To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

If you’re 60 or fast approaching it (like me), you’re likely concerned about not having enough saved up for retirement. If so, you’re not alone.

According to PlanSponsor.com, last year, only 26 percent of working Americans 60–67 years old said they have enough money to retire. This year, that number dropped to 22 percent! According to a statista.com survey conducted last year, more than one in eight American adults age 60 or older (about one in six in their 50s) have zero saved for retirement!

The good news? This means most of us have at least some retirement savings. The bad news? If you’re one of those with nothing set aside, the above good news doesn’t help you (though reading on should help…). The worst news? As you’ll see below, the more you make now, the worse off you’ll be in retirement if you didn’t set aside enough.

How Much is Enough Money to Set Aside?

The answer to this crucial question depends on just three factors:

- How long you’ll live

- How much you need in retirement

- How much income you can count on in retirement

The problem is that you can only estimate what those will be for you.

On the other hand, even if you have zero saved up by now, it’s not too late to start. Below you’ll find a list of things you can do and why doing so now can still save the day. The most tantalizing thing is that starting to save for retirement will improve your retirement situation immediately!

1. How Long Will You Live?

According to the Social Security Administration (SSA) “Actuarial Life Table,” if you’re an American man aged 60, you can expect to live on average another 22 years. If you’re a woman, that number climbs to about 25 years.

But that’s on average. Men (women) aged 60 have a 1.24-percent (3.31-percent) chance of living past age 100 — another 40 years!

While you shouldn’t bet on living that long, how happy would you be to achieve such longevity in poverty?

2. How Much Do You Need to Retire?

Experts say you should expect to need 80 percent of your last salary when you first retire.

Naively, you could use the so-called “4-percent rule” to calculate that this means that by retirement, you need to have 20 times your last salary invested. However, Social Security retirement benefits will reduce that staggering amount to the more commonly accepted range of 10–16 times your final salary.

3. How Much Income Can You Count on in Retirement?

If you’ll have at least 40 quarters (10 years) of earnings on your Social Security record, you can count on retirement benefits from the SSA.

How Much of Your Salary Will Social Security Retirement Benefits Replace?

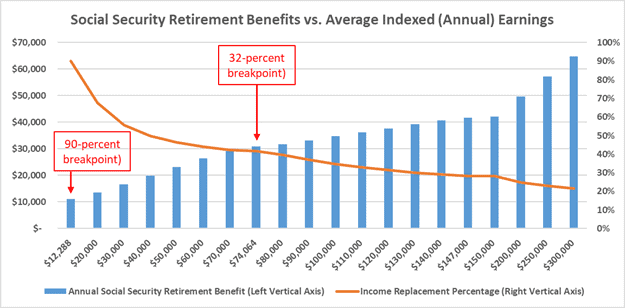

When calculating your retirement benefits at your full retirement age (67 if you were born in 1960 or later), the SSA uses a formula based on your Average Indexed Monthly Earnings (AIME) with two “breakpoints.”

For AIME up to $1024 ($12,288/year), benefits replace 90 percent.

For AIME between that and $6172 ($74,064/year), income up to the first breakpoint is still replaced at 90 percent, but the remainder is replaced at just 32 percent.

For AIME above $6172, income up to the second breakpoint is replaced as above, while the remainder of income is replaced at a miserly 15 percent.

The graph below shows how this works for a range of indexed annual earnings between $12,288 and $300,000. The blue bars and left vertical axis show the expected retirement benefits, while the orange line and right vertical bar show the effective income replacement rate.

Say your average indexed earnings are $80,000. Since that includes your highest 35 years’ worth of taxed earnings, you likely earn more now. Say you’re currently earning $100,000. At $80,000 average indexed earnings, your retirement benefits from the SSA (see above graph) will replace about 40 percent of that amount, $31,718 to be more precise.

Assuming you need 80 percent of your current $100,000 salary, your portfolio will be “responsible for” replacing the remaining $48,300. Using the 4-percent rule, this translates to needing about $1.2 million, or 12 times your last salary (agreeing with the above-mentioned range of 10–16).

How Does That Compare to the Average Social Security Benefit?

For the average retiree, SSA retirement benefits provide just $1673 a month ($20,073 a year), implying an average indexed income of about $40,000. Note that the $1547 a month ($18,559 a year) quoted by some includes the lower average benefits received by disabled individuals, survivors, and dependents and is thus not the right number to look at.

What Happens If Your Income Is Much Higher?

Looking at the graph, we see that the higher your income, the smaller the portion of your average indexed income Social Security benefits replace. For incomes far above $74,000, the fraction slides down ever closer to 15 percent. That’s why I say above that the higher your income, the worse off you are if you haven’t saved enough.

Can You Even Count on Social Security?

It’s become a widely believed notion that Social Security will go bankrupt in the next 10–15 years, so it won’t be there for you.

Is that really so?

According to the Trustees of the Social Security and Medicare trust funds: “The Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivors benefits, will be able to pay scheduled benefits on a timely basis until 2034, one year later than reported last year. At that time, the fund’s reserves will become depleted, and continuing tax income will be sufficient to pay 77 percent of scheduled benefits.”

Breaking this down, if Congress does nothing to fix the shortfall, Social Security will be able to continue paying retirement benefits for the next 12 years. After that, benefits would have to be cut by 23 percent.

Not great, but nowhere near the disastrous notion that it’ll totally disappear soon after you retire.

And keep in mind that between now and then, Congress can make changes to fix things and extend the trust funds’ liquidity for a few decades (which they’ll very likely defer until the last minute).

Here’s what they can do (in what I believe is a descending order of likelihood):

- Gradually increase the full retirement age (as they did before)

- Increase the maximum income subject to Social Security taxes much higher than the current $147,000

- Means-test benefits, reducing them for high earners and/or the wealthy

- Reduce benefits for everyone (the default outcome if they do nothing)

Why Starting to Save and Invest for Retirement Even at Age 60 Isn’t Too Late

First and foremost, even ignoring the savings you’ll build up, every dollar you start saving for retirement now lowers your retirement need by $0.80! And the best news is that this benefit starts immediately!

Reduce your spending by $100 a month, and your annual need in retirement will drop by $960 a year.

Reduce it by $500 a month, and that’s $4800 a year less needed in retirement.

Reduce your monthly expenses by $1042, and you’ll need $10,000 a year less.

That’s why I say that it’s never too late to start. Not at 60 and not at any other age. Also, don’t forget that many jobs these days can be done by people far older than 67, which still gives you more years to invest than you might expect.

What You Can Still Do to Improve Your Retirement

Writ large, you have four levers to make your retirement more comfortable.

- Reduce your spending

- Increase your earnings

- Increase your annual returns

- Delay your retirement

Let’s see how you can achieve each of these.

1. Reduce Your Spending

Your top priority is to review your spending and cut it as aggressively as possible. First, categorize each spending item into one of three categories.

1. Unnecessary: These are things you spend on that you don’t use, that don’t align with your values and priorities, and/or that don’t bring you enough joy to be worth the cost. Some examples could be subscriptions you no longer use, gym memberships if you accept you’ll never go, paying others to do things you can and are willing to do yourself, etc.

2. More Expensive than Needed: These are things you can replace at a lower cost without a significant impact on your quality of life. Some examples could be shopping for less expensive auto insurance (make sure to get all the discounts you cab based on, e.g., reduced average mileage driven, safe driving record, etc.), shopping at lower-cost grocery stores, dining out less often and at less-fancy restaurants, etc. You can also look for senior discounts to help reduce spending.

3. Needed: Here, consider if some of these are things you could buy less frequently or reduce your use. This could include, e.g., signing up for your electric utility’s time-of-use saving program, setting your thermostat lower in the winter and higher in the summer, replacing lightbulbs with higher-efficiency ones, etc.

For anything in the first category, cut it out of your spending altogether. The things in the second category, replace with cheaper alternatives. Those in the third? Try to buy them less often.

In addition, if you have any high-interest debt (e.g., credit cards), pay it off as quickly as possible. This will reduce your interest costs, and once you pay it off, you can shift those dollars to beef up your monthly investments.

If you’re wondering if you should use your budget reductions to pay off debt or invest, first set aside some money for emergencies, then pay off all high-interest debt (interest higher than what you can earn from your investments), then invest.

2. Increase Your Earnings

Here too, you have a variety of options. Pursue as many of these as you can.

- Sell stuff you don’t need, e.g., on eBay; this will also help with the following item

- Consider down-sizing your home if you can find a less expensive one where you’d be willing to live (this may be more difficult if currently, available mortgage rates are much higher than the rate on your current loan); if the new home is in a less expensive location, that can help reduce your spending too

- Consider “house-hacking” by renting out a portion of your home to someone trustworthy

- Check if a reverse mortgage makes sense in your situation (this is a complicated topic, so you’d be well-advised to seek a financial professional to understand your options and pick the right one)

- Start a side gig to bring in extra money; bonus points if it’s something you’d enjoy doing in retirement because every $10/month of such income can reduce the portfolio you need by $3000!

- If your employer offers a 401(k) plan with employer matching, invest at least enough to max out that match — it’s free money!

3. Increase Your Annual Returns

With interest on checking and savings accounts lagging far behind inflation, consider investing your new savings as aggressively as you can stick with.

Since the stock market has historically returned more than six percent a year above inflation, invest as much in the market as you can bear without panic-selling when (not if) the market drops like a rock.

Over time, if you don’t sell when the market tanks, you’ll make more and need to invest less.

4. Delay Your Retirement

Delaying your retirement brings multiple benefits:

- Every year you delay Social Security benefits beyond your full retirement age (up to age 70) will result in an eight-percent increase in eventual benefits (note that if you expect to have a short life expectancy due to illness or other causes, you may do better to claim early)

- Every year you keep working is another year you can save for retirement

- Every year you continue working is one year less your portfolio has to provide retirement income

- Every year you wait to retire gives your portfolio another year to compound its growth

However, many Americans who planned to delay retirement ended up unable to do so, whether due to failing health or because they were let go before they were ready to retire.

The Bottom Line

It’s never too late to start saving for retirement.

Even if you retire in a year, saving and investing now will reduce your current spending, which will reduce how much you’ll need. It will also give your new retirement investments a bit more time to compound their growth. Finally, your reduced retirement spending may also reduce the taxes you’ll need to pay on your retirement income.

The above offers a roadmap of how to reduce your spending, increase your income, invest in appropriately aggressive assets, and benefit from delaying retirement.

Find Your Next Financial Advisor on Wealthtender

📍 Click on a pin in the map view below for a preview of financial advisors who can help you reach your money goals with a personalized plan. Or choose the grid view to search our directory of financial advisors with additional filtering options.

📍Double-click or pinch pins to view more.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor