To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The big 3

Housing, transportation, and food account for more than 60% of the average household budget. That is why whenever I talk about budgeting, I lump these expenses into one category that I call “the big 3”.

While it is important to get a handle on all of “the big 3” expenses, in this article, I am going to be discussing how to turn your house and your car from your biggest expenses into monthly cash-flow.

I have not yet figured out a way to turn food into cash so we will not be discussing food. If you are interested in how to save money on your grocery bill, you can check out this article I wrote on saving on your grocery bill.

Housing & transportation costs are the major problems

Housing costs account for one-third of after-tax, household income in America. That means for every dollar earned (after taxes) 33 cents goes to housing costs.

For income earners in the bottom 20%, they spend 40% of their income on housing.

As for transportation expenses, if you have a transit pass you are doing great.

If you own a car, you might be shocked to learn that the average person would need to use every paycheck from January 1st to April 1st to pay for the annual cost of owning a new car.

If you find you don’t have enough cash to meet your financial goals, you probably spend too much money on housing and transportation.

The impact on your budget

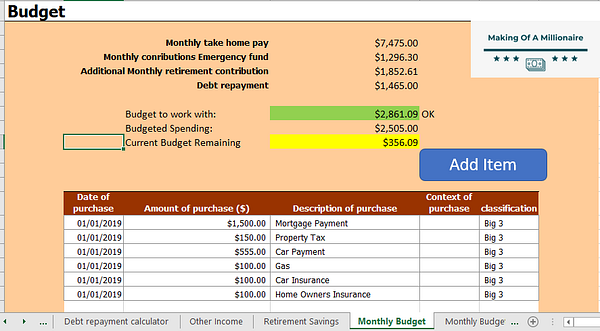

To understand the impact housing and transportation have on your budget let’s use an example.

Let’s assume the following.

- Your annual gross income is $125,000.

- Your monthly take-home pay is $7,475. This is the amount you have to spend each month and represents the maximum amount you can include in your budget.

- To fully fund your emergency fund in the next 10 months, you’ve committed to saving ,296 per month in cash.

- In order to pay off your debt in 5 years, you’ve committed to allocating $1,465 towards your debt each month.

- You have also committed to contributing $1,852 per month into your retirement accounts to meet your goal of retiring by 60.

- This leaves you with $2,861 in monthly take-home pay for the rest of your monthly spending.

- After budgeting for all of the costs associated with your house and your car, you have only $356 left to budget the rest of your monthly living expenses.

All of this is represented in a screenshot of the budget tab that students of Making of a Millionaire will be familiar with.

For someone making $125,000, $356 is not a lot of money to live off in a month. The first thought you might have is that the obvious solution is to allocate less money towards the financial goals of building an emergency fund, paying off debt and saving for retirement.

While it is true, lowering your financial goals would free up more cash flow in this situation. And it may be the case that you need to lower your financial goals to free up more cash.

However, I strongly believe you need to exhaust all other avenues before lowering your financial goals. Otherwise, you would be guaranteeing that you have less cash on hand in case of emergency, spend more time living in debt and push back your retirement.

Lowering your goals is an option but should be a measure of last resort, not the first option.

So the question remains how do you free up more cash without lowering your financial goals?

To answer that, we go back to the two levers of personal finance

- Making more money.

- Saving more of the money you have.

Luckily, it is possible to hit both levers at the same time by turning your two largest expenses into additional cash flow.

Hack your house and your car

The concept of house hacking is pretty straight forward. Find a way to generate rental income from your home to offset your personal living expenses.

There are a number of different ways to do this.

- Rent out a room in your house.

- Rent out your entire house on Airbnb when you are out of town.

- Buy a multi-family property, while living in one unit and renting out the others.

- If you rent and live alone, taking on a roommate is even a form of house hacking.

It is also possible to apply the same concept of house hacking to your car. The app, Turo is basically like Airbnb for your car. If there are days where you are not using your car, rather than allowing it to sit in your driveway and depreciate you can rent it out and earn some extra cash.

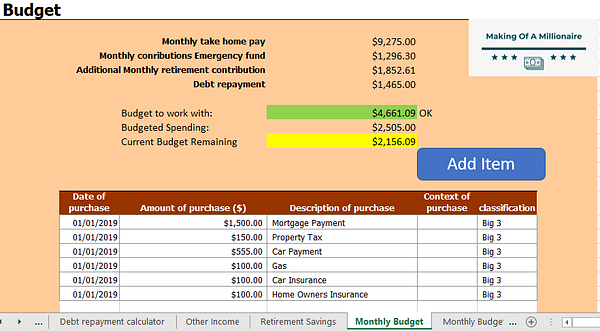

Let’s take a look at how well-executed house and car hacks impact your budget

Budget revisited

Let’s assume between you were able to generate an additional $1,800 in take-home pay from your house and car hacks. That would mean you would have enough money to meet your financial goals, pay for your housing and transportation costs and still have $2,156 leftover to cover your other living expenses.

This is just one example of how thinking outside the box can completely unlock your budget, to allow you to hit your financial goals without dramatically lowering your standard of living.

The beauty of house hacking and car hacking is that you do not need to do it forever. As your income increases or you begin reaching your financial goals, you will free up more monthly cash flow.

For example, in 10 months when your emergency fund is fully funded, you no longer need to contribute the $1,296 per month.

That is $1,296 that you could either apply to your debt to become debt-free faster.

Alternatively, if you have been renting a room in your house for the past 10 months and you really hate it, that extra cash from not having to contribute to the emergency fund could allow you to stop house hacking.

Once your debt is paid off you’ll have an extra $1,465 per month that can be used to increase your retirement savings or might allow you to spend it on other things you value like travel.

Lowering your goals is always an option. But if your willing to make sacrifices, you may not have to.

About the Author

Ben Le Fort

In the eight years following graduation, he paid off all of the debt and built a seven-figure net worth. Ben holds a Bachelor’s degree in economics from Acadia University and a Master’s degree in Economics & Finance from The University of Guelph.

Ben lives in Waterloo, Ontario, with his wife, son, and cat named Trixie.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor