To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The year was 1955.

My parents were buying their ever first home.

My then-28-year-old mom pushed my then 31-year-old dad into taking on far more debt than he was comfortable with – their mortgage payments ate up half their income!

To say things were tight would be an understatement. My oldest sister tells stories of growing up with the bare necessities only, and sometimes not much of those.

By the time they made their last payment, however, inflation made it equivalent to the cost of a family meal at a neighborhood restaurant.

This story taught me important lessons about inflation and mortgages.

What Happens When Inflation Soars

Inflation is what economists call it when prices go up.

There are many inflation measures, such as the well-known Consumer Price Index (CPI), the “chained” CPI, the Producer Price Index (PPI), etc., all of which measure how different prices change over time.

When inflation is high, as it has been in the past year plus, prices increase more rapidly.

If you have money in a bank account earning 0.1% interest and inflation runs 6%, that bank balance lost ~5.9% of its purchasing power. That’s why I suggest you consider if you should maintain large balances in such low-risk, low-return assets, even for an emergency fund.

On the flip side, if you owe money, the value of each dollar you owe also drops.

How Inflation Affects Debt May Make You Smile

For loans you need to pay off in a handful of years, especially when the balance isn’t very high, the impact of inflation doesn’t usually make a big difference.

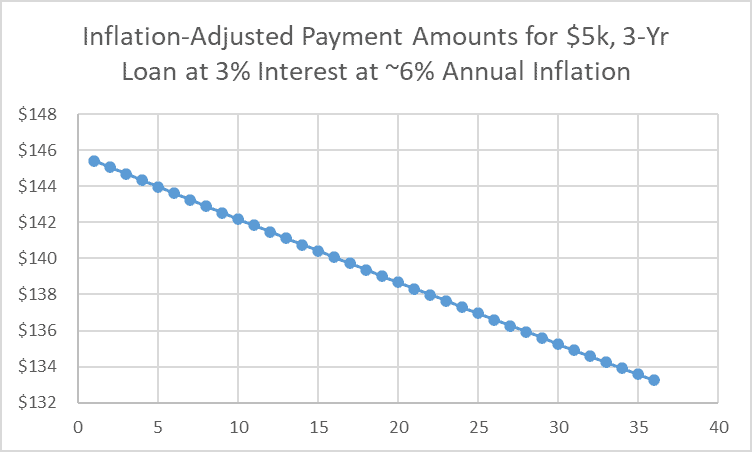

For example, if you borrow $5,000 at 3% annual interest for 3 years, your monthly payment is about $145, for a total payment of $5,235. If there’s no inflation, this costs you $235 in total interest over 3 years. If inflation runs at 0.5%/month (~6%/year), the purchasing power of your payments reduces over the 3 years from $145 to $133.

The total paid over the life of the loan, adjusting for inflation, is $5,013. This is good for you as the debtor since it saves you almost all the interest costs. However, in absolute terms, it saves you an average of only $6/month.

Nothing to write home about, right?

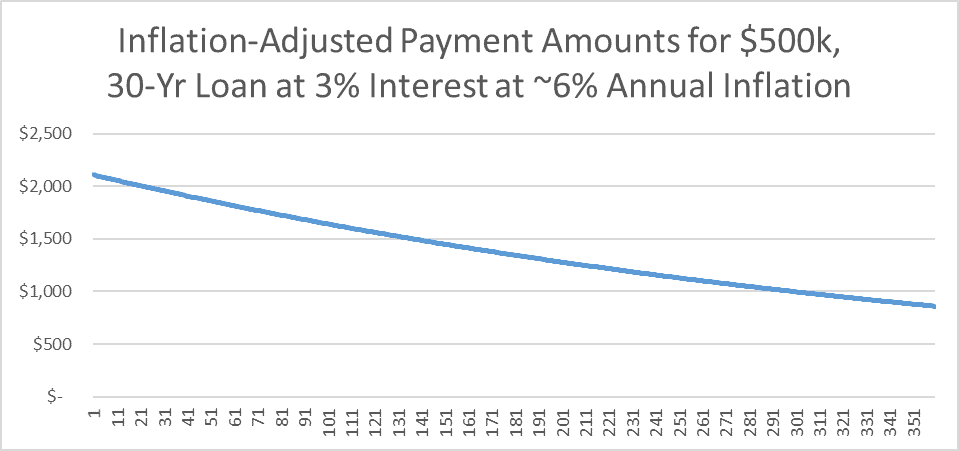

However, say you borrow $500,000 on a 30-year mortgage at 3%, having the value of your owed balance drop by 6% a year makes a huge difference.

Here, your monthly payment is $2,108. Over 30 years, the inflation-adjusted cost of those payments drops from $2108 to only $860! Instead of feeling the full impact of nearly $759k in total payments, adjusting for inflation, it costs you only $501,250!

That saves you nearly $258k, or $716/month on average – over a third of your monthly payments!

Enough to make you smile?

Here’s What Determines If High Inflation Helps or Hurts You

There are 4 factors that affect whether high inflation is your enemy or friend:

Does your income keep up with inflation, e.g., through cost-of-living adjustments (COLA)?

- If your income doesn’t keep up, inflation makes it harder to cover your expenses – Enemy!

- If your income goes up enough to keep up (or better yet, exceed) inflation – Friendly!

Do your assets keep up with inflation?

- If you keep a lot of your assets in checking or savings accounts that pay less interest than inflation, your real (inflation-adjusted) net worth is dropping – Enemy!

- If most of your assets have higher (preferably much higher) returns than inflation, especially if pumped up by inflation – Friendly!

Are you in a high tax bracket (federal + state + local)?

- If you’re in a high tax bracket, you pay taxes on “phantom gains” when inflation sucks out much or all of your gains, yet you’re taxed on nominal gains – Enemy!

- If your tax bracket isn’t very high, this is less of a concern – Neither.

Do you have large, long-term, fixed-interest-rate debts?

- If you have a large mortgage with many years until it’s paid off, at interest rates lower than inflation – Best Friend!

- If you have any short-term debt at any interest rate – Friendly!

- If you have no debts on which you pay interest – Neither.

The Bottom Line

The overall impact you suffer or enjoy when inflation soars depends on where you fall on each of the above 4 factors, and how significant each is relative to your financial situation.

For example, if you have few assets but those earn high returns, have a low-interest mortgage, and your income goes up faster than inflation, you should be smiling.

If, on the other hand, you hold significant sums in checking and savings accounts, low-coupon bonds, etc., your income is stagnant in nominal dollars with no COLA, and you don’t have any fixed-interest debt, high inflation is a major problem for you.

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor