To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

A dynamic asset allocation investment strategy employed by financial advisors attempts to reduce risks by adjusting portfolio holdings based on timely factors.

When the stock market declines by 1%, 5%, or 20%, should you be concerned if your investment portfolio earmarked for your retirement falls by an equal amount?

The answer will depend upon your investment objectives and tolerance for risk. Unfortunately, for many people who thought their portfolios were diversified and protected from suffering declines just as severe as major stock market pullbacks, the 2008 Financial Crisis and the 2020 COVID Crash proved otherwise.

While no investment strategy with exposure to asset classes like stocks and bonds is immune to losses when prices fall, a dynamic asset allocation approach attempts to reduce the severity of declines in investment portfolios when markets pull back while still achieving the long-term performance returns needed to meet investment objectives.

Suffice it to say that constructing and monitoring dynamic asset allocation portfolios requires considerable education, confidence, and fortitude. If you’re interested in the potential benefits of investing with a dynamic asset allocation approach, you may want to hire a financial advisor who specializes in this area.

You’ll likely find dozens of nearby financial advisors well-suited to help you reach your money goals with a personalized plan. But it may be more difficult to find a financial advisor who specializes in building and managing dynamic asset allocation portfolios for their clients.

Fortunately, many financial advisors offer virtual services so you can meet online no matter where you (or they) live. This means you can choose to hire a specialist financial advisor who lives hundreds of miles away if you decide their knowledge and experience managing portfolios using a dynamic asset allocation approach is a better fit to help with your unique financial planning needs.

Financial Advisors Who Specialize in Dynamic Asset Allocation

💡 In the Q&A below, you’ll gain insights from financial advisors who specialize in building portfolios using dynamic asset allocation to help their clients achieve their investment goals with the potential for reduced losses when markets decline.

🙋♀️ Do you have questions not answered below? Use the form on this page to submit your questions, and we’ll update this article with answers from the financial professionals and educators in the Wealthtender community. You can also contact the financial advisors featured in this article directly to set up an introductory call or ask your questions by email.

📊 Get to Know Financial Advisors Who Specialize in Dynamic Asset Allocation

This page is organized into sections to help you quickly find the information you need and get answers to your questions:

- Q&A with Financial Advisors Specializing in Dynamic Asset Allocation

- Get Answers to Your Questions About Dynamic Asset Allocation

- Browse Related Articles

Q&A: Financial Advisors Specializing in Dynamic Asset Allocation

Answers to Investing Questions with Zack Swad, CFP®, CWS®, BFA™, AWMA®, AAMS®

We asked Santa Rosa, California-based financial advisor Zack Swad who specializes in managing dynamic asset allocation portfolios for his clients, to help us learn more about the potential benefits of this approach to portfolio construction.

Q: When meeting with new clients, how do you describe what dynamic asset allocation is?

Zack: A dynamic asset allocation is an alternative to a strategic allocation, which is typically based on “Modern Portfolio Theory” (MPT). Unlike a strategic allocation, which has a mostly-fixed percentage in each asset class (stocks, bonds, etc.), a dynamic allocation considers certain factors to determine which investments make the most sense at a given time.

Pretend you (and your investment portfolio) are in an airplane, and you have a pilot (the portfolio manager) flying the plane. The pilot can see through the windshield, and he also has an indicator dashboard. The indicator dashboard begins to blink and sends a signal to the pilot, informing him that if he keeps flying in the same direction and at the same speed, he will run into a storm in twenty minutes. What does the pilot do? Of course, he will try to avoid the storm. He will change course, or he may need to slow down or lower the plane.

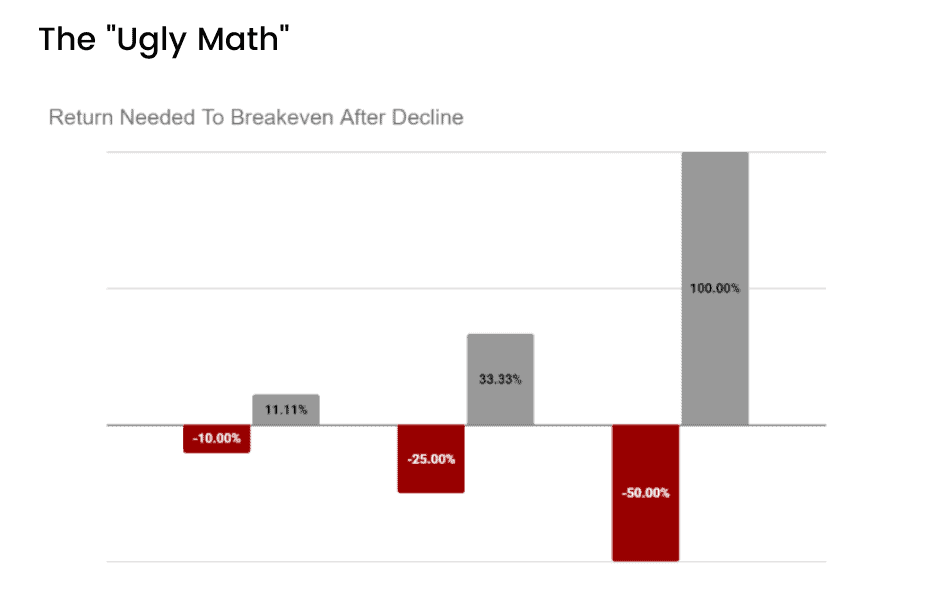

A dynamic asset allocation works similarly. It attempts to avoid catastrophic losses by actively managing the risk in a portfolio. At the same time, because a dynamic allocation typically does a better job of avoiding large losses, it doesn’t need to return as much when the markets are up. As you can see in the “Ugly Math” chart below, the less a portfolio declines, the less return it needs to get back to even and start making new profits.

For example, if you have $1,000,000 and lost 10%, you would have $900,000. To get back to even, you would need to make $100,000 or an 11% return. On the other hand, if you have $1,000,000 and experience a 50% loss (similar to what was seen for “buy-and-hold” stock investors during the 2008 financial crisis), you would then have $500,000. To get back to even, you would need to make $500,000 or double your investment (i.e., 100% return), which can take many years and is tough to bear psychologically.

Different managers use different factors and indicators to determine how to make allocation changes, so it’s important to learn more about their specific processes. You can read more about our process in the “What is an adaptive asset allocation” part of our FAQs section on our website. I’m also happy to provide research papers that I’ve used to inform our investment philosophy and process. Simply email info@swadwealth.com for more information.

Q: How did you first learn about dynamic asset allocation, and what led you to specialize in managing dynamic asset allocation portfolios for your clients?

Zack: I first learned about dynamic asset allocation while I worked as an advisor at Charles Schwab. Charles Schwab had a strategy called “Windhaven” that utilized this approach. Also, one of their partner RIA firms that I worked with had been successful for decades by using an active risk management approach. This inspired me to do more research on the topic, so I began reading countless books and research papers. I found that there were certain factors and indicators that have worked consistently throughout history, providing superior returns with less risk.

Furthermore, as someone who specializes in retirement planning, many of my clients cannot afford a major loss in their portfolio, which could significantly delay their retirement or force them back to work if they are already retired. I believe a dynamic allocation approach does a better job of mitigating that risk for them compared to a strategic allocation.

Get to Know Zack Swad, Financial Advisor and Dynamic Asset Allocation Specialist:

View Zack’s profile page on Wealthtender or visit his website to learn more.

Q: Are there particular market environments where you feel dynamic asset allocation is especially valuable to investors?

Zack: I believe a dynamic allocation is best in any market environment; however, it is especially valuable when interest rates or inflation are rising. Traditional portfolios typically have a fixed percentage of their assets in bonds. Unfortunately, bond performance can be hampered by rising rates and inflation. A dynamic allocation allows an investor to move into areas that may be better suited for the current environment instead of holding all asset classes at all times.

Investors need to be careful when considering making a change to a dynamic allocation during bear markets. It’s important to talk to a financial advisor to see if it is “too late” to reduce the risk in your portfolio and determine if there are any tax considerations.

Q: How does the cost of a dynamic asset allocation portfolio compare with a strategic asset allocation?

Zack: Commissions can be higher with a dynamic asset allocation because there is the potential for more trading. Also, because a dynamic asset allocation requires more research and attention, some advisors may charge more for this investment approach. Lastly, because there is more trading or “turnover,” the strategy can incur more taxes if held in a taxable account. With that being said, based on research, I believe the tax drag of our strategies is outweighed by the risk management and return potential.

Q: How do you work with clients to determine whether their investments will be managed with a dynamic or strategic asset allocation?

Zack: When I first started in the industry over 11 years ago, I believed there was only one way to do things. However, after working with hundreds of real people, I found it wasn’t that simple. People are complex, and companies like Dalbar have proven over and over again that investing and savings behavior is the number one factor on an investor’s portfolio return.

Because of this, I educate and ask my clients questions to help determine their investment philosophy. Then, I will align their portfolio to that philosophy, which I believe will give them the best chance of success. The key to investing is sticking with a well-thought-out strategy, one that you will stick with in good times and bad times. Where most people go wrong is they want to change their strategy or allocation style at the wrong time.

Q: For people interested in learning more about dynamic or adaptive asset allocation, are there online resources you recommend people consider?

Zack: For those interested in learning more about dynamic, tactical, and adaptive asset allocation styles, I recommend checking out the extensive work, research, and white papers produced by Mebane Faber. Meb is the co-founder and Chief Investment Officer of Cambria Investment Management and the author of multiple books on investing.

I would also look into the work done by Gary Antonnaci and his book “Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk.” Gary has over 40 years of experience as an investment professional, received his MBA from Harvard, and his research on momentum investing was the first place winner in 2013 and the second place winner in 2012 of the Founders Award for Advances in Active Investment Management given annually by the National Association of Active Investment Managers (NAAIM).

Are you a financial advisor who specializes in dynamic asset allocation?

✅ Join Wealthtender and get featured as a specialist financial advisor based on your knowledge and experience. (Subject to availability and terms.)

✅ Sign up today and join financial advisors attracting their ideal clients on Wealthtender

✅ Or request more information by email:

Resources to Help You Choose a Financial Advisor

✅ Top Questions to Ask a Financial Advisor

✅ How Much Does a Financial Advisor Cost?

🙋♀️ Have Questions About Dynamic Asset Allocation?

📰 Browse Related Articles

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

About the Author

Brian Thorp

Founder and CEO, Wealthtender

Brian and his wife live in Texas, enjoying the diversity of Houston and the vibrancy of Austin.

With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor