Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

TL;DR: People that can often help in any phase of the business:

- A business coach privately tutors you as the leader of your business.

Their core job is to try and get the answers out of the owner rather than helping to contribute the answers; coaches don’t give you the answers.

Usually, DIY (Do-It-Yourself): has ways to change your thinking, mindsets, and patterns. - A business consultant provides services/solutions for the business itself.

Their core job is to provide answers to the owner in a narrow field of expertise.

Usually, DFY (Done-For-You): has subject matter expertise on narrowly focused outcomes. - A business value growth advisor/ value growth advisor is a full spectrum guide on what to do next to optimize your business and make it more attractive, ready, and valuable.

Their core job is to be a guide in the changing landscape of business, creating new maps and helping the owner lead the way to business optimization.

Usually, DWY (Done-With-You): has professional expertise in strategy, operations, finance, and exit.

TL;DR: Certified Exit Planning Advisors (CEPAs) that help in the last few years with the exit, transition, or transaction:

- A business broker or mergers & acquisitions advisor helps you get ready for a sale transaction, doing the due diligence.

- A family business advisor helps you transfer value to the next generation of owners in the family.

- An Employee Stock Ownership Plan (“ESOP”) advisor helps transfer the business to the employees.

Each day brings new challenges for a business owner. No matter the stage of your business, an experienced coach, consultant, or advisor can offer tremendous value to overcome obstacles and accelerate growth.

Often, business owners in their first few years of operation feel hiring a coach or advisor is premature. This couldn’t be farther from the truth. In the same way someone who has never stepped foot in a gym before can improve their physical health considerably by establishing a workout routine, business owners can improve the health of their business by hiring a coach or advisor.

But before starting a search for professional help, it’s important to first understand the difference between a business coach, a consultant, and a business value growth advisor. You might think that all three titles mean the same thing, but their education, experience, solutions, and ways of doing things are usually very different.

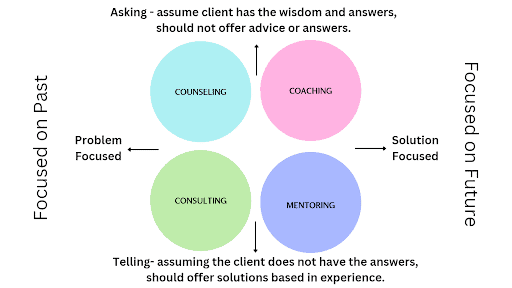

The first difference is in the approach to their core methods. None of these are good or bad, but if someone needed a mentor, counseling is not going to be the right fit. If someone needed a coach, a consultant would not be the right fit.

- Coaches focus on the Future, and Asking the client for the answers.

- Consultants focus on the Past problems, and Telling the Client what solutions to use.

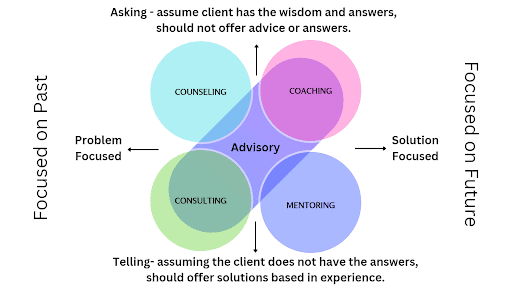

- Advisors focus on the Present (with a perspective of the past and future), and Co-Design with the client a collaborative plan for executing now.

- Advisory thinking tools include the core tools from consulting and coaching, and some from counseling and mentoring, depending on the client’s personality and situation.

Business coaches are not the same as coaches that focus on sales, marketing, or life coaching. There is some overlap with executive, leadership, and strategic coaches. All three are mostly in the lower middle market (firms with revenues of $40 million to $3 billion). Business consultants do most of the work for you, but business coaches do not do any of the work for you. They generally work with small business owners (firms with revenues of $1.00 to $1 million) to improve the performance of their teams, provide general advice, and create a roadmap to achieve their goals. A business coach can help in several ways, but a coach’s main aim is to change the leadership.

A good coach will help you define your goals and map out the steps to get there, while a bad coach is interested in making a quick buck. A good business coach can help you assess your strengths and weaknesses and work on growing as a business owner. They can also help with the planning stages of achieving goals.

A business coach’s core offerings are accountability and inspiration. They should not advise on professional matters like legal, accounting, investments, insurance, or human resources unless they hold the relevant professional licenses, certifications, and education. You could lose your business by taking advice from someone who is not an expert on that subject. Even well-meaning teams and HR advice can cause lawsuits and backlash that can be hard to survive.

The best business coaches have grown their businesses from an idea and are not simply employees of a national coaching franchise. This type of experience indicates a lot of industry knowledge from the company they started that is useful in that niche. A successful restaurateur might be a great coach in hospitality, food & beverage, or resort tourism, but a bad coach in manufacturing, construction, logistics, or finance.

A business coach steps into a similar position as a personal financial coach, both focusing on the mindset, accountability, and basic education that can help you get started.

Ideally, your personal financial coach should have an Accredited Financial Counselor (AFC®) or a Certified Money Coach (CMC®) certification. Ideally, your business coach should hold a certification such as the EOS Implementer, Certified Professional Business Advisor (CPBA®), or at least one from the International Coaching Federation (ICF®). In both cases, coaches can help you take the first steps to becoming a more successful business owner.

Business consultants are professionals that do most of the work for you, each with a different area of expertise. Some common types of business consultants include:

- Management consultants: organizational, change, management practices

- Financial consultants: cash flow, accounting, budgets, analysis, planning

- Marketing consultants: sales, branding, advertising, promotion

- Human resources consultants: management, benefits, recruitment, training

- IT consultants: technology, software development, cybersecurity

- Operations consultants: logistics, operations, manufacturing, distribution, supply

- Environmental consultants: sustainability, environment, efficiency, and waste reduction.

These are just a few examples of the many types of business consultants available. Some consultants specialize in multiple related areas, while others focus on a single area of expertise. The big thing to remember is they are usually going to do it for you as a small business owner, while in the middle market, they will usually just make a recommendation and train your team.

A business value growth advisor is usually a financial professional such as a Certified Public Accountant (CPA), or Certified Financial Planner (CFP), or a previous Chief Financial Officer (CFO) or Chief Value Officer (CVO) of a larger middle market company. Some used to be mergers and acquisitions consultants or regional business brokers; ideally, once becoming an advisor, one should stop providing transaction services due to the conflicts of interest in doing both.

Tip on Conflicts of Interest: You do not want your business advisor to work for the same business as the broker, in the same way that you do not want your primary care physician working directly for the pharmaceutical business. This is for the same ethical reasons that you do not want your personal financial planner or wealth advisor to work for a place that sells financial products or gets commissions for referrals. Conflicts of interest in pay are the most common to look out for; for example, you do not want your business attorney to also own the brokerage they send you to. Advice is far more valuable than products or transactions, but “free advice” may end up costing you far more than you could have imagined. An anonymous source told us, “I have seen several $100,000+ commissions for finding business owners interested in a certain financial product, and that surely influenced the decision of the so-called advisor.”

Many also become business coaches until they get the education, experience, and skills to help with more types and sizes of businesses; they often also offer consulting based on what they already know. They typically work with businesses with revenue over $500,000 to $100 million. Some have minimums for revenue or number of employees, but most are concerned with finding the right fit for long-term clients. There are some Value Growth Advisors that do membership, hourly, and project work to help owners of smaller businesses get professional advice.

A business value growth advisor’s main goal is to help business owners set up their company so that it will be an attractive and valuable asset that is ready for an exit, like a sale or merger, even if it won’t happen for many years. A business that is ready to sell is one that requires far fewer hours from the owner, has less risky profits, and has far fewer emergencies. Your business is a complicated investment, and it will need advice from many professional advisers as it matures.

Many of the best business value growth advisors have also earned the Certified Exit Planning Advisor (CEPA) designation, which is a multidisciplinary credential that shows their knowledge and dedication to helping business owners. But take note: the majority of CEPA credential holders prioritize their efforts on the personal financial plan of a business owner. Less than 5% of CEPA professionals primarily focus on creating value and accelerating the growth of the business itself.

So, if you want to hire a business value growth advisor with a CEPA designation, it’s important to make sure that their skills and focus match what you’re looking for. You will eventually need both a personal wealth advisor and a business value growth advisor, and ideally, they are both going to be CEPAs. If there are multiple (unmarried) owners, then each owner will need their own personal wealth advisor to reduce conflicts of interest.

As your business matures or grows, the professionals you work with will probably change to include a wider range of advisors, such as an accountant, an attorney, and others. In this article, we’re focusing on the distinctions between a business coach, a business consultant, and a business value growth advisor, including how to find these professionals.

There are many approaches to coaching. However, most effective business coaches share some common traits. By being aware of these characteristics, you’ll have an easier time choosing a business coach who’s right for you and your business.

A Good Business Coach Has the Ability to Listen, Empathize, and Inspire

The best coaches know how to listen. They understand that listening is how they learn about you. A good business coach is open to what their clients want, what they need, and how they can help them achieve their goals. Listening is a skill that requires practice, but it’s also one of the most important skills a business coach should have.

Another important characteristic of an effective business coach is empathy. This is a skill that helps a business coach understand what clients are experiencing without judging them or trying to fix their problems for them. When you have empathy, you understand that your client has a different perspective than you and can relate to their circumstances and situation.

The third characteristic of an effective business coach is the ability to inspire. A coach must inspire people and motivate clients to make their businesses successful. An effective business coach should be positive but realistic. You don’t want a “yes” person who parrots everything you say. Instead, a good coach should offer useful criticism and know how to inspire you to be the best you can be. This type of positivity should shine through in an interview.

A Good Business Coach Has the Ability to Challenge Your Assumptions and Beliefs

An effective business coach can shatter limiting beliefs that hold a business back. These beliefs keep people from achieving what they want to accomplish in life. When you work with the right business coach, you should feel empowered to make your business better and believe you can do so. If you have limiting beliefs, a good business coach will challenge them and help you think differently.

A Good Business Coach Will Hold You Accountable

When you’re working on something that’s out of your comfort zone, the tendency is to avoid it — even if it’s necessary for the growth of your business. An effective coach holds you accountable and keeps you moving forward so that you achieve the results you want in your business and life.

A business coach can help you better define your goals. Unless your goals are clearly defined, it’s less likely you’ll follow through with them. A business coach can also help you fine-tune your goals so they’re more achievable. They can help you stop making excuses and get back on track if you’ve lost your way.

The best coaches bring accountability and tangible value to the table. They push you to do better and are there to pick you up should you fall down. If a coach can’t do that, they might not be worth the investment.

An Effective Business Coach Will Help You Achieve Success on Your Own Terms

A good coach doesn’t tell you what to do; they empower you to come up with solutions on your own. They try to get you to the best outcome by asking you questions that make you think and writing down any advice you give. You can’t succeed at being someone else; a successful coach should help you succeed at being yourself. They will take the time to understand your business and adapt their recommendations and coaching to meet the needs of you and your business. Facilitating can be very useful, as you learn the process of solving problems rather than having a coach hand you the solution.

What to Look for in a Business Value Growth Advisor

In many instances, business coaches add the greatest value to their role by offering motivation and encouragement for entrepreneurs to feel energized and excited when they wake up each morning. A business value growth advisor, on the other hand, has advanced training, tools, and experience in how to use proven drivers of value to improve the business itself.

Integrative personal financial advisors combine coaching, counseling, therapy, and life planning into a broad, multidisciplinary practice that is about much more than just investments, insurance, retirement, and technical financial planning. In the same way, integrative business advisors have combined exit planning, accelerating value, aligning growth with business strategies, introducing new ideas, and making business plans that can actually be carried out.

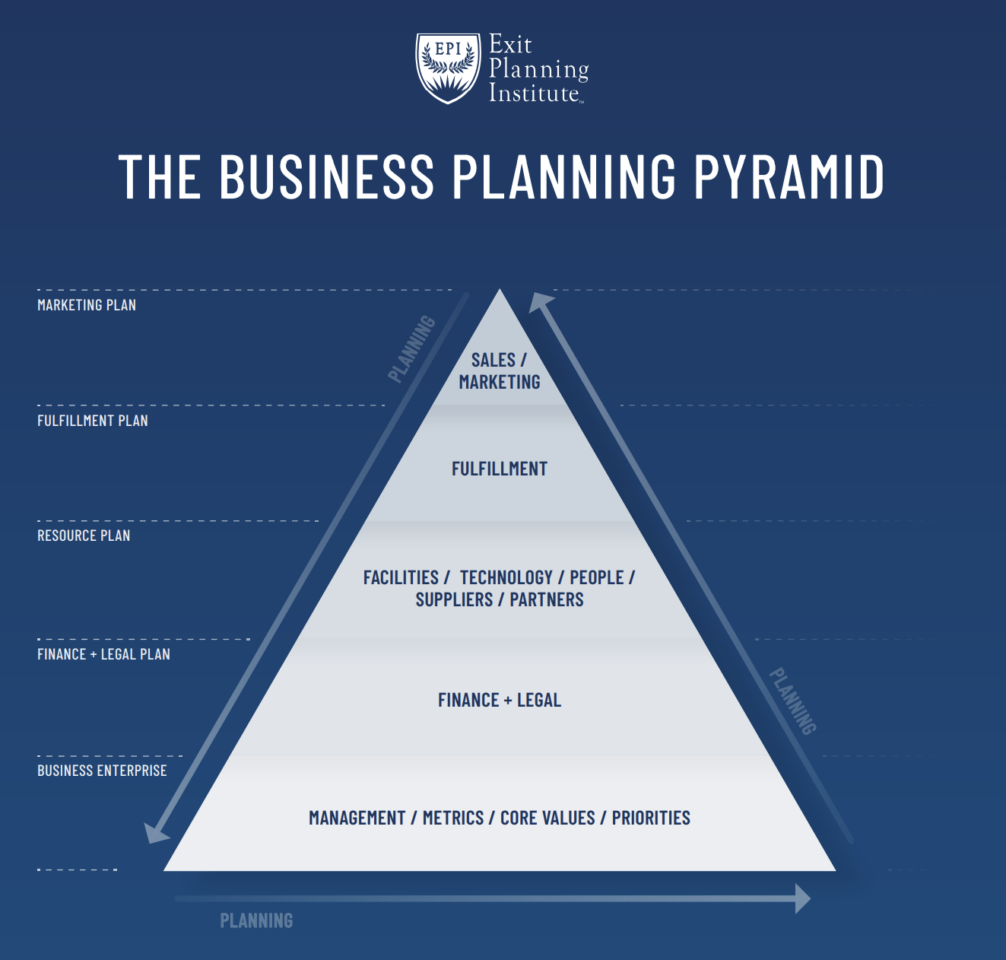

There are two major sides to being a business value growth advisor:

A business value advisor is a type of business-focused financial planner that helps owners to identify, protect, build, harvest, and manage their business value. They work with businesses to look at how well they are doing now and find ways to improve their value proposition, bring in more money, reduce risk, and cut costs. The value that will be harvested is maximized by value acceleration, and optimized by business exit planning.

Value advisors are also exit planning professionals who help business owners and advisors make and carry out exit plans that maximize the value of the business. They use their knowledge to help the business find ways to increase its value and lower unnecessary risks, as well as to evaluate how well it is doing right now. In terms of exit planning, the goal of a business value growth advisor is to help owners reach their exit goals, leave a lasting legacy, and maximize value.

A business growth advisor helps businesses in the early stages of growth or that have hit a plateau acquire new customers, products, or markets and maximize customer lifetime value. They look at the problems with growth efforts and come up with a strategy to fix them. This strategy is based on innovation, research, choosing the right channels or jobs, analyzing the customer journey, getting advice on product development, and setting up the right growth processes and systems.

While they are generally not marketing consultants, they may also help a business identify new opportunities for growth and expansion, assess risks, and develop strategies to mitigate those risks. They will be able to tell if there is something wrong with your strategy, messaging, channels, funnels, and processes, but they will not necessarily be the ones to fix them.

The value (&) growth advisor acts as both a business value advisor and a business growth advisor. They don’t do everything for you, but they help you figure out how to get everything done. Small businesses, especially those with less than $5 million in revenue, usually cannot afford all the advisors, coaches, and consultants that a business with $50 million in revenue would use.

Just hiring an outsourced Chief Value Officer could cost $75,000 to $150,000 a year, and growth consultants cost $300 to $600 an hour. While the highest-touch, most expensive services of a value growth advisor are generally between $1,000 and $5,000 a month. Many also offer services for people in all stages, including hourly advice, project packages, workshops, and group coaching.

And so the Value Growth Advisor can work with small businesses of sizes 1–6 to provide broad, holistic professional advice that middle-market companies have traditionally taken advantage of.

They help businesses improve their value proposition, bring in more money, cut costs, and find new growth and expansion opportunities. They also coordinate exit planning, maximize business value for all stakeholders, and help businesses be ready for exit.

They use a wide range of methods and tools, such as financial analysis, market research, customer surveys, and competitive benchmarking, to look at both qualitative and quantitative data and figure out what it means. The outcome they seek is a better business that is worth more, is easier to operate, and is ready, attractive, and easier to sell—on your terms.

———————————————————————

Q&A with Daniel Bishop, CFP®, CEPA®, CPBA™, CDAA™

The founder of Black Swan Advisors, Daniel L. Bishop, CFP®, CEPA®, CPBA™, CDAA™, is a highly respected business value growth advisor who we talked to for this article. We sat down with Daniel to gain his insights on what business owners should look for when hiring a business value growth advisor.

Q: Daniel, what can you tell me about the current business and exit planning environment?

Daniel: Well, we have the risk of unrealized inflation becoming realized, radical advancements in artificial intelligence that could displace workers and create more hard-to-fill jobs, cybersecurity and ransomware being a bigger threat than ever, workforce issues still crippling some industries, and business/supply chain interruptions is still a problem. There is also more awareness about payment diversity risk and using digital assets as defenses against manufactured banking crises. So it is becoming a more complex operating environment. Leaders are being forced to increase their talent management, digitalization, automation, and innovation budgets.

Usually, about 80–90% of a small business owner’s net worth is locked up in their business. Out of the 33+ million businesses, 99.9% of businesses in the US are small businesses.

About 80–90% of them never go to market, and about 50% of owners are forced out of their businesses. Of those that go to market, only about 30% sell. And there aren’t enough buyers from generations X and Y to replace the Baby Boomer business owners who will be forced to exit or retire over the next decade.

So what we have is value locked in the business, and the business owner’s mind, that will literally be lost to the next generation. Value that will be lost to the community, and that may even be lost in that field. Unless we find ways to unlock all that value and make the business ready and attractive to a buyer. If you evolve your business into something far more than just a job, then there are many people who could want it. You could pass the torch to someone else, and it could live on. If you can sell or exit, you can take the value of your life’s work and use it to protect, provide for, and spend time with the people you love.

Q: Daniel, you have suggested that there are more than 50 business value drivers that advisors such as yourself will consider when working with business owners. What would you suggest are the three biggest drivers of value?

Daniel: The three most important value drivers right now are decommoditization, owner decentralization, and creating diversified, predictable revenue.

- Decommoditization– Creating a niche competitive advantage in a growing market

- (Owner) Decentralization– The owner cannot continue to be the best salesperson, the decider of all things, and the bottleneck of operations.

- Diversified, Predictable Revenue– Repeat customer loyalty and satisfaction, recurring revenue, and how dependent you are on each customer matters a lot.

Q: You told us that business owners need to avoid falling into a “growth trap.” Can you elaborate on this for us?

Daniel: Sure. In fact, this is an area where I often see business coaches and growth consultants fall into this trap when they overly focus on growth, scaling, or efficiency. Let me explain.

Growth means top-line revenue expansion, and at nearly the same pace, you are adding resources. Scaling means margin expansion, adding revenue at a faster rate than cost. How effectively a company produces goods and renders services in relation to the cost of doing so is a measure of its efficiency.

And those things are each important, but sometimes growth, scale, or efficiency are directly at odds with what your business really needs to optimize or even survive. The first trap is confusing growth with scale. Growth without proper profit, scale, and value is dangerous.

In fact, if you’re not careful, you can grow so fast that you destroy a business, just as surely as you can starve a business to death. There are a lot of zombie businesses out there that were trying to grow when they should have been consolidating, de-risking, and optimizing. But because the only advice they hear is to grow or die, they took too much of the wrong type of risk.

I would guess that about two-thirds of small businesses were profitable at the start of 2023, which leaves over a third that are a “zombiz”, the walking dead. A zombie business is a small business that somehow continues to operate off the backs of the owners, earning only enough to keep the doors from shutting.

Q: You mentioned exit planning. Can you tell me the best way for someone to exit?

Daniel: Well, the best way to exit depends on the current market, the owner’s finances, the context of what they want to do after exit, and the owner’s values. But I can tell you some of the ways to exit.

There are four core inside strategies: family transfer, management buyer, partner buyout, and employee ownership. There are also four core outside strategies, like a 100% market sale, a strategic sale to competitors, an orderly liquidation of all assets, or a recapitalization.

Let me explain that last one a little bit more. Once you have built something to a certain level of sophistication, a private equity group, a large family office, or even an investment bank will want to invest. How they invest can differ significantly, but they are effectively giving the owner cash for a part of the business. Often, this is part of a plan to take the business public, or take the business to a new scale of profitability. In this case, the investor is long-term and active in helping improve the business but may be looking to sell the business in as little as 5 years at a much greater value.

Most people do not sell their businesses at all; they just retire, use it up, or let it slowly die.

There are many ways to exit, and sometimes the right way is to sell the business and stay working for it, sometimes to sell and walk away, and sometimes to grow for a few more years until it is worth selling. My favorite is often a hybrid transition, where you take multiple bites of the apple pie while you are growing it. That can look like selling off pieces of your business, or using a combination of the strategies above. In this way, you can usually optimize your lifestyle, improve your tax situation, maximize the value you get out of your business, and better align your time, money, and energy with what is most important to you.

Q: It’s clear that a small business in its early stages will have very different needs (and budgets) than a large, established business. What steps do you recommend early entrepreneurs take as their businesses grow?

Daniel: Wow. That is a really big question. At the risk of oversimplifying it, there are some things to do when you reach a certain complexity level. Let’s use size and maturity level as proxies for the complexity level because those are easier to identify. Imagine that there is a string connecting size and maturity, but they are not the same thing; they are only connected. You can have a fairly mature, super profitable business that is still a Size 1 lifestyle business. I have also seen size 5 businesses that were in the growth-stage chaos of a go-go toddler. But this is a really good place to start.

I also want to point out that there is no shame in building the type of business that fits your dreams. There are many ways to optimize a business for your life, and bigger is not always better. So these maturity stages and size levels often come close together, but they do not have to. If you have hit either one, you have probably hit the complexity level, which often feels like a glass ceiling or a sheer cliff you can’t climb. The important thing is that if you have this level of complexity, then you need to start thinking about these things.

Maturity Infant: Your business is launched and has some cash flow; it is no longer a dream. This stage is marked by long hours and is stressful, like having a newborn.

Or

Size 1: Lifestyle business or bootstrap startup, 50K-250K in Revenue, often a Solopreneur with an outsourced virtual assistant. Often the highest profit margins.

You should find both a personal wealth advisor and a business value growth advisor who focuses on small businesses. You ideally want to seek out hourly, flat-fee, or advice-only versions of both who will do project plans, as you may only need a small amount of work and guidance each year.

This work may include separating business finances from personal finances, reducing personal and business risk, building business and personal credit, getting basic but effective accounting and marketing systems, as well as an initial plan to extract profit from the business in the most tax-efficient ways.

What is also needed is business owner education, which business value growth advisors offer face-to-face, but some offer cheaper options with online education platforms and events.

This is all about aligning all of your vision, strategies, and plans with your values: personal, business, financial, family, etc.

Maturity Toddler: This is the go-go time primarily focused on sales and fulfillment.

Or

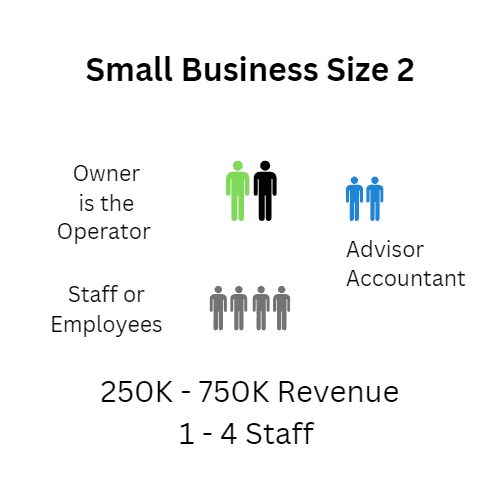

Size 2: 1-4 Staff, 250K-750K in revenue, owner is still the operator and primary technician.

Common problems are limited resources, managing time, learning how to delegate to systems instead of people, customer acquisition, and managing cash flow. To deal with these problems, business owners need to focus on strategic planning, effective time management, customer engagement, regulatory compliance, and cash flow management processes.

At this point, it is a really good idea to also see a business-focused attorney and accountant, and possibly look into outsourcing that bookkeeping. To reduce your risk and taxes, your business advisor, accountant, and attorney need to weigh in on your entity formation. We also want to make sure we are executing on strategies to build critical intangible value through the 4 Cs.

Q: Can you explain the 4 C’s?

Daniel: The Four C’s of Intangible Capital (from the Exit Planning Institute) are the biggest direct drivers of Intangible Value. They represent mostly Intangible Assets that can contribute to a 4X+ multiple of value when the business is sold. To put that into perspective, optimized tangible assets (that are measured by accounting systems) can lead to a 1-2X multiple of value.

- Structural Capital – Everything that makes your business work efficiently. The processes, documentation, training programs, technology, tools, equipment, real estate, and your knowledge which needs to be documented and transferable such that someone else can learn from you and apply it. Your knowledge is a business asset.

- Human Capital – Human Capital is a measure of the talent on your team. Business owners feel today more than ever that this is their greatest challenge.

- How do you Recruit, Motivate, Retain, Evolve your employees?

- Consider why top talent would want to join your business. Can you clearly articulate your business values to your recruits? What characteristics are you looking for in a key employee?

- What are you doing to motivate the talent you already have? Today’s employees want more than just a “job” and will leave if they are not part of something “bigger”. Are you a passionate leader who provides inspiration for your team? And mainly, do you have the “right” incentive programs in place to motivate talent? Today employees place a high value on “quality of life” and free time.

- How does your team need to evolve to grow your business and can your leadership team evolve as your business evolves.

- How do you Recruit, Motivate, Retain, Evolve your employees?

- Customer Capital – What do you do so well for your customers that they couldn’t possibly think about doing business without you? Is your business an integral to your customers’ success because the products/services you offer are unique? Is your customer base diversified? Most of all, are your customer relationships transferable? Contractual?

- Social Capital – Does your business culture embrace people? Culture is what pulls people together, customers and employees. Social Capital represents your Brand, how your team works, the rhythm of your day-to-day operations… the heartbeat of the organization.

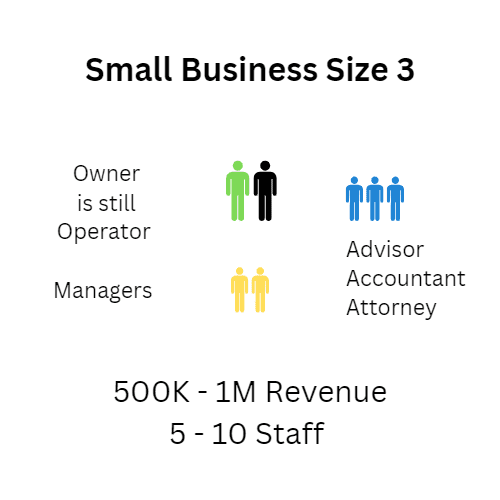

Q: I think we were at size 3?

Daniel: Right, well, after the go-go stage, we have the no-no! Stage, which is often around size 3. For most people who are natural entrepreneurs, it can be the most personally challenging.

Maturity Preschool: This is the time for no-no! when the founder and business must start rejecting opportunities and say no to everything that does not fit the business model. But what they naturally want to do is say yes to all the new opportunities, great ideas, and shiny objects.

Or

Size 3: 5-10 staff, 500K-1M in revenue, owner is still the operator and primary rainmaker.

At this point, you need to worry about more advanced estate planning through the lens of your business entities. While your business value growth advisor can do a lot of your succession, continuity, and resilience planning, in most cases, you will want to bring on both an attorney and accountant who have each earned their CEPA designation, as well as a business insurance subject matter expert.

You are also starting to make enough money that it makes sense to think about hiring a specialist personal wealth planner who focuses on your exact situation. For example, if you have a child with special needs, are going through a divorce, or have kids in high school ready to go to college. Certain things really need to be brainstormed by a roundtable of experts, and your personal wealth advisor and business value growth advisor have critical perspectives on most of them.

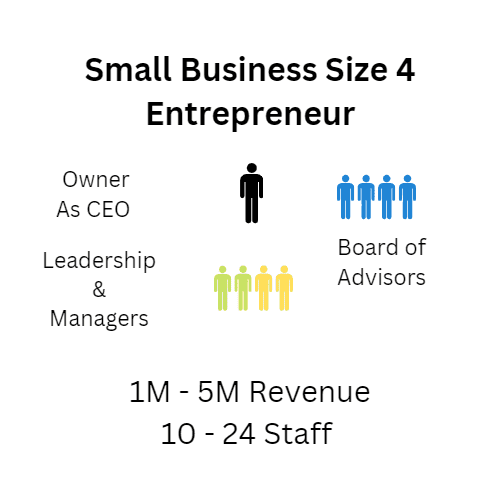

Maturity Child: The founders are still making all the critical decisions. Finding the right people is hard, growing leadership, management depth, and employee engagement become critical.

Or

Size 4: 10-24 staff, 1M-5M in revenue, owner is still the operator and CEO.

If you don’t already, this is where you should have regular meetings with your “Core 4 Advisory Team”: business (value growth) advisor, personal financial advisor, business accountant, and business attorney.

Utilizing the services of a business value growth advisor who is CEPA credentialed is absolutely critical at this stage when 80% of your wealth is in your business. This is not to say that your personal wealth advisor is not important, at the minimum, you want a fee-only Certified Financial Planner who is focused on helping you plan your life, not just your assets. It would be ideal if they have also earned their CEPA designation, and are either advice-only or at least flat-fee.

You want to make the most progress, with the least unnecessary risk because of the limited resources. This is where you should be routinely meeting with your core advisors as a group, typically monthly with your business value growth advisor, quarterly with your personal wealth advisor, quarterly with business accounting, and yearly with your business attorney and any other specialists or subject matter experts.

Common problems include not having a formal business operating system, not having enough resources, having problems with management and leadership, employees leaving, competition, not following the rules, and technology and infrastructure problems. Overcoming these challenges requires strategy, planning, effective leadership and management, employee engagement, and investment in key areas like technology and infrastructure.

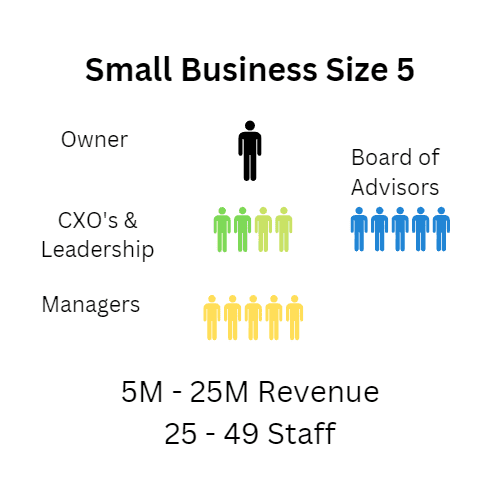

Maturity Preteen: Adolescence is a tough time for kids and companies… they have problems controlling themselves, communicating, and have serious problems with leadership. Leadership style fit, internal conflict, and inconsistency produce most of the problems.

Or

Size 5: 25-49 staff or 5M-25M in revenue, owner is CEO, building out CXOs.

In addition to keeping track of all the issues that have already been dealt with, the owners and CXOs now have to set up clear lines of responsibility and authority, improve communication, standardize processes, and develop strong leadership and a clear vision.

Leadership is the first to break the rules, especially for entrepreneurially minded founders who are still used to making all the important decisions. While it still might be emotionally rewarding to express that independence and autonomy, it literally hurts your business. Leadership needs to become subject to the same policies as everyone else, or this will teach everyone else that the rules mean nothing. Just like teaching teenagers, an example is 10X more powerful than what you say.

You have to delegate more jobs to systems and more authority to people without losing control. You cannot abdicate, but there is no way you can still be aware of everything. You should not be the rainmaker, renegade, or rockstar. Your job at this level is to grow teams, preferably as teams. Employees need to be taught how to think the way you want them to, and you have to let them make cheap mistakes so that they will not make expensive ones later.

When things are going better than average, it is time to start upgrading management depth. Inconsistent goals, nontransparent compensation, and a lack of clear career paths often cause a “us vs. them” culture. Which creates unproductive meetings and problems with the delegation of authority.

But bringing in professional management is very difficult; it will create a new set of problems. If you go down this path, the new manager must be a leader, not just someone to get the monkey off your back. They will institutionalize systems, policies, administration, etc., and that will be at odds with the way the business has been run so far. They could not have grown the business in the beginning, but the founder could not have gotten to the next level by staying the same person.

The conflict for the founder is that you are looking for someone like you who does all the things you would not do… and that doesn’t exist. The founder will have to grow as a leader, find a better fit, or exit the business. There are many business owners who love building their businesses but hate running large ones. So they sell them off as mostly finished projects. It comes down to values, how you want to live your life, and what you need out of the business.

You need two types of people to get to the next level, and they are normally diametrically opposed in their conative, cognitive, and leadership styles. But if you can work together, everything is better. One good example is the Visionary & Integrator dynamic of the EOS® system. Like the comedian duo Penn And Teller, or the classic Buffer and Munger example, a right-fit team is significantly more effective than either could have been alone.

At this level, you should engage a subject matter expert for your situation: such as a risk advisor, an estate planning advisor, a family advisor, a business banker, or an M&A (mergers & acquisitions) advisor. Your core business advisory team, family members, board of advisors, and/or management team become even more important.

If you haven’t yet, it is worth talking to an operating system consultant, like a Professional EOS Implementer®, to work on team alignment. While those small business operating systems like EOS can work with teams as small as 10 and all the way up to 250, 25 seems to be where it is critical to fix this issue.

Maturity Teen: The early prime of the life of most companies, when they have the most energy, and have not started picking up any of the diseases of aging.

Or

Size 6: 50-99 staff or 25M-50M in revenue, Owner has a Core C-suite, and is often the chair of the Board of Directors.

A prime business is a stage in a business’s life cycle that is characterized by a high degree of stability and balance. The business has already gone through the early stages of growth and has established a solid position in the market. The business is able to maintain its market position and profitability while continuing to innovate and improve its operations. Companies will eventually face challenges and will need to adapt and change in order to continue to grow and succeed over the long term.

The company may become complacent and lose the drive and ambition that helped it succeed in the earlier stages. This can lead to a lack of innovation and an inability to adapt to changes in the market. They frequently have an overinflated sense of their own success and begin to take risks without adequate planning or research. This can lead to costly mistakes and setbacks. may struggle with defining its long-term direction and vision. This can lead to a lack of focus and a failure to capitalize on opportunities. More complexity means more leadership challenges can arise. This can happen when there isn’t enough communication, when people don’t know how to delegate well, or when there are disagreements between leaders or departments.

This is a great place to think about “taking some more of the table” while things are going well. That could mean fully exiting the company. You could keep part of it, expand into a family enterprise, fully retire, or build out a franchising model.

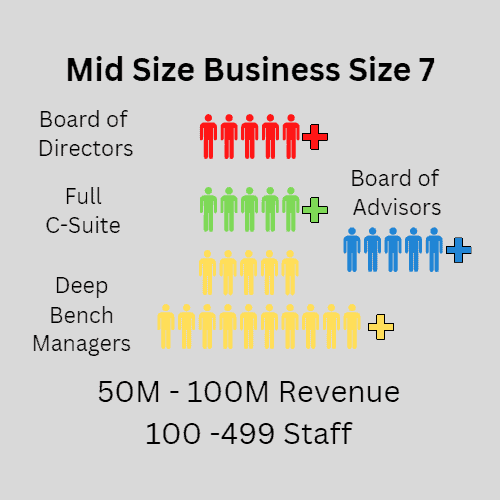

Maturity Young Adult: You have effectively reached the lower middle market, at this size you are swifter than the industry giants, are more competitive than many smaller firms, and have the upper hand in many of your negotiations with suppliers. Now you have to keep it, the culture, the people, the systems and processes, the positioning, your moat (competitive advantage), and your lead on the competition. Like juggling 1,000 plates, it cannot be done alone.

Or

Size 7 +: 100-499 staff or 50M-100M in revenue

While size 7 is still considered a small business by the government, we have really reached the middle market level complexity here. Typically, a strong and visionary leader who can spur growth and innovation is in charge of the organization. Their secret weapon is typically a COO in sync with the vision. However, as the organization becomes more successful, it can become complacent and resistant to change. This can eventually lead to the organization entering the decline stage of the life cycle. After the decline stage, organizations may experience a fall from their peak, resulting in what Ichak Adizes calls the diseases of recrimination, bureaucracy, and death.

- Recrimination refers to the tendency for people within a declining organization to blame each other for the organization’s problems rather than taking responsibility for their own actions. This can lead to a breakdown in communication and cooperation.

- Bureaucracy refers to the tendency for declining organizations to become more bureaucratic and rigid in their structures and processes, making it difficult to adapt to changing circumstances and innovate.

- Death refers to the eventual demise of the organization if it is unable to overcome its decline and renew itself.

To stop this decline, organizations need to focus on renewal and revitalization by addressing problems with leadership, communication, strategy, innovation, and adaptability. This can involve restructuring the organization, developing new products or services, and investing in training and development for employees, but often it involves cutting something away that is making the business culture sick.

Think of a small business like a sailboat, or a powerboat… a middle market business is like a cruise ship. It is hard to turn, you have to forecast out farther, you are farther from your customers, and employee engagement is a constant threat. They are some of the most resilient businesses, and employ the most people, but have significantly reduced profit margins because of their size. Because of their size, they can have the image problem of a faceless corporation- not big enough to be a household name, not small enough to feel like they truly care about customers.

BUT, this is the time that a recap, strategic acquisition, or exit can get you massive rewards. Wealth enough to be the last dollar you or your kids ever have to make. Wealthy enough that you are thinking about how little money you should give your kids so that you don’t spoil them. This is the time to start thinking about a Single Family Office, where you primary financial advisors work directly for you and no one else. You can have someone on staff that is both preparing your wealth for you family, and your family for your wealth. Wealth is a burden if you are unprepared for it, and a blessing if you are, and so the legacy you leave them needs to incorporate a lot more than just the money.

Q: Are we going to stop there?

Daniel: Yeah, there are larger organizations, but I think that is the right pace for our small business owner audience. I should mention that size and maturity level are just two of the useful ways to think about the challenges of business. Between each business size, and sometimes inside them are periods of growth that can be depicted in “S curves” of the lifecycle. The places between the S curves from stages 1 to 2, 2 to 3, and 3 to 4 are often called the valley of death.

The average failure rate for new products hovers around 75% to 90%. Single product companies without a great strategy, contribute to the 50% failure rates in the first 5 years of the business. While this example is a single offer business, you can see how this could apply to different divisions of a business, or different product lines. Because business growth phases come in patterns, we also need to look at them as one of the phases in a lifecycle.

You can see those s-curves happening over and over again in sequence as the business grows and matures. Within a specific business, you might have this lifecycle growth s-curve repeat itself several times before breaking through the glass ceiling. This is true of both a value-maximizing business and a value-extraction business.

Q: What additional thoughts would you like to share about the distinction between a business coach, a consultant, and a professional business advisor/value growth advisor?

Daniel: It really is a team sport, but your value growth advisor is far more holistic than just a business coach or consultant. Business coaches just don’t have the technical or expertise answers, and consultants will provide lots of answers on specific topics but not the deep, overall understanding of how to diagnose the entire business. And so, while they’re both actually great for certain situations, we have seen owners that had several coaches and consultants over several years… and were still stuck. Wasting their money was bad, but what kills owners is their lost time. Most owners don’t need a whole bunch more ideas, they just need to understand the idea they are missing that helps them fix their overall systemic problems.

If you only want to go whitewater rafting, you should go with an experienced guide who has done that before, especially if that is the only thing you are thinking about. If you want business coaching, make sure they have actually successfully, repeatedly done the thing you are hiring them for. If they are just employees working for a franchise that taught them how to sell coaching services, you are going to feel like you are making progress until you hit the iceberg. Often, these business coach training levels are several levels deep and end in a charismatic but flawed founder. There are several coaching franchises that got all their training material from another program, and nobody in the whole business has any real professional education or experience. I am not saying franchises are bad; franchises are great businesses for owners to build. But for someone giving advice, building from scratch gets you a whole different set of tools that are necessary to help owners who are not building off of corporate blueprints.

Now, let’s say you have a coach that specializes in coaching owners who are starting family restaurants in small towns. If that is your thing, then great, you are going to get a lot of value.

What is usually better for most people is to hire an outdoor guide who knows the lay of the land, when the map is no longer any good. A guide in a changing landscape, that can help you with the many legs of your journey, whether that be biking, kayaking, hiking, camping, or climbing.

Most small business owners are experts IN their business and really just need help with working ON their business. That is not just a tired old phrase; it is really a whole different set of jobs. Jobs that usually call for an educated financial or business professional, not just a motivation and mindset coach.

As far as consultants, the limitation of hiring a person with one or two skills for your primary thinning partner is that they probably do not understand how everything works together. I certainly didn’t understand years ago. You don’t want to hire a plumber to build your house; you want a general contractor to find the right plumber, electrician, framers, etc., to build your house.

When you have something wrong with your car, you should take it to an ASE-certified master mechanic to inspect it first before you throw money at something specific, like a new transmission. You will need some consultants, but not all of them, and not until the right time.

Most coaching programs are only built so they can scale, not so you can scale. And consultants can help you scale, but their narrow focus often makes them a better fit for outsourced employees. Value growth advisors make advice cheaper, better, and faster. They make it cheaper by not doing the things you can do yourself or delegate as an owner. They make the advice better by doing some of the financial, strategic, and planning things that you need done for you. They make it faster by using business health monitoring, to help you get to the answers faster, which helps you keep momentum.

Fundamentally, business advisors usually use a market-dominating strategy (better, faster, and cheaper) because they know how. Advanced business strategy is part of their education and part of the exit planning process. So you can often get a real business advisor for little more than the cost of a coach, but they can do so much more.

A word of caution. When you are paying anyone, pay them in cash flow from the business. Do not pay people in shares of your business for advice. This also goes for private token sales. Don’t buy advice from someone who wants to get a piece of your business; we have seen many owners lose 20-50% of their business to people pretending to be “Mentors” and “Investors” that provided about $10,000 worth of advice but took millions in payments when the business sold. That is like paying an architect on a remodel with ownership of half of your house and then having to pay up half of your sale after years of appreciation. You did all the work, don’t get taken.

Your business advisor should NOT get a part of your business, they need to stay objective and the best way to ensure that is to go to someone who is Advice-Only. While it is normal for your Mergers & Acquisitions or Broker to get a percentage of the sale as a commission, your Value Growth Advisor should not be your business partner, and should not own any shares. They should be your objective thinking partner. If they own a part of your business, they now have a massive bias and are thinking about their share of the pie, not yours.

Business Value Growth Advisors are guides in a changing landscape. They are part business coach, part growth consultant, part value growth advisor, and part financial professional… but coordinators of the overall journey. Business advisors should have a deep and broad enough knowledge of business and finance to guide and coordinate your journey – To help you know where your real issues and operational holes are, who to put in the game, when to change strategies, and when to hire coaches or consultants and subject matter experts. We still may want to hire another coach or consultant, such as an Outcome-Driven Innovation Consultant, or a marketing growth consultant, or a valuation expert. It needs to strategically add a lot of value in your specific case.

How to Find a Business Coach, Consultant, or Business Value Growth Advisor

Many entrepreneurs begin their search for business coaches and business value growth advisors online. If you’re a local business, you might want a business coach or value growth advisor in your own community since a local professional will better understand your local market. So, what are the best places to find one?

Search Online

The internet can help you find a business coach or value growth advisor. A great place to start is here on Wealthtender to find financial advisors who have earned their CEPA designation. You can also visit the Exit Planning Institute that sponsors the CEPA designation to find qualified CEPA business value growth advisors.

Beyond Wealthtender and the Exit Planning Institute, consider an online search for “certified business coach”, “certified growth consultant”, or “CEPA business value growth advisor”. You’ll find professionals who provide services on their own and companies that specialize in coaching and consulting for small businesses.

Ideally, you want a financial advisor that is focused on your personal wealth and another business advisor focused on your business value growth, with both of them understanding the CEPA exit planning methodology.

Small Business Development Centers

If you are just getting started with your small business, the SBDC is the first place to go. Small Business Development Centers (SBDC) are small business resource centers that provide free and low-cost consulting services to help small businesses start, grow, and succeed. There are over 200 main SBDCs in the US, with more than 900 additional locations in local universities, colleges, and community organizations.

The SBDC has information about all kinds of resources, including business coaches, value growth advisors, accountants, and lawyers. They can also refer you to someone who fits your needs and budget. You can find an SBDC near you by searching on SBA.gov or calling 1-800-U-ASK-SBA (800-827-5722).

SCORE — Service Corps of Retired Executives

SCORE is an established national organization that offers free mentoring services for small businesses and entrepreneurs who need help getting started or growing their companies.

People from all walks of life, like accountants, lawyers, engineers, doctors, dentists, and more, who have built and run successful businesses themselves are members. They are all willing to share their experiences and advice with others who need help starting a business. If you just need some advice, a few sessions with a SCORE mentor may be helpful, especially if you’re just starting up.

The Chamber of Commerce

Your local chamber of commerce is a good place to start if you’re looking for a business coach or value growth advisor. Almost every chamber has a small group of volunteer mentors who offer free advice to new businesses. The chamber of commerce is an organization that promotes the interests of businesses and the community, but they are not all created equally. It’s a good resource for networking and possibly business referrals, but many chambers in smaller cities might not have the size and sophistication to have a real business coach, or value growth advisor.

The national chamber also hosts seminars and workshops on basic topics like accounting, marketing, management, and human resources — all of which can help any entrepreneur better run their business. Because of this, they also have contact with business coaches, value growth advisors, mentors, and people with knowledge of how to start and grow a business.

To learn more about this option, call or visit your local chamber office and ask if they have any information about business coaching or mentoring programs in your area.

Networking events

Networking events are a terrific way to meet people who may recommend a good coach or value growth advisor. You can also ask other members of the group if they have used one before and what they thought of it. If they do have a recommendation, do some research on that person first, and make sure they are qualified to help with your needs (i.e., if you need someone with experience in marketing, don’t accept recommendations from attorneys).

Also, search for local business networking groups. Check with your chamber of commerce or look up a local networking group on Meetup.com or Facebook. You can also search Google for “business network” followed by your city name (e.g., “business network San Francisco”). This will expand your horizons and give you a larger pool of coaches to choose from.

Local Universities/Community Colleges/Trade Schools

Many colleges have programs that teach students about running a small business, including topics like marketing strategies, customer service techniques, and accounting practices, which can help improve your business’s performance. Many schools also offer courses on starting your own business from scratch or expanding an existing one into new markets or industries that could benefit from your products/services.

Your local university may have someone who specializes in small business coaching, or they may be able to refer you to someone else in the community who does.

The Bottom Line

Business coaches, consultants, and business value growth advisors can be great additions to your team. They can help you find clarity, solve problems, and achieve success. But the distinction between them is considerable, so it’s important to first consider your particular needs and circumstances before hiring any professionals for your business.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor