To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Are you a Prisma Health resident or fellow? You may have heard about the Guaranteed Standard Issue (GSI) program offered by Guardian Life to Prisma Health residents and fellows. This program can be complicated to navigate on your own.

Fortunately, Michael Acosta, financial advisor with The Dumas Team of Consolidated Planning, has considerable experience helping residents and fellows learn the potential benefits of the GSI program.

In the Q&A below, you’ll gain insights from Michael to better understand if the GSI program may be a good fit for you.

🙋♀️ Do you have questions not yet answered? Use the form below to submit questions anonymously and watch this article for updates with answers to your questions. You can also reach out to Michael below to set up an introductory call or contact him with your questions by email.

💸 Smart Money Insights for Prisma Health Residents and Fellows

This page is organized into sections to help you quickly find the information you need and get answers to your questions:

- Q&A: Understanding Prisma Health’s GSI Program for Residents and Fellows

- Get Answers to Your Questions About the GSI Program

- Browse Related Articles

Q&A: Understanding Prisma Health’s Guaranteed Standard Issue (GSI) Program

Answers to Employee Questions with Michael R. Acosta, CFP®, ChFC®, CSLP®

Michael R. Acosta is a financial advisor located out of Charlotte, NC, and specializes in offering subscription-based financial planning services to residents and fellows of Prisma Health Hospital System in both Columbia and Greenville, South Carolina.

Michael and his team assist their clients within Prisma to optimize their personal long-term disability income protection coverage by educating them on a specialized program known as the Guaranteed Standard Issue (GSI) disability program with Guardian Life. Keep in mind there are only a handful of residency programs within the entire nation that offer a GSI program, so Prisma’s offering is very unique.

Q: When speaking with the residents and fellows of Prisma Health, what are some of the major highlights you provide regarding their personal long-term disability options?

Michael: As a resident or fellow, you’re being called on frequently by insurance agents soliciting long-term disability coverage. More often than not, medical professionals are not well-versed in the ins and outs of disability insurance. This is where we add tremendous value by being both process driven and agnostic.

The first notable factor of the Guaranteed Standard Issue (GSI) program with Guardian Life is that there is ZERO medical or financial underwriting required for the eligible residents and fellows. This is huge because should these same individuals try to apply with another carrier outside of this program, they’ll likely be required to complete full-medical underwriting, which could lead to a policy with exclusions. With the GSI program, the applicant simply needs to answer the following two questions:

- “Are you currently disabled?”, if “No” you’re halfway to qualifying for the GSI program coverage.

- “Have you applied for coverage with another carrier other than Guardian/Berkshire?” If Yes, “Did you receive a clean offer with zero exclusions?”. If yes, you’re good to go. If you did receive a non-clean offer from another carrier, you’re no longer eligible for the GSI program.

Disclosure: Any resident or fellow previously turned down or provided with a modified offer by other disability insurance carriers (not including Berkshire Life) is not eligible for this program. Therefore, you are encouraged to look into this program as soon as possible.

From a benefit of coverage standpoint, the program offers a total combined benefit of $10,000 for the first year through the final year. This $10,000 monthly benefit is broken up between the base benefit and the future increase option (FIO). There are certain caps on how much base benefits an individual is eligible for based on their year of residency or fellowship.

The contract offers a total disability definition True-Own Occupation with Specialty Language. This is huge, being that if the insured were to become too sick or injured to perform the material and substantial duties of their occupation, they would be considered totally disabled, even if they were earning income in another occupation. If the insured is an MD or DO and more than 50% of their income is from performing surgical procedures and hands-on patient care, then they’ll be considered totally disabled.

There are other benefits and features that can be included in this coverage, such as:

- Benefit payable to age 65 or age 67

- 90-day elimination period

- An Enhanced Partial Disability Benefit

- Future Increase Option

- Student Loan Repayment Feature

- Supplemental Income Feature

- Graded or Level-Fixed Premium Structure

- Potential for additional discounts based on mental/substance-related disorder limitations, being a student and resident, and/or being with a preferred occupation

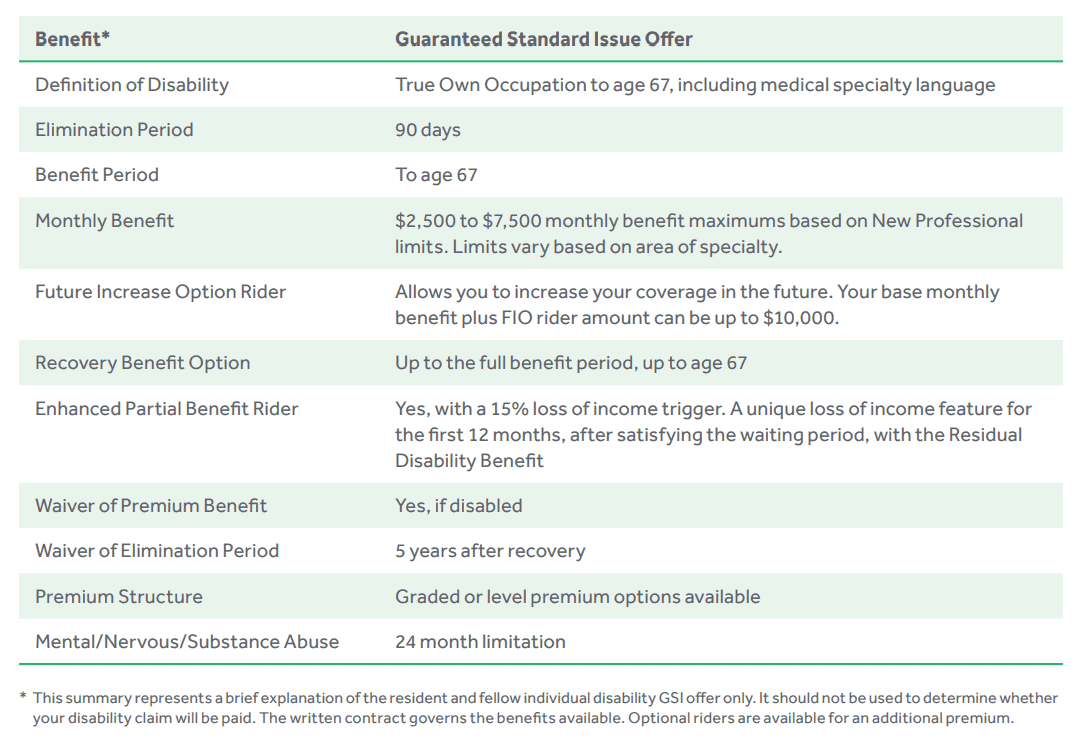

For an additional description of benefits, please view this table:

Keep in mind that these specific options are only available through the Prisma GSI program that we facilitate. The residents have the option of obtaining personal coverage elsewhere, but they’d be forgoing some meaningful benefits.

Q: For Prisma Health residents and fellows, when would it make the most sense for them to consider looking into the GSI program for disability coverage?

Michael: Within this program, disability coverage can be obtained as early as PGY1 and all the way through their final year of training. Usually, cost is one of the major concerns being that the medical residents are making the lowest level of income they’ll likely ever make within their career and being overworked.

From a pricing perspective, the cost of insurance tends to be less expensive when we are younger. We focus on providing education on what their options look like for obtaining coverage. You have to understand that these medical professionals have the highest level of risk exposure, being that they tend to have a large sum of student debt and are earning well below what they will be making once they’re in an attending position. If something were to happen to them while in residency, their financial future could be derailed.

By walking them through their options, we’re able to get creative with how we design the coverage so that they can obtain as much income protection as early on as possible without blowing up their monthly budget.

➡️ To get a disability insurance quote, visit this page.

Get to Know Michael R. Acosta, Financial Advisor for Prisma Health Residents and Fellows:

View Michael’’s profile page on Wealthtender or visit his website to learn more.

Q: What should the residents and fellows of Prisma Health consider as they transition from residency to practice?

Michael: The soon-to-be attending physicians should focus on trying to accumulate as much tax-free, clean, true-own occupation disability coverage as possible in order to optimally protect their income earning potential long-term.

Too often, we have physicians reach out to us wanting to obtain personal disability coverage while or after they’ve experienced a medical concern. By that point, it’s often too late, and there isn’t much that we can do for them. These residents and fellows need to understand that their greatest and biggest asset is their ability to earn income. If they were to lose that ability, the life they thought they would produce would no longer be a consideration.

Also, by working with a financial planner that understands the struggles of living a balanced lifestyle while in residency and specializes in student loan planning, they can begin implementing disciplined habits to put them on a path toward financial success.

Important Disclosures:

Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS). Securities products and advisory services offered through PAS, member FINRA, SIPC. Financial Representative of The Guardian Life Insurance Company of America® (Guardian), New York, NY. PAS is a wholly owned subsidiary of Guardian. Consolidated Planning, Inc. is not an affiliate or subsidiary of PAS or Guardian. CA Insurance License # 0M50974. 2022-145315 Exp. 10/24

Individual disability income products underwritten and issued by Berkshire Life Insurance Company of America (BLICOA), Pittsfield, MA or provided by Guardian. BLICOA is a wholly owned stock subsidiary of and administrator for The Guardian Life Insurance Company of America (Guardian), New York, NY. Product provisions and availability may vary by state.

This summary presents a brief explanation of the resident and fellow individual disability Special Guaranteed Standard Issue offer only. It should not be used to determine whether your disability claim will be paid. The written contract governs the benefits available. Product availability, provisions, and features may vary from state to state. Optional riders are available for an additional premium. Individual disability income products underwritten and issued by Berkshire Life Insurance Company of America (BLICOA), Pittsfield, MA or provided by Guardian. BLICOA is a wholly owned stock subsidiary of and administrator for The Guardian Life Insurance Company of America (Guardian), New York, NY. Product provisions and availability may vary by state. This publication is provided for informational purposes only and should not be considered tax or legal advice. Your client should contact their tax or legal advisor regarding the tax treatment of the policy and policy benefits. Your client should consult with their own independent tax and legal advisors regarding their particular set of facts and circumstances. The information provided is not intended or written to be used, and cannot be relied upon, to avoid penalties imposed under the Internal Revenue Code or state and local tax law provisions. © Berkshire Life Insurance Company of America 2019 Guardian® is a registered trademark of The Guardian Life Insurance Company of America.

🙋♀️ Have Questions About the GSI Program?

📰 Browse Related Articles

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

About the Author

Brian Thorp

Founder and CEO, Wealthtender

Brian and his wife live in Texas, enjoying the diversity of Houston and the vibrancy of Austin.

With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor