To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Comparing 6 retirement (or work-optional) distribution strategies and figuring out which is best given your priorities.

I hate the word “retirement.”

It isn’t that I have anything against people who’ve worked multiple decades being able to downshift a gear or two.

My pet peeve here is that even after spending nearly a quarter century studying (all the way to my physics PhD), 16 years working in academic research, two years in corporate America, and 12 years as a self-employed consultant, I have no desire to sit on the couch and wait to die.

Not me.

No, thank you very much.

Like many others, what I’m looking forward to (in another 4–5 years) is getting to my “work-optional” phase of life.

Truth be told, I’m already sort of there, at least if we’d downgrade our lifestyle to what it was a decade or so ago.

However, if we want to enjoy all the things on our lists, it’ll take those 4–5 additional years.

And, given how close to the target we’ve come, it’s time to shift attention from asset accumulation to focus more on the best way distribution strategy.

As we’ll see below, this means it’s time to…

Go Beyond the 4-Percent Rule

When you start planning for work-optional (a.k.a. retirement planning), you need a target.

The number that’ll tell you you’ve accumulated enough to be able to live life on your terms — working only with/for people you like and trust, on projects that light you up, as many or few hours as pleases you, with no regard to what, if any, monetary compensation results.

In brief, seeing when you reach the point of “no more needed.”

The simplest way is the so-called 4-percent rule invented in the 1990s by William Bengen, a then-little-known financial planner.

Bengen realized that if you draw 4 percent at the start of retirement from a 50/50 portfolio of large-cap stocks and Treasurys and each following year increase your draw by the prior year’s inflation rate, you would not have run out of money over a 30-year retirement anytime from 1927 to 1992.

This “rule” was our goalpost for decades. Now, it’s time to get dialed in on the best possible distribution strategy, which may need to be…

A Dynamic Distribution Strategy

A recent Morningstar State of Retirement report states that, if you want a static distribution strategy with a 90-percent chance of success (i.e., not running out of money while still alive), your number is 3.8, not 4 percent, and last year that figure was 3.3 (13 percent lower).

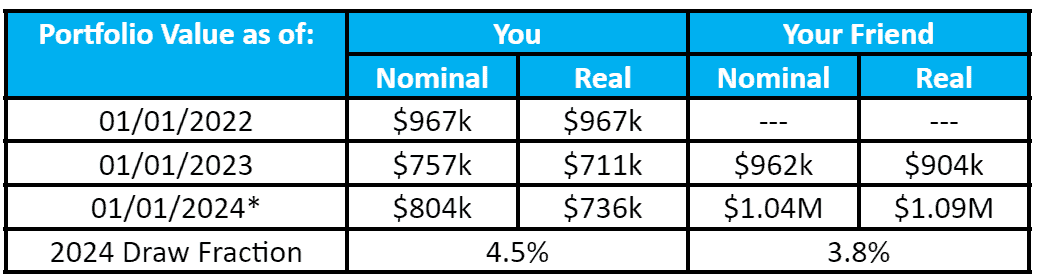

Worse, had you drawn 3.3 percent last year, you’d need to draw a larger fraction of your portfolio this year than your friend’s 3.8 percent draw if he started this year.

Here’s why…

As the table shows, your hypothetical portfolio is now worth $736k after adjusting for inflation from 01/01/2022; while your friend’s is worth $1.09 million. Your $33k real-dollar draw is thus 4.5 percent of your portfolio, while his $38k draw is just 3.8 percent of his.

This demonstrates the so-called sequence-of-returns risk, where a bad market early in your retirement can lead to financial disaster even if followed by a decade of decent returns, where having the same decade of decent returns precede that bad market may work out ok.

The report shows that if the market tanks by over 15 percent in your first year, your likelihood of running out of money (continuing static-real-dollar draws) increases eightfold to 50 percent (!) compared to a 5.9 percent risk with an average year for the markets.

As Frank Murillo, CFP® at Frank the Planner says, “The most common problem with using the 4-percent rule (or any static withdrawal strategy) is that it doesn’t account for fluctuating account values throughout a retirement lifespan. Using a dynamic approach, such as reducing withdrawals following, say, a 20 percent portfolio decline, and conversely increasing distributions after a 20 percent increase can materially increase the longevity of a client’s nest egg.”

To try and avoid such a fate, Morningstar examined five dynamic strategies compared to the above (3.8-percent static-real-dollar) strategy.

These were:

- If your portfolio value drops, you cut spending by 10 percent, but go back to your previous schedule as soon as your portfolio restarts providing positive returns.

- If your portfolio value drops, don’t adjust your draw for inflation.

- The Guardrails Approach, where you cut spending by 10 percent if your planned inflation-adjusted draw is over 20 percent higher than your target percentage; and give yourself a raise if your portfolio increases to the point that your planned draw is 20 percent lower than your target.

- Use the government’s formula for Required Minimum Distributions (RMDs), which are designed to keep adjusting based on your remaining life expectancy.

- Instead of adjusting your draw by inflation, you adjust it by inflation minus 1 percent.

To achieve a 90-percent success rate with the same 50/50 portfolio as the 3.8-percent rule (out of 1000 Monte Carlo simulations), they found that (using the above order of the five strategies) you get:

- 4.0 percent initial draw and 3.9 percent lifetime average draw.

- 4.4 percent initial, 4.0 percent lifetime average.

- 5.3 percent initial, 4.8 percent lifetime average.

- 4.4 percent initial, 5.4 percent lifetime average.

- 4.3 percent initial, 3.7 percent lifetime average.

All of these are compared to the static strategy, which has a 3.8 percent initial draw and the same for its lifetime average.

The strategies result in a different median value after 30 years of distributions.

If the static case results in a $1 million median 30th-year remainder, the dynamic strategies have medians of:

- $950k

- $840k

- $420k

- $110

- $1 million, respectively (truthfully, I wonder if this one isn’t an error — I’d expect to have a higher median remainder if you draw less throughout the 30 years).

Interestingly, the variation in your draw amount in real dollars across 900 successful simulated scenarios also changes dramatically.

The static case, by definition, has zero variation, as does the last dynamic scenario. The first two dynamic scenarios have small but non-zero variations (6–7 percent).

The Guardrails approach 30th-year variation is considerable, at 35 percent.

Finally, the RMD approach has the greatest variation of 30th-year draw, at 50 percent.

What do these all mean when we reach…

The Bottom Line?

Any of the five dynamic strategies will let you draw more than the static one initially, and all except the last result in a higher lifetime average draw (i.e., more comfortable retirement) without increasing the risk of running out of money.

The Guardrail Approach gives you the highest initial draw, at 5.3 percent, and the second-highest lifetime average, at 4.8 percent. Indeed, if you changed your stock allocation from 50 percent to 100 percent, the lifetime average draw increases from 4.8 percent to 6.3 percent!

The only approach giving a higher lifetime average is the RMD approach. However, this approach leaves almost nothing at the end of 30 years, whereas the Guardrail Approach leaves over 40 percent of what remains in the static 3.8 percent case.

The biggest drawback of the Guardrails Approach is the relatively high uncertainty about your real-dollar distribution in your 30th year. However, this is likely partially due to having some simulated scenarios end up with a much bigger portfolio, so you keep increasing your distribution.

Another (minor) drawback of the RMD method is that it requires you to recalculate your distribution amount each year to check if it should stay as-is, be cut 10 percent, or be bumped up 10 percent, whereas the static approach only requires adjustment for inflation.

Given all the above, each person approaching a “work-optional” phase of life needs to consider what they value most:

- The most efficient use of their funds for a comfortable lifestyle (i.e., spend as much as possible, for as long as possible, with as low a risk as possible of running out of money).

- Leaving the largest bequest possible while enjoying a reasonably comfortable lifestyle commensurate with the size of your nest egg.

- Having the simplest calculation with the most predictable annual spending amount.

If your priority is solely item 1, use the RMD method.

If your priority is item 2 and/or 3, use the static (3.8 percent, as of this writing) approach (it lets you spend about 3 percent more than the fifth dynamic approach).

If your main goal is 1, but 2 is also important (that’s my pick), the “Guardrails Approach” is best.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor