost over 10 years.

Really?

Let’s check.

For a $429k (median home price), assuming 20% down, you’d borrow $343,200. With Cardone’s 7% rate, your interest cost over a decade would be $225,307.

That’s 52.5% of the purchase price, not 70%.

What’s more, this ignores the mortgage interest tax deduction. Assuming a marginal tax rate (federal, state, and local) of, say, 18%, the effective mortgage interest over a decade drops to 43% of the purchase price.

The Real Final Picture

Putting this all together, what’s the real break-even number Cardone should have quoted instead of $1.2 million?

- $85.8k down payment

- $42.9k maintenance

- $47.6k property taxes

- $14.3k homeowner insurance (Cardone neglected this one)

- $44.6k “roundtrip” closing costs

- $184.5k post-tax-benefit mortgage interest

- $48.7k mortgage principal

- $294.5k mortgage payoff balance

That’s $763k, which means Cardone’s fuzzy math is off by 57%!

How About Appreciation Grant?

Thus, to break even over the decade, your home would need to appreciate by 78%.

Still sounds like a lot, right?

Not when you look in annual terms. Then, it’s just 5.9%, which is slightly higher than the 5.24% long-term average annual appreciation Case and Shiller found for US residential real estate.

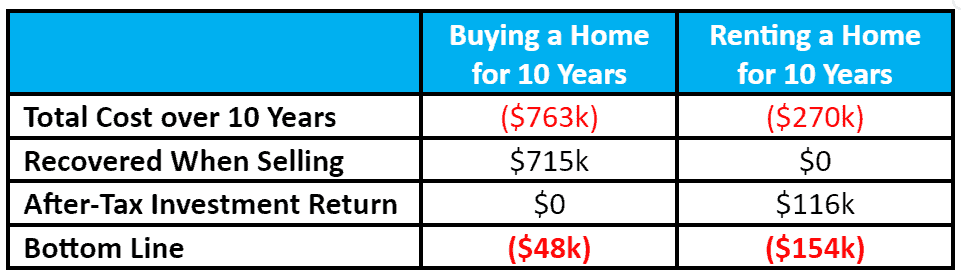

Assuming a 5.24% annual appreciation over a decade, you could expect to sell your home for $715k. Since you’d have paid a total of $763k by then, you’d be down $48k.

Hmmm. That still sounds like a less-than-stellar investment, right?

Not so fast…

What Cardone Completely Missed

Unless your alternative plan was to couch-surf with your family for a decade, you’d have to account for renting a place to live.

The median rent was recently $2052 a month (and that assumes the average rental property is the same size and quality as the average purchased home, which in my experience it isn’t).

Ignoring potential rent increases, owning your home for 10 years saves you $246k in rent! Add $24k for a decade of renter’s insurance, and that’s $270k.

On the other hand, as Cardone points out, if you rent, you could invest the money you’d tie down through your down payment.

Being generous, let’s assume a 10% annual return for ten years. Your $85.8k saved on the down payment could grow to $222.5k. If the $136.7k gain is taxed at 15%, you’d have $116k net return.

Where does that leave us, when comparing Cardone’s recommended option of renting to what most Americans have done — buying?

As the table shows, you’d be $48k in the red after a decade if you buy. However, following Cardone’s advice, you’d be $154k in the hole!

Relatively speaking, that makes it $106k better to buy than rent! That’s why I say that following Cardone’s advice could cost you over $100k.

Unfortunately, Cardone has over 4.6 million Instagram followers, and this particular segment received nearly 60,000 “likes” as of this writing.

If only those 4.6 million (or even the 60k fans) could read this, it could save a lot of people needless financial misery.

What Disinterested Financial Advisors Think

To verify my argument holds water, I asked financial advisors who aren’t real estate moguls what they think about Cardone’s assertion.

Here’s what they said.

Joe Marshall, Partner, Coastal Capital Advisors, says, “It’s extremely misleading to say that buying a home is the worst investment ever. While I agree that some of the benefits of homeownership tend to be overstated (often the ‘gain’ is calculated as ‘I bought for x, I sold for y,’ not including property taxes, maintenance, insurance, etc., as done here), even if it’s not the best, it’s a good forced savings mechanism.

“Further, buying today is very different from buying in 2020 or 2021. That’s why you need to run the numbers for yourself. I expect people on either side of this argument can (and will) find something wrong with the math because buying vs. renting borders on religion and politics.”

Doug Greenberg, President Pacific Northwest Advisory, says, “Cardone’s assertion oversimplifies a complex decision. Homeownership isn’t just about the numbers; it’s about stability, security, and personal preference. Financial wisdom isn’t one-size-fits-all.

“It’s critical to approach Cardone’s statements with a balanced perspective. Every investment, including homeownership, comes with a unique set of challenges and benefits. Financial success is rooted in individualized strategies, not universal proclamations.”

Then, there’s this from Eric Rodriguez, Eric Rodriguez, CFP®, Founder & Financial Advisor, Wealthbuilders, “Cardone’s comments assume homes don’t appreciate much. However, if you have the means to buy vs. rent in a high-cost-of-living area, e.g., CA, WA, NYC, etc., it’s advantageous to put your money into an asset that can grow and guarantee tax benefits, such as purchasing a home.

“Cardone’s bias is due to his real estate investment business thriving when people rent vs. buy. Without renters, his business would go bankrupt. Regardless, it’s not always about the numbers. Buying a home can provide peace of mind, build equity, and potentially make a profit should you choose to sell.”

Garrett Harper, Chief Possibility Officer, Harper Financial Strategies LLC, rounds out the discussion, saying, “Grant Cardone is spot on… in certain real estate markets. For example, Nashville and many parts of Florida are at all-time highs, and real estate prices are starting to come down. This means you might end up ‘underwater’ on a property, especially factoring in maintenance, property taxes, and insurance costs.

“However, the blanket idea that buying a home is a horrible investment is completely wrong. In today’s market, you have to do your homework and know what home you can afford.”

The Bottom Line

Does all the above mean everyone should rush out now and buy a house?

Of course not.

That’s why we call it “personal” finance — what’s right for me personally may be wrong for you.

As I previously wrote, there are at least 15 situations where you’d be foolish to buy instead of rent.

It’s just that you have to be cautious when listening to some grand proclamations from an uber-wealthy guy, even when it’s within his or her area of expertise.

You have to question if he or she may have a hidden agenda (for example, if he owns hundreds of millions of dollars in rental units, would he stand to benefit from lots of people preferring to rent than own?).

You also need to consider whether his numbers are accurate (as we’ve seen, they’re off, and not by a little).

In the final analysis, do your due diligence when making major life decisions such as buying a home or not. Don’t just assume a rich guy knows better (and has your best interest at heart).

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor