To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

My colleague Ben Le Fort wrote a really nice piece, How Do You Get Rich? Slowly, and Then Suddenly.

That got me thinking. Is it really that simple?

As I commented there, I think it’s actually a bit more nuanced than two speeds – slow, then fast.

4 Factors Affect Your Wealth Building

There are really only 4 factors that determine how quickly (or if at all) you become wealthy.

- How much you invest each year

- Your average annual investment returns

- Your consistency over time

- Your retirement budget

Let’s take a closer look at each of these.

1. How Much You Invest Each Year

Clearly, if you invest nothing, you’ll never build wealth.

As clearly, the more you invest, the faster you’ll grow wealthy. This is why you need to increase your savings (and investing) rate, by controlling your spending and increasing your income.

2. Your Average Annual Investment Returns

If you simply take money you’re not spending and stuff it under the proverbial (or real) mattress, your “investment” returns will actually be negative because inflation will eat away at the value of that cash.

If you invest only in ultra-safe bonds, you may barely keep up with inflation, but you’ll still need to set aside every last dollar you’ll need to fund your retirement.

To avoid that, and let your money work for you at least as hard as you work for it, you have to accept at least some short-term risk in order to get higher long-term returns, as I explain here.

Over the very long term, from before the Great Depression nearly 100 years ago, stocks have returned about 10% a year on average, or about 7% a year after adjusting for inflation. It’s why I’ve tended to hold close to 100% of my investments in stock mutual funds.

The higher your investment returns, the less you’ll need to squirrel away and/or the sooner you’ll reach financial independence, but…

If you shoot for too high a return, you’ll have to take on a lot more risk.

That may work out, but as is clearly implied by the word “risk,” you may end up “losing your shirt.”

3. Your Consistency over Time

If you invest a large enough amount of money when you’re very young, you can get away without investing any more money over your lifetime, and just let your investment returns build up your wealth for you.

This could work if you’re in the top 1%, whose net worth as they enter adulthood is over $435,000.

At 7%/year inflation-adjusted return, your investment will double roughly every 10 years. Investing $435,000 at age 18, by age 65 you’ll have over $10 million to live off. This without ever investing another cent.

The rest of us, who aren’t 1-percenters, need to be disciplined enough to invest consistently each year, for as long as we can.

4. Your Retirement Budget

This final piece is every bit as crucial as the others.

The higher your desired (or required) spending in retirement, the larger a portfolio you need to fund it. Using the so-called 4% rule, for example, you’ll need $3 million to fund a $10,000/month retirement budget, but only $1.5 million to cover a $5000/month budget.

That’s why your financial independence will be easier to achieve if you don’t let your spending increase as fast as (let alone faster than) your income.

The Promised Practical Math of Wealth Building

There are two formulas we’ll look at. First, a dead-simple one that’s only relevant for someone like the 1-percenter I mentioned above.

The Dead-Simple Math of the 1-Percenter

Here’s the formula:

P(T) = S × 1.07^T

Where P(T) is portfolio value after T years (where T = 0 at age 18), S is the starting investment of $435,000, 1.07 is used because that’s what the 7% annual return looks like mathematically, and T is the above-mentioned number of years.

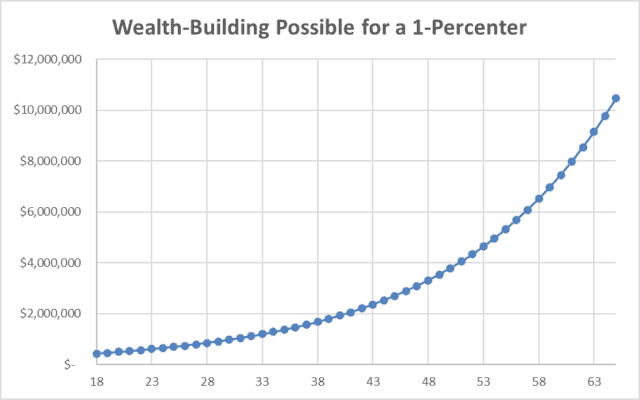

Here’s what it looks like visually as a function of the 1-percenter’s age.

This 1-percenter starts today with $435,000 at age 18, invests at 7%/year real return, and just goes about his life from that point forward, working only enough to cover his ongoing living expenses.

Never adding a penny in new investments, by age 65 his portfolio balance would be $10.5 million in today’s dollars!

It’d actually be over $38 million in nominal dollars, but assuming the historic inflation rate, you’d need $3.67 nominal dollars to buy what a dollar would have bought when he was 18.

This is the magical power of compounded returns.

The More Complicated but More Achievable Math for the Rest of Us

I didn’t start with $435,000 at age 18, and in fact, had a negative net worth when I graduated with my Ph.D. at age 30. That’s why the above simple exponential growth was never in the cards for me.

I suspect the same is true for you.

For us, here’s a more achievable (albeit more complicated) formula for building wealth:

P(T) = C × (1.07^(T+1)-1)/0.07

Where P(T) is again the portfolio’s value after T years, C is the annual contribution to the portfolio, 1.07 is used again to denote the 7%/year real returned assumed, and T is again the number of years.

Note that by using 7%/year, all the dollar values shown from this point forward are adjusted for the historic average rate of inflation.

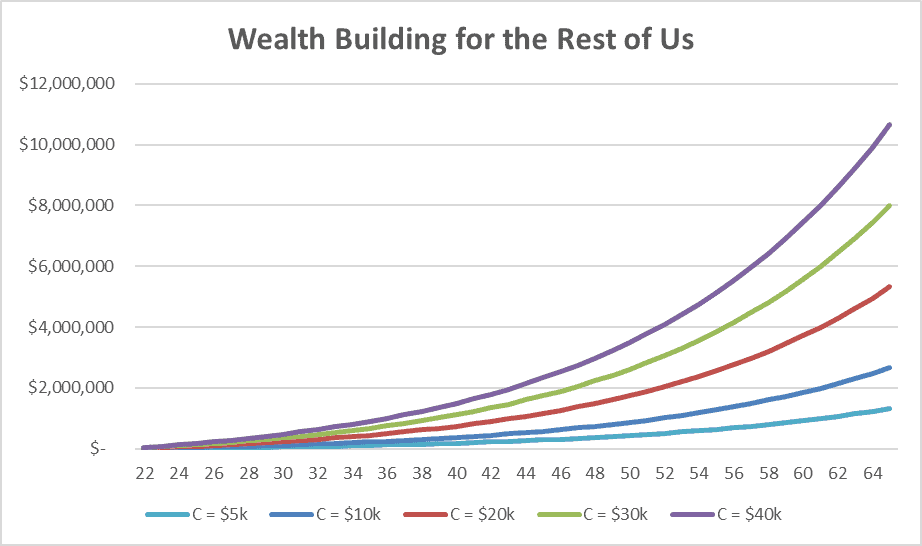

Here’s what this formula looks like for annual contributions C of $5k, $10k, $20k, $30k, and $40k, starting from nothing at age 22.

Starting at $0 at age 22, you must invest as much as you can, as consistently as possible for several decades.

In the above graph:

- The blue line shows annual contributions of $5k grow to about $1.3 million by age 65

- The light purple line shows $10k annual contributions growing to about $2.7 million

- The red line shows $20k annually reaching $5.3 million

- The green shows $30k annually grows to almost $8 million

- The dark purple shows $40k annually grows to just over $10.6 million.

Using the 4% rule, these 5 portfolios should allow a safe draw in year 1 of retirement about $53k, $106k, $213k, $319k, and $426k, respectively.

The graph shows some interesting milestones.

- After 10 year, around age 32, the investment returns start exceeding than the contribution C.

- Assuming the savings/investing rate is 20%, around age 48 the investment returns exceed annual income from work.

- Around age 52, a 4% draw would exceed the 80% annual spending assumed in the above.

- By age 65, the 4% draw would more than double the assumed income from work.

Caveats

As always, there are caveats.

- While 7%/year has been the average real return for US stocks over the past century or so, future returns may well average lower.

- Returns will definitely not be constant each year, but will rather be higher (sometimes much higher) some years, lower in other years, and will likely be negative about one year in four.

- Few of us can invest a constant amount each year starting from age 22. Personally, I had zero invested at age 30, just over $1k sometime in my early 30s, and only gradually managed to contribute annually slowly growing those contributions. It wasn’t until my consulting business took off about a decade ago that my contributions became much higher.

- Far too many of us never make enough to be able to set aside even $5k/year, let alone more than that. Thus, while the above math is fairly simple and plausibly practical for many, it’s far from easy for most.

The Bottom Line

The math of wealth building isn’t terribly complicated in principle. However, that doesn’t make building wealth easy for those of us who start at zero, let alone owing more than we own.

As you can see from all the shallow slopes of all 5 lines in the above graph, even if you invest consistently, and even if your annual contribution is sizeable, your wealth will grow slowly at first. Then, as compounding works in your favor, the slope gradually increases, so each year your wealth will go marginally faster than it did the year before.

That’s why I agree with Le Fort that you can get rich slowly at first, but rather than say “then fast” like Le Fort, I’d say “gradually faster until your investment returns zoom past whatever you can bring in from working.”

Ten years in, your investment returns will exceed your annual contribution. Another 16 years later, those investment returns will outstrip your income from work. If you can live on 80% of your income, you should reach financial independence after investing diligently for 30 years. That’s when your portfolio should be able to sustain your spending without working any more.

Every additional year you put off retiring, especially if you continue contributing to your portfolio, your eventual retirement will become more financially comfortable, albeit shorter.

However, the above-simplified analysis is only indicative. Your actual results will be different since:

- Your income will hopefully grow over time rather than stay constant

- Your investment contributions will also hopefully grow over time, preferably faster than your income

- There will be years when you can’t add anything to your investments, while other years you’ll be able to add a lot more than usual

- Your investment returns will vary year to year, and if you put a significant portion of your portfolio in cash, bonds, or other safer vehicles, those returns will likely average lower than stock returns.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor