Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Buying an annuity during a period of high interest rates means you could receive larger payouts and greater guaranteed income in retirement.

Annuities. If they scare you, you’re not alone. I recently wrote about annuities and how they can be a shrewd opportunity or a major financial mistake. However, in the right situation, the right annuity can be very helpful.

You’re Already Paying for an Annuity (of Sorts) Every Month

If you think you’ve never paid for an annuity, you might be surprised…

If you’re an American worker, each paycheck shows deductions for payroll taxes, which help provide your eventual Social Security and Medicare benefits. Social Security retirement benefits are, in many ways, a sort of annuity. However, better than commercial annuities, Social Security benefits get adjusted to account for inflation. Also, those benefits depend on your inflation-adjusted earnings history. They don’t depend on current bond rates. That makes Social Security retirement benefits stand out relative to regular annuities.

Annuity Payouts Offered Today Are Significantly Higher

Historically high inflation pushed the Fed into making a series of interest-rate increases not seen in four decades. That, in turn, pushed bond rates higher. These higher bond rates prodded insurance companies that sell annuities to raise their monthly benefits.

Significantly.

But are we at the peak?

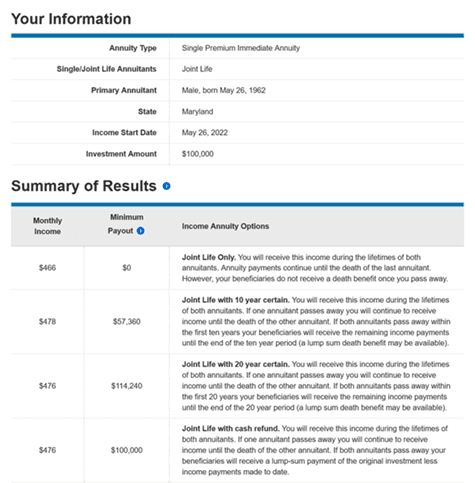

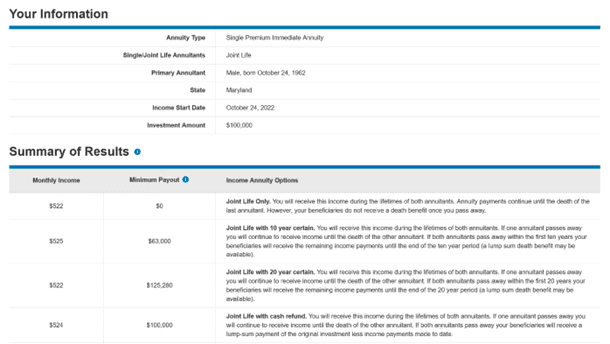

Below, we see screenshots showing estimated fixed annuity payments for three scenarios. We compare two scenarios, October 24, 2022, to five months prior May 26, 2022. For all three, I used a Charles Schwab annuity calculator for $100,000 single-premium annuities for a 60-year-old Maryland couple.

Scenario 1: Immediate Annuity

In May 2022, we saw the following.

Now, with higher rates in the market, we see new monthly income numbers.

Looking at the highest minimum payout option, “Joint Life with 20 year certain,” we see monthly payments increased from $476 to $522. That’s nearly a 10 percent increase. The “Joint Life Only” payments increased by 12 percent.

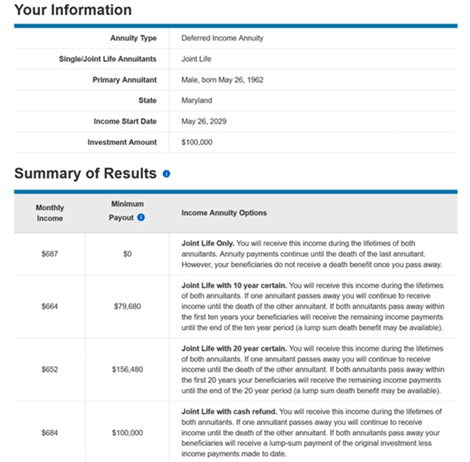

Scenario 2: 7-Year-Deferred Annuity

For this scenario, our hypothetical 60-year-old couple pays $100,000 now and defers payments until they reach age 67 in 2029.

Five months ago, such a couple could expect the following payments.

Today, those payments would also be higher.

Looking again at the highest minimum payout option, “Joint Life with 20 year certain,” we see monthly payments increased from $652 to $762. That’s nearly a 17 percent increase. The “Joint Life Only” payments increased by 13 percent.

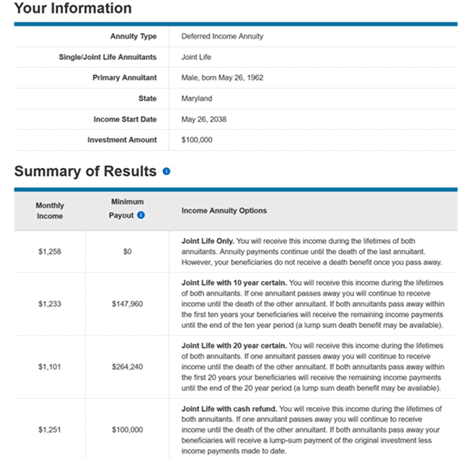

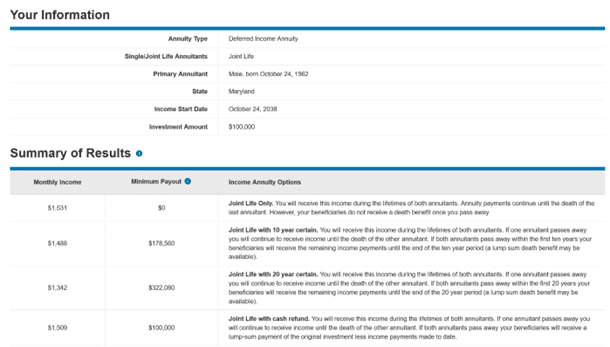

Scenario 3: 26-Year-Deferred Annuity

For this scenario, too, our hypothetical 60-year-old couple pays $100,000 now, but here they defer payments until they reach age 86 in 2038. Five months ago, they’d have expected the following payments.

Now, the payments have gone up a lot.

With so many years for the issuer to benefit from investment returns, the monthly payments for “Joint Life with 20 year certain” increased from $1101 to $1342, nearly 22 percent higher! The “Joint Life Only” payments also increased by nearly 22 percent.

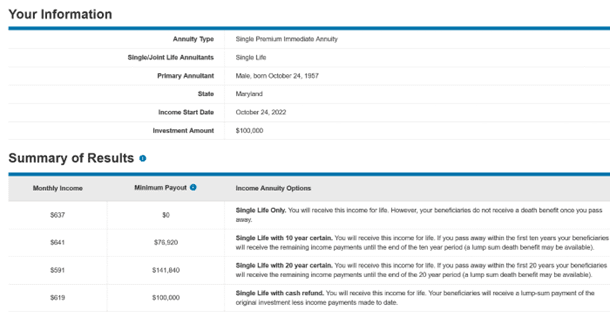

How Do Today’s Estimated Rates Compare Historically?

According to ImmediateAnnuities.com, rates now are the highest they’ve been in over a decade. A 65-year-old man could get about $570 a month for a “single life with 10 years certain.”

That’s 27 percent higher than the $450 they show for early 2021, though still 16 percent lower than the $675 peak seen in late 2008.

However, as shown below, Schwab estimates a 65-year-old man could get as much as $641 from a “single life with 10 years certain” annuity, just 5 percent lower than the ImmediateAnnuities.com 2008 peak.

What Does Inflation Look Like Now, and What Does It Imply for Annuities?

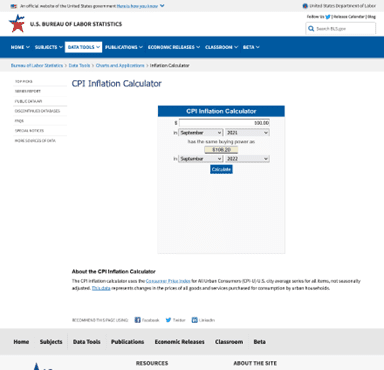

Using the Bureau of Labor Statistics (BLS) inflation calculator, we see the most recent year-over-year seasonally unadjusted “Consumer Price Index for All Urban Consumers” (CPI-U) increased by 8.2 percent.

That’s still in 40-year-peak territory.

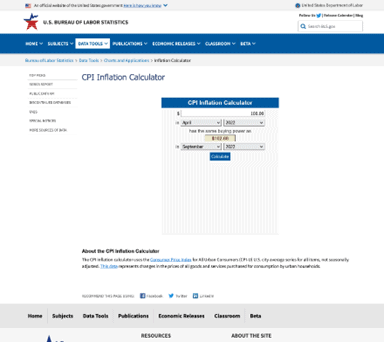

Over the past five months, however, the CPI-U increased by just 2.66 percent.

Annualizing that, we’d get 6.5 percent.

Even more interesting is how inflation behaved in the last three months. From June to September 2022, the CPI-U increased a barely noticeable 0.17 percent.

Annualized, it would be just 0.68 percent.

That’s right. If inflation continues for another nine months at its recent three-month average rate, the June 2023 CPI-U would be less than one percent higher than in June 2022!

Since payments offered by new fixed annuities track bond rates and bond rates track interest rates and inflation expectations, lower inflation could quickly lower payments promised by new fixed annuities.

The Bottom Line — Have Fixed Annuity Payment Offerings Peaked?

Honestly, it’s impossible to know.

Quite possibly not, but they may be getting close to their peak.

And, they’re high enough that if you’ve been thinking about buying an annuity, now seems like a good time to start your due diligence with a view to buying soon.

Just make sure to talk with a professional who doesn’t raise any red flags.

Given the recent lull in the CPI-U’s race up and the mounting concern that continuing to raise rates aggressively could slide the economy into a deep recession, the Fed may, sooner than expected, moderate the pace of rate increases, stop raising rates completely, or even reverse course.

Once that happens, expect annuities to become less generous. By that point, you might have missed the opportunity before even realizing it was there.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor