To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

As I’ve talked about many times in the past, nearly every problem in personal finance can be solved by pulling one of the two levers of personal finance.

1. The income lever

2. The saving lever

99% of money problems can be solved through some combination of making more money (the income lever) and saving more of the money you already have (the saving lever). The perfect financial plan will allow you to find the sweet spot between these two levers. If your primary objective is to give yourself as much room for error as possible or if you are trying to climb out of a financial hole, you’ll need to focus on pulling both levers as hard as possible.

However, most people won’t pull the saving lever as hard as they should. It has been my experience that it is easier to convince people that they need to make more money than it is to convince them that they need to save more of the money they already make.

Holding all other factors constant, saving more money implies spending less money. Spending less money means that people will have to reduce their current standard of living. Most people struggle with reducing their standard of living. Once someone gets used to living a certain lifestyle, it’s difficult for them to move backward.

While I firmly believe most people need to do a better job managing the money they already have, today I will focus on pulling the income lever. Specifically, how side hustles can unlock your budget and help you achieve your financial goals.

Meet Amanda

To illustrate how a side hustle can unlock your budget let’s consider a hypothetical example. Amanda is a 32-year-old account manager at a local bank. She would like to be debt-free by age 36 and be able to retire by age 59

Amanda’s income & assets

- Amanda makes $45,000 per year in salary.

- Her employer also offers a Defined Contribution retirement plan where Amanda and her employer each contribute 5% of her salary into a retirement account.

- The current value of Amanda’s retirement savings is $20,000

- Amanda owns a car this is currently worth $15,000.

- After all taxes and deductions are accounted for, Amanda’s monthly takes home pay is $2,626.

Amanda’s debts

- Credit card with a $3,500 balance and a 19.99% interest rate.

- Student loans with a remaining balance of $28,000 and a 5% interest rate.

- A car loan with a $13,000 remaining balance and an 8% interest rate.

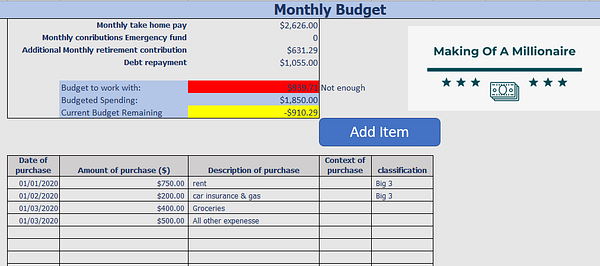

Amanda’s current monthly budget

Amanda decides to create a monthly budget that locks in her financial goals of being able to retire by 59 and being debt-free by 36.

- Current take-home pay: $2,626.

- Additional savings required to retire by 59: $631

- Monthly payments required to be debt-free by 36: ,055

- Remaining income to budget: $940

With only $940 left to budget with, Amanda will not have enough money to pay for her rent ($750) other expenses related to her car ($200) and cover her other monthly living expenses ($500).

Amanda is $910 short of being able to achieve her financial goals and cover her other monthly living expenses. In this type of situation, someone has three options.

1. Cut their spending

2. Lower their goals

3. Make more money

Amanda is not spending excessively so cutting her spending won’t be of much use in this situation.

She could free up more monthly cash by pushing back her retirement age or deciding to pay her debt off over a longer period. While lowering your financial goals is always an option to free up more cash, I like to think of that as a measure of last resort.

That leaves Amanda with one clear option. Make more money. This is where the side hustle comes into play.

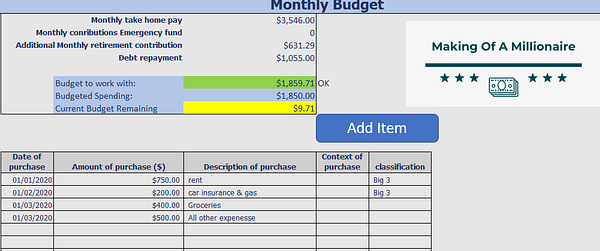

Budget Revisited

Amanda is determined to do whatever it takes to reach her financial goals. She decides to pick up a side hustle where she earns $20 per hour after taxes. Luckily, she has chosen a side hustle with flexible hours so she can choose when she works.

To come up with the $910 shortfall, she decides to work an extra 46 hours per month at her side hustle. This allows her enough money to retire when she wants, live debt-free when she wants while also covering her other living expenses.

This is just one example of how thinking outside the box can completely unlock your budget, to allow you to hit your financial goals without dramatically lowering your standard of living.

The beauty of a side hustle is that you do not need to do it forever. As your income from your day job increases or you begin reaching your financial goals, you will free up more monthly cash flow.

For example, in 4 years when Amanda’s debts are paid off, she is going to have an additional $1,055 in net cash flow. If she gets an annual 3% raise at her day job, her monthly take-home pay would increase by $325 per month. All told that will free up $1,380 per month.

This would allow her to quit her side-hustle, increase her savings or increase her standard of living. Or any combination of the three options.

Final thoughts

If you are struggling to find the cash to meet your goals, you always have three options.

1. Make more money

2. Spend less money

3. Lower your goals.

For many people spending less money is not going to get the job done. After all, you can only cut your spending to zero.

Lowering your goals is always an option, but it should never be your first option. If you are willing to get creative and work a little bit harder making more money through a side hustle or a second job has the potential to tilt the numbers in your favor.

About the Author

Ben Le Fort

In the eight years following graduation, he paid off all of the debt and built a seven-figure net worth. Ben holds a Bachelor’s degree in economics from Acadia University and a Master’s degree in Economics & Finance from The University of Guelph.

Ben lives in Waterloo, Ontario, with his wife, son, and cat named Trixie.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor