Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

I’m sure you know that delaying Social Security benefits increases them.

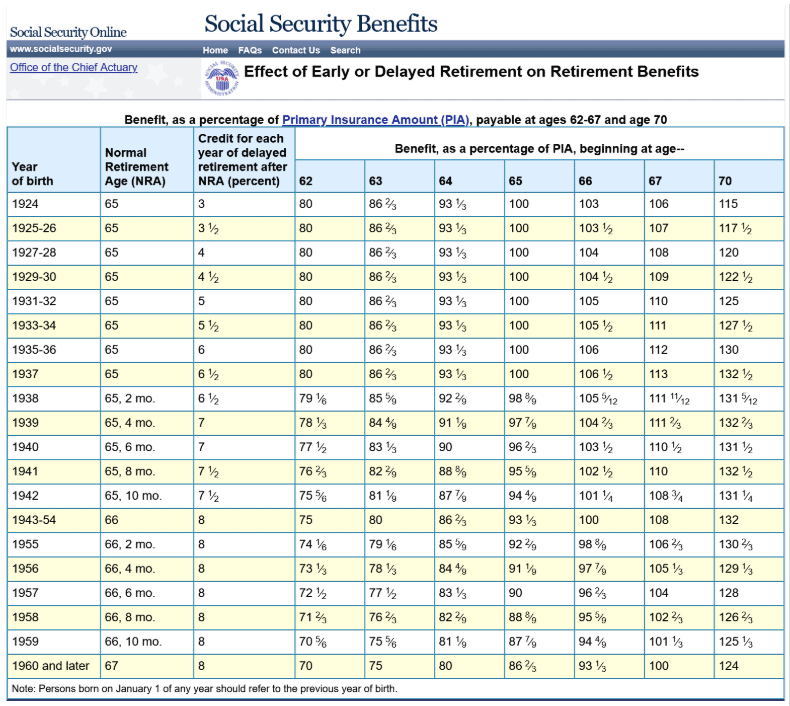

According to the Social Security Administration (SSA), your benefits increase by up to 8 percent for every year you delay claiming them.

Conversely, they decrease by 5 to 6.7 percent per year you claim earlier than your FRA.

The following SSA table shows how your benefits are affected by when you claim, depending on when you were born.

The SSA’s calculation is intended to offer the same lifetime benefits no matter your birth year or when you first claim benefits, assuming you live exactly to your life expectancy per SSA’s Actuarial Life Table.

When Delayed Claiming Makes Sense – Common Knowledge

As mentioned above, the SSA calculates your benefits based on the nominal life expectancy at your age when you first claim benefits.

This means that the more you delay claiming Social Security benefits and thus miss out on however many months’ worth of payments, you’ll exactly make this up if you die at the age predicted by your life expectancy when first claiming.

If you happen to live longer, you’ll come out further ahead.

If you die sooner, your lifetime benefits will be less (though you likely wouldn’t care at that point).

Another tidbit is that if your spouse survives you and has lower benefits than yours, his or her benefits would be boosted to match yours, making this a great way to help provide for him or her.

The extra 8 percent per year of delay won’t benefit him or her.

Given all this, if you expect to live longer than average, you’d likely do better by delaying when you claim. Here are seven factors that will likely make delaying the better choice.

- Your parents and grandparents lived longer than average.

- Your health is good for your age.

- You’ve never smoked.

- You don’t participate in high-risk activities (skydiving anyone?).

- You have a college or graduate degree.

- You’re Caucasian, Hispanic, or best of all Asian American.

- You’re financially well off.

If you live past age 84, your lifetime benefits would catch up with what you’d have received by then had you claimed at your (assumed) FRA of 67. Die younger and you’d “leave money on the table.”

When Delayed Claiming of Social Security Benefits Is Less Likely to Be Helpful

First, the obvious. Early claiming makes more sense if you expect to die younger than average. Here’s how the above factors flip.

- Your parents and grandparents died younger than average.

- Your health is poor for your age.

- You smoke.

- You participate in high-risk activities.

- You never graduated from college.

- You’re African American or, more impactful, Native American.

- You’re impoverished and have poor prospects of improving your financial situation to better than average.

Your breakeven point relative to claiming at your (assumed) FRA of 67 is age 79.

Should you die younger, your lifetime benefits would be higher. Live longer, and your lifetime benefits start falling behind what you’d have had if you had claimed at your FRA.

Now we move to the less obvious.

The Less Obvious Factor Affecting the Results of Late Claiming

According to Morningstar’s annual “State of Retirement Income” report for 2024, you get more out of delaying benefits if you have an alternate source of income that doesn’t tap your portfolio before your benefits begin.

This could be from rental properties, annuities, part-time work, royalties, etc.

The report states, “If higher early portfolio withdrawals are the retiree’s only source of cash flow until Social Security commences, that reduces the benefits of delayed filing because it leaves less of the portfolio in place to compound over the 30-year horizon.”

In numbers, assuming a starting portfolio of $1 million (invested 60 percent in equities and 40 percent in bonds) and $36k in annual FRA benefits from Social Security, claiming at FRA (assumed here to be 67) your safe Year 1 spending (assuming the 3.7 percent safe withdrawal rate the report projects for those retiring this year) would be $73k. You’d expect a lifetime spending of $2.19 million, and your median-case ending balance in Year 30 would be $1.33 million.

Say you delay claiming until age 70 but have no non-portfolio income other than Social Security, all else being equal, your safe Year 1 spending would increase somewhat, to $77k. Your expected lifetime spending would grow to $2.31 million, while your median-case Year 30 balance would drop to $1.15 million.

This is a 5.5 percent increase in spending, but a 13.5 percent drop in the median Year 30 ending balance.

However, if you can “bridge” the gap from age 67 to 70 without touching your portfolio, your safe Year 1 spending would jump to $82k, your expected lifetime spending would increase to $2.46 million, and your median Year 30 ending balance would be $1.30 million.

In other words, such bridging income increases your spending by 12.3 percent, more than double the non-bridged case. Your median Year 30 ending balance would still drop by 2.3 percent, nearly six times less than the non-bridged case.

On the flip side, claiming at the earliest point possible, age 62, reduces your spending by 13.7 percent, and your median Year 30 ending balance by 6.0 percent.

As a final note, Morningstar points out that their analysis assumed an annual inflation of 2.32 percent. Should the actual inflation run hotter, Social Security’s Cost of Living Adjustment (COLA) would make delaying and receiving a higher monthly benefit even more compelling.

What the Pros Think

I asked several financial advisors to weigh in on this topic. Here’s what they had to say.

Stephen Mazer, Principal, Senior Wealth Advisor at Rational Wealth Solutions says, “Most clients these days come in with the notion that they should delay Social Security income until age 70 to maximize the benefit. Even for people with long life expectancies, we review their income sources and illustrate the impacts of delaying or beginning Social Security income. Generally, clients with no alternative income benefit from starting Social Security as soon as they retire but clients should consider delaying if they have an alternative income source, such as the excess markets returns, they can use as income. Please keep in mind any delaying strategy should be reviewed no less than annually.”

Cecil Staton, Founder of Arch Financial Planning adds, “The decision to delay or claim early depends on factors like other income sources, health, and family history. Clients often worry about missing out on benefits if they delay, but I remind them that delaying increases their monthly benefits, which can provide more financial security in later years. It often makes sense for the higher-earning spouse to delay filing to maximize benefits for the surviving spouse.”

Anthony Ferraiolo, CFP®, Partner Advisor at AdvicePeriod elaborates, “Social Security is a very nuanced and personal planning topic, that needs careful consideration to illustrate the options available to those who claim it.

“When I review social security, I cover the topics mentioned here but also outline the following details: (1) What is the age gap between spouses? If there is a big age gap, this also provides a benefit for delaying social security because it allows the other spouse’s benefit to grow. (2) What are your preferences? Some people aren’t optimizing for life in a spreadsheet, they’d much rather go on that big trip at age 67-70 than 71-74 when health issues could creep up. Others will want to receive what’s there, because they may have little faith in the long-term stability of Social Security (even though I’m generally optimistic about the stability of benefits). (3) What are the real numbers if you delay? Some people prefer to miss out on more funds if it means getting them sooner – everyone has a price if it could be $10-$20K more, maybe they’d claim earlier while others may have a $20K threshold to be willing to delay.

“It’s also important to review the tax impact of Social Security benefits. For some people, delaying means more of their benefits could become taxable, plus they might be hit with the Medicare Income Related Monthly Adjustment Amount (IRMAA), both of which would reduce their net benefit from delayed claiming.

“Our goal is to educate, illustrate, and guide clients so they understand their choices and the pros and cons of each. Looking at it from a purely spreadsheet/numbers perspective would likely encourage most people to delay until age 70 since the life expectancy tables were designed in the 1980s when life expectancy was somewhat lower.

“Now, most average healthy people will likely live into their early to mid 80s so they’d eventually break even and pull ahead. As healthcare evolves, this effect could grow even more. Especially after you factor in COLA and delayed credits, folks would be hard-pressed to find such a stable increasing longevity benefit. However, it’s called personal finance for a reason, so this is a very personal decision.”

Lauren Williams, CFP®, CRPC®, MBA, Co-Founder and Financial Advisor at Prosper Plan Wealth adds some very welcome news to hundreds of thousands of Americans, “There are 3,000,000 people and their spouses who need to revisit their social security claiming strategy due to the Social Security Fairness Act. The House of Representatives approved this legislation in November with the Senate approving it on December 21st completing congressional approval and needing only President Biden to sign it into law.

“This Act was introduced in the House of Representatives in 2023, but its core issues simmered in Congress for over 20 years, since 2003. The Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) significantly impacted many teachers, police officers, firefighters, and public servants by depriving them of crucial Social Security and spousal/survivor benefits, especially when their partners pass away first.

“In financial planning, we call this ‘mortality risk’ – the risk of losing your spouse’s income and your lifestyle when your spouse predeceases you. Over the years, I witnessed firsthand how this impacts clients and how challenging it was for them. The Act does away with both of these provisions.

“This development will be life-changing for the hundreds of thousands who never expected to receive these social benefits. By my initial estimate, this adjustment could increase their annual retirement income by anywhere from $6k to $44k!”

Is Delaying Social Security Benefits Right for You?

The longer you expect to live, the more financially beneficial it would be to delay claiming Social Security benefits to age 70 (assuming your financial situation and health allow it, of course).

However, having some “bridge income” to offset the missing benefits from your FRA to age 70 turbo-charges your outcome over a 30-year retirement.

Should you have no such bridge income, your increased benefits would be significantly muted.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor