To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Stonks. Really? Yes, Really.

Let’s face it. Creative slang and lingo frequently used in conversations among investors isn’t exactly new. (The slang term dead cat bounce remains a perennial favorite of mine.)

So perhaps it’s no surprise that a new slang term referring to stocks as stonks is gaining traction in popular culture as the subreddit r/wallstreetbets also becomes a household name with millions of community members (or degenerates as its members are affectionately referred to by the community’s moderators).

Let’s take a minute to learn the meaning of stonks and what the stonks craze is all about.

The Meaning of Stonks

Just as the meaning of life remains a hotly debated topic (or mystery depending upon your point of view), the meaning of stonks likely means very different things to different people.

According to dictionary.com, the meaning of stonks in internet slang is: a deliberate misspelling of stocks, as traded in the stock market. It is often used to refer to such stocks—and finance more generally—in a humorous or ironic way, especially to comment on financial losses.

But for certain members of the wallstreetbets community who have made millions of dollars primarily from call options on stocks that have gone up sharply in 2021, it’s more likely they equate stonks with their sizable financial gains.

YOLO Stocks (ahem, Stonks)

Most of us are familiar with the saying, “Don’t put all your eggs in one basket”. The term is commonly used among investors as a reminder of the importance of diversifying your investments across many different stocks representing a diverse range of sectors, industries and geographies.

When it comes to investing in stonks, many in the wallstreetbets community choose to put all of their eggs (dollars in their investment account) into just one basket (an individual stock). This practice is increasingly referred to today as YOLO investing (aka You Only Live Once investing). Among many, it might also be referred to as gambling.

But just as the occasional gambler hits a jackpot, a relatively small bet on a YOLO stock has the potential to pay off big, too.

For example, the wallstreetbets community member known as Roaring Kitty turned a $53,000 investment in the stock of video game retailer GameStop (ticker: GME) into an investment valued at over $48 million at one point in January 2021.

And just before the stock market was rattled by COVID-19 in early 2020, wallstreetbets made the cover of BusinessWeek magazine in February 2020 for their style of YOLO investing.

You Might Also Enjoy:

Growing Interest in Stonks

While the unprecedented impact of the pandemic on global equity markets dominated the headlines through the rest of 2020, YOLO investing and online searches for the term stonks reached new heights in January 2021, fueled by the meteoric rise of GameStop’s stock from under $20 per share on January 1st to over $320 per share on January 31st.

In fact, looking at Google Trends, we can see interest in the search term “stonks” has reached its highest level during the 90 day period ending January 29, 2021:

And by diving deeper into the data, we can learn more about who’s conducting Google searches for the term stonks.

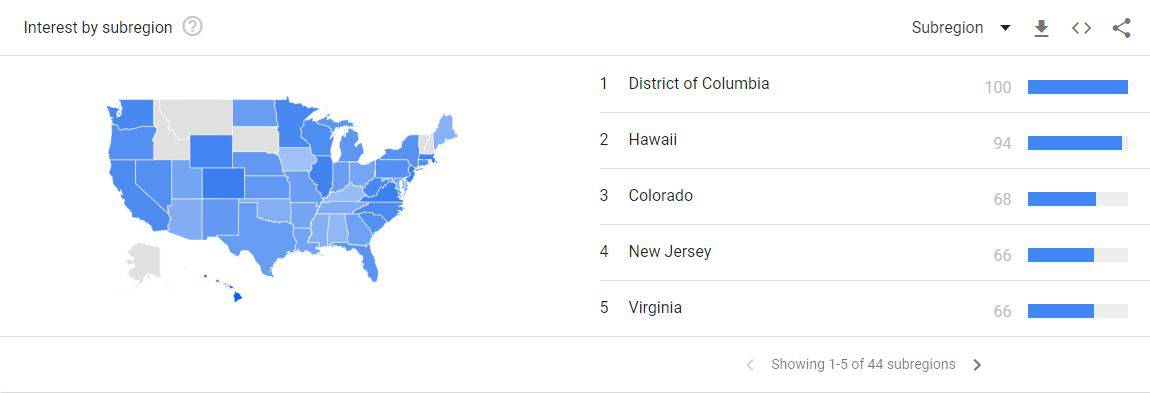

As of January 29, 2021, the top 5 states searching for stonks during the past 30 days were:

- Hawaii

- Colorado

- New Jersey

- Virginia

- Massachusetts

But perhaps most noteworthy, Washington, D.C. tops the list of subregions according to Google with the most searches for stonks.

With increasing media attention and politicians quoted in the news as calling upon the Securities and Exchange Commission (SEC) to conduct investigations or consider new rules to regulate the activity of the wallstreetbets community and YOLO investors, perhaps it’s not surprise to see the nation’s capital among the most interested in learning more about stonks.

Of course, many in the wallstreetbets community would be the first to say it’s Washington, D.C., and more specifically the Federal Reserve, that deserve credit for the YOLO style of investing fueled by sizable COVID-19 stimulus checks sent to bored Americans and paid for by the Fed printing more money. As many wallstreetbets degenerates will tell you, when the “money printer go brrr“, it’s a good time to buy stonks.

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender. He and his wife live in Texas, enjoying the diversity of Houston and the vibrancy of Austin.

With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor