To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Wrapping up a successful year, sitting down to look at your taxes, and being shocked by the bill is a rite of passage for most small business owners. While this can be a valuable learning experience the first time it happens, it’s a completely avoidable situation and shouldn’t happen more than once. Managing your taxes is simply another part of managing your business. Creating a plan to project and pay your taxes will save you time, stress, and money.

Having a framework to help you plan for your taxes, assess your options, and reduce your taxes is a key part of not only your financial plan, but your business plan itself.

One of Ironclad Wealth Management’s strengths is how we assist small business owners in planning for their taxes. Read along for a quick overview of our tax planning philosophy. While this isn’t a replacement for a tax plan, it can be a guiding framework to help as you consider various tax decisions.

What is Tax Planning to a Small Business Owner?

Making the change from being a W-2 employee to a small business owner is both liberating and stressful. On top of trying to market your business, close sales, manage employees, and keep the lights on, taxes rear their ugly head. One of the newest sources of stress for small business owners specifically is the unknown nature of taxes as you start your business. As you move from a ‘done for you’ situation (through payroll withholding) to a ‘DIY situation,’ it’s easy to fall behind, especially when you have your first big year of profit. Managing your expenses, payroll, and taxes in an environment where you’re never quite sure what you’re going to make each year can get the better of even the most prepared.

So, what is tax planning for a small business owner? Tax planning means understanding how your business income translates into the taxes you will owe and analyzing ways to reduce those taxes. Put simply, it means putting yourself in a position of knowledge when it comes to your taxes. By reducing the unknowns when it comes to your taxes, you may not only save money, but most importantly you reduce the stress that you face come year end. Realistically, tax planning means sitting down, projecting your business income, projecting your taxes due, and analyzing methods to reduce the taxes you expect to owe before the end of the year. While it’s impossible to nail this exactly at the beginning of the year, it IS possible to set a benchmark, evaluate your options and then adjust as your business changes throughout the year. To do that, you need knowledge and a framework to evaluate your options.

How is Tax Planning Different from Tax Preparation for Small Business Owners?

Before we get into our tax planning philosophy, I think it will be helpful to discuss how tax planning differs from tax preparation. Tax preparation is how most small business owners experience taxes today.

Tax preparation is the act of filling out your taxes, filing your taxes, and paying your final balance. The main difference in tax preparation is directional. Tax preparation looks back at the previous year and then converts that data into a tax return. Tax planning looks at the upcoming year and analyzes options to help reduce your taxes which will then be prepared on the tax return.

Both are critical pieces of an effective tax plan and are necessary to achieve the best results. While tax preparation is necessary, if you are waiting until the end of the year to talk to your accountant, you’re probably not achieving the best results possible.

3 Keys to Tax Planning for Small Business Owners

Tax planning can be complicated and it’s important to have a framework before you begin planning for your taxes. Ironclad Wealth Management’s tax philosophy consists of three key principles:

- Proactive – first, to achieve the best results you MUST plan ahead.

- Lifetime– second, a good tax plan does not chase savings each year. A good tax plan emphasizes savings over your entire lifetime.

- Legal – finally, and you would think this goes without saying, that good tax planning does not result in pursuing illegal or fraudulent schemes.

So, let’s review what each of these mean in more detail.

What does Proactive Tax Planning for Small Business Owners Look Like?

The first and most important aspect of tax planning is that it’s proactive in nature. As with any good plan, the best results are realized the more time and planning you have done before the actual event occurs. This is even more true in tax planning when you are dealing with deadlines and rules set by the IRS. Planning ahead is the main differentiator in tax planning vs. tax preparation.

When we say proactive, we mean that you need to plan before a particular event happens. However, the question then becomes what are we planning before? The answer is before any item that can impact your taxes; however, there are a few easy ones that I can list out here:

- Before your annual tax year closes (this means before 12/31 for most small businesses)

- Before an action that incurs taxes, typically a sale (whether real estate, business, stock, etc.)

- Before you start a business

The best example we can use today is probably your annual tax filing. While items 2 & 3 may only happen a few times in your life, tax filing happens every year. While you may not file your taxes until April or October of each year, the end of the calendar year, or Dec. 31st, is when most tax items close for the year. Once the tax year closes, a significant amount of planning opportunities are lost and can’t be utilized until the following year. Typically, there are very few items that can be accomplished between Jan. 1st and April 15th to lower your taxes.

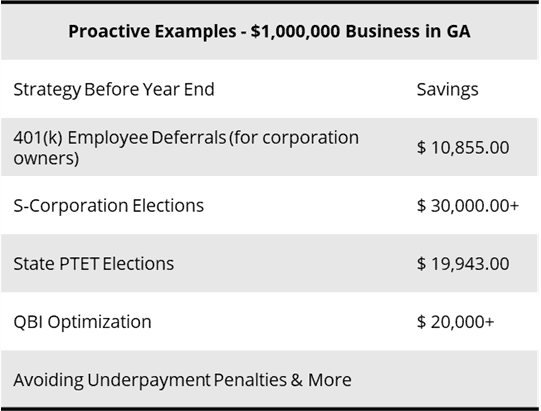

Here are a few examples of what you lose by not planning.

These options could easily add up to tens of thousands of dollars in tax savings(1) depending on your income. Most importantly, all of these opportunities are lost if you wait until the calendar year ends and you’re facing your April deadline to file.

Hopefully, you can see the value in creating a proactive tax plan. We certainly think it’s worth it. Once you decide it’s worth creating a plan, you need to implement a few steps to make it effective. Here’s our general order of operations, although this varies client by client.

- Establish baseline income expectation for the year

- Utilize tax software to create projections (or your accountant or tax planner can do this)

- Analyze strategies and their savings based on your expectations

- Review how much you will pay in for the year in withholding

- Calculate your safe harbor based on last year’s income

- Setup estimated payments to reach at least the safe harbor limit

- Monitor and update throughout the year

Before you even consider a tax strategy, you need a grasp of what you are going to pay without any tax strategies implemented. Then you can review strategies with a clear understanding of their pros, cons, and how difficult they will be to implement.

Most importantly, when you operate this way, you are operating from a position of knowledge. If you wait until the end of the year, you may find yourself making suboptimal tax decisions that result in even more problems down the road.

How Does Emphasizing Lifetime Tax Savings in Small Business Tax Planning Work?

The second step in an effective tax plan for small business owners is targeting lifetime tax savings instead of short-term tax savings. When most small business owners are first impacted by that large tax bill they scramble. I have found that this typically results in decisions that emphasize short-term, immediate tax savings over decisions that lower your lifetime taxes. It’s understandable, but this rush may even result in decisions that negatively impact your overall financial health.

There are a few examples that I believe illustrate the tradeoffs between short-term and long-term tax savings:

- The trade-offs between pre-tax and Roth accounts

- Investing in a new truck or business equipment you really don’t need at the end of the year

- Utilizing a cost segregation study on a real estate property vs. not

- How you incorporate your business

Choosing either side of these options could leave a small business owner better or worse off depending on your projected current and future income. Zooming out and looking at the big picture before making decisions is the next step in building a solid tax plan.

The hard part about planning to reduce your lifetime taxes is that by its very nature you are making predictions about the future. Not only that, but you’re making predictions about your future 5, 10, or even 20 years down the road. While it is difficult and you must understand your assumptions may be wrong, it is well worth the effort to plan ahead.

Here’s a quick example of how this could look in your life as a small business owner and why you need to have an idea of what your taxes will look like long term when tax planning.

Let’s say you’re considering starting up a new business venture with a friend. Typically, most small business owners focus on what benefits them most as they startup a business and not what may benefit them most in the future. That often results in small business owners chasing income tax savings above all else because that’s what benefits them most in the current year.

However, let’s say that you intend to sell your business at some point after growing it with your partner. While it’s impossible to quantify what a business can be sold for upfront, it is helpful to consider the future when tax planning.

Here’s an example:

- Business is projected to earn $500,000

- Business is expected to sell for 8x earnings, or $4,000,000, in future

- Plan is to sell in 10 years

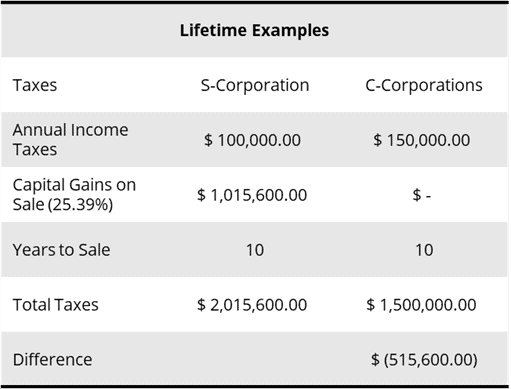

A short-term plan may result in a business owner prioritizing income tax savings above all else. Let’s say that in this example an S-Corporation results in $50,000 less in annual taxes than a C-Corporation (these are illustrative and not real figures). It would make sense for the average small business owner to utilize an S-Corporation to realize these immediate savings.

However, these small business owners plan to sell their business in 10 years. In that situation, C-Corporations have significant benefits over S-Corporations including:

- Ability to sell tax-free utilizing QSBS exclusion (if the business qualifies)

- Ability to sell tax-deferred to an ESOP using the 1042 exclusion

- Ability to gift their shares to a CRUT and sell tax deferred

These options may result in a complete deferral or elimination of capital gains taxes on the sale. On a $4,000,000 transaction with no basis, there would be $1,015,600 in taxes due on the sale at a 25.39% tax rate (20% + 5.39% state in GA).

Utilizing the above-mentioned strategies (which do not work for everyone), you could potentially defer or eliminate this entire tax. However, if you had chased the short-term tax savings you may have been prevented from utilizing these strategies!

Short-term planning may have cost this small business owner $515,600 in taxes! Or if they had invested their income taxes savings in the market and earned 7%, it would have only cost them $325,077.60 ($1,015,600-$690,822.40). While it’s impossible to know if you’ll actually be able to sell the business for that amount in year 10, by going through tax planning you can weigh the pros & cons of each option and make informed financial decisions as your life and small business changes.

So, what questions do you need to ask in order to begin developing a lifetime savings plan?

- What is my income today?

- When will this income stop?

- Do I plan to sell my business?

- Do I plan to retire?

- Will I hold the business the rest of my life?

- Will I pass the business down to family?

- Is my income higher or lower now than it will be in the future?

- Can I shift some of this income to my lower earning years?

- Do I have a way to model these outcomes?

- Is this idea a good financial decision also? (if it saves you money on taxes, but negatively impacts your business, avoid it!)

These are simply some starter questions for you to consider. There are definitely more questions, and they will vary by each person’s individual situation and decisions. However, planning ahead and emphasizing lifetime savings over short-term savings can yield significant results for any small business owner.

Keeping Your Small Business Tax Planning Legal

You’d think it would go without saying, but keeping your tax planning legal is a good idea. However sometimes the allure of something that sounds too good to be true can be too strong and the idea can in fact be too good to be true. Avoiding these traps and pitfalls is a key part of any good tax plan for small business owners. Part of the benefit of good tax planning for small business owners is that it helps you set expectations early and often. In my opinion, most small business owners who make poor tax decisions do so as a result of a lack of knowledge. Creating a tax plan results in you having a baseline of what to expect, having an idea of what to expect results in fewer surprises, and fewer surprises results in fewer rash decisions.

Unfortunately, there are unscrupulous actors out there who take advantage of well-meaning business owners. These small business owners believe they are doing good tax planning, but are in reality simply purchasing a tax strategy that’s too good to be true.

I think there are a few good questions for you to consider when vetting your tax strategies:

- Is the person recommending a true plan or are they selling you a specific strategy?

- Will the person be compensated directly by you or will they be compensated by a third party?

- Is this person operating as a fiduciary to you?

- Are they billing you as a % of whatever tax savings you realize (also called contingent fees)?

- Is the strategy on the IRS’ Dirty Dozen list?

- Does the person selling you the strategy have a clean track record?

- Can they provide a due diligence document outlining the standing of the strategy and will they meet with your existing team?

- Is the person confrontational to your existing advisors?

- Will this strategy unnecessarily complicate my life?

- Does it seem like you’re “getting one over on Uncle Sam?”

- Do you want your name to be in the news related to this if something happens?

If you can answer these questions positively, then a strategy may be worth considering. However, I believe if the strategy is considered on its own rather than part of a plan it may not be worth pursuing. Working with a tax planning team who develops an entire strategy for you will yield better results than working with someone who is selling one-off tax strategies for a commission.

So, what happens if you get bamboozled? Unfortunately, the penalties can be severe. Here’s a list of a few possible consequences:

- Negligence – 20% of the underpayment amount

- Fraud – 75% of the underpayment amount

- Criminal Fraud – $100,000 and up to 5 years in prison

- Inability to sell your business for a fair value

On top of the fact that utilizing illegal tax strategies will result in penalties, they can also reduce the attractiveness of your business and prevent possible sales from materializing. New buyers do not want to buy into a business that has taken overly aggressive tax positions and faces legal risk. Not only do you put yourself at the risk of significant financial penalties, you may impair the value of your most valuable asset.

Remember, as you begin to develop your own framework for tax planning or engage with a tax planner, keep it legal.

Summary

Everyone wants to save money on taxes. Before you can create an effective tax plan you need to build a framework that can help you determine which paths and options are best for you. Armed with that knowledge you can save money on taxes and hopefully reduce a little tax related stress along the way. As discussed, our framework has three key tenets:

- Be Proactive

- Reduce Lifetime, not short-term taxes

- Keep it Legal

While I think these are 3 key steps in any tax plan, you can update and develop this framework as you consider your own plans. If you find this framework helpful and you’d like to engage a professional to develop your plan, Ironclad Wealth Management is here to assist. We work with small business owners to help develop plans to reduce your taxes and reach your goals faster. And we do it all while maintaining our fiduciary standard and putting your interests before own.

1 These estimates reflect a business earning $1,000,000 in Georgia. Savings are estimates. 401(k) is based on an S-Corp earning this amount and a $120,000 W-2 salary. The S-Corp election reflects utilizing an S-Corp and paying $120,000 in W-2 Salary against an LLC. State PTET Election reflects the GA State Income Tax Rate of 5.39%QBI Optimization reflects increasing the W-2 Salary in an S-Corp from $120,000 to $240,000.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Patrick G. Moore, CFP®, EA | Ironclad Wealth Management

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor