Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

I am a second-generation Californian and a San Diego native. However, with our 10-year plan for retirement on the horizon, my husband and I have pulled up stakes and moved to Lake Havasu City, Arizona.

Initially, when we shared our plans with friends, some were excited for us, others were shocked, and most thought we were downright crazy.

Repeatedly, we heard a similar reaction, “Well, it’s going to be quite an adventure…a real journey!”

Ready for a Good Laugh?

We sold our lovely executive home in Fallbrook, California.

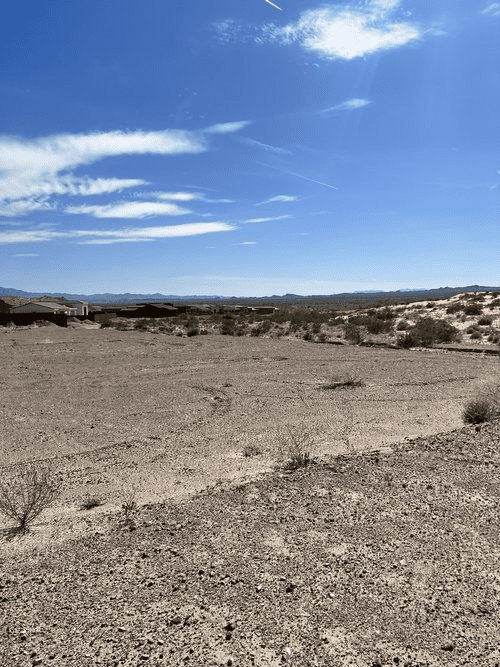

We bought a piece of land in Lake Havasu City, Arizona. Over the next year, Merrill Home Builders LLC will build our new home.

Where Will We Be Living During the One Year Build?

Well, that’s the big funny, let me explain.

We have two big Golden Retrievers. In the resort community of Lake Havasu, rental agents do not look kindly on renting to pet owners.

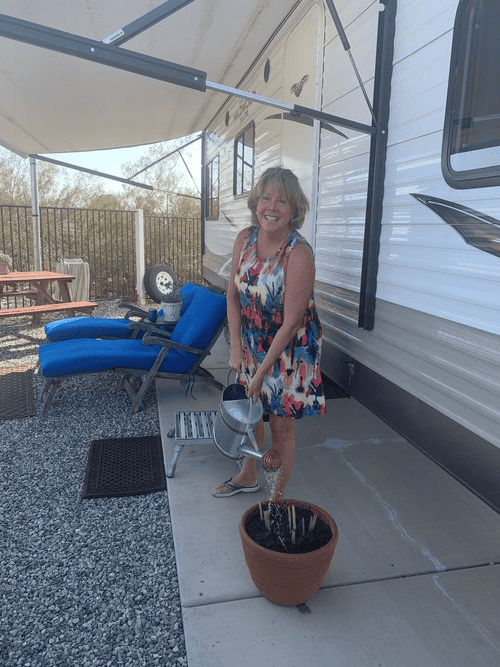

A month or so ago, my husband and I were outside at the pool chatting about what was to come. I brought up the issue of our next year of lodging. He looked at me and said, What about our trailer?

Well, I’m all for ‘glamping’ in our 25-foot toy hauler trailer over a long weekend, but a year? Ok self, keep your eye on the prize. I answered, I can do it!

Our Why

I’m a Certified Financial Planner®. I love to plan and think about money. So let me share about our why.

First, when a person retires, they often feel like they are giving up a significant part of their identity. Work is why they have been getting out of bed each morning for the past 40 years!

Second, retirees quickly recognize they don’t need the big house and the hefty expenses associated with maintaining their previous lifestyle. Downsizing and moving away from their community becomes a topic of conversation.

Give up work and move from your community. That is two big life decisions! Many retirees take on these transitions all at once. Sometimes that all-in-one transition is overwhelming.

I’ve adopted a new philosophy. The impact of this major life shift could be softened with a long glide path.

Our Solution

We are making the downsize move now. We are getting established in our new community today. We will be meeting new friends and taking the opportunity to clear out the clutter of our former lifestyle. How cool!

Let’s face it, our kids do NOT want our china, crystal, and collector’s pieces. I rarely use these ‘treasures’ anyway. When I pass away, I do not want the burden of having to clear out all this ‘stuff’ to fall on my kids.

Financial Impact

This new chapter in our lives has put me into serious planning mode. It is entwined in critical financial decision-making for long-term success.

Bottom line, we have calculated and expect a significant benefit to our financial lifestyle!

I’ll write more about these changes in the next blog installment.

Stay Tuned

For more good laughs, savvy financial tips, and some updated pictures about a slow retirement glide path, stay tuned. Over the next year, I will frequently post about our Adventure and Journey.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Marianne Nolte, CFP®

Website | Wealthtender Profile

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor