To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

As a financial advisor, coordinating estate planning services for your clients represents an important and impactful way to deliver considerable value. You’ve likely developed trusted partnerships with estate planning attorneys, alongside online tools and off-the-shelf resources for less-complex situations.

But a point of frustration heard among many advisors has been the lack of a cost-effective and advisor-friendly solution for ongoing estate planning document maintenance and management.

This is where a new company called Wealth excels.

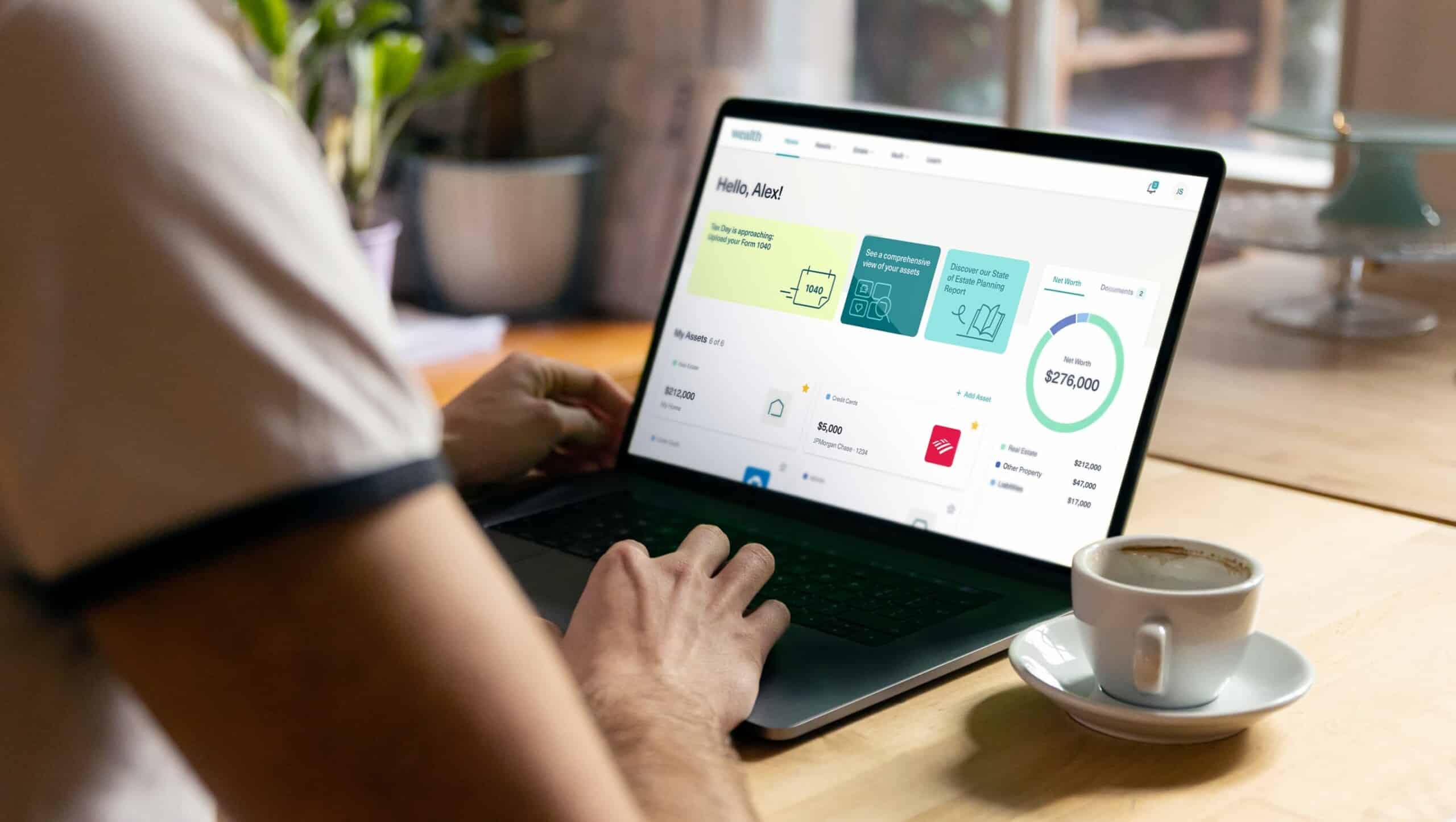

Wealth is the first comprehensive estate planning platform that provides a holistic view of your clients’ assets, visualized and securely stored in one place. The platform utilizes asset aggregation technology and meets bank-level encryption standards to make estate planning easier and more accessible.

🧑💻 Wealthtender Wealthtech Spotlight Series: Get to Know Wealth

This page is organized into sections to help you quickly find the information you need and get answers to your questions:

- Q&A with Danny Lohrfink, Chief Product Officer, Wealth

- Quick Facts about Wealth

- Browse Trending Articles

– Wealthtech Spotlight: Wealth –

Q&A with Danny Lohrfink, Chief Product Officer, Wealth

We asked Wealth’s Chief Product Officer Danny Lohrfink to tell us more about the company, how Wealth came about, and why financial advisors may want to consider learning more about Wealth to support and enhance their delivery of estate planning services.

Q: What did you feel was missing in the estate planning marketplace that led to the launch of Wealth?

Danny: Before Wealth.com there were two ways to create an estate plan: you could either use a one-and-done DIY digital document creation solution, or you could go to a T&E attorney. It was very akin to the Financial Management industry a decade ago, where you either had the DIY crowd managing their own portfolios with folks like Schwab and Fidelity, or you had a Financial Advisor. The robo advisory space and the “bionic” advisory space were barely existent (only $55bn of AUM back then). In short, there was no middle ground.

Wealth.com is the middle ground for the estate planning space. We have rich data integrations that allow us to provide proactive guidance and support to keep plans continuously optimized and up to date. This is very different from many of the early players in the digital estate planning space who saw the bright lights of mass volumes using a boilerplate, transactional approach. What was missing was a solution that was incredibly high quality, holistic, and proactive.

On the quality front, we tested and reviewed hundreds of documents from our soon-to-be competitors and found that most were not only subpar, but in many cases, they were inadequate and introduced more potential conflicts than what they purported to alleviate.

We went out and hired the best of the best. Top lawyers hailing from the top trust and estate firms. The same high-quality documents that you might get for $8,000 after going to one of those law firms are what you’ll receive with Wealth, for a fraction of the cost.

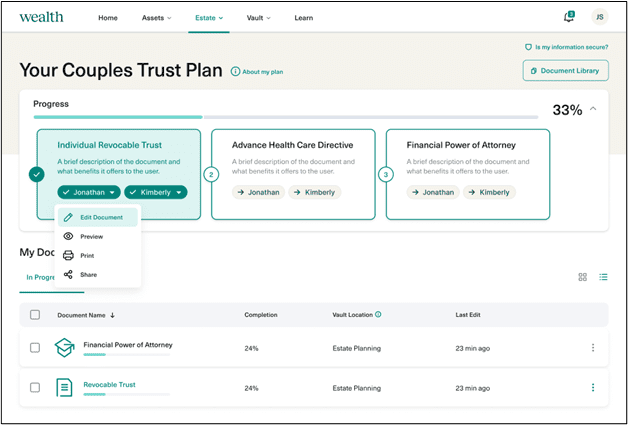

On the holistic front: estate planning is not a one-and-done thing. You’ll always need to make updates.

For example, I talked to a gentleman last week who is 60 years old, very tech savvy, but whose executor in his Will is his business partner, that is 12 years his senior. He knows that he needs to add a backup executor, but the lawyering process is too expensive and cumbersome for such a small change. We are here for the journey, allowing you to make unlimited updates, and we store all copies in our digital vault along with an inventory of your assets and other key documents so that you and your executor have a single repository for your estate.

Q: Why has Wealth chosen to prioritize partnering with financial advisors?

Danny: We conducted one of the largest estate planning studies of the past few years, surveying 10,000 Americans making more than $100,000 HHI, and found that advice from financial advisors was the #1 reason why people surveyed created their estate plans.

Financial advisors fundamentally understand the value of estate planning and the inextricable link and interplay between financial management and estate planning. They just need the right tools to be able to advocate for their clients and shepherd them through the process.

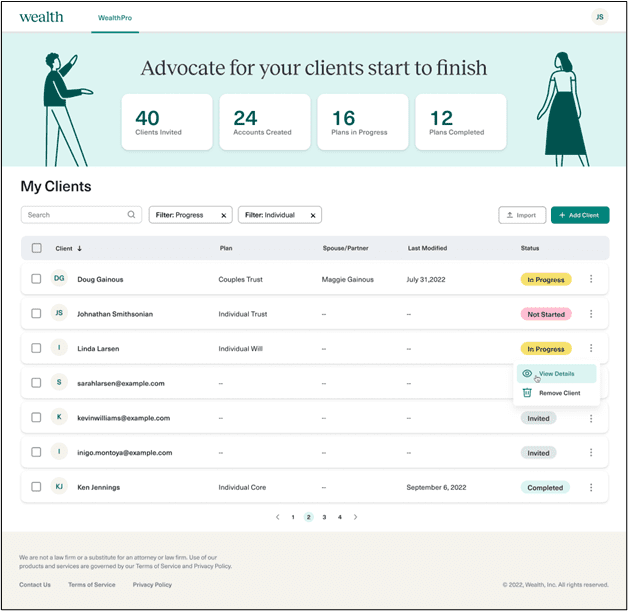

We firmly believe that the Financial Advisor should be the quarterback of the relationship, which is why we developed a central dashboard called WealthPro, for advisors to be able to track and monitor their clients’ estate planning progress.

GET TO KNOW WEALTH

Q: For financial advisors who work with estate planning attorneys today, what role can Wealth play in complementing these relationships?

Danny: Getting started is the big thing here, and getting a solid estate plan in place with Wealth is going to be a heck of a lot easier and more cost-effective than going to an estate attorney.

With that said, we fully expect some customers to leverage the foundation of what we’ve created and eventually graduate off our platform. And rather than starting from scratch, they will be able to download our Review Summary sheet and visualizer and provide it to the attorney. This will help reduce the total cost by hundreds, if not thousands, of dollars because the upfront discovery/leg work is already complete.

In addition, at Wealth, our ethos is “do no harm.” Our documents are highly customizable and are of very high quality (we have multiple sub-trusts such as the Family Trust, the Marital Trust, and the Trust for Descendants, which more than adequately provide the necessary tax planning foundation for even HNW clients running up against state and federal estate tax exemptions).

However, we ultimately know our swim lanes. We know when our documents are right for the client and when the client needs to speak to an estate attorney. And given that only 32% of Americans making more than $100,000 a year have a Will, I’d say that there is plenty of opportunity to work as partners with estate attorneys rather than adversaries.

Q: What does the setup process look like for financial advisors interested in partnering with Wealth?

Danny: Our team has deep experience partnering with some of the largest financial institutions in the world, such as American Express, HSBC, Santander, Citibank, etc.

What we have found is that a hands-on, kid-glove approach is always valued and appreciated. That’s why we have a full-time member success team that does everything from upfront training and live demo sessions to ongoing client support.

I also mentioned the concept of reinforcing the Financial Advisor as the quarterback of the relationship, which we do in a myriad of ways. First, we can set up a custom landing page that is co-branded with the Financial Advisor’s logo, picture, and quote. This serves as the unique portal from which the client can access their account, and it will give a feeling of continuity with the advisor’s existing client portal. We also provide co-brand educational and marketing materials (with the advisor’s logo).

Lastly, and perhaps most importantly, we have a dashboard called WealthPro that the advisor can leverage to invite clients to the Wealth platform and monitor their progress.

Q: Once a financial advisor has become a Wealth partner, what happens next?

Danny: Our member success team immediately schedules an onboarding session, and our design and engineering teams begin working on creating custom landing pages and co-branded materials. The advisor is then provisioned with an account (with the WealthPro dashboard) to be able to invite clients to the platform.

Q: Do financial advisors who partner with Wealth gain access to a dedicated account manager?

Danny: They sure do.

Q: What level of access and control do financial advisors have to help clients manage their Wealth accounts?

Danny: Advisors have View-Only access to monitor the status and progress of their clients’ estate plans. Once a document is complete, the Advisor gets a read-only view into the key summary of details and into the actual document itself.

Q: Wealth provides financial advisors with a discount code for their clients to sign up. Can financial advisors alternatively choose to absorb or build in the cost of Wealth to their financial planning fees?

Danny: Of course, they can. In fact, that’s the most common way it’s done today. Advisors are continuously looking for ways to provide holistic value to their clients while maintaining a relatively stable profit margin. So what most Advisors on our platform do is they will buy a bunch of licenses in bulk to get a discount and then amortize that cost across their client base as an operating expense for the business. Ultimately, this results in a negligible impact to the overall profit margin but a massive boost to the value that they are able to provide to their clients.

Q: Where should financial advisors look to get more information about Wealth?

Danny: https://wealth.com/advisors

📗 Quick Facts About Wealth

| Year Founded: | 2021 |

| Website: | www.wealth.com |

| HQ Location: | Phoenix, Arizona |

What to Read Next:

- The Ultimate Guide to Financial Advisor Marketing

- Are You a Fee Only Planner? Consider BC Brokerage for Your Insurance Needs

- What is Wealthtech?

Are you a wealthtech firm interested in being featured on Wealthtender?

Hi! 👋 I’m Brian Thorp, Founder and CEO of Wealthtender, a wealthtech startup that helps financial advisors and wealth management firms get more clients online (Learn More).

If you’re also in the wealthtech space, I’d love to get to know you and learn more about your business.

While most of the content published on wealthtender.com is written for individuals looking for help with money matters, we also write articles like this one for financial advisors and wealth management firms interested in learning how to grow their business more profitably.

These articles cover topics ranging from advisor marketing and practice management tips to profiles of wealthtech companies we think should be on their radar.

If you have time to connect so we can learn more about each other’s businesses, or just want to say hi, I look forward to hearing from you. Please write, call, or schedule a Zoom meeting for us at your convenience.

Wealthtender Founder & CEO Brian Thorp

Brian Thorp

Wealthtender Founder & CEO

LinkedIn Profile

brian@wealthtender.com

(512) 856-5406

📰 Trending Articles in Advisor Practice Management & Marketing

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender. He and his wife live in Texas, enjoying the diversity of Houston and the vibrancy of Austin.

With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor