Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The Morningstar 2024 outlook report is full of insights on investment risks and opportunities in the market today.

Starting with the risks they list and adding a few more, here are 9 macro or systemic risks that could bring down the markets (along with other nasty consequences) and what Morningstar suggests you consider doing to mitigate risk and take advantage of opportunities.

Then, I’ll share my preferred strategy.

1. Resurging Inflation

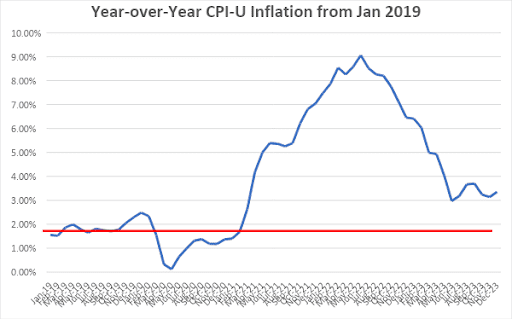

The graph below shows that U.S. inflation started rising above the Fed’s 2% annual target in March 2021 and peaked at just over 9% in June 2022.

The Fed responded late, arguing for months that inflation was “transitory.”

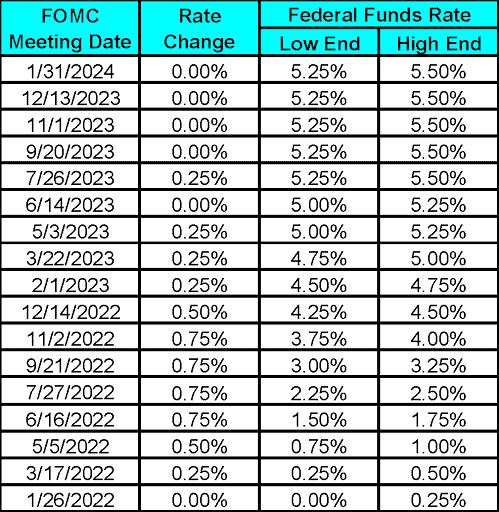

When it became clear it wasn’t, they started hiking interest rates from March 2022 (see table), by which point year-over-year (YoY) inflation had climbed above 8.5%.

Once they decided to act, they raised rates 11 times in 12 meetings, for a total of 5.25%, the most aggressive tightening in decades.

The results, thus far, have been positive, with YoY inflation dropping more or less steadily until it seemed to hit a plateau of just over 3%.

However, looking at the Month-over-Month (MoM) inflation data, we seem to have hit the Fed’s target and then some, as seen in the next graph (the red line at 0.165% is the geometric average monthly reading resulting in a 2% YoY rate).

The Fed signaled it’s likely to cut rates three times in 2024, but the market projects as many as six such cuts. It’s unclear what will end up happening since the Fed’s decisions are affected by new data as it’s collected.

As Forbes points out, the Fed needs to walk the fine line between cutting rates too little too late, resulting in a potentially severe recession (see next risk); or too much too soon, which could overheat the economy and reignite inflation.

Since the Fed would start raising rates again in the latter scenario, corporate profits could fall as a result, and we’d face a heightened risk of recession.

In such unstable times, Morningstar expects both stock and bond markets to be volatile.

2. U.S. Recession

One widely accepted metric of recession risk is the so-called yield curve, which looks at the yield of treasuries as a function of their duration to maturity.

Usually, longer-duration treasuries offer higher yields.

Periodically, this relation inverts, with shorter-term treasuries offering higher yields than longer-term ones. This so-called “yield inversion” has a good track record of showing higher recession risk. According to Forbes, the yield curve has been flashing a recession warning since 2022.

CNBC reports that “More than three-fourths of economists — 76% — said they believe the chances of a recession in the next 12 months is 50% or less, according to a December survey from the National Association for Business Economics.”

If the Fed achieves a so-called “soft landing,” it would be only the second time in 60 years, which makes the risk of a moderate to severe recession a real one.

3. U.S. Deficits and Ballooning National Debt

The U.S. national debt is over $34 trillion. That’s right, more than $34,000,000,000,000.

That’s 125% of the $27.36 U.S. GDP where anything over 100% is considered risky.

What’s worse, this already too-high level continues to increase due to the annual federal deficit running over $2 trillion ($510 billion in the first quarter of fiscal 2024).

With increased interest rates, the debt service portion of the federal budget is growing, reaching 18% of the federal budget as of December 2023. If the average interest rate paid by the government continues to increase, an even greater portion of the budget will need to cover debt service.

Unless Congress prevents it, the deficit will increase to cover the higher interest payments, which will, in turn, increase the national debt, which will then increase interest payments – a vicious debt spiral.

Morningstar points to a risk of investors demanding higher long-term yields, leading to dropping bond prices.

4. Commercial Real Estate

Following the Covid-19 pandemic, remote work took off, and many workers moved to lower-cost locales to stretch their dollars.

With the pandemic becoming “endemic” and less deadly (especially to fully vaccinated people), many companies are trying to convince employees to return to the office, at least part-time.

Many employees, especially those who moved away, refuse.

As a result, commercial real estate vacancies increased, especially office space but retail space too, since people shifted to buying more stuff online. As a result, commercial real estate values are dropping.

In a 60 Minutes interview, Fed Chairman Jerome Powell responded to questions about this potentially leading to a banking crisis.

He agreed there will be losses in real estate but said that the larger banks will likely find this problem manageable.

However, he allowed that “There’s some smaller and regional banks that have concentrated exposures in these areas that are challenged some smaller and regional banks that have concentrated exposures in these areas that are challenged… It feels like a problem we’ll be working on for years. It’s a sizable problem… there will be some banks that have to be closed or merged… out of existence because of this. That’ll be smaller banks, I suspect, for the most part… It’s a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable.”

If Powell’s assessment turns out to be optimistic, we could see continued drops in demand for commercial real estate, driving down values, borrowers defaulting, and severe impacts on banks’ cash flows and write-offs.

5. Election Uncertainties

According to a CBS poll, three years after the January 6th assault of the Capitol, the negative reaction to those who carried it out is waning, and more people believe violence over election losses is likely.

- In Jan 2021, 21% of Republicans approved of the actions of the attackers. Since then, this number has grown to 30%.

- This number is 43% among MAGA supporters vs. 22% among non-MAGA Republicans.

- Nearly two-thirds (66%) of Republicans support Trump pardoning the January 6th attackers should he become president again.

- 49% of Americans expect violence over future election losses.

- 70% feel our democracy is threatened.

The Supreme Court is expected to rule on states’ right to remove former president Trump from ballots. Several other cases involving Trump are also likely to reach the Supreme Court.

If Trump loses in some or all of these cases, he stands to lose vast sums of money in some cases and face jail time in others. Should that happen, will his tens of millions of supporters quietly accept this outcome, or will there be widespread violence?

Morningstar expects such political uncertainties to lead to at least short-term volatility in U.S. equity markets.

6. China’s Slowing Economy

For decades, China’s economy surged.

Now, however, it faces slowing GDP growth driven by a severe property slump. A stagnating or even collapsing Chinese economy could cause global economic and/or geopolitical instability.

Morningstar expects Chinese equities to drop, and heightened recession risk for China’s trade partners.

7. China-U.S. Conflict

While in office, Trump began a trade war with China. President Biden continued this trend, working to restore chip development, manufacturing, and many other strategic technologies. One result has been that for the first time in over two decades, the U.S. imported more from Mexico than from China.

What does 2024 hold?

According to Reuters, we should expect lots more economic and geopolitical turbulence between the world’s two largest economies. Foremost of the geopolitical risks is the risk of a cross-strait war between the People’s Republic of China (PRC) and Taiwan, formally known as the Republic of China.

Will this be the year the PRC decides it’s time to invade Taiwan? If they do, how will the U.S. react, and what will be the impact?

Morningstar expects global equity volatility.

8. Russia-Ukraine War

Moving from a potential war to one that’s ongoing for over two years, Russia’s war in Ukraine.

Beyond the devastating direct impacts of the war on the Ukrainian people and the impact of punishing sanctions on Russia’s economy and people, there are global impacts.

These are primarily upward pressure on global food and energy prices. Beyond this, there’s always the risk of a miscalculation expanding the war beyond Ukraine, potentially drawing in all of NATO.

Morningstar expects disruptions in food and energy markets potentially causing shocks to global food and/or oil prices, which, in turn, could increase recession risk for vulnerable economies around the world.

9. Expanding Middle East Regional Conflict

On October 7, 2023, over 3000 Hamas terrorists invaded Israel and proceeded to torture, maim, rape, and kill over 1000 Israelis. They also took over 250 hostages back into Gaza.

The Israeli reaction was swift and severe, launching an aerial and then ground assault into the densely populated Gaza Strip.

It’s unlikely that Iran caused the Hamas attack and Tehran may not even have known it was coming until after the fact. However, Iran has long provided weapons and training to many terrorist groups, trying to challenge Israel with a potential multi-front proxy war.

Hezbollah in Lebanon, multiple militias in Syria and Iraq, Hamas, and the Houthis in Yemen have all been attacking Israel and/or U.S. interests in the Middle East. The Houthis in Yemen, especially, have been attacking international shipping traveling through the Red Sea to or from the Suez Canal that leads to the Mediterranean Sea.

Some have also raised the specter of a Houthi (or even direct Iranian) attack on underwater cables allowing Internet traffic between Europe and North America on one side and the Far East on the other. These cables, over 14,000 miles in length, pass through the same narrow waters off the shores of Yemen, as shallow as 330 feet in some places – making them an inviting and relatively easy-to-access target.

If the conflict was to expand, it could potentially cripple the global economy, according to the Brookings Institute. They say, “In a ‘large disruption’ scenario—comparable to the Arab oil embargo of 1973—global oil supplies would shrink by 6 to 8 million barrels per day, driving up prices to between $140 and $157 a barrel.”

The International Monetary Fund (IMF) sees risks, especially to regional economies, while the World Bank sees much more devastating potential global outcomes.

Morningstar sees the potential for food and/or oil price shocks, which, in turn, could increase recession risk for vulnerable economies.

What Can You Do to Mitigate Risks and Take Advantage of Opportunities?

Here are some ideas, mostly from Morningstar, as to how you can position your investments to mitigate the risks and potentially take advantage of opportunities arising from these scenarios.

- Inflation: Consider short-term, high-quality government bonds and hedged alternatives, or if you believe the AI revolution will continue, consider some AI stocks; if you expect interest rate cuts, consider positive real yields in fixed income that could also appreciate when interest rates get cut.

- U.S. Recession: Defensive sectors that often provide safe havens in recessions include utilities, healthcare, consumer staples, and possibly banks; or, if you believe in a recovery, consider small-cap value stocks; in fixed income, you may prefer treasuries over corporate bonds.

- U.S. deficits: Morningstar suggests considering short-term, high-quality government bonds.

- Commercial Real Estate: Morningstar suggests considering oversold regional banks.

- Election Uncertainties: Morningstar suggests considering long-term, high-quality government bonds; or you could consider diversifying overseas.

- Chinese Crash: Morningstar suggests considering oversold Chinese technology equities.

- China-U.S. Conflict: Morningstar suggests considering long-term, high-quality government bonds.

- Russia-Ukraine War: Morningstar suggests considering cheaply priced energy assets like U.S. MLPs and European energy.

- Middle East Conflict: Again, Morningstar suggests considering cheaply priced energy assets like U.S. MLPs and European energy.

My Preferred Strategy

Despite all the systemic risks detailed above, I won’t try to time the market, let alone pick which stocks or bonds to buy and hold and which to sell.

I learned my lesson many years ago.

As a retail investor, I lack the expertise, experience, analyst support, and sheer time to do as good a job as the best investment managers out there, let alone beat them. That’s why I “hire” them, by investing in select active mutual funds and ETFs with a great long-term record of beating the market in terms of risk-adjusted returns.

I trust them to take advantage of current opportunities and mitigate current risks, systemic or specific.

The only shifts I’m making are these:

- Reducing our stock exposure from 85% to 70%, since I expect to start our decumulation phase in under six years.

- Allocating 25% of our stock position to international equities since U.S. equities have long outperformed and, at some point, will likely revert to the mean.

- Shift from over-concentration in large/mega-cap growth investments that have massively outperformed in recent years and seem to be fully or over-priced to a more balanced allocation between large/mega-caps to small/mid-caps and between growth and value/core.

The Bottom Line

There are always risks that could tank your portfolio. However, it seems systemic risks are especially prolific this year.

As Jorey Bernstein, Executive Director, Wealth Manager, and Founder, Bernstein Investment Consultants, lists, “(1) Geopolitical tensions: conflicts or instability in key regions could disrupt global trade and supply chains, leading to economic uncertainty and market volatility. (2) Inflationary pressures: persistent high inflation could erode purchasing power, leading to reduced consumer spending and investment, as well as potential interest rate hikes by central banks to curb inflation. (3) Monetary policy shifts: changes in central bank policies, such as interest rate adjustments or tapering of quantitative easing programs, could impact borrowing costs, investment decisions, and asset prices. (4) Technological disruptions: rapid advancements in technology, such as automation, AI, and digital currencies, could reshape industries, workforce dynamics, and market structures, creating both opportunities and challenges for economies. (5) Environmental challenges: climate-change-related events, such as extreme weather events or regulatory changes aimed at reducing carbon emissions, could affect industries, infrastructure, and economic activity, leading to both physical and transition risks.”

Given all these risks, how can you could reposition your investments to mitigate risk and take advantage of opportunities?

Omar Morillo, Founder of Imperio Wealth Advisors, says, “With looming risks, we advise clients on many investment options to mitigate downside exposure. We also caution against becoming dogmatic; for instance, instead of making a blanket statement on real estate being on thin ice, we look into REITs invested in sectors that stand to benefit from demographic trends (like ten thousand baby boomers turning 65 each day), focusing on long-term-care and assisted-living facilities. Rather than drastically reducing equity exposure, we may look at structured notes, a strategic investment option for mitigating downside risk while maintaining exposure to potential market upsides. However, as with any investment, it’s crucial to conduct thorough due diligence and consider the complexities and risks in the context of one’s investment strategy and objectives.”

Or you could follow my strategy and let the best fund managers out there make the best investment decisions they can for you.

It’s what we pay them for.

Have a Question to Ask a Financial Advisor?

When you’re uncertain about money matters, submit your question to Wealthtender, and it may be answered by a financial advisor in an upcoming article or in the Wealthtender Expert Answers Forum.

Need personalized help? Visit wealthtender.com to find the right financial advisor for your unique needs.

This article was originally published on Wealthtender and is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions. Wealthtender earns money from financial professionals, which creates a conflict of interest when these professionals are featured in articles over others. Read the Wealthtender editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com, and/or follow my Medium publication. Opher Ganel’s Bio on Wealthtender.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor