Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers.

I’d just moved my young family halfway around the world to pursue my academic career.

We owed thousands more than we owned: What’s known as having a negative net worth. And making less than 60% of the median income at the time, things didn’t look good for the future.

Fast forward many years, and our fortunes (no pun intended) have truly changed.

Over the past 3 years, we could have lived off our passive income and still grown our net worth. Including our active income, our savings rate was over 55%.

We’ve truly come a long way.

I won’t lie; much of it was due to a combination of building successful solo businesses (that brought in much more than a median income), and exceptionally good market returns.

However, the following 3 simple steps would have allowed us to build wealth even without those advantages.

First, What Is Wealth?

Let’s start by what I don’t mean by wealth.

I’m not talking about the Gates, Buffet, or Bezos level of money.

I’m not even talking about having over $11 million and making it into the top 1% of net worth.

What I do mean by wealth is having enough passive income to cover your spending with a comfortable margin. I believe that’s what people call “FU” money.

Personally, I prefer to call it FI money – financial independence.

For me, that’s what wealth means.

Next, What’s the Median Income in the US?

The median US income is the level of income where half of the American households have higher incomes, and half have lower incomes.

According to the US Census Bureau, the median household income was $67,521 in 2020. According to DQYDJ.com, the median income dropped by 1.39% from 2020 to 2021, which would make the 2021 median income in the US $66,582.

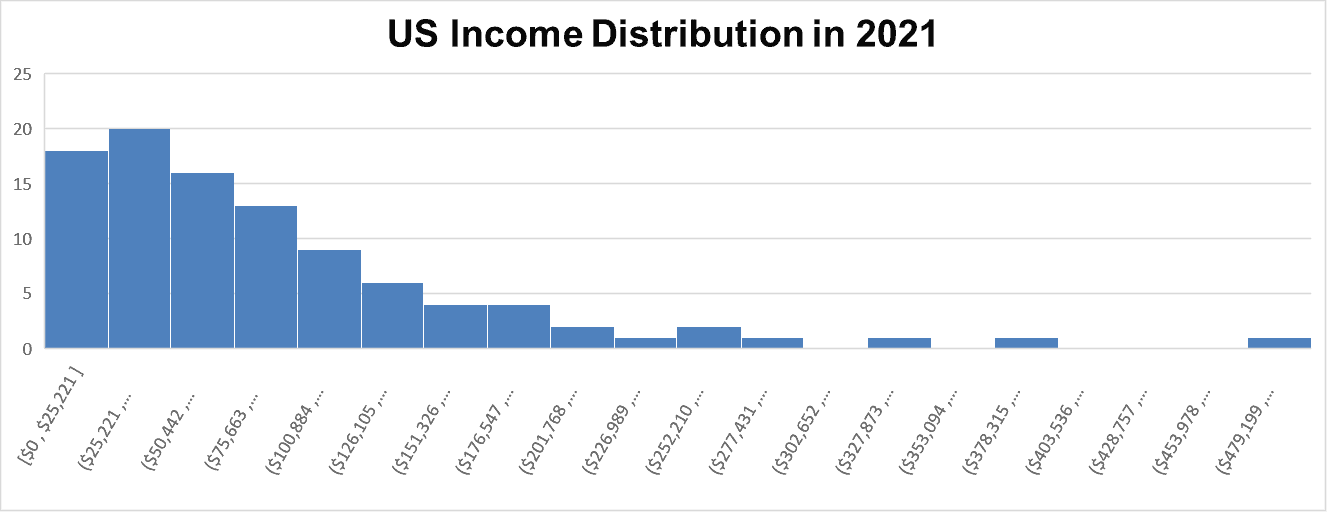

The average income was almost 44% higher than the median, skewed by the extreme income inequality in the country. You can see that inequality in the following graph. Instead of a normal bell curve, 38% of households make less than 10% of the top percentile income, and the median income is at just 13.4% of the top percentile.

What’s Financial Life Like at the Median (if You Plan for the Future)?

You make $66,582.

Let’s say you’re in your 30s, have a spouse and a couple of kids, and live in Maryland.

You just bought a house at the median home price of $346,900 with a 20% down payment and a mortgage at 3.5% interest. Your monthly principal and interest payment is $1,558. Adding in insurance and property taxes, your monthly payment is $1930.

According to the H&R Block federal tax estimator, you’re eligible for a $10,000 tax credit, which after your federal taxes are taken into account, means you actually get $5314 more from the IRS than was withheld from your paycheck.

According to GoodCalculators.com, your Maryland income tax is $2,325.

Your after-tax net income is thus $69,571.

This makes your mortgage payment about a third of your after-tax income. Not great, but not horrible for this part of the country.

You’re committed to reaching financial independence, so you live frugally and set aside 15% of your income, or $10,000 a year.

Your employer offers a 401(k) plan and matches dollar-for-dollar up to 6% of income. You take advantage and contribute $3995 to capture the full match.

You contribute another $3,000 into a traditional IRA and another $3,000 into a taxable account, where you invest it in a low-cost index fund like Warren Buffet recommends.

How Much Do You Need to Set Aside Each Year to Reach FI?

Taking into account your employer’s 401(k) match, you’re saving 21% of your pay. But wait, you’re also paying down your mortgage each year, starting at $6657 in Year 1 – another 10%+ savings. Overall, your savings rate is actually over 31%!

Good job!

However, for the purpose of figuring out what you need to cover your retirement spending, we can only count the 15% you’re setting aside from your own income.

That means you’ll need the other 85% of your income to cover expenses. Taking into account that some expenses will drop (no kids to take care of in retirement, no commuting expenses, no payroll taxes, etc.) while others will increase (higher healthcare costs, higher leisure spending, etc.), let’s say you’ll need 80%, or $53,266.

According to Fool.com, you can expect Social Security benefits to replace about 40% of that, so you only need to cover the remaining $32,000.

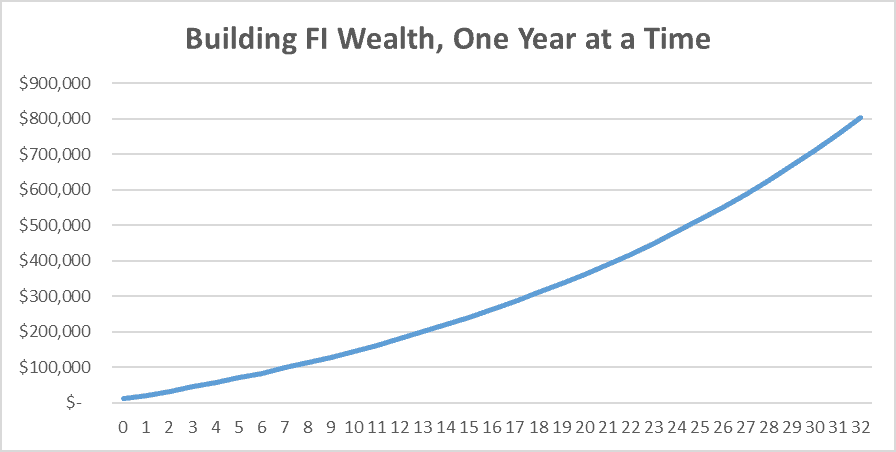

Using the venerable 4% rule, your target is $798,984, which we’ll round up to $800,000.

With 32 years left until retirement age, what I call your “add-on factor” is about 80.

That’s the number by which you divide your target portfolio value to get the amount you need to invest each year. This is based on an assumed inflation-adjusted return of 5%/year.

Using this factor, you’ll need to invest $10,200 annually, or $850/month.

Of course, you’ll need to adjust that for inflation each year to reach your ultimate target in terms of purchasing power. After all, it would be a shame to reach that $800,000 only to realize that in today’s dollars you only have $424,500! That’s what would happen after 32 years of 2% annual inflation. If inflation averages 5%, you’d only have $167,893 in today’s dollars.

So what does all this mean?

The bad news is that your current $10,000 isn’t going to cut it.

The really good news is that you’re almost there, you just need to increase your annual set-aside by 2%, going from 15% of income to 15.3% of income.

You can do it!

Your 3 Simple Steps to Building Wealth

The first step is one you’ve already taken – buy a home at a fixed affordable monthly payment. Ideally, that’s under 28% of income, but in no case more than 36% of income. Generally, you want to target homes that cost under 3 times your annual income, but these days that’s very hard to do. Thankfully, with mortgage rates near historic lows, you can squeak by with 5.5 times your annual income.

I first did this somewhat late, at age 38. At the time, I was paying $1,600 a month in rent for a 3-bedroom apartment in a not-so-great part of town, and that was by far the best deal available at the time. In today’s dollars, that translates to $2,587/month.

Assuming a 20% down payment, 1.2% of house value for insurance and taxes, and a 3.5% 30-year fixed mortgage, I could buy a home worth over $570,000 and have lower monthly payments. And that’s before counting the mortgage interest tax deduction or the fact that part of each payment pays down the principal and increases my net worth. Plus, rent is almost guaranteed to go up with inflation (if not more), while a fixed mortgage keeps your payment constant (though the insurance and taxes do go up over time).

Your second step is also simple and surprisingly easy. Each time you get a raise, bonus, or significant cash gift, direct at least half to your retirement savings. Personally, I target 2/3 to savings. Spending the remainder on great experiences, replacing an old clunker of a car, or some other improvement to your standard of living is ok. In fact, it’ll make it easier to stick with your long-term plan.

However, take into account that if you increase your spending, you’ll need to revisit your portfolio target. For example, say you just got a 10% raise, and decide to save half of it, and spend the other half. Your portfolio target just increased from $800,000 to $840,000, and your annual savings requirement upped from $10,200 to $10,700.

That seems a burden until you realize that investing the other half of your raise increased your $10,200 to $13,500. This is how you painlessly increase your savings rate while balancing your future self’s needs with your present self’s desires.

The great news is that if you stick with this step, you’ll likely blow past your target portfolio value much earlier than you ever thought possible. In my case, I only started setting aside and investing serious money toward retirement 13 years ago, and I already have more than I imagined possible back then.

The third step is also simple. It’s to invest your long-term money in the stock market or some other plausible-risk, high-return asset. I’m not advocating you take up day trading, or dumping all your money into crypto, or even that you start investing in individual stocks.

Instead, learn how to pick good mutual funds or exchange-traded funds (ETFs) and/or educate yourself on building wealth through rental real estate. Preferably, do both to diversify your investments.

While this last step is simple, it isn’t always easy or painless. On average, the stock market loses money about one year in every 4, and while it has averaged about 6-7% inflation-adjusted returns over the past century, it has lost over 20% in a single year dozens of times.

The important thing is to not panic-sell when it crashes.

Just remember that on average, the market has made it back from such losses in 2-3 years, and even in the absolute worst case, it has never had a 20-year period with losses. If you think the market is currently overheated, with a poor risk/reward ratio, you can temporarily allocate more money to safer assets (e.g., money market funds, CDs, short-term bonds, etc.), and move them back into stocks once the crash comes.

The Bottom Line

Even on a median income, which is less than 1/7 of the top-1% income, you can build real wealth. By that, I mean a portfolio large enough to cover your retirement spending.

All it takes is a bit of knowledge, a bit of planning, a good bit of grit to keep on plan when (not if) things go sideways for a while, and following the above 3 simple steps.

What do the financial pros think about this?

Michael R. Acosta, CFP®, ChFC®, CSLP®, Financial Planner at Genesis Wealth Planning, LLC says, “There is a misconception in society where people believe that if you earn more, you’ll save more. This isn’t 100% accurate, because if you earn $1 million a year but spend $999,999 a year you have no saving power. Our ability to save depends on our lifestyle needs and desires and whether or not we ‘pay ourselves’ first when we receive our earnings. For someone earning $67,000 a year, if their lifestyle needs and desires are modest and they set money aside, in the long run they’ll likely achieve FI. Financial independence or success is purely subjective. For example, if someone earning $67k a year reaches retirement with zero debt and a modest amount of retirement savings, expecting Social Security benefits to replace 30-40% of their income, they’ll very likely be able to maintain their pre-retirement lifestyle. Tips for increasing the likelihood of achieving FI by the time one retires are: (1) pay yourself first 15-20% of your annual gross income; (2) be mindful of your monthly ’burn rate,’ keeping outflows lower than income; (3) focus on ‘asset location’ – if you earn $67k a year your marginal tax rate is relatively low, which means there isn’t a huge incentive for pre-tax retirement savings. Consider after-tax Roth contributions, paying taxes upfront based on your lower marginal rate, and enjoy tax-exempt growth, which also lowers your income taxes in retirement.”

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. An MSc in theoretical physics, a PhD in experimental high-energy physics, a postdoc in particle detector R&D, a research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started several other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. I draw on these diverse experiences to write about personal and small-business finance to help people achieve their personal and business finance goals.

Follow me on Medium (opher-ganel.medium.com).

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers.