Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Tax loss harvesting is a strategy uniquely suited to small business owners, especially those who are contemplating selling their business in the near future. While Tax Loss Harvesting is a strategy that all investors can utilize to help lower their capital gains taxes, I believe the benefits to small business owners aren’t commonly considered when planning how to manage your investments. This is yet another reason why having a comprehensive financial plan that includes both tax and financial planning is key to long-term success. This blog will review how tax loss harvesting works, the different styles and methods of tax loss harvesting, and the 3 benefits that small business owners may derive from implementing tax loss harvesting in their portfolio.

How Tax Loss Harvesting Works

Before we get into the specifics of how tax loss harvesting benefits small business owners, we need to discuss the basics of how it works. There are two components to tax-loss harvesting – the investment mechanics and the tax mechanics.

Investment Mechanics

Tax Loss Harvesting refers to a process where you identify investments that are at a loss in your portfolio and sell them to capture, or realize, the loss. You then replace the investment with another investment that is not “substantially identical.” Let’s break this down into its component steps.

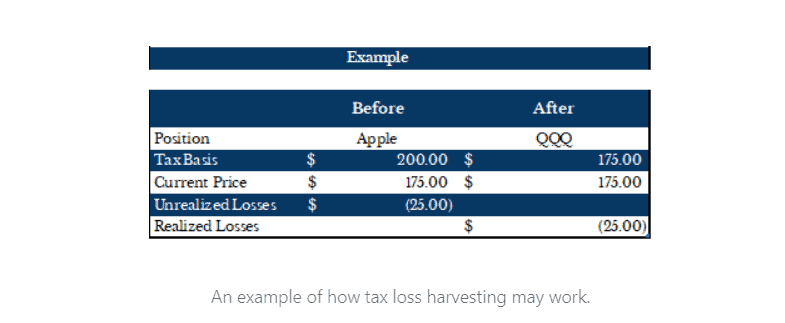

- You identify a position at a loss. Let’s assume that you have Apple stock with the following characteristics:

- Purchase price – $200

- Current Price – $175

- Unrealized Loss – ($25)

- Holding Period – 250 days

- You then sell Apple and lock-in the following:

- Realized Short-Term Loss of ($25)

- Realized Short-Term Loss of ($25)

- You then buy $175 of QQQ, the NASDAQ 100 ETF, to replace the Apple in your portfolio and maintain a similar investment strategy to what you previously employed.

- While NASDAQ shares some of the same profile as APPLE, it is not substantially identical as it comprises 100 positions, not just Apple.

Utilizing tax loss harvesting in this manner keeps your portfolio’s general investment characteristics very similar both before and after the transaction due to Apple and QQQ’s correlation to each other.

The Tax Rules of Tax Loss-Harvesting

When you utilize tax-loss harvesting, whether you’re a small business owner or not, there are several tax rules you need to follow to do this properly. The main rule to consider is the wash sale rule, which has several key components.

The first component of the wash sale rule is timing. You are subject to the wash sale rule if you purchase a substantially identical security in the wash sale window. The wash sale window includes both the 30 days preceding the sale, the day of the sale, and the 30 days following the sale for a total of 61 days. (tip: remember to check if your dividends have been reinvested in a DRIP program as a dividend reinvestment is a purchase!)

The second component of the wash sale rule is the substantially identical security rule. This aspect of the wash sale rule states that you cannot purchase a substantially identical security during the wash sale window. So, what does “substantially identical” mean? While the wash sale window is clearly defined, the substantially identical security rule is not clearly defined in every case. I believe showing a few examples may be helpful.

Here are a few examples:

- Selling Apple and then rebuying Apple = wash sale (this is the purest example)

- Selling Apple in your brokerage account and buying it in your IRA = wash sale

- Selling Apple and buying QQQ (which holds Apple) = not a wash sale

- Selling Apple and buying Apple call options = wash sale

- Selling SPY (SPDR SP500 ETF) and buying VOO (Vanguard SP500 ETF) = wash sale

- Selling VOO (SP500 ETF) and buying VTI (Total Market ETF) = not a wash sale

While these examples are straightforward, substantially identical has several more complicated areas – put options, bonds, convertible bonds, and preferred stock being the more complicated areas. If you’re contemplating tax loss harvesting for these types of positions, I would run it by your tax advisor before tax loss harvesting.

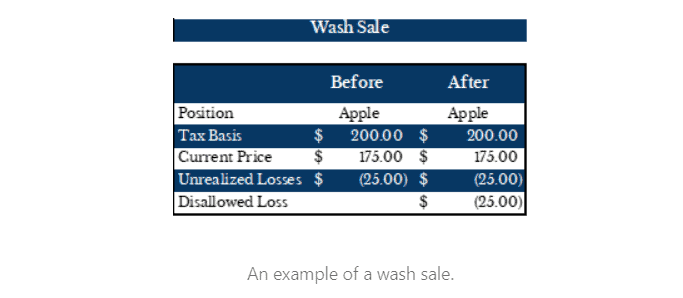

What happens if you run afoul of the wash sale rules when tax-loss harvesting?

If you run afoul of the wash sale rules, your loss is disallowed. However, this does not mean you lose the loss entirely, instead the disallowed loss is added to your new position’s basis.

Here’s how that works:

The penalty does not eliminate your loss; however, it does delay the realization of said loss until a disposition that satisfies the wash sale rules. Essentially, this puts you in the same tax position you were in prior to the sale.

In general, these rules are straightforward – don’t buy a substantially identical security within a 61-day window and your loss will be allowed. The only complication is what substantially identical means.

So, now that I have these losses what can I use them for? There are two ways that you can use your losses.

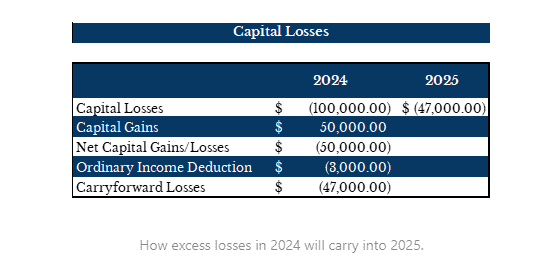

Tax losses from tax loss harvesting are capital in nature. If you have capital gains, your capital losses can be used to offset capital gains with no limits. This is particularly valuable if you have other accounts generating gains.

Once the capital gains are offset, two things happen. Capital losses can be used to offset up to $3,000 per year in ordinary income – think W2 and business income. Any amounts over $3,000 are then carried forward to your next year’s tax return. Here’s how it works:

At a 37% tax rate, the annual ordinary income deduction yields $1,110 in tax savings. Paired with the unlimited offset of capital gains, these savings can be substantial over time.

Types of Tax Loss Harvesting

Now that we have established how tax loss harvesting works, I think it would be helpful to discuss two different approaches to tax loss harvesting – basic tax loss harvesting and systematic tax loss harvesting. While these may not be common distinctions, I believe that they are helpful as you consider implementing tax loss harvesting into your portfolio.

Basic Tax Loss Harvesting

Basic tax loss harvesting could best be described as periodic reviews of an investment account to sell positions at a loss for tax reasons. This could be done monthly, quarterly, or annually. Typically, without a systematic approach in place, most investors do this at the end of the year as they review their gains to try and find losses to offset their taxes.

This approach is better than doing nothing, and can result in tax savings, but is typically done as a secondary consequence of general investing.

Systematic Tax Loss Harvesting

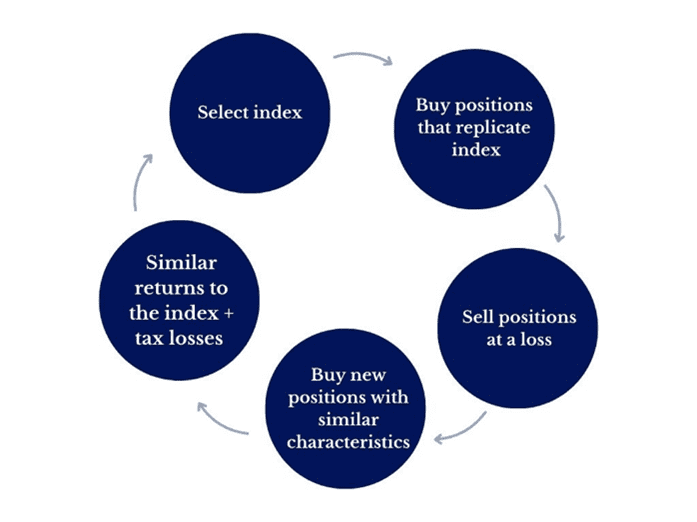

When you read articles about tax loss harvesting strategies – whether done by Vanguard, Wealthfront, Parametric, or others; you are most likely reading about a systematic tax loss harvesting strategy. Systematic tax-loss harvesting differs from basic tax loss harvesting in that they are typically dedicated to tax loss harvesting as a primary goal of their investing method. This means that losses are reviewed daily and taken as frequently as possible instead of on an ad hoc basis.

Systematic tax loss harvesting was made commonly available with the adoption of algorithmic trading and $0 commissions. Instead of having a human manage 3000 stocks, a program is coded with investment and tax rules to maximize the tax losses taken each year.

Here’s how it works:

- Instead of buying an ETF to replicate an index, let’s use the Russell 3000, a certain number of stocks in the Russell 3000 are purchased. Let’s say 1800 or 60% of the index.

- These stocks are weighted in such a way that the performance of 1800 stocks is extremely close to buying the full 3000. For example, if the R3000 is 20% Information Technology, 20% of the stocks purchased are also information technology. This minimizes what is called tracking error.

- Because the tax loss harvester has only purchased 1800 of the 3000 stocks, there are stocks in the R3000 that are very similar to 1800 that you already own. When one of the stocks owned is at a loss, it is sold and replaced by a new stock that is similar to the old stock, but not substantially identical. In this way, you capture the tax loss while still maintaining the same investment outlook.

- Most importantly, this is done daily, typically resulting in almost the same performance as the index and a much higher amount of tax losses than what most people accomplish when only tax loss harvesting at the end of the year.

As you utilize systematic tax loss harvesting, your annual losses will decline over time. Think about it this way:

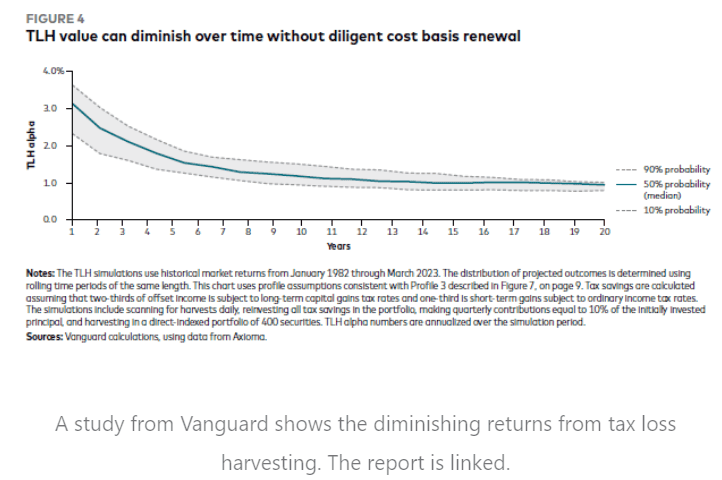

If in any given year, 80% of an index is positive, then 20% of the index will be negative. While there are intra year fluctuations, which mean you may have loss harvested some of the positive stocks, over time your portfolio will only consist of stocks that are at a gain as each year 80% of your account will increase in value. This means that eventually, your tax loss harvesting account will run out of losses to take. This typically happens in 10-15 years and results in the tax losses being exhausted. The below chart from Vanguard shows how tax losses begin to decrease over time. However, the tax benefits can be extended in certain scenarios.

If implemented properly, Vanguard estimates an improvement in investor returns due to tax loss harvesting of .47-1.27% in “tax alpha”. While Vanguard is an interested party, the math shows that the benefits of systematic tax loss harvesting can be substantial.

While implementation of a systematic tax loss harvesting strategy, otherwise known as direct indexing, can be complicated, the rewards may well be worth it. In my opinion, systematic tax loss harvesting provides the highest benefits to small business owners.

Three Benefits of Tax Loss Harvesting for Small Business Owners

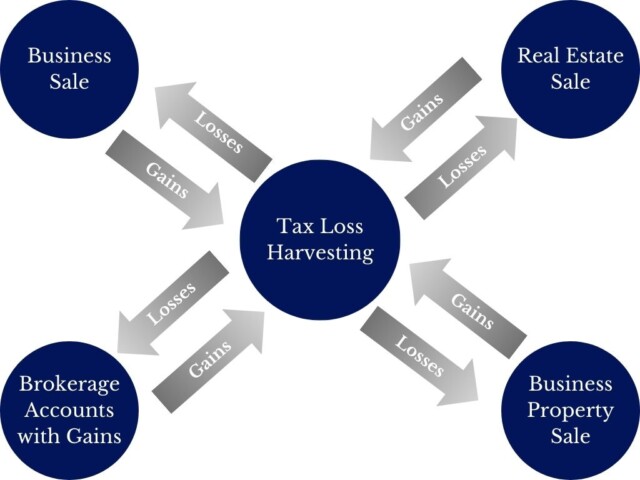

Now that we’ve discussed how tax loss harvesting works, it’s time to discuss how tax loss harvesting may benefit small business owners specifically. As we discussed earlier, utilizing tax loss harvesting often results in excess capital losses sitting on your tax return. These losses are then carried forward year after year. Business owners have three additional ways to plan and take advantage of their losses without having to carry them forward.

Preparing for a Sale of a Small Business

The first and largest opportunity that a small business owner has with regards to tax loss harvesting is in preparing for the sale of your small business. Some of tax gains generated by selling your small business can be offset utilizing capital losses from your tax loss harvesting account.

To properly accomplish this, it requires planning ahead. For most business owners, their net worth is mostly made up of their business. To achieve any level of significant offset, the tax loss harvesting account will need to be comparable in size to the business. If the account is smaller, you can still offset some gains, but you will not be able to offset a high percentage of the sale.

That means 1 of 2 things:

1. Either you plan ahead and begin to fund the tax loss harvesting account a few years before the sale

Or

2. You invest the proceeds of the sale into a tax loss harvesting account to offset as much in taxes as possible.

Option 1 is by far the best option. Most business owners are already saving towards retirement and other goals which means there is typically cash flow available. Redirecting this cash flow towards a tax loss harvesting account can help you begin to prepare for the eventual taxes on the sale of your business. If you start a few years early, you may be able to save a significant amount when compared to the total business value.

However, if you can only fund a tax loss harvesting account post-sale, there are a few additional considerations.

- Payment Structure – will the sale be a lump sum or installment note? If it’s an installment note, you may have more time to build up your account.

- IRS Penalties – if you fund a tax loss harvesting account, that means you are sending what would otherwise be tax dollars into the investment account. You would need to model out if the tax savings are greater than the penalties or invest only the amount that you plan to receive net of any expected taxes.

- Timing – if you knew you were going to use this strategy, it may make sense to structure the sale at the beginning of the year so you can use as much of the year as possible to harvest losses.

The next question to ask is what types of business sales qualify. Selling a business is extremely complicated and can result in several different types of taxation.

- Asset Sale

- In an asset sale, the purchase price is allocated across the assets being purchased. Several types of assets will not qualify.

- Accounts Receivable – ordinary income and does not qualify.

- Depreciation Recapture – ordinary income and does not qualify.

- Goodwill – qualifies as it is capital.

- Capital Assets – qualifies after depreciation recapture.

- Stock Sale

- In a stock sale, the asset to be sold is the equity of the company and most of the sale will qualify. However, sometimes other assets will be retained like accounts receivable.

- Accounts Receivable – does not qualify.

- Equity – does qualify.

Once you’ve determined what type of sale you have and the payment structure on your proceeds, you can begin to model out if a tax loss harvesting strategy makes sense for you.

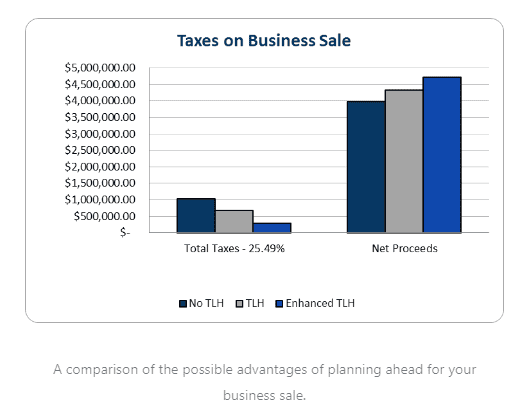

Below, I have a comparison of three scenarios for a small business selling for $5,000,000 with $1,000,000 in basis. The first shows a sale where no planning has been done, the second shows a tax loss harvesting account being opened 3 years prior to the sale, and the final shows an enhanced tax loss harvesting account being opened 3 years prior to the sale. The hypothetical losses incurred in the basic tax loss harvesting scenario are 17%/6%/4% and 32%/15%/11% in the enhanced version.

As you can see, there may be significant gains made for small business owners by planning ahead and utilizing a tax loss harvesting program as you plan the sale of your business. However, market will dictate exactly how many losses you incur during the 3 years. Setting this account up in advance gives you the best chance to offset taxes you would otherwise have paid on the sale of your business.

Sale of Business Property

The second way that business owners may access their tax losses is through the sale of appreciated business property. If you are a small business owner who owns a passthrough entity, the gains on the sale of business property flows through to your personal return where they can be offset by the capital losses you have generated.

Things to watch out for:

- Depreciation Recapture – if you have depreciated the property, the recapture cannot be offset by capital losses.

- C-Corporation – this is not possible if you are a C-Corporation as capital gains do not flow through to your personal return.

Sale of Real Estate (business or personal)

Similar to other business property, the sale of real estate (which includes business or personal real estate) may qualify to be offset by your capital losses. If you are a pass-through entity, or your real estate is held in a separate LLC, these gains will flow through to your personal return where they can be offset.

Things to watch out for:

- Depreciation Recapture – once again, depreciate recapture will apply and recapture cannot be offset by capital losses.

- C-Corporation – as with business property, if the Real estate is held by a C-Corp, the gains will not flow through to your personal return.

If you’re a small business owner in one or all of these situations, tax-loss harvesting may be able to help you save a significant amount in taxes.

Summary

Systematic tax loss harvesting is a recent development in the world of investment management after the advent of trading algorithms and commission free trading. Small business owners are uniquely positioned to take advantage of this system as they consider the sale of their business. Through careful planning that takes all of their financial needs into account, you may be able to significantly reduce the taxes owed on the sale of a business. This is yet another reason why having a comprehensive financial plan that includes both tax and financial planning is key to long-term success.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Patrick G. Moore, CFP®, EA | Ironclad Wealth Management

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor