Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Whether you earn multi-six figures or less than $100,000 per year, being self-employed offers many benefits over remaining an employee.

Working for yourself is especially preferable if your employer classifies you as “exempt,” expects you to work long hours without overtime pay, yet pays you an underwhelming salary.

You may have thought longingly about the day you could tell your boss to take a hike, but you know new businesses face a lot of risks, and many don’t last even one year, let alone five, 10, or more.

Being responsible for keeping a roof overhead and food on the table makes it an especially daunting prospect.

Perhaps the following illustration of just how big the payoff can be will motivate you to consider it more seriously, and the two low-risk solutions may make it less fear-provoking…

Comparing Even High-Income Employees to the Self-Employed

Even if you make multi-six figures as an employee, striking out on your own can bring substantial benefits. Here’s how.

1. Employees Have to Split the Value They Create with Their Employer

If you have the right skill set to command a $250k compensation package as an employee, you may well be able to strike out on your own.

Then, even if you don’t scale up by hiring employees, you benefit from the full value you create without splitting it with an employer.

In this situation, you may well be able to bring in over $400k in annual revenue, and if you’re, say, a consultant or programmer, your profit margin can be over 95 percent!

2. Employees Can’t Deduct Many Work-Related Expenses that Business Owners Can

Most employee work-related expenses aren’t tax deductible, while business owners can deduct every work-related expense.

In fact, since 2018, many passthrough business owners even get a “qualified business income deduction” (QBID) of 20 percent without needing to prove any concrete expense related to it!

3. Business Owners Can Classify Much of Their Income as Profit Distribution; Employees Cannot

If they take a defensible salary, business owners may be able to classify much of their income as profit distribution, reducing payroll taxes significantly (though they do pay both the employee and employer sides on what they classify as salary).

Ryan Firth, Founder of Mercer Street Personal Financial Services, agrees, saying, “Assuming business owners actively participate in running their business, they can make an S-corporation election, pay themselves a reasonable salary, and take the rest of the profit from the business as passthrough income on their individual tax returns.

“Unlike wages, this passthrough income isn’t subject to Federal Insurance Contributions Act (FICA) taxes. Plus, business owners can defer income to a much greater extent than employees, delaying tax liabilities.”

4. Business Owners Can Set Aside Far More than Employees into 401k Plans

Finally, the self-employed can max out their 401k contribution and employer match, deducting huge amounts from their taxes and building outsized 401k balances within not too many years.

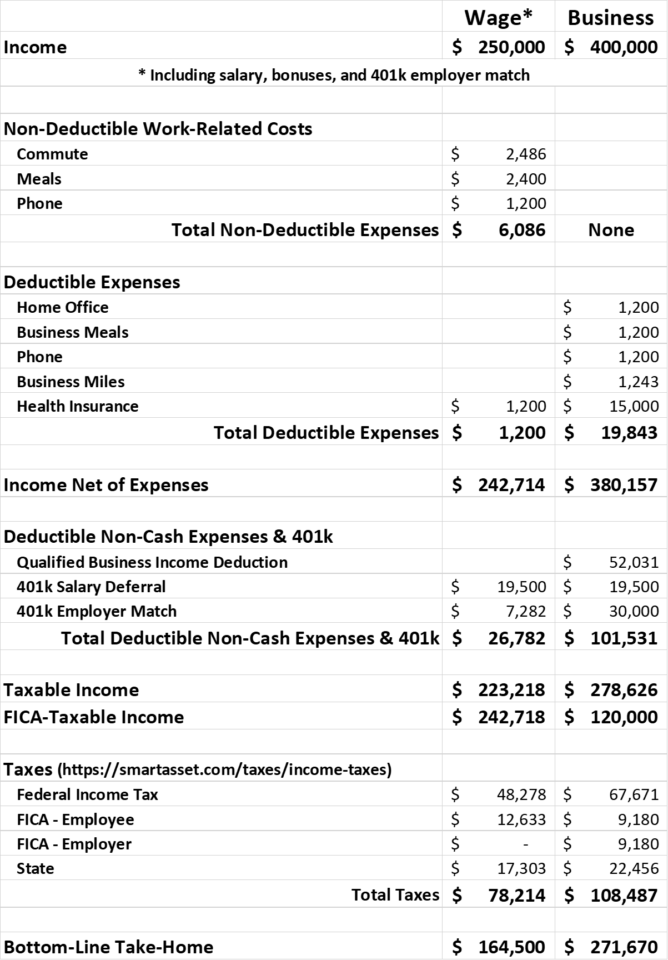

The table below shows a plausible comparison between two situations, an employee with $250k total compensation vs. a similarly skilled self-employed person earning $400k.

The employee can only deduct about 20 percent of work-related expenses, while the business owner can deduct 100 percent of work-related expenses plus the QBID.

Despite the business owner being on the hook for 100 percent of health insurance premiums vs. the small fraction paid by the employee, the business owner’s pre-tax income is higher by over 56 percent. Despite this, the business owner’s effective tax rate is 28.5 percent vs. over 32 percent for the employee!

As a result, the bottom-line take-home for the business owner is 65 percent higher than the similar-skilled employee.

Pros and Cons of Being an Employee vs. Self-Employed

Let’s compare the benefits and drawbacks of these two situations.

Pros and Cons of Being an Employee

First and foremost, as an employee, your employer is usually responsible for bringing in paying work for employees. That means that unless you’re in sales, you don’t have to do much marketing. If your employer is successful in these efforts, you can concentrate on your specific role and don’t have to take responsibility for other aspects of the business.

On the flip side, once your employer assigns work to you, it’s difficult to get out of doing it. Worse, if your employer can’t find enough paying work for you, you’ll quickly find that “job security” has become a myth for most employees.

That’s what caused my last employer to lay me off after less than two years.

Beyond that, Eric Maldonado, CFP®, MBA, Owner of Aquila Wealth Advisors, LLC, says, ”As an employee, all your taxes are automatically taken out for you by your employer’s payroll throughout the year. You will need to update withholding elections each year to try and get it close to what’s owed, but all the tax payments for federal, state, Social Security, Medicare, and state disability insurance are all automated by your employer. That simplifies things for you.”

However, he says, “You can’t deduct as many business-related expenses as a business owner, and you don’t have as much control over the deductions you can take.”

Pros and Cons of Being Self-Employed

Here, you have the benefit of being in control of everything about your business. If you don’t like a project, you don’t have to do it.

If you don’t like a client, you can fire them.

However, as a business owner, you’re responsible for all aspects of the business, including finding paying work. If you’re not successful at that, your business will fail before you can take advantage of all those nice tax breaks.

Regarding those tax breaks, Maldonado says, “Business owners can get a little more creative in finding business deductions. A business owner can take a home office deduction, a mileage deduction for business travel, and business-related meals.”

Grant Bledsoe, CFA, CFP®, Three Oaks Wealth adds, “Business owners can write off expenses, make contributions to a retirement plan, and accelerate business expenses and defer income into future years. Most of these avenues aren’t available to employees, though they can still make deductible contributions to retirement plans.”

As for drawbacks, Maldonado points out, “It takes more time and effort to manage your taxes. It’s all on your as the business owner to make sure you pay your taxes accurately and on time. You can, of course, hire a CPA or tax preparer, but it’s still your responsibility.”

Bledsoe mentions another drawback, “FICA taxes are your contribution to Medicare and Social Security. They total 7.65 percent of your wages. Employers pay payroll taxes of 7.65 percent on your wages too. Since the IRS considers business owners as both employee and employer, they have to pay 15.3 percent, which is not coincidentally the sum of an employee’s FICA taxes and an employer’s payroll taxes.”

Two Creative Solutions for Highly-Paid Employees

Beyond taking advantage of the few deductions the IRS does allow you as an employee (e.g., tax-advantaged retirement plans and health savings accounts if your health insurance plan is compatible), here are two more creative solutions.

First, start a side hustle related to your skill set and build it up over time.

Once it reliably and consistently replaces enough of your salary, you can quit your job so you can spend your full time growing your business. The sensitive thing here is to make sure you don’t run afoul of the terms of your employment contract and don’t get into conflicts of interest and/or commitment with your day job.

Second, start building a portfolio of rental properties.

As Maldonado says, “Acquiring rental real estate gives you the advantages a business owner gets tax-wise, while staying an employee.”

Doing well in this requires a lot of knowledge and experience, as well as time to build up enough capital to invest in properties. You can start by, e.g., buying a duplex or a quad, living in one part, and renting out the other(s).

You can also start leasing out your old houses each time you move to a new place.

The nice thing about real estate is that you can leverage your investment through mortgages, and you get to deduct depreciation against your income, even if the depreciation exceeds your rental income.

Should You Work for Yourself or Someone Else?

The tax code favors business owners over employees. This means that if you want to reduce your tax rate, you need to do something different or in addition. Like becoming self-employed and/or investing in real estate. Both solutions come with risks and aren’t a fit for everyone. However, if they are a fit for you, they can help you build significant wealth much faster than staying an employee.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor