To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Does their bad reputation mean you should never consider a reverse mortgage? Answers to 14 questions you should be asking…

At some point, we all realize we have fewer years ahead of us than behind.

Then, if you’re like many of us, your next thought might be something like, “Shoot!” (or a more colorful expression) “I better start saving for retirement!”

Our Society-Wide Retirement Deficit

According to DQYDJ.com, the median net worth of Americans in their mid to late 60s is almost $272k. That’s not too bad, but… that’s including primary residence equity.

Discount that equity, and the median net worth drops by over 72 percent to just $75.5k!

That’s (sarcasm alert!) just $209.5k shy of what you’d need to retire…

Here’s why.

The median US income at age 65 is $60k.

Financial planners suggest you’d need 80 percent of your last salary annually in retirement, so, in our example, that’s $48k.

The average retired couple receives $2,800 monthly from Social Security, or $33.6k, leaving a gap of $11.4k. According to the 4-percent rule, you’d need $285k to safely generate that $11.4k annually for 30 years.

Unfortunately, more than half of Americans ages 65-69 have less than that, counting home equity. Excluding home equity, the have-nots are nearly 2 in 3.

Reverse mortgages were designed to let older homeowners access their home equity to help close that gap.

What Is a Reverse Mortgage?

If you own a home, you’re very likely making mortgage payments. According to Zillow, just 37% of homeowners own their homes free and clear. In 2021, 8.4 million mortgages were written.

You’d be easily forgiven if you’ve never heard of reverse mortgages since just over 45 thousand of those were written in 2021, Investopedia.

That’s fewer than 1 in 185 mortgages!

A reverse mortgage is a way to borrow against the equity in your home without having to make monthly payments. You can take the loan as a lump sum, as monthly payments, as a line of credit, or a combination of those, and because it’s a loan, the money you get is tax-free.

The first such loan was written in 1961. In 1988, Congress passed a law allowing the Federal Housing Administration (FHA) to insure reverse mortgages. From that point, more such loans were written, peaking at 115,000 loans written in 2009. Since then, annual numbers dropped by more than half.

How Do Reverse Mortgages Work?

Just as with regular mortgages, the lender determines how much you can borrow, based on many factors, including your age or the age of your spouse; if you’re older (the older the younger spouse is, the more you can borrow), the value of the home (you can’t borrow more than the home is worth), the interest rate (the higher it is, the less you can borrow), and whether the home conforms FHA’s mortgage limit.

If the real estate market drops after the loan starts and your house value goes below the loan amount, you (or your estate) don’t need to make up the difference, either then or when the loan comes due. The most the bank can collect is the proceeds from the sale of the home.

There are three types of reverse mortgages.

- The most common is the Home Equity Conversion Mortgage (HECM). These usually have the lowest interest rates and the greatest oversight by the government. However, they come with high fees.

- Proprietary Reverse Mortgages are a type of jumbo reverse mortgage. These private lender loans aren’t guaranteed by the federal government but may be regulated by the state. The lack of guarantee leads to higher interest rates and fees. However, they can provide up to $10 million and borrowers may qualify at ages as young as 55.

- Single-Purpose Reverse Mortgages, backed by state, local, or nonprofit agencies, usually carry the lowest interest rates and fees. However, they’re not available everywhere and can only be used for limited purposes such as home repairs or property taxes.

Since reverse mortgages have interest and don’t require monthly payments, your balance increases every month by the month’s interest and fees, decreasing your home equity. When you sell, move, or die, the home is sold to pay off the loan balance and you or your heirs receive any remaining amount.

Alternatively, you or your heirs can choose to pay off the loan and/or refinance it to avoid selling the house.

If the house is sold and the balance owed exceeds the proceeds, the lender takes the proceeds as payment in full, and the remainder is written off.

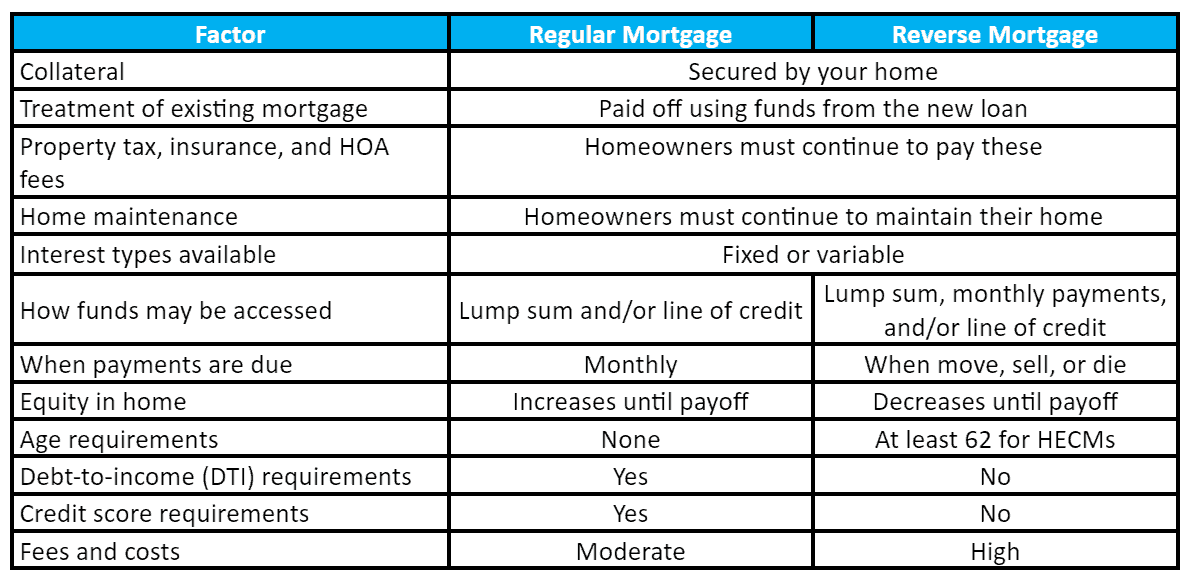

How Are Reverse Mortgages Different from Regular Mortgages?

As alluded to above, there are both similarities and differences between reverse and regular (or forward) mortgages, summarized in the following table.

Why Do Reverse Mortgages Have a Bad Reputation?

Reverse mortgages come with high-interest rates and high fees. Especially before 1989, bad actors used them to take homes away from senior citizens.

The worst of the abuses were then curbed through tight regulations that were put in place since then. From 2014, people who want to take out a reverse mortgage are required to go through a federally mandated financial assessment. Many states and Washington DC have their laws that go beyond federal requirements.

Who Can Get a Reverse Mortgage?

Not everyone can get a reverse mortgage.

- In general, everyone on the title to the house must be at least 62 years old (some private loans allow borrowers to be as young as 55). The older you and your spouse, if any, are, the more you can borrow.

- The home must be your primary residence.

- Your equity must be at least 50 percent of the home’s value.

- The lender may also check your credit score and/or your DTI ratio (though these aren’t usually required to qualify for HECMs)

- For HECMs, you cannot be delinquent on any federal debts (e.g., student loans, tax debt, etc.) and need to show you have enough resources to continue paying property taxes, homeowners’ insurance, homeowner association (HOA) fees (if any), and home maintenance because failing to take care of any of these would allow the lender to foreclose.

- As mentioned above, you must also complete the federally mandated financial counseling session by an approved HECM counselor to ensure you understand all the terms and conditions and know your alternatives, to be sure you’re making an informed decision.

How Much Can You Get from a Reverse Mortgage?

The exact amount you can borrow, as mentioned above, is determined by the lender based on your specific situation, including the age of the borrower(s), the home’s value, etc.

For a HECM, the absolute maximum in 2023 is $1,089,030.

Lending Tree offers a reverse mortgage calculator to estimate the lump sum you may be able to borrow.

What Are the Advantages of a Reverse Mortgage?

Since many seniors have most of their net worth buried in their home equity and do not have enough to fund a comfortable retirement from their liquid assets, a reverse mortgage lets them live more comfortably in retirement without draining their nest eggs too quickly.

You can convert your home equity into cash while retaining title and don’t have to sell and move out.

You can qualify even with bad credit and/or a high DTI ratio.

Your existing mortgage, if any, will be paid off by the new loan.

You don’t have to make any monthly payments during the life of the loan.

The proceeds of a reverse mortgage can be on top of Social Security retirement benefits and Medicare.

The money you get is debt, and thus tax-free.

The funds can help cover large emergency expenses, including medical bills.

You can use the money to pay off high-interest debts.

You can even use a HECM to buy a new home, so long as you move in no later than 60 days from closing.

If you take the money in monthly payments, those will continue coming as long as you meet the loan requirements (e.g., staying current on property taxes and HOA fees, maintaining insurance coverage, keeping the home in good repair, etc.), no matter how long you live, even if the balance owed exceeds the value of the home.

If you take the money in monthly payments, those are guaranteed so you can invest your portfolio more aggressively.

If you set up a line of credit with some or all of the money, you can use the funds when needed.

Your spouse can stay in the home after you die or move into a long-term care facility, even if he or she wasn’t a co-borrower, so long as you were married when you took out the reverse mortgage loan.

When the home is sold, the loan will be considered paid in full if the lender receives the proceeds, even if that’s less than the amount owed.

Your heirs can choose to keep the home, in which case they’ll need to pay the balance owed in full. This can be done in cash or through refinancing.

What Are the Drawbacks of a Reverse Mortgage?

If you’re spending more than you should be or can support, a reverse mortgage may seem like a dream come true. However, it has some significant drawbacks you should fully understand to make sure it doesn’t become a nightmare.

If you’re someone who simply spends money whenever it’s there, you could find yourself having spent all of your home equity and facing the same issues without that extra cushion left. Worse, you could reach a point where you can’t pay insurance, property taxes, HOA fees, or repairs and maintenance costs, and lose your home.

The fees and interest of reverse mortgages are higher than those of regular mortgages, so your equity will likely drain faster than it built up. These costs can include:

- Loan origination fees that could be up to $6k.

- Upfront mortgage insurance premium of 2 percent of the home’s value, not the loan balance.

- Annual mortgage insurance premiums of 0.5 percent of the home’s value.

- The financial counseling fee that could be as much as $150.

- The usual closing costs such as home appraisal, title fees, taxes, etc.

The loan comes due when you move, sell, or die. In the last of those cases, your family may need to deal with all of your possessions while having to take care of funeral arrangements, etc., not to mention the grief.

If you take the money as a lump sum, or as a line of credit which you then draw from, you need to avoid doing this before the Medicaid means test, or the money could count as a qualifying asset, reducing your eligibility.

While interest on the loan is tax deductible, that doesn’t happen until you make payments, at which time the interest portion could be deductible.

Since you don’t make any monthly payments, the fees and interest grow the balance owed. That could eventually exceed the value of the home. In such a situation, your heirs may be stuck with a huge bill if they want to keep the home (they could give up the home, in which case they’d owe nothing).

Because the lender would receive any shortfall from the government’s guarantee, the government instituted new rules in 2017 that increased upfront payments and decreased the amount you can borrow to less than 60 percent of your equity.

Finally, the rules of a reverse mortgage are complicated. If you move to a long-term care facility, does that count as having moved out, making the loan come due? If you marry after you took the loan and then die before your spouse, would he or she have to move out? These and other questions are things you need to fully understand before taking out a reverse mortgage.

What Are Your Other Options to Close Your Retirement Funding Gap?

Reverse mortgages are not the only option that lets you tap the equity in your home. However, all of the following options have requirements as to your credit score (620 or higher), DTI, and remaining equity after the new loan is funded.

This makes such options hard to qualify for if your credit score is low and/or your income is low,

- Home equity loans (a.k.a. second mortgages): To get one of these you need to have a high enough credit score (at least 620), have at least 15 percent home equity after counting the new loan amount, and must meet DTI requirements.

- Home equity lines of credit (HELOCs): These typically have a 10-year draw period during which time you can, but don’t have to draw money and make payments that at least cover the interest. Interest usually adjusts each month according to market conditions. When the draw period ends, you must make monthly payments that pay the loan off in full within a set payoff time, typically 10 years.

- Cash-out refinancing: This means taking out a regular mortgage loan but where you borrow more than you owe on your existing loan, leaving the excess money available to cover your needs.

In all these options, as you pay the loan off you rebuild your equity rather than continuing to drain it, as happens with a reverse mortgage.

Who Shouldn’t Consider a Reverse Mortgage?

If you have other, less expensive options (e.g., using ongoing income, second mortgage, HELOC, cash-out refi, or downsizing, a reverse mortgage should not be your first option.

If you want to leave the home to your heirs for sentimental or other reasons, a reverse mortgage will force them to pay off your loan, potentially having to spend more than the value of the home.

If you aren’t certain you’ll be able to keep paying property taxes, homeowners’ insurance, HOA fees, and maintenance costs, you run the risk of the lender foreclosing on the home. Especially notable in this regard is that the statistics show default rates on reverse mortgages may be six-fold higher than on regular mortgages, about 1 in 10 vs. 1 in 58.

If you’re planning to use a reverse mortgage as a bridge from the earliest you can file for Social Security benefits at age 62 to your full retirement age (FRA) which could be as late as 67, the costs and risks of a reverse mortgage may end up higher than just taking the reduction in Social Security benefits.

If you plan to move soon (whether downsizing, relocating, or moving into an assisted living facility), a reverse mortgage is likely far more expensive than other options because you need a long time for the high initial costs to be divided over more years.

If you need more than the $1,089,030 federal limit and can’t qualify for a proprietary reverse mortgage, you have to find a different way to get the money.

Who May Be a Good Candidate for a Reverse Mortgage?

First and foremost, you must meet the requirements, including age, equity level, and not be delinquent on any federal taxes and/or loans.

Second, you should either not have heirs, or not care if you leave your home to heirs.

If you own your home, have a great deal of equity (the recent price appreciation of residential real estate makes this more likely), and have too little in liquid assets to cover your expenses (especially given the recent high inflation), a reverse mortgage may offer a solution since it can provide a life-long income stream. If you’re currently paying an existing mortgage, a reverse mortgage will pay the old loan off so your expenses will be much lower.

If you need extra income and can’t qualify for other options such as a cash-out refi, second mortgage, or HELOC, a reverse mortgage may be your best bet.

Paul Monax, CFP, finAGILE Planner, Agile Wealth gives a great example, “I have a single client in her late 60s with no children. She moved to a new home that was $100k more expensive than the proceeds from selling her old home. Had she taken the $100k from investments, she’d be plowing it into equity, reducing her ongoing income and liquid assets to address, e.g., unexpected health expenses. A traditional mortgage would weigh on her budget without providing much equity for many years. I recommended a reverse mortgage to avoid all that and provide her with a more comfortable lifestyle.”

When Does a Reverse Mortgage Come Due and What Happens Then?

You can pay down the balance or pay off a reverse mortgage in full whenever you want.

In any case, the loan comes due and must be repaid when you move out, sell, or die. However, as mentioned above, the full proceeds from the sale of the home must be accepted as payment in full in those cases where the balance owed is higher.

In such a situation, the lender writes off the remaining balance and gets the difference from the government-backed mortgage insurance.

How Do You Get a Reverse Mortgage?

To get a reverse mortgage:

- Make sure you meet the requirements.

- Meet with an approved third-party financial counselor.

- Comparison-shop to find the right loan for you with the lowest interest rate and fees.

- Verify that the money you expect to get once all fees are covered (closing costs can be many tens of thousands of dollars) is enough for the needs that drove you to take out such a loan.

- Complete a loan application.

- The lender’s underwriters will evaluate the application.

- The lender will have the home appraised to determine the amount you can get.

- The loan processors will take care of all the paperwork.

- The loan closes and you receive the money in the manner(s) you choose.

You may want to also talk about it with your heirs so they’re not blindsided once you die.

Where Can You Find Reverse Mortgage Interest Rates?

Just as with other types of mortgages, you can find generic rates through lender websites and those of third parties (e.g., https://reverse.mortgage/rates. Normally, you’ll need to complete at least some initial paperwork to find out what your personalized rates would be for different loan types from each specific lender.

The Bottom Line

Reverse mortgages can be a lifeline that lets you access the majority of your net worth when it’s tied up in your home’s equity. Especially given how much of the median American’s net worth is tied up in their home’s equity, and how high residential real estate values have recently risen, this is a significant consideration.

Better yet, any money you receive is considered debt, and is thus tax-free.

However, that isn’t always your only, let alone the best, option. These loans come with high fees and interest rates, complex rules, and strict requirements that could end up costing you your home.

On the positive side, you don’t have to make monthly payments, and you gain access to extra cash, in lump sum, monthly, payments, line of credit, or a combination. Even better, if the loan balance exceeds the value of the home when you move, sell, or die, the lender can only take the home. Any remaining balance will be written off from your loan and paid by the government.

On the negative side, you or your heirs would need to pay off the loan or refinance it when the reverse mortgage comes due if the home is to be kept in the family.

If you decide to move early (or need to do so for health reasons), the high fees and closing costs will be very expensive for the short time the loan was there to help you.

If you find yourself unable to keep up with property taxes, insurance premiums, HOA fees, and/or maintenance costs, the lender could foreclose on the home.

If any of the above is a concern (and it likely should be), make sure you fully understand what you’d be getting into before going this route.

As Marguerita Cheng, CFP & RICP, Chief Executive Officer, Blue Ocean Global Wealth, says, “This topic is important to me professionally, and even more so personally because my dad had Parkinson’s disease for 9 years. A HECM gives access to home equity to pay for long-term care and other expenses for aging relatives. However, while older people often want to age in place, that may not always be best. Before taking out a reverse mortgage, verify the home in question is appropriate for aging in place. A home where people raised their children may now, when they’re much older, be too big; too much to manage; unsafe because of stairs, wet leaves, uneven sidewalks, etc.; and/or too expensive to maintain.”

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor