Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Would you like to increase your odds of enjoying a comfortable retirement? If you already set aside money from every paycheck for long-term savings, you’re off to a good start. But to really turn the money you save into a sizable nest egg, you need to invest wisely.

In this article, we’ll show you 5 simple steps to create a personalized investing plan that can generate the savings you need to enjoy your golden years.

Why You Should Begin Investing for Your Retirement Today

If you’re ever planning to retire, annuity.org has some sobering, not to say frightening, statistics. Here are the top 10:

- The expected amount needed for a comfortable retirement was $1.04 million (as of 2021)

- 15% of Americans have $0 saved for retirement

- 22% have under $5000 saved for retirement

- Just 25% of American workers ever used a retirement calculator to see how much they’re likely to need; 43% just guess (the rest estimate based on current spending)

- 48% of workers think their income doesn’t let them save enough for retirement

- The median household retirement savings level is $93,000

- 43% of millennials fear being unable to cover their family’s basic needs in retirement; 70% are stressed and anxious about retirement finances

- Social Security retirement benefits were about $18,500/year as of 2020 (US News & World Report says that increased to $19,884/year in January 2022)

- Over 19% of workers expect to continue working in retirement because their retirement savings aren’t enough; 14% plan on working as their primary “retirement” income source

- On average, retirees spend 80% of their pre-retirement spending ($49,780/year vs. $61,960/year)

Concerned yet?

If you’re not saving for retirement, or even if you’ve started but haven’t made a plan yet, remember the famous saying, “Failing to plan is planning to fail.”

How Much Money Will You Need to Retire?

Giving an accurate answer to this is impossible, even knowing every detail of your current personal finances.

The good news is that you don’t need accuracy. You need a plausible estimate.

Here’s one simple formula described in more detail elsewhere:

P ≥ (B – F)/R where:

- P is the portfolio size you need (that’s what we’re solving for)

- B is your estimated retirement budget (if you haven’t used a retirement calculator, do that, or you can use the 80% of current spending estimate)

- F is your fixed income in retirement (think Social Security benefits, defined benefit pension, annuities, rental income, etc.)

- R is your expected investment inflation-adjusted return during retirement (this depends on many things, but for estimation many experts suggest using 4% for a 50/50 stock/bond portfolio, and some suggest dropping that to 3.5% or even 4%)

For example, say your current spending is $80,000/year so you expect to spend $64,000 in retirement (80% of $80,000), you expect $20,000 from Social Security and no other fixed income in retirement, and you’re comfortable using the somewhat aggressive 4% assumed return. Here’s your calculation:

P ≥ (64,000 – $20,000)/0.04 = $1.1 million

Seems a bit frightening, doesn’t it? How do you get to over a million dollars?

Five Simple Investing Steps to Save For Your Retirement

Here are five simple steps to help you get started investing with a plan to achieve the savings you need to retire comfortably.

Step 1: If you haven’t already, start now!

The first and most important is to start as soon as possible, if not earlier! Starting 10 years later can double the amount you need to invest each year!

If you start at age 22, $4178/year is enough to reach $1.1 million by age 67 (assuming 6.5% inflation-adjusted returns) if you increase it each year to account for inflation).

Wait 10 years, and you’ll need $8266/year, almost exactly double!

Wait another 10 years to age 42, and you need $17,267/year, more than double again!

Step 2: Take Advantage of Your 401(k) Matching Benefits

If available, sign up for your employer’s 401(k) and contribute at least enough to get the full match (if any), and preferably as close as possible to the maximum allowed by the IRS

According to the Bureau of Labor Statistics (BLS), 67% of private industry workers have access to employer retirement plans, almost all defined contribution plans like a 401(k).

According to the Society for Human Resource Management (SHRM), 1 in 4 workers miss out on the full match offered by their employer, missing out on an average of $1336/year in free money.

To put that in perspective, investing $1336 a year at 6.5% inflation-adjusted return from age 22 to 67 would come to over $350,000!

That’s over a third of the $1.04 million needed for a comfortable retirement!

If you can’t afford to invest enough to get the full match, invest whatever you can, even 1% is better than nothing. Then, try to increase your investment each year until you maximize the match.

If you don’t have access to a 401(k), or even if you do, use all other possible tax-advantaged funds. These include Roth and traditional IRAs; SEP IRAs, SIMPLE IRAs, etc. if you’re self-employed; and/or Health Savings Accounts (HSAs) if your health insurance is HSA compatible.

Especially HSAs invested in mutual funds are a great option, as contributions are in pre-tax dollars, money grows untaxed, and withdrawals for qualified health-related expenses are tax-free.

Step 3: Invest for Growth!

Historic inflation-adjusted returns for stocks since 1928 were over 6.5%

Bonds? Just 1.9%

The stock market has a positive return on average in 3 out of every 4 years, and the market hasn’t had a negative return over any rolling 20-year period since the 20s including with the Great Depression!

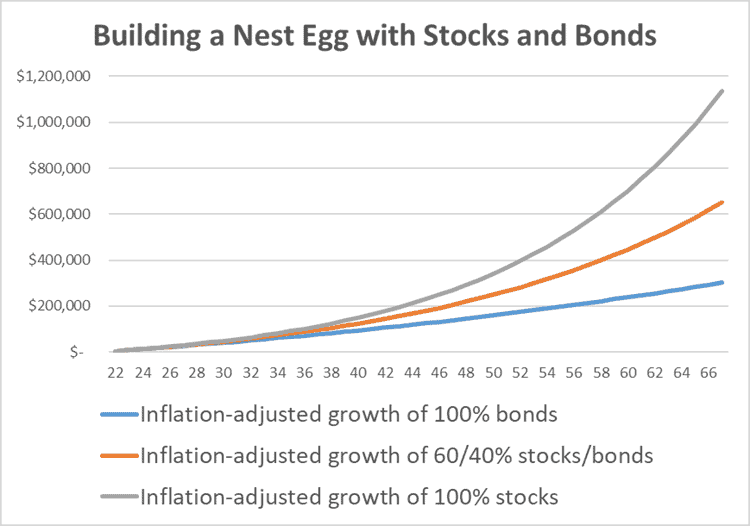

Here’s a comparison of a 6.6% annual inflation-adjusted growth of 100% stocks to the 4.72% growth of a 60/40 stock/bond portfolio, and to the 1.9% return of a 100% bond portfolio.

All three assume the same $4178 annual investment (adjusted each year for inflation).

As a caveat, note that the graph shows results of having the same exact return each year. In reality, each year returns will be higher or lower, and sometimes negative.

However, over the very long haul, it’s hard to beat stock market returns (unless you, e.g., invest in your own successful business, rental real estate, etc.).

Step 4: Choose your Investments Based on Your Level of Knowledge and Confidence

In a 401(k), plan investment choices are limited to what the plan administrator picked.

In an IRA (or a solo 401(k) if you’re self-employed and have an official payroll), you have much more control over your investment options.

Depending on what’s available and on your confidence, here’s what you should do.

If you have no knowledge or confidence in being able to learn how to allocate your investments between stocks and bonds, between US and international, etc. (let alone picking specific funds), and you have access to them, you could do worse than looking at so-called target-date funds.

If this is your choice, find a target-date fund that has in its name a year that’s close to when you plan to retire (these funds usually target in 5-year increments – e.g., 2030, 2035, 2040, 2045, etc.).

These funds invest in a variety of underlying funds that specialize in US stocks, US bonds, international stocks, international bonds, etc. They change their allocation over time, reducing their stock allocation as they approach their target year.

Some “glide” down more sharply, getting to a low stock allocation at their target year, and then stay at that level through your retirement.

Others, glide less steeply down, but then continue gliding down more slowly as you go through retirement.

Note that some target-date funds invest in index funds, lowering the underlying fees and staying close to the overall market’s return, while others invest in active funds, that have higher fees and may under- or over-perform the market indexes.

If you’re somewhat confident you can figure out the allocation you want, and how that should change as you get closer to retirement (and then live through retirement), but don’t think you can pick winning actively managed mutual funds (or ETFs), Warren Buffet has some advice for you:

“A low-cost index fund is the most sensible equity investment for the great majority of investors. My mentor, Ben Graham, took this position many years ago, and everything I have seen since convinces me of its truth.”

If you’re somewhat confident you can benefit from active management, but if you don’t want to do the stock picking yourself, there are low-cost so-called robo-advisors that can offer somewhat personalized investing advice without having to pay thousands of dollars or 1% or more of your assets annually. In fact, the industry average is about 0.25%.

Robo-advisors ask you a few simple questions. Based on your answers, they determine what investment mix, including individual ETFs, stocks, and bonds, match your goal (retirement) and your risk tolerance. Then, they rebalance your portfolio over time and try to optimize to lower your tax liability.

If you’re very confident in your ability to pick winning funds, you can do exactly that, as I do. In this situation, you avoid paying any advisory fees, but still pay management fees for any ETFs and/or mutual funds you pick.

If you’re extremely (over?) confident, you may even try picking individual stocks. However, remember that every stock transaction has a buyer and a seller, and it’s quite possible you’re buying from or selling to a professional money manager with years or decades of industry experience and possibly a deep bench of analysts. Are you still confident you’ll reliably make better investing decisions than she will?

No matter you’re level of confidence, consider the potential benefits of hiring a financial advisor who can work with you to develop a personalized plan to achieve your financial goals. Many financial advisors offer affordable financial planning services and don’t require a minimum level of assets to serve clients who are just getting started on their investing journey.

Step 5: Leave Your Investments Alone

An interesting study by Fidelity came out a while back, looking at who among their investors did best.

Can you guess?

It was those investors who had forgotten they had the investment. As a result, they didn’t try to move in and out of the market, didn’t borrow from their 401(k) plans, and didn’t sell (paying extra taxes and penalties).

Your retirement investment’s best friend is time in the market!

Ask the Experts: Financial Advisors Share Investment Tips for Beginners

For additional insights, we asked financial advisors in the Wealthtender community to share a tip they recommend to people who are just getting started with investing. Here’s what they said:

The Bottom Line

Investing for retirement now is crucial for your future self’s well-being. This article provides you with the 5 critical, yet simple steps to do exactly that. Whether you’re a complete investing novice, a middling-fair investor, or can beat the pants off the pros, the above will help you chart your path to success.

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor