Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Not everyone has this choice.

But you may — someday.

Should you retire now or wait a few years?

In the following, we look at how this choice may play out for a hypothetical Maryland couple, John and Janice Smith, both 62-years-and-one-month old.

The Assumptions for Immediate Retirement

The Smiths have been frugal and dedicated to setting aside money and investing it, accepting prudent risks. As a result, they have several sources of retirement income.

Their portfolio is worth $1 million, and since they’re savvy enough to use the Guardrails Approach, the Smiths expect to safely draw 5.3 percent a year, or $53k if they start now.

The Smiths have rental income that nets them $40k a year.

They also bring in $10k a year from hobbies.

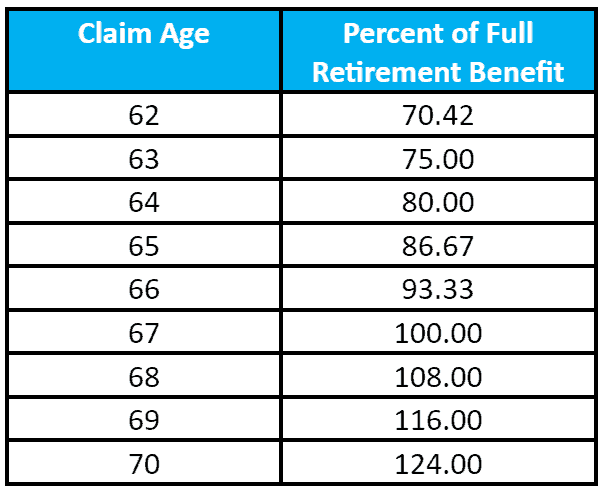

Should the Smiths both take Social Security benefits now, they’d get 70.42 percent of their full benefit, or $23.1k a year.

All told, the Smiths could have $126.1k before taxes, putting them at the 84th percentile without having to work (beyond their hobby).

As for taxes:

- The Smiths take the standard deduction.

- 25 percent of what they take from their portfolio is investment basis.

- Half of their rental income is shielded by depreciation.

- 85 percent of their Social Security benefit is subject to federal income taxes.

- $10k is subject to self-employment taxes.

Their AGI of $89.4k leads to federal taxes of $11.8k, and since Maryland doesn’t tax Social Security benefits, their state income taxes are $5.4k.

Their after-tax income, should they retire now, would be $108.9k.

But What If They Delay?

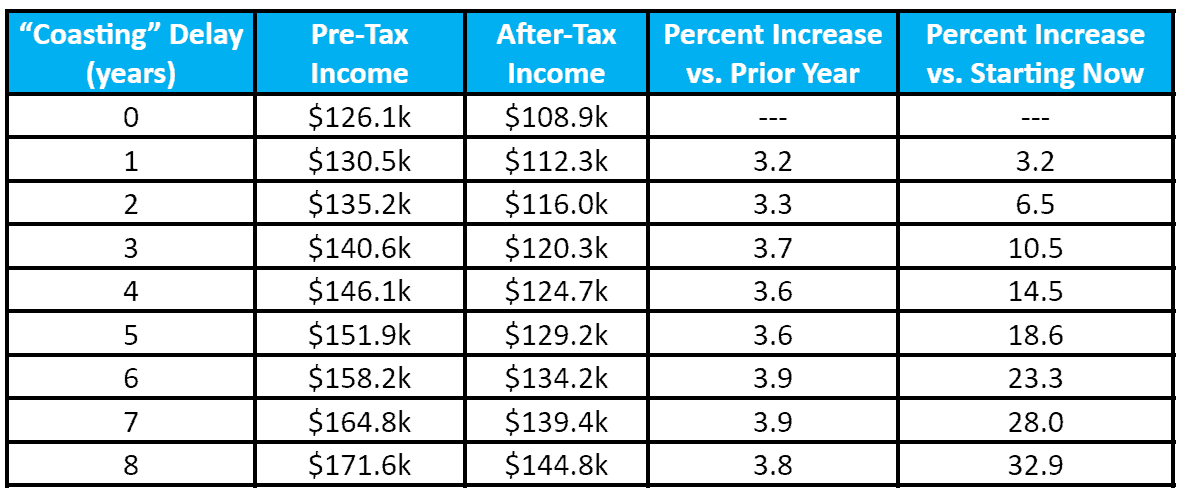

For this, we assume the Smiths would “coast,” only bringing in enough during the delay to cover taxes and expenses, so they don’t add anything to their portfolio beyond the 5.4 percent (inflation-adjusted) return they expect, given their (somewhat aggressive for their age) 70/20/10 allocation between stocks, bonds, and cash.

According to the Social Security Administration (SSA), for each year you delay past age 62, your benefits increase by 6.5 to 8 percent.

Adam Cornwell, Partner at North Ridge Wealth Advisors says, “In most scenarios, we’ve found it’s optimal for the higher-earning spouse to take Social Security at 70 for the higher benefit. This acts as an annuity for the surviving spouse. The lower earner can take Social Security at their full retirement age since the survivor only gets the higher of the two benefits. For a married couple, both aged 62, the joint life expectancy is 30.8 years, or age 93. If a 62-year-old couple who enjoys what they do for work is looking to potentially “coast” into retirement, they can do so until full retirement age, then live on the lower earner’s Social Security plus portfolio returns until age 70, when the higher Social Security benefit kicks in.”

Specifically (neglecting the fact that you can’t start before turning 62 and a month):

We neglect the impact of changes in tax brackets and Social Security full retirement benefits, assuming they follow inflation.

For simplicity, we also assume the Smiths already have 35 years of Social Security earnings that are higher (after inflation adjustments) than they’ll have while coasting.

We’ll also assume their rental and hobby incomes keep pace with inflation.

Thus, the couple’s total pre-tax income and after-tax income, adjusting for inflation, would be as follows:

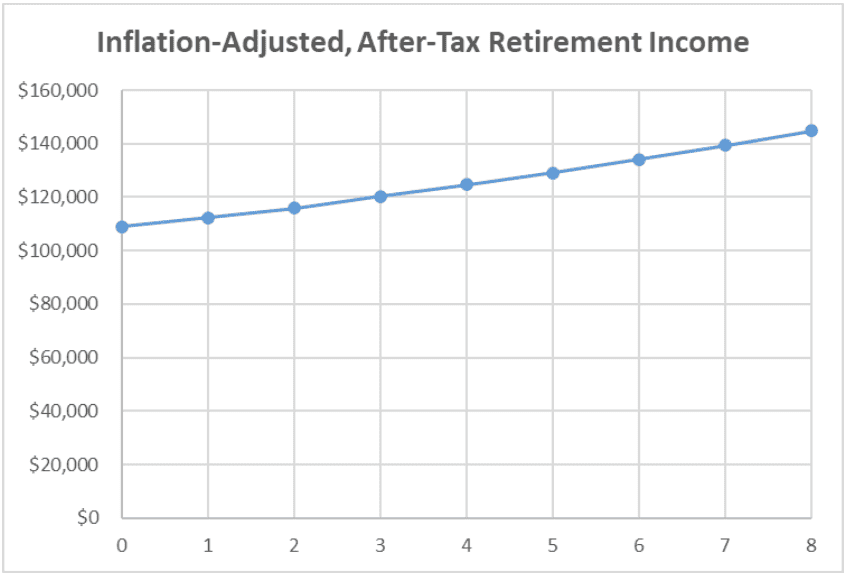

And in graph form…

What Does All This Mean?

Each year the Smiths coast, working at a slower pace (just enough to cover taxes and expenses), should grow their portfolio.

Each year (up to age 70), their Social Security benefits grow substantially faster than inflation.

These two factors increase their after-tax retirement income by somewhere between 3.2 and 3.9 percent per year. Coasting for eight years, until age 70, could increase their real after-tax retirement income by nearly 33 percent vs. retiring now, at age 62.

In addition, according to the SSA’s actuarial table, at age 62 John has a 50 percent chance of living 19 additional years, while Janice has a 50 percent chance of surviving 22 years (note, however, that research shows that being affluent can increase one’s life expectancy by many years).

This means their portfolio would need to survive with them, ideally over 30 years.

Should the Smiths retire at age 70, their life expectancies would be about 14 and 16 years, respectively, so their portfolio needs to survive six fewer years.

This can increase their likelihood of success or allow them to draw more per year.

The Caveats

The above uses average numbers. In reality, market returns are never exactly equal to their long-term average.

The Smiths’ portfolio could have returns that are far better, far worse, or about as expected. This is especially important in the initial years of retirement. A bear market hitting just as you retire could decimate your retirement plan!

We’ve also neglected the fact that according to research, retirees tend to reduce spending by as much as 1 percent a year, which allows you to spend more than the “safe draw” early on, if rather than adjusting each year for inflation you adjust 1 percent below inflation.

In the non-financial realm, retiring at age 62 gives the Smiths an extra eight years of relative youth to enjoy their freedom.

And since none of us is guaranteed another eight years (or even tomorrow), retiring earlier could be the difference between enjoying a few years of retirement vs. dying before reaching that goalpost.

Kevin Burkle, CFP®, Founder of HCP Wealth Planning says, “I work with people who target early retirement, and the coast-FI strategy comes up often. I tell my clients that if we’re going to explore this strategy, we need to understand the “why” behind it. Sure, it can create additional retirement income, but is that income needed? What specifically would they use it for? It’s one thing to be able to afford to spend more in retirement, but feeling confident enough to do it is another. If they don’t spend it, all they did was work more years to create a larger nest egg that gets passed on as part of their legacy. And that’s okay if it’s their main priority, but for many people, it’s not. Without a clearly stated vision of how that additional income would be spent, and a plan that makes them confident enough to do it, the additional working years won’t be worth it.”

Anthony Ferraiolo, Partner Advisor at AdvicePeriod agrees, “When considering retirement, whether early or delayed, it’s important to retire “to something” that doesn’t fit in a spreadsheet. You should try to maximize your life plan, rather than chase an arbitrary dollar amount. Maximizing for a number on a spreadsheet will almost always tell you to save more, spend less, delay social security, wait until you’re eligible for Medicare, and adjust spending in bad markets. However, there’s no calculator to measure happiness or determine your date of death. Therefore, take a balanced approach and ensure you not only know the pros and cons but are willing to adjust along the way. Whether that means leaving less to your heirs, working part-time in retirement, or traveling less.”

The Bottom Line

Financially speaking, delaying retirement for several years and coasting should let you enjoy a wealthier retirement.

However, you run the risk that your health may not hold up, and you’d be unable to enjoy the extra affluence.

You could even die before retiring!

That’s why you and your partner (if any) should carefully consider all aspects of this decision, not just the financial ones.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor