Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

When you contribute to a 401(k), your investments grow tax deferred. But when you start taking distributions, you typically pay ordinary income taxes on the entire amount withdrawn.

However, if you own your employer’s publicly traded stock inside your 401(k) — and that stock has appreciated in value — you may be able to use a strategy called Net Unrealized Appreciation (NUA) to lower the taxes you pay.

NUA allows you to instead pay the lower long-term capital gains rates when you sell the shares. This can result in significant tax savings, but strict IRS rules must be followed.

How to Qualify for the NUA Tax Strategy

To take advantage of NUA, you must meet three important requirements:

1. Experience a Qualifying Event

To unlock the NUA tax benefit, you must experience one of the IRS-defined “triggering” events. These include:

- Separation from service (i.e., you leave your employer, whether through retirement, resignation, or termination).

- Reaching age 59½, even if you continue working.

- Death (in which case, beneficiaries can utilize the NUA strategy under specific rules).

2. Distribute Employer Stock Shares In-Kind

The employer stock must be transferred directly to a taxable brokerage account without selling it first.

- You cannot liquidate the stock inside the 401(k) and move cash instead — this would disqualify the stock from NUA treatment.

- The shares must move “in-kind,” meaning as-is, to preserve their original purchase cost (known as your “cost basis”).

3. Complete a Lump-Sum Distribution

You must distribute the entire balance of your employer-sponsored retirement plan within one calendar year.

- “Lump-sum” doesn’t necessarily mean cashing out all investments; it means you must move all assets (stock, mutual funds, etc.) out of the plan to reach a $0 balance.

- Any assets not related to employer stock (like mutual funds) can be rolled into an IRA to maintain their tax-deferred status.

Partial or phased distributions would disqualify your ability to claim NUA tax treatment.

Example

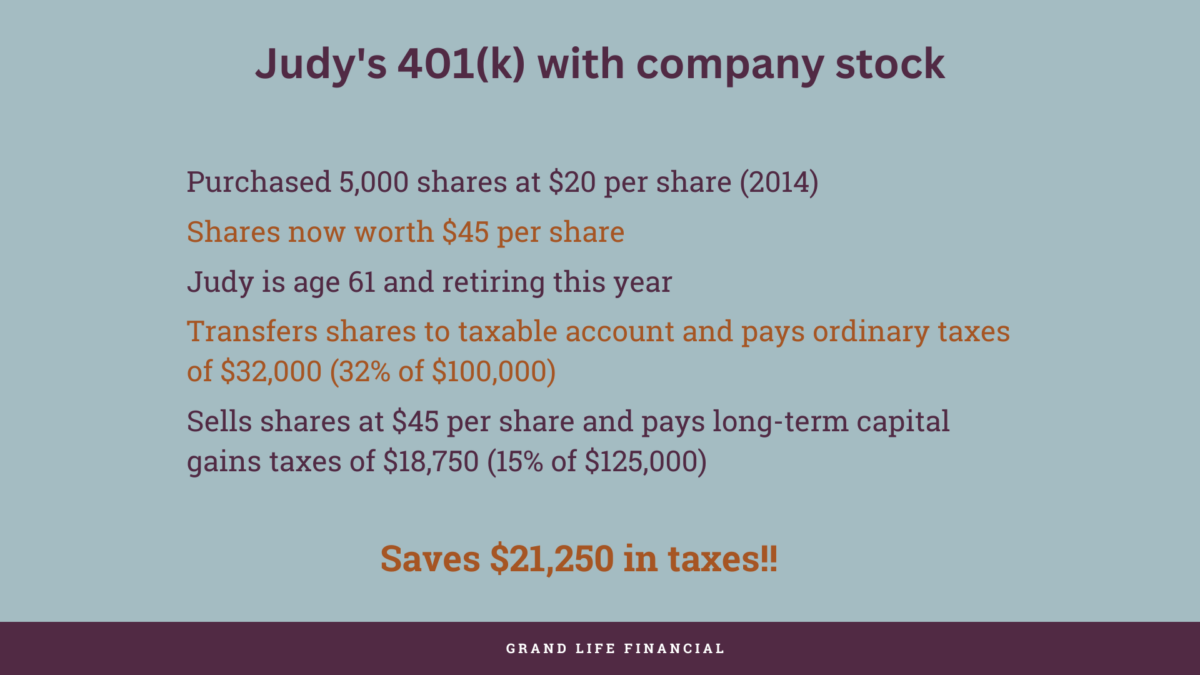

Judy participates in her company’s 401(k) and owns 5,000 shares of her employer’s stock.

- She bought the stock at $20 per share in 2014.

- Today, the shares are worth $45 each.

Judy is 61 and retiring this year — a qualifying event. She decides to use the NUA strategy.

When Judy transfers the shares in-kind to her taxable brokerage account:

- She pays ordinary income tax on the $100,000 cost basis (5,000 shares × $20).

- She does not pay tax yet on the $125,000 of appreciation (5,000 × ($45 – $20)).

Later, when Judy sells the shares, she will pay long-term capital gains tax on the $125,000 of growth — saving her over $21,000 in taxes compared to if she had taken a normal 401(k) withdrawal.

Final Thoughts

If you have highly appreciated company stock inside your 401(k), using the NUA tax strategy can be a powerful way to cut your future tax bills.

However, the rules are strict — missing any one step can disqualify you from the benefit. Make sure you work closely with a financial professional to properly execute the NUA distribution.

This article was originally published here and is republished on Wealthtender with permission.

John Foligno, CMC® | Grand Life Financial

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor