Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers.

It Can Pay Off in Surprising Ways to be a Contrarian…

It’s fairly well known that transportation is one of the three largest expenses (at least for most Americans).

Clearly, if you can get away with owning one car (for a couple), you’re better off than owning 2. If you can get away with not owning a car at all, even better. By better, I mean both financially for you and in terms of the planet’s sustainability.

However, if you do need to buy at least one car, should you buy new or used?

Many financial experts (with or without quotation marks) harp on and on about what a terrible financial choice it is to buy a new car. Almost invariably, their main point is how the car drops in value by 10%, 20%, even 30% (so they claim) “as soon as you drive it off the dealer’s lot.”

It’s so much more financially savvy, they say, to buy the car when it’s used, letting the poor sucker who bought it new pay for the massive depreciation of the first year or three. If you buy it used, say they, you’ll save massive amounts of money that you can then, e.g., invest for retirement.

But is it really so?

What the Data Told Us Last Year

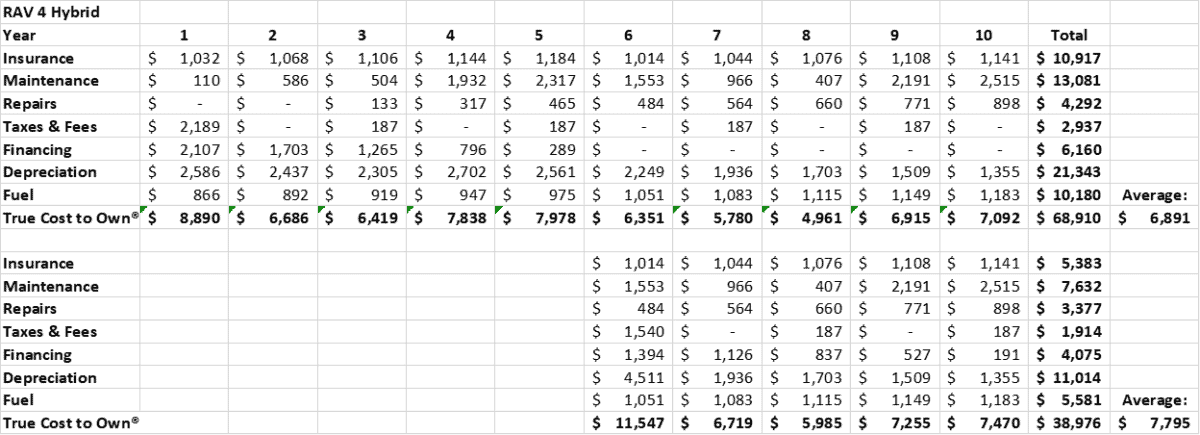

In December 2019, I published a data-based comparison of buying a car new and keeping it for 10 years vs. buying the same model as a 5-year-old car and keeping it until it turns 10.

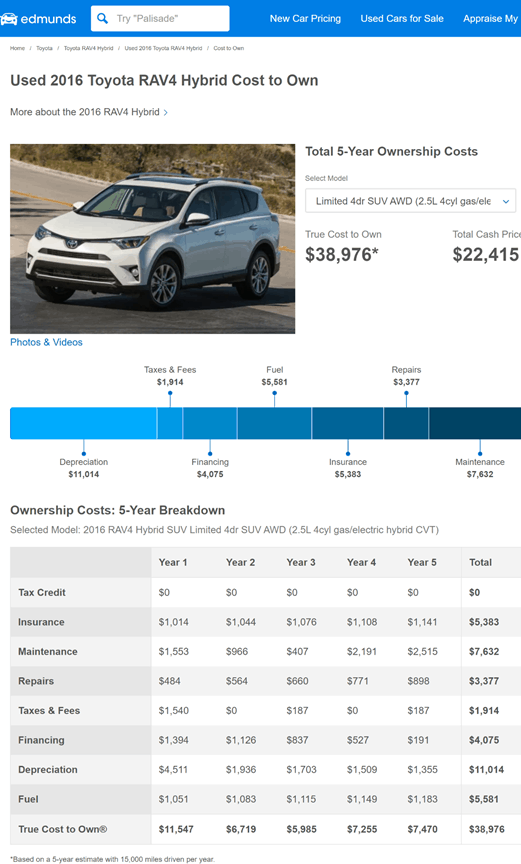

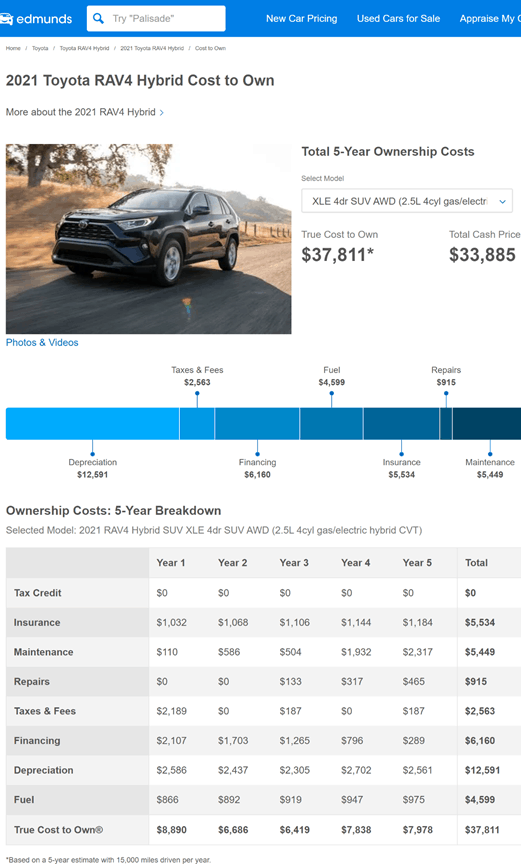

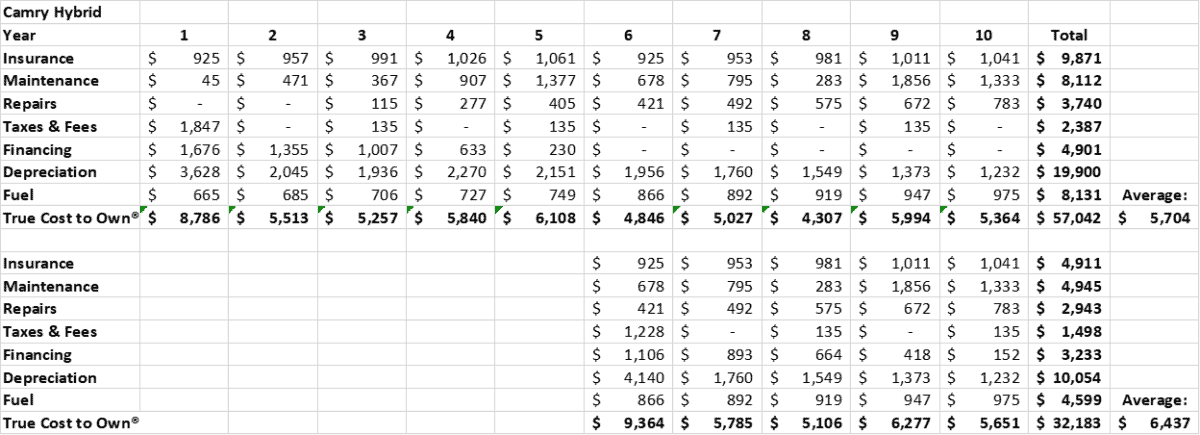

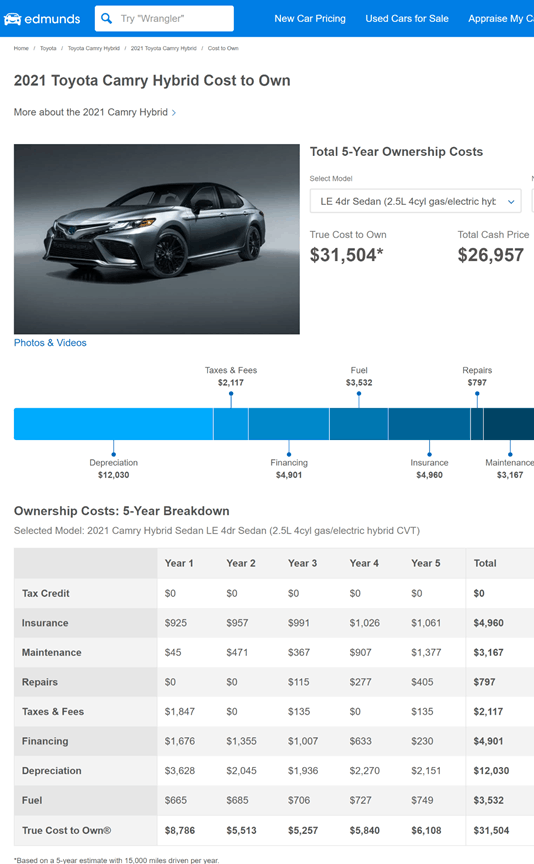

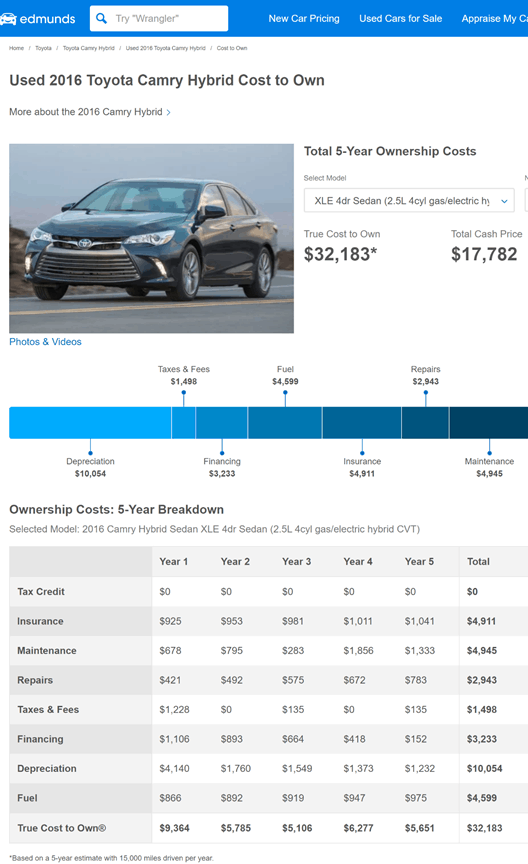

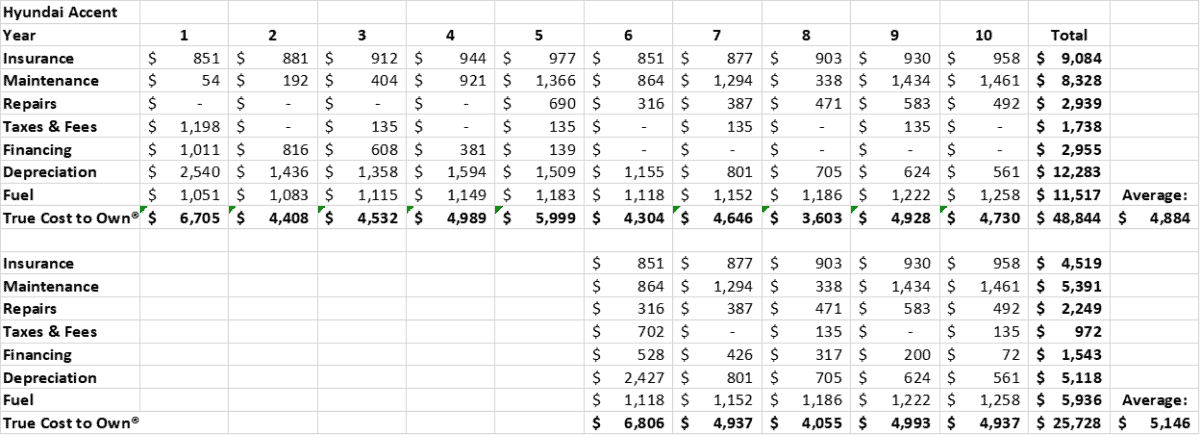

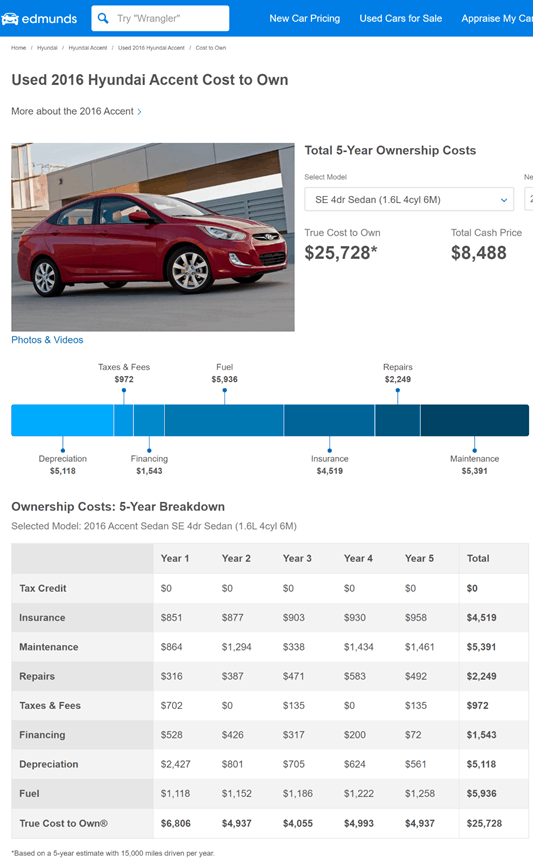

I used Edmunds.com’s “True Cost to Own,” which offers a massive database of the full cost of ownership of cars in the US. Edmunds provides that cost over a period of 5 years, so I had to come up with a way of “stitching together” data for buying a car new with the costs of buying it at 5 years old. You can see the details of how I did that in the original article:

The data showed that for two of the three models I compared, it was actually cheaper (on average per year) to buy new and drive a car 10 years, than it was to buy it 5 years old and drive it for the 5 years it has until it hits 10.

Which Cars and SUVs Should We Consider in 2021?

To pick a few representative cars, I again went to US News and World Report’s Best Cars for the Money, of course updated for 2021.

There, I found that the best SUVs and minivans are:

- Honda Passport

- Kia Sorento

- Honda CR-V

- Toyota Rav4 Hybrid

- Honda Odyssey

- Kia Soul

And the best cars are:

- Kia Forte

- Toyota Corolla Hybrid

- Toyota Avalon

- Toyota Camry

- Hyundai Accent

This time, I changed things up a bit and picked the Toyota RAV4 Hybrid from the first category, and Toyota Camry and Hyundai Accent from the second. However, since I’m considering getting a Camry Hybrid in the next year or so, I decided to pick the hybrid version instead of the gas one for the Camry.

What the Data Tell Us in 2021

To recap the non-financial benefits of buying a car new:

- You get to choose the exact model, trim, options, etc. exactly the way you want them.

- You don’t inherit anyone else’s problems.

- Your get the most benefit from the new car warranty and potentially free maintenance for a while.

- Your spend a lot less time in the garage (in most cases).

But as Tom Cruise’s Jerry McGuire said, “Show me the money!”

Using Edmunds.com’s data, I compared costs again using similar methodology for those three vehicles. Here are the results, followed by the screenshots.

In brief, the average annual true cost of ownership is lower for each of the three models if you buy it new and drive it for 10 years than it is if you buy it when it’s 5 years old and drive it for 5 years (until it’s 10 years old).

For the RAV4, you save over $900 a year, or nearly 12%. For the Camry Hybrid, you save over $730 or 11% a year. For the Accent, the savings is lower, at just over $260 or 5% a year, but it’s still a savings.

All this, and you get to drive a car that’s an average of 2.5 years newer!

But What If We Buy a 2-Year-Old Car Instead? Or a 3-Year-Old One?

Beyond refreshing the data, I wanted to expand on my analysis from last year.

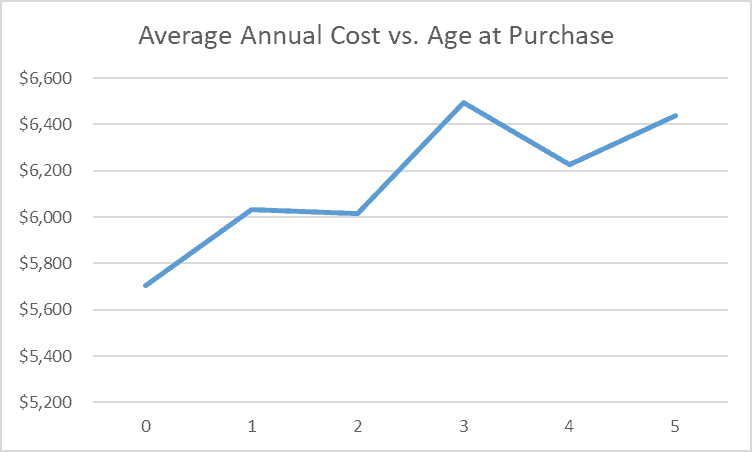

I decided that for one of the above models, the Camry Hybrid, I’d do a deeper dive and go beyond the two cases I compared for all three models. I thus looked at the option of buying it at ages varying from 0 to 5 years, and in each case driving it until it turns 10 years old.

Frankly, I expected to see that buying it after 2 or 3 years might offer a better value. Here’s what the data showed me…

As you can see, the cost is lowest if you buy the car new and keep it for 10 years! I’m not sure why the data spiked for buying a 3-year-old vehicle. It could be a fluke, a statistical fluctuation, or perhaps the 2018 model for some reason was more expensive and suffered worse depreciation.

Caveats

As in many cases, ultimate precision is hard to achieve.

Here, I stitched together Edmunds data in ways it wasn’t designed for, using what I believe are plausible adjustments. However, clearly the above is not a fully rigorous analysis.

For example, car makers change their car models periodically, so owning a 2016 model for 5 years starting now wouldn’t be exactly the same as owning the 2021 model from 2026 to 2031. Also, the analysis doesn’t taken into account the time value of your money, or the full impact of inflation.

However, the results should be accurate enough to reasonably conclude that if you can afford it, buying new is your best option, at least in the US, and at least if you’re not an auto mechanic.

Since the data used are from the US market, the results may be somewhat (or even very) different if you live in Europe, the Philippines, New Zealand, etc.

Finally, if you are an auto mechanic (or simply very handy around a car), your maintenance and repair costs will be vastly lower than the Edmunds data show, possibly enough to turn the results on their head.

The Bottom Line

Contrary to the supposedly expert opinion of many financial people, for most Americans (who can afford the large initial outlay and/or get financing), buying a car used is not just not cheaper than buying new, it’s actually more expensive. This is why I’ve been buying new ever since I was able to afford it.

Interestingly, when I was a kid, our neighbor across the street, an investment advisor, told my dad, “If you’re buying a car, buy new. You’re not rich enough to be able to afford owning a used car.”

I always knew he was a smart cookie.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers.