To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

An investment portfolio should be built based on a client’s risk and return objectives along with an assessment of their constraints. While downside protection is a common focus, the advisor must ensure that a portfolio’s probabilistic return outcomes are sufficient to meet the spending power needs of the client based on their time horizon.

Analysis of a client’s tax situation, liquidity needs, legal circumstances, and any unique risks should be outlined in an investment policy statement (IPS).

Going about the process of building a portfolio is straightforward once the advisor and client agree to an IPS. There are several other techniques an advisor may use to help lay the framework for a portfolio. Still, all the tools and rules of thumb pale in comparison to simply understanding the client and sticking with evidence-based portfolio construction and management strategies.

Definition of Portfolio Construction

Portfolio construction is the process of understanding how different asset classes, funds, and weightings impact each other, their performance and risk and how decisions ladder up to an investor’s objectives. It is the undertaking of crafting an investment portfolio suited to a client’s risk and return objectives and constraints.

The process begins with portfolio planning. According to the CFA Institute, portfolio planning is a program developed in advance of constructing a portfolio that is expected to define the client’s investment objectives. An IPS is often used so that the advisor and client both understand how a portfolio is built to achieve goals.

Once the IPS is established, the portfolio is constructed. Advisors and investment managers often use strategic asset allocation—a process whereby a portfolio is weighted by specific percentages to certain areas. A focus on achieving diversification at a reasonable cost is important to managing risk while maximizing returns based on a client’s objectives and constraints.

Portfolio Construction Process

Today’s world of low-cost index funds and commission-free trading makes crafting and managing an investment portfolio somewhat simple. The challenging part of the process is understanding what kind of strategic asset allocation is in the client’s best interest.

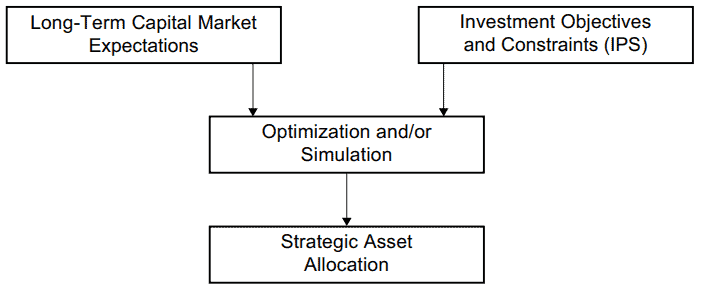

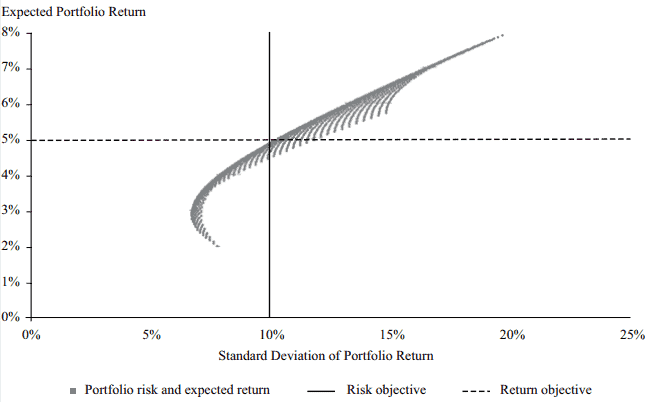

A strategic asset allocation might first start with establishing capital market expectations—the forecasted risk and return prospects of various asset classes and their correlations. Leveraging computer software helps plot hypothetical portfolios on an efficient frontier curve so that return is maximized with an eye on risk. Investment managers might know it as the minimum-variance portfolio.

Strategic Asset Allocation Process

Moreover, deciding on shorter-term tactical asset allocation decisions must be described in the IPS. Registered Investment Advisors usually have access to model portfolios using a set of mutual funds or exchange-traded funds (ETFs). Those models are effectively used as a starting point to then tailor investment plans for each client.

Constructing a portfolio is done with just a few low-cost and diversified index funds for clients with simple situations. Individuals and families—often of the high-net-worth variety—commonly require more sophisticated management. Foreign currency hedging, managing a concentrated position, asset-liability matching, and so-called “overlay” portfolios of derivatives add to the complexity.

Asset Allocation & Risk Budgeting

A strategic asset allocation itself is not a real-world portfolio. The investment manager must go about risk budgeting and security selection to form it. Risk budgeting is simply the amount of risk to assume and subdividing it across a portfolio’s assets. Focusing on what could go wrong in a portfolio under extreme market conditions helps both the advisor and client grasp maximum risk. Behaviorally, a portfolio that is ideal on a spreadsheet might not work in practice if the client cannot endure inevitable bouts of market volatility.

With risk top of mind, asset allocation is done by selecting securities and weighting them to form a portfolio. An active investment manager might overweight a particular stock or fund in their portfolio to beat a benchmark to earn outsized returns for the client.

Of course, active security selection with more frequent trading can run up transaction costs and taxes. Today’s fast-moving markets and general level of efficiency make beating the market difficult. The latest S&P SPIVA Scorecard indeed shows most active mutual fund managers fail to outperform. For that reason, many advisors take a passive asset allocation approach.

Finally, after constructing a portfolio, it must be maintained. Tactics such as rebalancing should be done alongside periodic reviews of the client’s risk and return objectives and constraints. Investment management is an ongoing process, not a one-time event.

The Takeaway

Portfolio construction is easier than ever with today’s landscape of low-cost funds and technology. The challenge is sifting through so many options and possible portfolio tilts. Focusing on a client’s situation first, then outlining a proper investment approach in an IPS helps the advisor and client create and stick to a long-term plan.

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

About the Author

Mike Zaccardi, CFA®

Mike is a freelance writer for financial advisors and investment firms. He’s a CFA® charterholder and Chartered Market Technician®, and has passed the coursework for the Certified Financial Planner program.

Learn More About MikeTo make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor