Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The Pass Through Entity Tax Election or “PTET” Election is a new tax election available to Georgia business owners. Beginning in 2022, Georgia business owners can take advantage of this election to increase the tax deductions available to them on their income taxes. On this blog, we’re going to review how much in taxes the Georgia PTET Election can save you, what you need to consider before pursuing it, and the steps you need to take to make the election.

Key Takeaways

- How the Georgia PTET Works

- Major items to consider before electing

- How you make the PTET election

Prefer to watch our video breakdown instead?

How the PTET Election Works for Georgia Business Owners

When the Tax Cuts & Jobs Act of 2017 (TCJA) was passed, it generally lowered tax rates. However, it also increased taxes for a certain segment of the population by limiting the State and Local Tax Deduction (SALT) to $10,000 per year. For Business Owners in high-tax jurisdictions like California or New York, this can have an extremely negative impact on their overall tax picture. However, it can also impact business owners in more moderate, income tax states like Georgia. Most states have realized the impact and PTET Elections were the answer. The Georgia PTET election is one example of these laws designed to increase business owners’ SALT Deduction.

The Georgia PTET Election allows a Georgia business owner to elect to be taxed at the entity level. This means that the state income taxes are assessed at the business level and then do not flow through to your federal income tax return. The TCJA limited individuals’ SALT deductions, but the PTET allows a Georgia business owner to make the election as an entity. At its core, this allows a Georgia business owner to deduct their entire state income tax liability if the proper steps are followed.

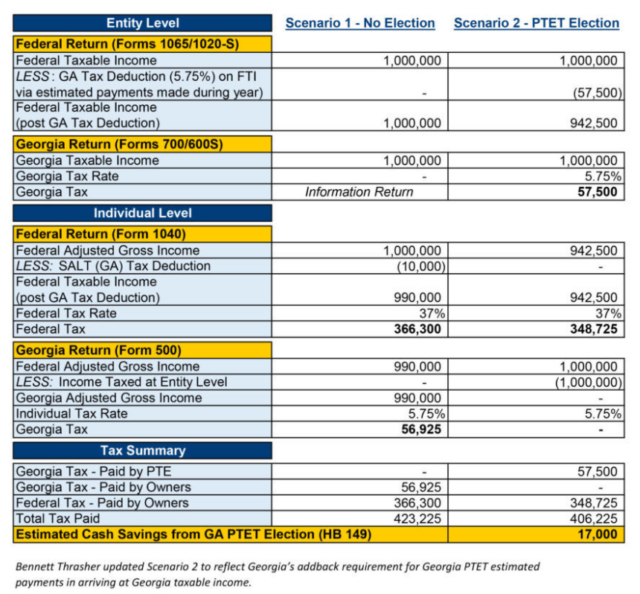

Is it worth it? The following table shows the tax liability of a business owner with and without the Georgia PTET Election.

As you can see, the net impact of a Georgia business owner making $1,000,000 and utilizing the PTET election is $17,000 in the example above.

These numbers will scale up and down based on your total income, but the outcome is clear. If you can make the PTET Election as a Georgia business owner, it may be worth it.

Is the Georgia PTET Election Right for Me?

There are several considerations that Georgia based business owners should consider before pursuing the PTET Election.

In this article we will review 4 main considerations:

- How your business is incorporated & who owns it

- Where your income comes from

- When you pay your taxes

- How you pay your taxes

What type of business do I need to be to qualify for the Georgia PTET Election?

To qualify for the PTET Election you must be a Pass-Through Entity. These entities are typically defined as entities where your income and taxes flow through to your individual returns. Typically, this refers to Sole Proprietorships, all LLCs, and S-Corps. However, you cannot make this election if you are a single member LLC or sole proprietorship. This is because you do not have an entity tax form where the tax can be assessed. All of your income flows through to your individual return where it is subject to the $10,000 limitation.

Finally, for business owners to qualify for the Georgia PTET Election, the firm must be owned by individuals and cannot be owned by corporations.

To summarize, you must be an LLC taxed as a partnership or an S-Corp and your shareholders must be individuals.

What if I have multi-state income for the Georgia PTET Election?

If your income comes all from one state, whether that is Georgia or another state like California, a PTET election will most likely not add a great administrative burden to your daily life. In those cases, you only need to worry about one state’s law, review it and comply with them.

However, if you have multi-state income, the complexity level of making a PTET election increases. If you do, you will need to not only consider the Georgia state election, but your other state’s election, and then how they will interact!

This doesn’t mean you can’t pursue making the election, but it does mean that you should review each state and how they interact before filing, increasing compliance costs.

When do you pay your taxes to qualify for the Georgia PTET Election?

Right now, a business owner in Georgia probably pays quarterly estimated taxes. Under the quarterly estimated tax method, your Q4 taxes are due January 15th. However, to maximize the effect of a potential PTET election, you should pay your taxes before the end of the year. Tax payments received after the end of the year may not be deducted on your federal return, minimizing the impact.

To summarize, paying these taxes during the calendar year is best if you make the Georgia PTET Election.

How do you pay your taxes when electing the Georgia state PTET Election?

As we discussed earlier, a business owner in Georgia is most likely making quarterly estimated payments. However, until now they have been incurring and paying these taxes on their individual return.

To have these taxes assessed at the entity level, you must also pay these taxes at the entity level. This means setting up a corporate tax account and making the payments from your business account. Making payments from your withholding or personal accounts will not qualify for the Georgia state PTET election.

In Georgia, this means that business owners should go to the Georgia Department of Revenue and create a business account to make their payments.

Finally, you should also make the payments according to the schedule of payments to be made by C-Corporations in the state of Georgia.

How Do You Make the PTET Election as a Georgia State Business Owner?

At the end of the day, it doesn’t matter if you do all of the prior steps and then the proper elections and forms are not filed at the end of the year. In order to take advantage of the PTET election, a Georgia business owner must follow specific steps come tax time.

The Georgia PTET election is an annual election. You must make the election each year that you want to use it. However, you do not have to declare this ahead of time. You only need to make this election when you file your taxes. You must also make this election annually. The election will not carry over year after year. Finally, you must also make sure that your state income is reported properly as there will need to be adjustments made based on your entity payments.

If you think the Georgia state PTET Election is right for you, there are several things that you need to do–

- You should consult your own tax advisor before making any plans to determine if this is right for you.

- You need to make any state tax payments through your business.

- You need to make these payments before the end of the calendar year.

- You need to make your annual elections.

I hope that this guide helped you as you consider pursuing the Georgia state PTET election. The Georgia Department of Revenue has a helpful FAQ Guide if you are interested in reading more.

A proactive tax plan is vital part of any financial plan. However, too often small business owners are left scrambling to try and plan for their taxes at the end of the year. Ironclad Wealth Management is a financial planning firm dedicated to helping Georgia business owners save money on their taxes to help them pursue their goals. If you have any questions, we offer a free strategy session to determine if we would be a good fit.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Patrick G. Moore, CFP®, EA | Ironclad Wealth Management

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor