To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Mortgage rates have never been lower than they have been in recent years. Throughout the 1970s to 1990s, mortgage rates were almost exclusively in the double digits, sometimes being as high as credit card rates are now. So it makes a lot of sense for older generations to recommend that you should pay off your mortgage as soon as you can. In the past, it was insanely expensive to have a mortgage.

But thankfully, times have changed. With mortgage rates decreasing, the advantage of paying off your mortgage early decreases too. We all know that having the lowest interest rate possible is in our best interest, that’s because a lower interest rate means we pay less in interest payments. The same is true with mortgages. The lower the interest rate, the lower the cost of borrowing is. So what is the best thing to do?

If you’re thinking about paying off your mortgage early, or if you’re exploring how you can use your money most efficiently, here are some things that I believe are important to consider while making a final decision.

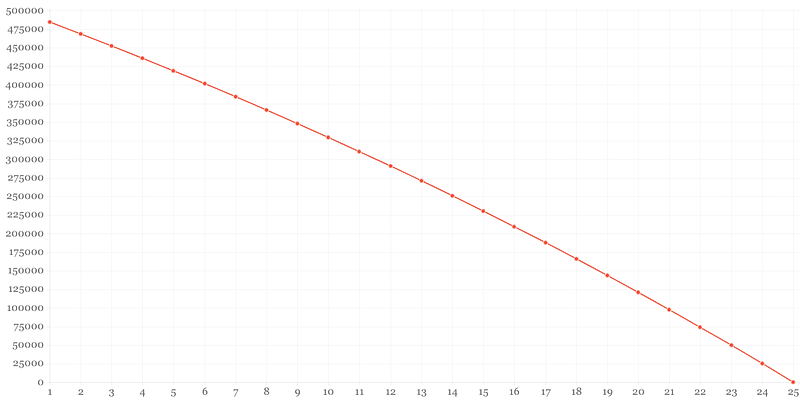

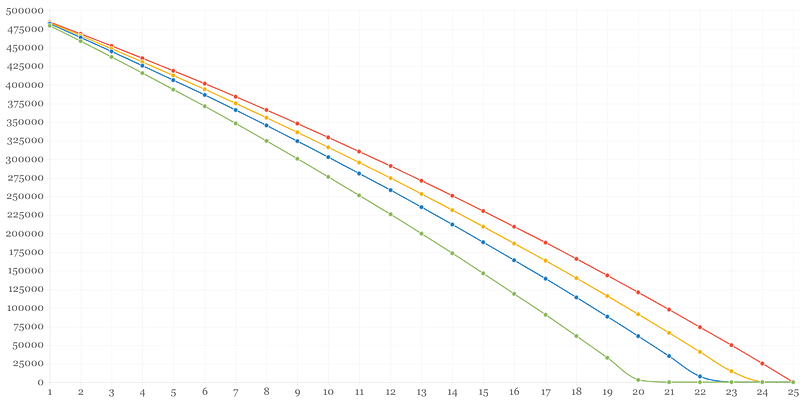

Mortgage payments are interest heavy at the beginning of the mortgage, and over time flip to become more principal heavy in the later years. In the above example, in the first year, $15,590 goes towards the principal, compared to $25,133 in the final year of the mortgage. There is a huge shift in the payment structure over the life of the mortgage.

When you make extra payments towards your mortgage, they go 100% towards the principal. So making extra payments early on makes the most sense because it allows you to really make a dent in your principal owing. When you make extra payments near the end of the mortgage, you have less benefit because the payments are almost entirely principal, and you have little interest still owing.

I believe the biggest advantage of paying off your mortgage early is the fact that you can become mortgage-debt-free. Especially when people are approaching retirement, not having to pay rent or your mortgage will free up so much of your cash flow, and allow you to make your retirement savings stretch all that much further. Imagine life now without your mortgage or rent payment, it’d be pretty nice.

For the majority of people, their mortgage or rent will always be their largest month-to-month expense. If you’re able to eliminate that financial obligation, it can make a big difference with your overall financial picture. By setting even a small amount of money aside to put towards your mortgage, you could end up paying off your mortgage years earlier, and get yourself out of debt quicker.

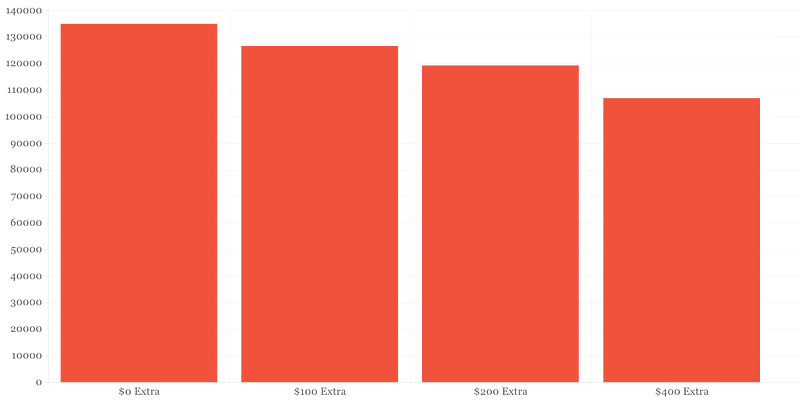

With a $500,000 mortgage with an interest rate of 2% and an amortization of 25 years, you’d end up paying $135,176 in interest. If you were able to pay an additional $400 per month towards your mortgage, you’d end up paying $107,151 in interest payments. So you would end up saving yourself about $28,025 in interest, a nice chunk of change.

If you paid an extra $400 per month, you’d also save yourself 4.8 years of mortgage payments. If your mortgage payments were $2,117.26 per month, you’d free up about $149,979 (including the saved interest). Consistently making an additional payment could be very beneficial!

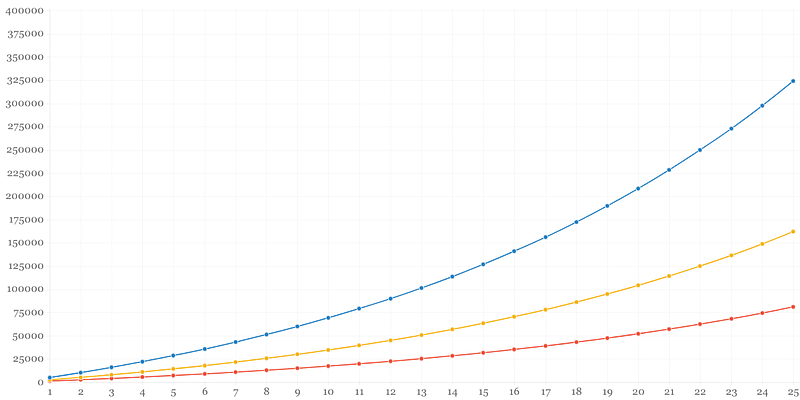

If instead of putting that extra money towards your mortgage principal, you invested that money, we see an even bigger benefit. An extra $400 per month for 25 years, gaining a 7% return per year, would end up being just over $324,000 at the end of the 25 year period.

Whether you’re looking to pay off your mortgage early or invest, I believe either is a good idea. You’re deciding between two really good things, which is always a great situation to be in. Investing carries slightly more risk, but offers more reward.

I think in the end it comes down to personal preference, and what is most important to you: being debt-free, or trying to grow as much wealth as possible. We all have different priorities, so either one that is more appealing to you is okay. No matter which way you want to proceed, both options are steps in a great direction.

About the Author

Derek Condon, CFP®

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor