Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Are you approaching retirement, or as I prefer, work-optional?

I am.

And I’m happy to report that all the years spent building our retirement portfolio worked out ok.

But… and isn’t there always a “but” with these things?

How Just Enough Success Can Backfire

I thought having a decent-sized nest egg would make things easier once I stopped earning wages. So, I maxed out my 401(k) for well over a decade, made catch-up contributions whenever I could, used every tax advantage I was legally allowed, and invested aggressively for growth.

In short, I did my best to play it smart, and it turned out pretty well.

And therein lies the problem.

It’s taxes, and most especially taxes on withdrawals we won’t need, once our Required Minimum Distributions, or RMDs, get much higher than what we’ll likely spend.

If you manage to build a nest egg that’s 40 or 50 times your retirement budget, you don’t need to worry about taxes on your RMDs. Even if they end up as high as 40% of your RMDs, your nest egg will keep growing, assuming you don’t draw more than the RMDs, because you simply won’t spend fast enough to make a dent in such a large portfolio.

On the opposite end, the median net worth of Americans in their late 60s is just $132k (excluding home equity, as it’s hard to spend equity without some undesirable consequences).

If that’s you, and you want your nest egg to last 30 years, you can safely draw between $4000 and $6600 a year.

That’s $330 to $550 a month.

Not nothing, but taxes are probably the least of your concerns.

Getting back to my case, and possibly yours, if you’ve done better than most, we have enough to make taxes a headache once RMDs hit, but not enough for plentiful “headache pills.”

What Are RMDs Anyway?

Remember what I said about using all the legal tax advantages I could?

That includes socking away as much money as I could into traditional IRAs and 401(k) plans. Traditional here means that those contributions were deducted from our taxable income, so we never paid a dime in taxes on that money (yet), or on all the investment gains it brought in.

Well, Uncle Sam was good enough to let us defer those taxes, but not generous enough to let us never pay those taxes.

Enter the dreaded RMD.

Depending on the year you were born, you start having to draw money from your tax-deferred accounts once you reach age 73 or 75. In general, it’s age 73, but the SECURE 2.0 act delayed RMDs to age 75 as of 2033, so if you don’t turn 73 until after 2033, your RMDs start when you turn 75.

How Much Will My RMDs Be?

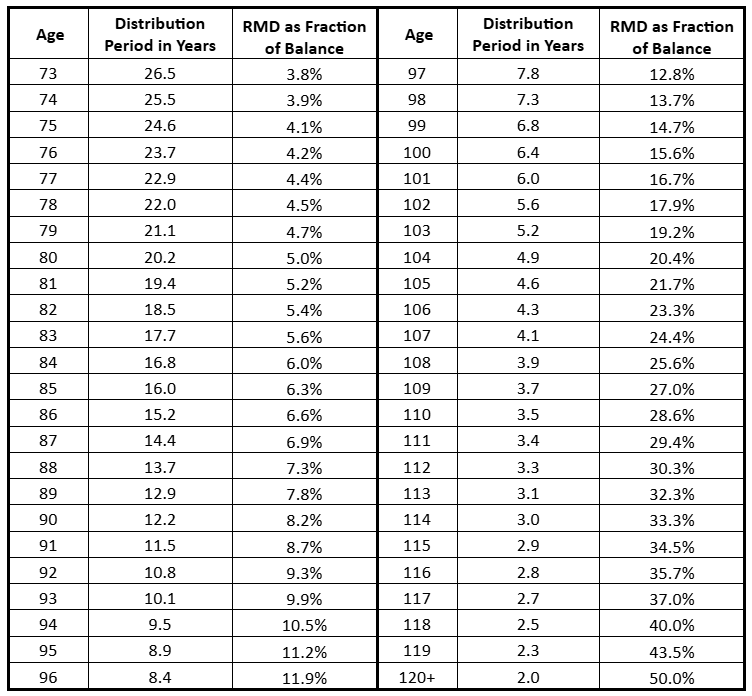

The IRS has an RMD table that tells you what your RMD will be as a fraction of your total tax-deferred balance across all such plans, and how it changes each year.

Let’s say you’re in the happy group that doesn’t need to take RMD until they turn 75.

At age 75, your RMD will be based on an assumed distribution period of 24.6 years, which translates to having to draw 4.1% of your total tax-deferred balance. If that balance is, e.g., $2 million, your first RMD will be $81,301 (there’s some nuance in how your first RMD is treated if you turn 75 partway into the year, but we’ll ignore that here).

Well, 4.1% isn’t too bad, right? I mean, it’s almost exactly what the 4% rule would have you drawing.

Sure. That’s true. But…

The following year, your RMD grows to 4.2%. The year after, 4.4%. See the pattern? By the time you’re 85, your RMD climbs to 6.3%, far higher than you should plan to spend. By age 90, it’s 8.2%. At 95, if you live that long, it’s 11.2%. And it only ever increases, until at the exceedingly unlikely age of 120, it hits 50% and stays there.

Why Growing RMDs Are a Headache

Research shows that retiree spending starts declining, rather than growing, as we grow older, less healthy, and less mobile.

Financial planners even came up with a catchy way of putting it – the first decade of retirement, they call your “go-go years.” The second decade, your “slow-go years.” Your third decade (if you’re still alive) – your “no-go years.”

Combine these two opposing trends, increasing RMDs and decreasing spending, and, assuming we reach old enough age, we’ll be forced to draw (and pay taxes on) sums that are much higher than what we’ll spend.

And lest you think that drawing down investments that were made years ago, far longer than 12 months, are taxed at the preferred long-term capital gains rates, as our New York and New Jersey buds would say, Fuhgeddaboudit!

Nope. All distributions from tax-deferred accounts (there are some very limited exceptions, like qualified health-related expenses paid from Health Savings Accounts) are taxed as regular income. That means your marginal rates could be as high as 37%(!), and that’s just federal income tax. State income taxes could add to that anywhere up to 13.3% (in California).

And adding insult to injury, once your taxable earnings (including RMDs) are enough to count as “too much,” you’ll get hit with the so-called Medicare Income-Related Monthly Adjustment Amount (IRMAA) that increases your Medicare Part B and Part D premiums.

What Can You Do About RMDs?

Straight off the bat, let’s exclude dying before you reach RMD age or not having any retirement plan balances.

Some people swear by doing a so-called Roth conversion (or even a mega-Roth conversion), whereby they convert tax-deferred money in traditional IRAs or 401(k) plans to after-tax money in Roth versions of those accounts.

The problem is that rather than avoid paying taxes, or at least reducing how much you get taxed, these conversions are taxed as distributions in the year(s) you take them.

And since you’re trying to minimize RMDs that won’t hit until age 73 or 75, paying extra taxes when you’re 60, or 65, or 70 hardly seems to me like a great solution. In fact, I modeled it for our case, and the projected results showed our net worth shrinking rather than growing for the first 20 or 25 years. It’s only once I’d be 90 or older that we’d break even.

So, no, Roth conversion isn’t in my game plan, though, as they say, your mileage may vary, and in your specific circumstances, it may make more sense.

So, I started looking for a better solution. Not a gimmick. Not some convoluted strategy that flips my whole financial plan upside down. Just something simple that could help reduce the size of my eventual RMDs without paying more taxes now.

You might think that would be a wild goose chase, but it turns out that since the so-called “Setting Every Community Up for Retirement Enhancement 2.0” or SECURE 2.0 Act of late 2022, there is actually a solution like that.

It’s called Qualified Longevity Annuity Contracts (QLACs).

An Annuity?! Really?!

I’m sure you’ve heard just as many annuity horror stories as I have. And there are certainly a lot of questionable, high-fee annuity products out there, ones that most benefit the agent who sells them to you and pockets a large commission, whether or not it’s the best solution for you.

But let’s not tar an entire industry with that broad brush. So, yes, an annuity, but a very specific type that you buy inside an IRA or 401(k) plan that allows it.

Here’s how it works.

- You take a portion of your plan balance (up to $210,000 lifetime allowed, indexed for inflation, and you can do it all at once or break it up into several smaller annual amounts) and use it to buy a deferred income annuity.

- The amount you invested in the annuity is immediately removed from your plan balance, which reduces your RMDs (e.g., if you invest $200k out of a $2 million total balance, your RMDs are reduced by 10% from the later of your RMD starting age or when you made the investment).

- When you make the investment, you specify several things, including (a) at what age you want to start receiving annuity payments, which can be any age up to 85; (b) if you want it to be for your lifetime, your joint lifetime with your spouse; (c) if you want an inflation rider (if it’s offered); and (d) if you want your heirs to receive a lump sum equal to any amounts you paid in as premiums less the total amount of payments you received over your lifetime.

- Once you start receiving annuity payments, those count toward your RMD even for the portion of your plan balance that isn’t in the annuity.

- Since the insurer makes a good bit of money from investing your premiums for many years without any payouts, those payouts are far more generous than you’d be able to safely withdraw from a portfolio of the same size. Also, those payouts continue for the defined lifetime, even if they exceed by far the premiums you paid in.

What’s to Like About QLACs?

QLACs are not right for everyone. But if they’re right for you, you get multiple benefits:

- The reduced balance in your tax-deferred portfolio reduces your RMDs, and thus your taxes, until you start receiving annuity payments. This can also drop your income below the IRMAA limit, potentially saving you thousands of dollars a year in excess Medicare premiums, potentially until you’re 85.

- For the portion of your portfolio that’s invested in the annuity, you get a guaranteed-for-life payout that’s much higher than what you’d get from an immediate annuity (though it may not be more than you’d get if you invested those premiums for all those years and then bought an immediate annuity. However, you remove all market risk, and if you pick a strong insurer, the risk of not receiving the guaranteed payments is very low.

- Once you reach the QLAC’s payout age, your QLAC payments will count toward your RMD, so the non-annuity part of your portfolio isn’t depleted as quickly.

- If you plan to have some part-time side gig that brings in some cash after you no longer hold your full-time job or business, the QLAC payments can replace that income once you’re no longer able to or interested in continuing that side gig.

Stephen Mazer, Principal and Senior Wealth Advisor at Rational Wealth Solutions, thinks there’s a lot to like in QLACs now, but points out that timing is crucial. “We love the advantages the recent SECURE Act provides many people in a QLAC, but we find it’s a bit of a Goldilocks situation. Not too soon and not too late is our general rule of thumb for timing when to add a QLAC into a financial plan.

“Here’s why. If a client is just entering retirement, let’s say at age 65, they don’t yet know the patterns of their real retirement cash flows, and we don’t want to encumber their retirement savings until we do. Also, markets could provide a better return over such a long period, and that risk may be more tolerable once you have a shorter investment time horizon in the future.

“But if you wait too long, you’re too near the year of income starting, so you miss out on much of the benefit of RMD reduction or the annual income bumps during the waiting period the QLAC provides.”

He then adds, “Another bonus of a QLAC is the certainty of lifetime payouts that can provide for long-term care (LTC) when it’s most needed. Many clients at this age aren’t insurable, so they can’t get approved for a new LTC policy.

“QLACs offer a neat alternative, no matter your health status. Sure, an investment account might grow more, but the deferred annuity guarantees an amount that most clients are happy to lock in with no further market risk to that portion, knowing it will be there if and when they need to pay for long-term care.”

So, that’s it in a nutshell.

What Are the Drawbacks of QLACs?

There are three main drawbacks.

First, while QLACs are simple in concept, there are lots of complicated terms and provisions, so you need to make sure that (a) you work with a great financial advisor who can help you decide if a QLAC is right for your situation and goals, and then, if the answer is yes, (b) you work with a scrupulously honest agent who will explain clearly and honestly how those terms and provisions will impact your finances.

The second drawback is even more nuanced. QLAC payouts are guaranteed, and if you pick a plain vanilla one, the payments will be predetermined. The flip side of that coin is that, to make sure they make a profit after paying the agent commissions and your expected payouts, those guaranteed payments will be lower than the average you could expect to get by investing the money in other types of financial products. In short, you’re trading a likely better financial outcome to get a guarantee of (what you need to verify) is a good enough outcome.

The third drawback is that, like with any annuity, once you invest money in it, it becomes totally illiquid, i.e., you can never withdraw your premiums (the one caveat is that your heirs can get back some or all of the premiums you paid, assuming that you buy that rider and that you haven’t received more in payouts than your initial premiums). All you can take out of the annuity is the contracted payouts, and those don’t start potentially until you’re 85. This is why you should most likely not invest more than a reasonably small fraction of your portfolio value.

Is This Solution Right for You?

The answer is that I don’t know, but I think it’s worth asking a professional financial advisor about it and getting them to show you your projected results with a QLAC vs. without one.

You should also ask them to compare investing the full lifetime limit at once, or breaking it into three, four, or even more years. That latter option can reduce your risk that interest rates happen to be lower in the one year you get the QLAC (though it’s possible that the year you’d have made the full investment would have especially high interest rates, with lower rates in the subsequent years – as they say, you make your bet and you take what you get).

But QLACs aren’t necessarily just for those who want to minimize their RMDs. Mike Hunsberger, ChFC®, CFP®, CCFC, Owner of Next Mission Financial Planning, recommends QLACs to some clients even if RMDs aren’t their top concern.

He says, “I suggest clients consider QLACs if they are concerned about longevity and potentially running out of money. Even though Social Security is adjusted for inflation, many pensions are not. As people age, even the inflation adjustment may not keep pace with their increasing spending needs. A QLAC could address this shortfall because, with payments starting later in life, they provide a relatively high payout.”

Ryan McLin, CFP®, MBA, Founder & Financial Advisor at Impact Wealth Group, elaborates on what kind of client would be a great fit for investing in a QLAC, “A QLAC is ideal for high-net-worth clients in their 60s with large pre-tax IRAs, no immediate income need, and longevity in their family. It reduces future RMDs, defers taxes, and guarantees income later in life—fitting well into a tax-focused, long-term retirement income strategy.

“Here’s an example of one of our clients: in their early 60s with several million dollars in investment assets, still working and investing. About 90% of their retirement dollars are in pre-tax accounts, and they expect millions more to come in over the next few years—perhaps from a business sale, deferred compensation, or other liquidity events. Despite proactive Roth conversions up to the 32% tax bracket, there’s simply too much tax-deferred money to meaningfully reduce RMDs through conversions alone.

“Come age 75, their RMDs will be enormous—ballooning income, spiking tax brackets, and triggering Medicare IRMAA surcharges. This client has no need for IRA withdrawals in the near term, a family history of longevity (mid-90s+), a focus on tax-efficient income planning, and a willingness to sacrifice liquidity for guaranteed income in later years.

“For them, a QLAC is a tax-smart lever: it lets them defer RMDs on up to $420,000 ($210k each) until age 85, reducing forced income at age 75. This allows a longer timeline to continue to implement Roth conversions as well, instead of trying to ‘do it all’ before 75 years old.

“A good advisor will know the answers to these questions for their clients, but some important questions to answer include: Will you need RMDs for income in retirement, or are they more of a tax problem than a spending need? Are you comfortable giving up access to part of your IRA balance until age 85? If you were to pass away earlier than expected, would you be concerned about not fully receiving the value of the funds you contributed? Do you have a family history of living into your late 80s or 90s? Are you trying to decrease RMDs to avoid higher tax brackets or Medicare surcharges?

“For charitably inclined clients, we explain the benefit of Qualified Charitable Distributions (QCDs) after age 70.5, along with QLACs and Roth conversions.”

But lest you think QLACs are always a slam-dunk proposition, Joseph Carbone, CFP®, Founder & Financial Planner of Focus Planning Group, has the opposite view. While he sees the benefits of QLACs, he doesn’t recommend them to his clients, “QLACs are a great way to reduce the tax effect of RMDs if you have substantial income, while also reducing the potential impact of IRMAA surcharges, because they allow you to defer the RMDs on the amount invested in QLAC until the income starts, typically between age 80 and 85. The maximum amount that can be put into a QLAC in 2025 is $210,000. Having said all of that, I don’t end up recommending these products to clients, mainly due to their illiquid nature.”

The Bottom Line

While I’ve been successful enough to have a decent nest egg that should let us live comfortably for the decades that I hope we’ll live without having to work, that nest egg isn’t so large that I can ignore the eventual impact of excessive taxes once RMDs hit.

This means that I need some reasonably simple and effective solutions that could reduce our RMDs, and QLACs seem to fit that bill.

To make sure, I plan to model how a QLAC would impact our taxes and Medicare premiums over a multi-decade retirement, considering all sources of income including the taxable portion of Social Security benefits, and the eventual QLAC payouts and remaining RMDs; how that, in turn, will affect our projected net worth; and how all this will affect the eventual bequest we’ll be able to leave to our kids and our favorite charities.

I’m also planning to find a good financial advisor and ask him or her to poke as many holes as he or she can in my plan and then help me tweak it to close those holes.

And no, this won’t make our RMDs magically disappear, but it may help shrink them and delay a portion, making our taxes that much more manageable. If you’re in a similar spot—worried about RMDs forcing you to withdraw more money than you need, resulting in higher taxes you don’t want to pay, and income you’d rather spread out—then QLACs might be worth a look.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor