Financial Advisors Who Simplify Complex Topics with Visuals

Financial Advisors Who Simplify Complex Topics with Visuals

Financial Planning is Complicated. These Advisors Make it Simple with Visuals.

A picture is worth a thousand words. If this age-old adage resonates with you, you’re not alone.

In fact, studies consistently show that people benefit considerably when information is presented visually, not just in writing or verbally. Consider these statistics:

👀 “90% of the information transmitted to the brain is visual” (MIT Study)

🧠 “The human brain can process an image in just 13 milliseconds” (MIT Study)

🗺️ “People who follow directions with illustrations do 323% better than those who follow text-only directions” (Effects of Text Illustration: A Review of Research ECTJ)

When it comes to financial planning, is a picture worth a thousand numbers?

According to Dr. Ted Klontz, a financial psychology expert, the answer is a definite “yes”. Dr. Klontz says visuals help people better understand money concepts and develop more engaging relationships with their financial advisors.

Is a Financial Advisor Who Uses Visuals Right for You?

If you’re thinking about hiring a financial advisor, you may want to find an advisor who will use visual aids and tools to help you learn important money concepts more quickly, feel more confident about your personal finances, and make the complex much more understandable.

Fortunately, a growing number of financial advisors now use easy-to-understand visual tools and illustrations to make meetings much more enjoyable and rewarding for their clients. But where can you find an advisor who uses visuals? We prepared this guide to help you find financial advisors across the US who use visuals in their meetings with clients so you can discover an advisor who may be right for you.

And while you can choose to work with a financial advisor who lives in your neighborhood, most of the financial advisors featured in this guide can work with you online, no matter where you or they live. In fact, by hiring a virtual financial advisor who you’ll meet with using a videoconferencing service like Zoom, you’ll save time commuting to meet with an advisor in-person, providing more time for you to spend on more important priorities.

Examples of Visuals that Simplify Financial Planning

To help demonstrate the value of visual tools, let’s see a few real-life examples a financial advisor might review with you based on your individual financial planning needs.

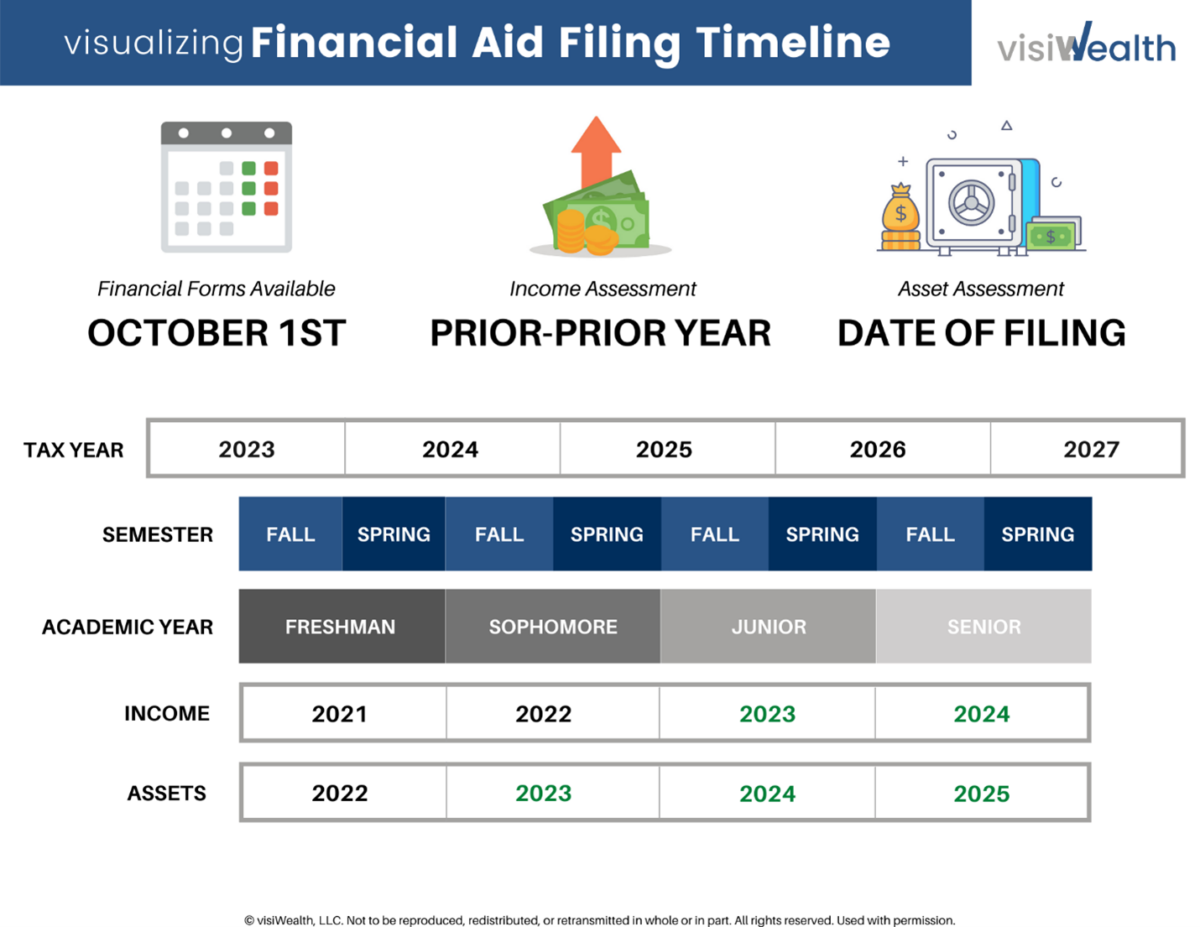

🎓 Financial Aid Visual

This is a visual that one financial advisor uses to identify when income and assets are assessed for financial aid planning purposes. The process of applying to colleges and filling out financial aid forms is stressful enough!

If you are saving for college and interested in the potential for financial aid to lower your costs, your advisor may use a visual like this one to help explain what gets assessed and when it’s assessed so you can plan today to achieve a better outcome in the years ahead.

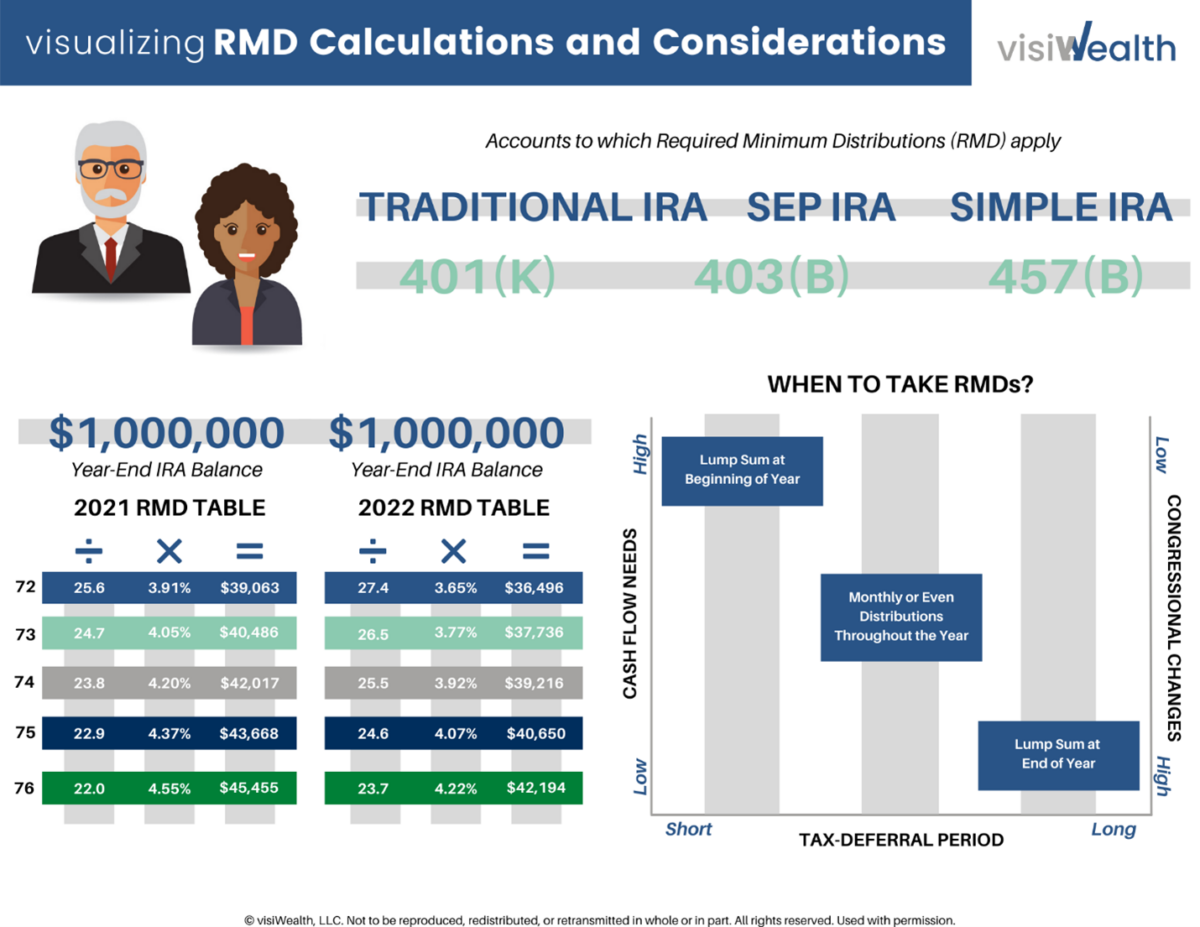

🧓 Visual for Required Minimum Distribution (RMD) Calculations

This is an example of a visual aid used by a financial advisor that explains not only how required minimum distribution computations will change for retirees given the new mortality tables released for 2022 (Hint: distributions will generally be lower now!), it also introduces a discussion around when distributions from certain tax-deferred accounts should be taken in any given year.

Should distributions be taken as a lump sum in the beginning of the year, at the end of the year, or in equal amounts throughout the year? If you’re interested in optimizing your income in retirement to minimize taxes, a financial advisor who uses a visual tool like this one can simplify a very complicated topic to help you feel confident about your RMD strategy.

⛳ Visuals to Make Financial Planning More Enjoyable

Some visuals can even be used to make your meetings with a financial advisor, dare we say, fun? By drawing analogies to non-financial topics such as your hobbies and sports, visual aids can make conversations about financial topics more relatable, and even enjoyable.

This next example is a visual used by a financial advisor to explain how three primary investment planning concepts – diversification, asset allocation, and asset location – can be applied to the game of golf!

For example, just as you shouldn’t invest solely in a single company stock, industry, or asset class, you wouldn’t only use one golf club on the course (unless we’re talking about mini golf!). Instead, you use a variety of different investment vehicles each designed to help you achieve a specific outcome while reducing risk, just as a golfer uses different clubs that are designed to approach different shots in different ways.

Q&A with Ross Riskin, DBA, CPA/PFS, CCFC, MS Tax

We asked Ross Riskin, Founder of RWM, Chief Learning Officer at the Investments & Wealth Institute, and Chief Creative Officer for visiWealth, a company that specializes in creating visuals of complicated wealth management and financial planning topics, for his thoughts on a few questions about using visuals as a financial advisor.

Q: As a practicing financial advisor, why is it important to focus on using visuals in your conversations with prospective and current clients?

Ross: Aside from the enjoyment I receive and mental exercise I go through when creating visuals, using them effectively has resulted in me being able to better connect with prospective clients and build deeper relationships with existing clients because I am no longer viewed as a financial advisor – I am seen as an educator.

Effectively using visuals allows me to communicate complex concepts in a way that does not overwhelm others and ultimately results in them receiving a sufficient level of understanding – something a good teacher is always focused on doing.

Q: Is there an example of a complicated topic you frequently use a visual to simplify where you often see clients have a ‘lightbulb moment’?

Ross: I don’t have a specific concept or topic in mind, but I can say that being able to use visuals when talking about any sort of tax-related concept or strategy almost always results in a “lightbulb” moment for the client in my experience.

Taxation is a topic that usually triggers one of three responses from a client (and even advisors for that matter) – boredom, confusion, and anger.

Using visuals allows me to neutralize those feelings and flip the script on what they think tax planning is actually about. This has not only resulted in my clients being able to better understand complicated topics, but their willingness to follow through on my recommendations has increased, which is a sign that a high level of trust has been established and the foundation of a long-lasting relationship has been built.

Q: When someone is beginning their search for a financial advisor, how do you suggest they inquire if the advisor offers educational support and visual tools to simplify complex topics?

Ross: That is a great question and one that I don’t think people ask the advisors they are interviewing about enough!

If you are interviewing a financial advisor, don’t hesitate to ask them if they are able to use visuals to not only explain complicated planning strategies but to also help answer more specific and straightforward questions you may have.

If they stumble around answering this question or say that they aren’t able to do this, get ready to be bombarded with convoluted text-heavy emails, 40-slide PowerPoint presentations, and pages upon pages of tables containing lots and lots of numbers as part of the “planning experience.”

Get to Know Financial Advisors Who Use Visuals

If you’re ready to find a financial advisor who uses visual tools to make planning for your financial future more enjoyable, you’ll find a growing number of advisors featured in this guide in the weeks ahead ready to work with you. Simply scroll down to find financial advisors featured on Wealthtender who use visuals and may be right for you.

Or browse our financial advisor directory to discover financial advisors with the experience and credentials important to you, then be sure to ask if they use visual aids to help their clients become more informed and educated about their financial future.

Are you a financial advisor?

If you’re a financial advisor interested in hosting more engaging and rewarding meetings with your clients, visit visiWealth.org to gain access to high-quality visuals covering a broad range of planning concepts for a low annual cost.

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor