To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

If you want to know someone’s priorities, don’t ask them for their priorities.

Even if they’re honest, they’re probably deluding themselves.

No. If you want the real answer, ask where their money goes.

The answer to that, through financial focus areas, was one of several fascinating topics covered by a recent report from the Certified Financial Planner (CFP) Board, titled, “Building Wealth: Insights on Women’s Aspirations & Growing Financial Power.”

The report concentrates on women, stating that they are now more likely to lead or equally share financial leadership with their spouse or partner.

In addition, their labor force participation rate increased to 57.3% in 2024, compared to its 43% level 55 years ago, in 1969. In parallel, men’s labor force participation dropped from nearly 80% to just under 68%. This reduced the inequality in labor participation from about 37% to under 11%.

Interestingly, far more women than men now attain a bachelor’s degree by age 34 – 47% vs. 37%. This compares to an equal likelihood of 25% as of 30 years ago, in 1995. This increase in higher education degrees leads to a nearly 85% increase in median lifetime earnings, from $1.3 million to $2.4 million.

With all these higher financial, labor, and education stats for women, and their greater financial hurdles, it’s high time someone looked at how women-led households have different financial priorities than their men-led counterparts.

What (Female) Financial Planners Say About Clients’ Focus by Gender

First, the men…

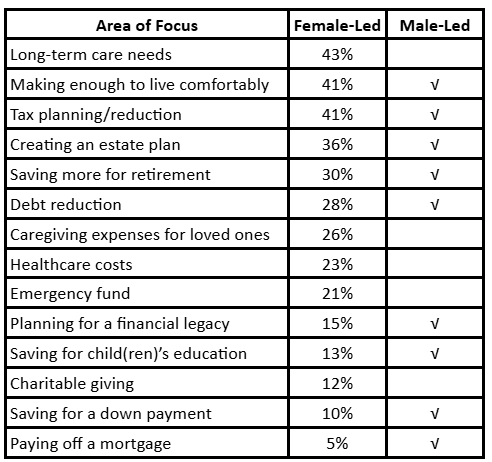

CFPs, when asked what their male clients focus on cited tax planning/reduction, paying off a mortgage, saving more for retirement, planning for a financial legacy/bequest, and creating an estate plan.

Next, equal focus…

They further identified several areas where male and female clients are equally focused. These were paying off student loans and/or credit card debt, saving for a home purchase down payment, saving for kids’ education, and making enough to live comfortably.

Finally, the women…

Areas on which women were more likely to focus than men included planning for caregiving expenses for loved ones, planning for long-term care needs, building a large enough emergency fund, exploring charitable giving, and managing healthcare costs.

How Does This Affect Financial Plans for Woman-Led vs. Man-Led Households?

Since financial plans are designed to address the financial goals and priorities of the client, one expects that the above assessments would lead to differences in financial plans for households based on the gender of the person leading them.

Female-led households would likely seek the same financial plan elements as male-led ones, but with different emphases.

While plans for male-led households tend to emphasize planning for future financial matters in general, female-led ones focus more on saving for care of one sort or another, for themselves, their family, and others.

Jordan Gilberti, Founder, Sage Wealth Group observes, “In my experience, female-led households often prioritize long-term security, contingency planning, and family legacy more holistically. Women tend to ask more questions about the ‘why’ behind recommendations, focusing on how financial decisions support their life goals. Male-led households can lean more toward growth and performance metrics. That said, both share the desire for clarity, confidence, and financial independence, they just approach the process from slightly different angles.”

Ben Loughery, Founder of Lock Wealth Management adds, “I’ve noticed women are more likely to seek financial advisors than men. Building trust is key and what I believe creates trust is allowing them to feel heard and seen. Of course, we are in the helping business, but the more we try to understand the way they think (both men and women), the better our future relationship.”

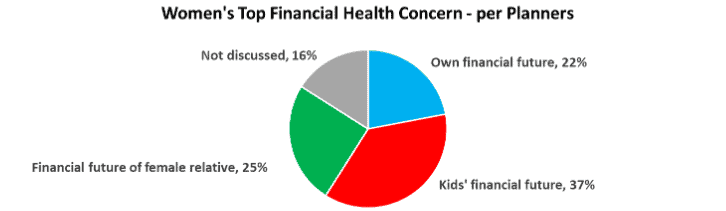

Planners reported kids’ financial future as their female clients’ top concern (37%), with the financial future of a female relative (e.g., sibling, mother, grandmother, etc.) taking second place (25%), and their own financial future last (22%). In 16% of cases, this was not discussed.

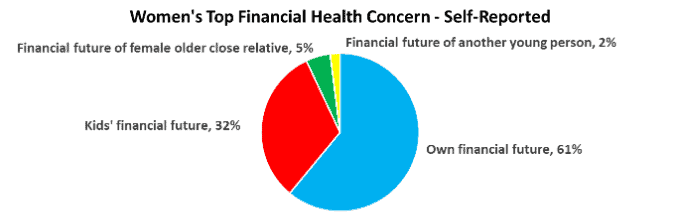

However, when women are asked about their top financial-health concerns, their answers differ from what planners say. Here, the majority of women identified their own financial future as the top concern (61%), with kids in second place (32%), another female relative a distant third (5%), and another young person in the fourth place of most likely to be the top concern (2%).

What’s Important for Women When Choosing a Financial Planner?

Beyond the different emphases, women have somewhat different criteria for choosing their financial planners, at least somewhat related to how planners present information to them.

When asked what qualities they believe are important and/or most important for a planner to have, they identify 11 qualities.

- Able to find suitable a financial solution for their specific challenges: 99% important (26% most important)

- Answering their questions: 99% (7%)

- Having a proven track record of success: 98% (17%)

- Able to clearly and effectively share complex concepts: 98% (15%)

- Be a CFP®: 96% (15%)

- Make sure they feel comfortable: 97% (5%)

- Listens without judgment: 95% (3%)

- Understands their situation and goals: 93% (12%)

- Accepts them regardless of financial situation: 90% (3%)

- Has similar life experiences: 58% (1%)

- Has a similar demographic background: 54% (1%)

How Does Working with a Woman-Led Household Differ for the Planner?

Planners find that there are differences when working with a woman-led household vs. a man-led one. This shows up in what clients focus on, the process, and the kinds of questions they ask.

Nannette Kamien, CFP®, RICP®, MBA, Principal, Inspiration Financial Planning relates, “When preparing plans for men vs. women, the process can be slightly different. This is because women often spend more time discussing their non-financial concerns and worries. They are more likely to be concerned with caring for family members, taking career breaks to have children, and worrying about running out of money when their partners pass away. I often spend more time talking with them about the qualitative aspects of the plan than I do about the quantitative aspects.”

Benjamin Simerly, CFP®, Financial Advisor and Owner, Lakehouse Family Wealth elaborates, “As of March 2025, just over 70% of our client households have female lead decision-makers. While we proudly include both members of each household in our planning, we also tailor plans to each lead decision-maker. For female-led households, there are real differences in both the planning and the process. Female-led decision-maker households tend to place more emphasis on planning for the what-ifs and unexpected events in life. Women tend to be far more aware that anything really can happen, and they want to be prepared for it.

“Beyond that, female decision-makers are more keenly aware of the challenges of living longer in retirement and the need for income to last. The language is different, too. Whereas all of my male clients with wives make clear that ‘they want their wives to be taken care of if something happens’ (to the husband), my female-led households get much more specific. My female decision-makers ask about long-term care and how income will change and adapt to medical needs after their husband passes.

“Another area is moving and home-buying expenses. Many female decision-maker households are more likely to be willing to plan for the costs associated with moving closer to children and grandchildren after the passing of a spouse, and how that would impact their retirement income. Many husbands tend to be more general, whereas women tend to care more about how things will actually work when life events happen.

“The planning process also has its differences. Whereas men want to know that ‘everything is taken care of,’ female decision-makers are more likely to want to plan for specific estate and legacy scenarios. Women want to walk through how their finances would work or need help if a spouse passed, or a grandchild is diagnosed with autism, or how advanced and long-term care planning will affect their assets. For example, in estate planning, while men seem to be more comfortable discussing end-of-life scenarios, my female decision-makers tend to be more interested in the specific legacy they will leave for each of their children and grandchildren.”

The Bottom Line

While men and women share many of the same financial goals and priorities, women tend to focus more than men on goals relating to providing care for their kids, families, and others.

As a result, planners who want to work with women need to craft their financial plans with attention to these priorities and challenges. Beyond providing effective plans, they also need to be able to connect by listening without judgment, accepting them where they are, making sure they’re comfortable, answering their questions clearly and effectively, and guiding them in advocating for themselves financially.

As Michelle Petrowski, founder of Being in Abundance points out, “Because of the earnings gap and career interruptions, women often retire with about 30% less wealth than men, yet we need more in retirement than men because we typically live longer. Adding insult to injury, women are 80% more likely to face poverty in retirement. When working with female-led households, we need to help them understand the reality that nearly 60% of us will be making financial decisions alone after age 65. Thus, we must save and invest early and consistently, have a larger emergency fund, and a longer-term nest egg. We have to encourage our female clients to advocate for themselves, negotiate higher salaries, and prioritize themselves. They have to work to secure their own financial futures before helping others. It’s like the oxygen mask on the plane; you need to put your own before helping your child.”

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor