Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Something interesting is happening in real estate.

And if you’re looking to buy a home, that “interesting” is in the sense of what people often refer to as an ancient Chinese curse, “May you live in interesting times.”

While the current market’s 6.48% rates aren’t especially high compared to the 7.75% average from 1970 to date, you’d have to go back over 20 years (to 2002) to find higher annual average rates.

That’s exceedingly bad news if you’re hoping to buy a home, for two reasons.

- First, the obvious one – with mortgage rates double what they were in 2021, payments are higher for the same loan amount (even if we ignore the big increase in home prices).

- Second, high rates are pushing supply down, propping up home prices. To see why, read on…

High Rates Are Far Worse When Coming on the Heels of Years of Ultra-Low Rates

Ordinarily, if mortgage rates are high but have been high for a while, you only feel the pain of the first of the above-mentioned problems.

However, coming off historically low rates as recent as 17 months ago, almost all existing mortgages are at much lower rates than what’s currently available for purchase or refinancing, many at rates that are half the currently available rates.

According to a recent Redfin study:

- Nearly 92% of outstanding residential mortgages have rates under 6%

- Over 82% are under 5% interest

- 62% are below 4%

- Nearly 24% are sub-3%.

This compares to an earlier Redfin study that showed 85% of mortgages below 5% interest. In the past 9 months or so, outstanding mortgages with rates over 5% went up from 15% to 18%.

What can we learn from these numbers?

- Only a small fraction of homeowners with mortgages can find a new mortgage at rates comparable to what they’re paying now.

- If we assume the 3% increase (from 15% to 18% of mortgages) at high rates reflects people who were forced to move in 9 months, the annual rate of such forced situations may be as low as 4% a year.

According to the US Census Bureau, as of 2021, there were about 143.8 million housing units (houses, apartments, etc., whether owned or rented) in the US. With an owner-occupied rate of 64.6%, this implies 92.9 million owner-occupied housing units. Four percent of that implies 3.7 million housing units likely to sell over a year.

According to the National Association of Realtors (NAR), in 2020, 5.64 million existing homes and 822,000 newly constructed homes were sold in the US, for a total of about 6.5 million homes.

According to Redfin, there are now about 40% fewer houses available for sale than there were before the pandemic, implying 3.9 million, in good agreement with my above estimate of 3.7 million.

That Redfin article says, “Redfin’s Homebuyer Demand Index–a measure of requests for tours and other services from Redfin agents–is up over the last two weeks and near its highest level in a year. That means there’s a fair amount of pent-up demand, and many buyers will be ready to pounce when more homes hit the market. Demand outpacing supply is preventing home prices from falling drastically: The median sale price is down just 1.1%, the smallest annual decline in three months.”

What Does All the Above Mean for Current Homeowners?

Assuming the median home price of $436,800 (per the St. Louis Fed) and the 14% median down payment (per Bankrate), we can estimate the typical new mortgage amount is around $375,600.

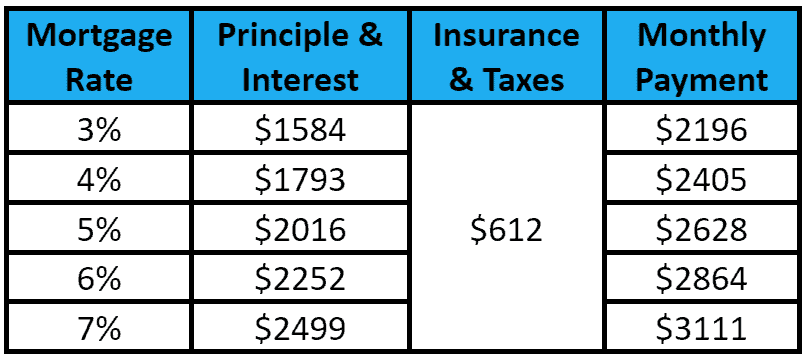

Here are the estimated monthly payments for such a mortgage at different interest rates. For insurance, we’ll scale from Bankrate’s estimate of $1428/year for a $250,000 home to $2495 for a median-priced home. For property tax, we’ll assume the national average of 1.11% (per the Motley Fool).

- If your current interest rate is 3% and you sell, moving to a similarly priced home, your monthly payments could jump by 36%, or nearly $800!

- Starting from a 4% loan, your increase would be a more moderate but still unacceptably high, at 24% or nearly $600 a month.

- In either case, upgrading to a larger, more expensive home would increase your housing costs even more.

This is why current homeowners are reluctant to sell until rates drop (or they’re forced to move by circumstances).

As Redfin reports, “Just over one-quarter (27%) of U.S. homeowners who are considering listing their home in the next year would feel more urgency to sell if rates dropped to 5% or below. That’s according to a Redfin survey conducted by Qualtrics in early June. Roughly half (49%) would feel more urgency if rates were to drop to 4% or below, and the share increases to 78% if they were to drop to 3% or below—a situation that is highly unlikely any time in the near future.”

Redfin also reports that nearly 60% of homeowners with mortgages bought their homes as recently as four years ago. Given the 13.2-year average period people stay in their homes (as of 2021), those who bought so recently are unlikely to want to move in the near future.

Why Downsizing Will Be Difficult for a Long Time

If you’re currently paying a mortgage and were planning to downsize as a way of taking advantage of the dramatic home price increases of recent years, you may need to think again.

Say you bought your home for $300k 10 years ago and refinanced to a $200k 3% loan in mid-2021 with a $843 monthly payment (principal and interest). Adding insurance and taxes, at a combined 1.61% of your home’s new $500k value per year), you’re paying about $1514 a month.

Your plan may have been to sell, pay off the mortgage, and use some or all of the remaining proceeds to buy a smaller home. You prefer to invest some of the money, because you’re nearing retirement, and your nest egg is nowhere near big enough for a comfortable retirement.

Here’s the problem…

If you sell, you’ll have about $450k after closing costs, and after paying off your $192k balance, you’ll have $258k. Let’s see what this lets you do if you want to buy a $350k home.

- If you apply the full $258k to the new home’s purchase, you’ll likely need a $95k mortgage (assuming $3k closing costs); at a rate of 6.5%, your monthly payment will be about $1070, saving you $444 a month, but doing nothing to increase your nest egg.

- If you apply half the $258k to the purchase, your loan amount would be about $224k, and at 6.5% your new payment would be $2016, or $502 a month higher than your current mortgage! And the extra $129k you can add to your investments? That will barely cover this extra cost (assuming you draw 5% a year).

- If you only put 20% ($70k) down, your loan balance will be $283k, which at 6.5% means your monthly payment will be a mind-boggling $2389, $875 higher than you’re paying now. The extra $188k you invest will only cover about $783 of that (again, assuming a 5% draw).

Clearly, downsizing to bolster your nest egg will be much harder in today’s environment than it was just a year and a half ago.

The Bottom Line

Given the tight supply and high mortgage rates, finding a home to buy that you can afford (both in terms of the down payment and the monthly mortgage payment) is hard.

Really hard.

And the problem is that, especially with the Fed’s recent messaging, interest rates aren’t likely to drop significantly for a long time.

This may well be a good time to consider renting instead. The long-term financial implications may favor that in most markets for quite a while.

If you already own a home, you’re almost certainly “handcuffed” by your relatively low existing payments and are probably hoping circumstances don’t force you to sell.

If you were thinking of downsizing to pull money out of your equity to increase your retirement nest egg, that’s unlikely to work well until mortgage rates drop down to 5%, or preferably 4%.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

What to Read Next:

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor