Rated Extraordinary By Advisors – T3 Advisor Software Survey, 2023 & 2024

Category – Digital Marketing Tools: Lead Capture

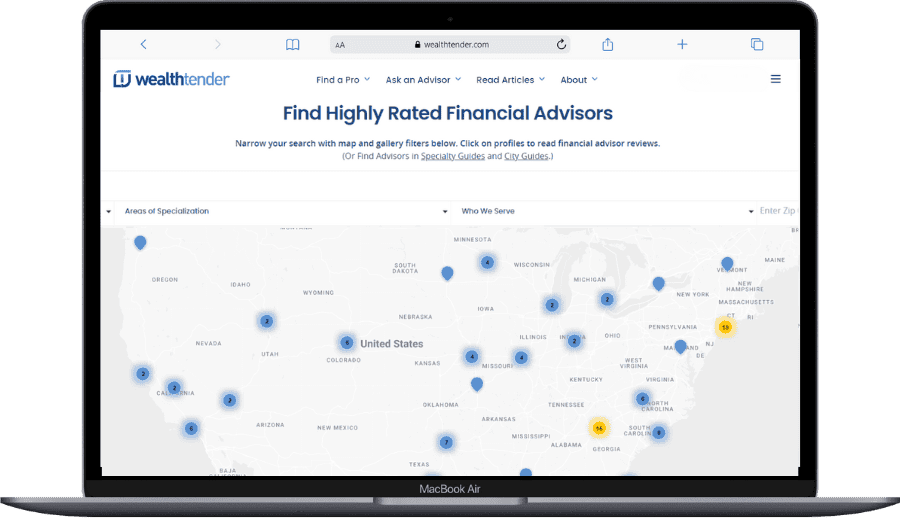

Empower your advisors to convert more prospects into clients with the industry’s first online reviews platform designed for regulatory compliance and the #1 find-an-advisor directory website.

Join top advisor networks and fast-growing wealth management firms that choose Wealthtender as their digital marketing partner.

Introducing Certified Advisor Reviews™

Wealthtender offers the industry’s first financial advisor review platform designed for regulatory compliance.

Certified Advisor Reviews™ help consumers make smarter hiring decisions when choosing a financial advisor.

Collect and Display Reviews Compliantly

Unlike sites like Google and Yelp, your advisors’ reviews on Wealthtender always include disclosures to satisfy regulatory and firm requirements. You can choose to only display client reviews and use admin tools to take actions to ensure regulatory compliance and protect the privacy of your advisors’ clients. If your advisors have received Google Reviews, Wealthtender’s import tool helps you unlock their potential to strengthen SEO (search engine optimization). You’re always in control of the features accessible by your advisors.

Build Trust with Prospects More Quickly

Online reviews accelerate the trust-building process with prospects. Your advisors already build credibility with their experience and credentials. With online reviews, your advisors also establish an emotional connection with prospects, increasing their likelihood of setting up an introductory call and choosing to hire your advisors over others without reviews online.

Rank Higher in Search Results and Win More Business

Your advisors’ reviews appear on wealthtender.com, visited by 500,000+ consumers annually. Your advisors’ reviews also send positive trust signals to Google’s algorithm, and their gold stars will shine bright in search results, helping your advisors stand apart from advisors who lack reviews to win more business. It’s also easy to display reviews on your advisors’ websites.

Let’s Discuss a Partnership

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.

Take An Interactive Tour of Wealthtender

Discover why national advisor networks and wealth management firms choose Wealthtender.

Testimonial Marketing

Testimonial MarketingSuccess Story

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

How Wealthtender Compares

Lower Cost. More Benefits. Wealthtender is the Leader in SEC-Compliant Testimonial Marketing.

| Solution Provider |

|

|

|

|

| Company Website (Link) | Wealthtender | Indyfin by WiserAdvisor | Amplify Reviews | FMG Testimonials (Formerly Testimonial IQ) |

| T3/Advisor Software Survey User Rating (2024) | 8.03 (Extraordinary) | Not Rated | Not Rated | Not Rated |

| PRICING | ||||

| Lowest Monthly Cost (1 Advisor) | $49/mo. | $99/mo. | $99/mo. | $79/mo. |

| Multi-Advisor Discounts | Yes (5+ Advisors) | Unknown | Yes | Yes |

| INBOUND LEAD GEN BENEFITS | ||||

| Consumer Website | wealthtender.com | indyfin.com | ❌ | ❌ |

| Monthly Consumer Traffic ** | ↗️ 63,700 | ↘️ 967 | ❌ | ❌ |

| Domain Authority (SEO Strength) ** | ↗️ 42 | ↘️ 18 | ❌ | ❌ |

| Advisor Profile with Client Reviews (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Advisory Firm Profile with Client Reviews (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Gold Stars Appear in Google Search Results (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Review Sync™ (Sync Firm Reviews to Advisor Profiles) | ✅ | ✅ | ❌ | ❌ |

| TESTIMONIAL MARKETING TOOLS | ||||

| Embed/Display SEC-Compliant Testimonials on Advisor Website | ✅ (↗️ Learn More) | ✅ | ✅ | ✅ |

| Easily Create Social Media Content from Client Testimonials | ✅ (↗️ Learn More) | ❌ | ❌ | ✅ |

| AWARD RECOGNITION | ||||

| Wealthtender Voice of the Client™ Awards | ✅ (SEO/AEO Schema) | ❌ | ❌ | ❌ |

| ADMINISTRATION FEATURES | ||||

| Dashboard to Manage Reviews | ✅ | ✅ | ✅ | ✅ |

| Convert Google Reviews to SEC-Compliant Testimonials | ✅ | ❌ | ❌ | ❌ |

| ADDITIONAL DIGITAL MARKETING BENEFITS | ||||

| Get Quoted in the Media | ✅ (↗️ Learn More) | ❌ | ❌ | ❌ |

| Get Featured in Local Guides | ✅ (↗️ View Guides) | ✅ | ❌ | ❌ |

| Gain Recognition for Areas of Specialization | ✅ (↗️ View Guides) | ❌ | ❌ | ❌ |

| Professional Advisor Community | ✅ (↗️ Learn More) | ❌ | ❌ | ❌ |

View Table Disclosures

** Domain Authority as of January 2025 (Source: Moz) & Estimated Monthly Consumer Traffic as of January 2025 (Source: Ahrefs)

*** Tools that enable consumers to submit Google Reviews introduce advisory firms to significant regulatory risk. In FINRA Regulatory Notice 17-18, FINRA offers guidance for Registered Representatives applicable to social networks (e.g., Facebook, LinkedIn, Google Reviews), stating: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Based on this language, FINRA makes it clear that the act of solicitation triggers disclosure requirements not supported by the Google Reviews platform.

Should SEC Registered Investment Advisors not subject to FINRA oversight expect the SEC to take a more lenient stance?

We don’t believe so and don’t think it’s worth the risk. Wealthtender believes it’s highly likely the SEC will take issue in upcoming exams and sweeps with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing Rule.

With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing Rule’s prohibitions and disclosure expectations.

We could update our platform tomorrow to enable consumers to submit their reviews to Google. That’s not the issue. We’re simply not in the business of ‘doing it anyway’ and asking for forgiveness later.

We designed our platform for 100% compliance with the SEC Marketing Rule. We’re not here to get cute or help advisors bend the rules. We’re here to empower advisors to abide by them and succeed with compliant testimonial marketing.