To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Your SGLI Benefits and the HEART Act: A Golden Opportunity for Your Future

As a Gold Star Widow, you have already given so much in service to our country. The loss of your spouse represents the ultimate sacrifice, and while nothing can replace what you’ve lost, there are financial tools available to help secure your future and honor their memory through wise financial planning.

If you’ve received Servicemembers’ Group Life Insurance (SGLI) benefits and Death Gratuity payments, you have a unique opportunity that most people or even the typical financial advisors don’t know about. Thanks to some legislation called the HEART Act, you can put these entire benefits into a special type of retirement account called a Roth Individual Retirement Account (IRA). This choice could mean hundreds of thousands of extra dollars for you and your family over time.

Think of this as planting a seed that will grow into a mighty oak tree over the years. The money you plant today can grow tax-free for decades, giving you and your children a much brighter financial future as a gift of love from your late spouse and as a debt of gratitude from our nation.

What is SGLI and Death Gratuity and Why They Matter to You

Servicemembers’ Group Life Insurance, or SGLI for short, is life insurance that the military provides for service members. When a service member dies, their family receives this insurance money. The current SGLI benefit is $500,000 for most military families.

Along with SGLI, you may also be eligible for the Death Gratuity benefit. This is a special tax-free payment of $100,000 that goes to eligible survivors of members of the Armed Forces who die while on active duty or while serving in certain reserve statuses. The Death Gratuity is the same regardless of the cause of death and is exempt from federal income tax. This benefit is typically paid out within 72 hours of receiving DD Form 397 so most people recieve this benefit before SGLI.

Together, these benefits can total $600,000. This money is meant to help you and your family during this difficult time. It can pay for immediate needs like funeral costs, daily expenses, and help replace the income your spouse provided. For many Gold Star families, these benefits represent the largest amount of money they will ever receive at one time.

Both the SGLI benefit and Death Gratuity come to you tax-free. This means you don’t have to pay income taxes on this money when you receive it. This is already a huge advantage, but there’s an even bigger opportunity available to you through the HEART Act.

Understanding the HEART Act: A Gift for Military Families

The Heroes Earnings Assistance and Relief Tax Act, known as the HEART Act, became law in 2008. Congress created this law specifically to help military families who lost loved ones in service to our country. The law recognized that these families needed special help and deserved special treatment when it comes to taxes and retirement savings.

One of the most powerful parts of the HEART Act deals with something called “qualified military death benefits.” Both your SGLI payment and Death Gratuity fall into this category. The HEART Act says that if you receive these benefits, you can put the money into retirement accounts in ways that other people cannot.

Normally, there are strict limits on how much money you can put into retirement accounts each year. For 2024, most people can only put $7,000 per year into an IRA. If you wanted to put $600,000 into an IRA the standard way, it would take you many decades! But the HEART Act changes this rule for military families like yours.

The Roth IRA Opportunity: Your Path to Tax-Free Growth

A Roth Individual Retirement Account, or Roth IRA, is like a special savings account for retirement. What makes it special is that once you put money into it, that money can grow for decades without you paying taxes on it again (subject to certain restrictions). Not when it grows, not when you take it out in retirement, and not when you pass it on to your children.

Here’s how it normally works: You put money into a Roth IRA after you’ve already paid taxes on it. The money then grows tax-free. When you retire and take money out, you don’t pay any taxes on what you withdraw. It’s like planting a seed with after-tax dollars and harvesting a tax-free tree years later.

The HEART Act gives you something amazing: the ability to put your entire SGLI benefit and Death Gratuity into a Roth IRA, even though it’s much more than the normal annual limits. You can contribute up to the full amount of your qualified military death benefits. So if you received $500,000 in SGLI benefits and $100,000 in Death Gratuity, you could potentially put all $600,000 into a Roth IRA.

The long-term benefits of this opportunity are truly life-changing.

The Amazing Long-Term Benefits of This Choice

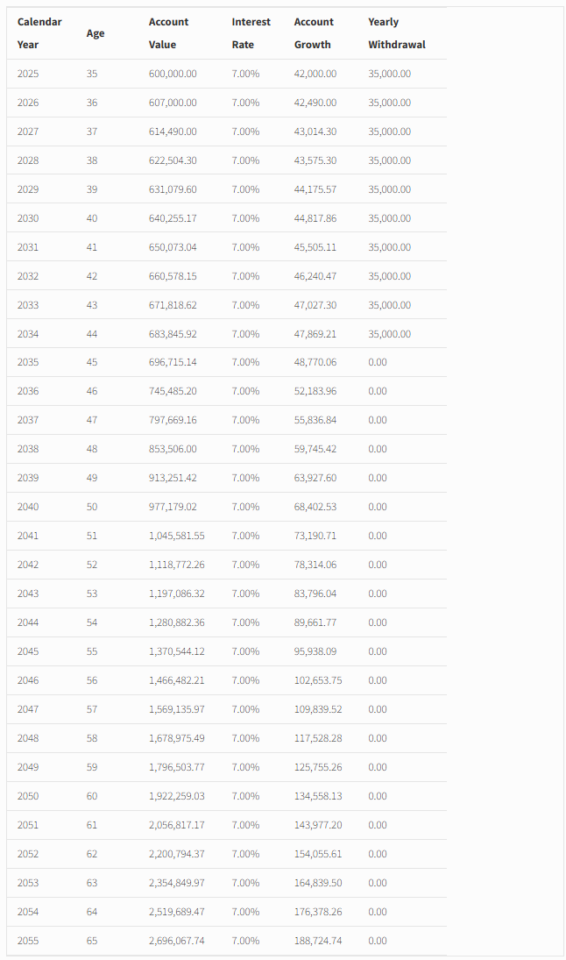

When you put your SGLI and Death Gratuity benefits into a Roth IRA through the HEART Act, you’re setting yourself up for incredible long-term growth. Let’s look at what this could mean for your future with some real numbers.

Imagine you put the full $600,000 into a Roth IRA and let it grow for 30 years. If your investments earn an average of 7% per year (which is reasonable for a long-term investment mix), your $600,000 could grow to over $4.5 million. And remember, you would never pay taxes on any of this growth or when you withdraw it in retirement.

But the benefits go far beyond just the numbers. Here are the key advantages that make this opportunity so special:

Tax-Free Growth Forever: Once your money is in the Roth IRA, it grows without any tax burden. Every dollar of growth is yours to keep. Compare this to a taxable savings or brokerage account where you pay taxes on interest, or a traditional IRA where you pay taxes when you withdraw money in retirement.

No Required Withdrawals: Unlike traditional retirement accounts that force you to start taking money out at age 73-75 (see SECURE Act 2.0), Roth IRAs have no required minimum distributions during your lifetime. This means your money can keep growing for as long as you want it to, even well into your retirement years.

Tax-Free Legacy for Your Children: When you pass away, your children can inherit your Roth IRA and continue to benefit from tax-free growth. This means the sacrifice your spouse made can continue to bless your family for generations to come. Your children will be required to withdraw the money over 10 years, but all of those withdrawals will be completely tax-free to them.

Flexibility When You Need It: This is one of the most common questions and hesitations from clients … “What about needing some of the funds in the near term, not just for retirement?” While the Roth IRA is designed for retirement, you can withdraw your original contributions (the $600,000 you put in) at any time without taxes or penalties. This gives you a safety net if you face a true emergency or just need withdrawals built into the plan along the way. The growth portion has some restrictions if you withdraw it before age 59½, but your original contribution is always available to you.

Let’s look at another example to show the power of time. If you’re 35 years old when you make this contribution and let it grow until you’re 65 (30 years), your $600,000 could become over $4.5 million. If you’re 25 years old, that same money growing for 40 years could become over $8.9 million. The longer it compounds, the more powerful this becomes.

Even if you need to use some of the money along the way, you’re still far ahead. Let’s say you withdraw $350,000 over 10 years for various needs while still having kids in the house and taking the time to figure out what is next. In that case, the original contribution plus account growth is still on track to set you up for future retirement needs very nicely with a projected balance of more than $2.6M at age 65.

How to Actually Do This: Your Step-by-Step Guide

Making this HEART Act Roth IRA contribution might seem overwhelming, but the process is straightforward when you break it down into steps. Here’s exactly what you need to do:

Step 1: Know the Timeline – You Have One Year: The most important thing to know is that you must make this contribution within one year of receiving your SGLI benefits. This deadline is firm, so don’t wait. Mark your calendar with the one-year anniversary of when you received these benefits. Ideally you want to have this completed several months ahead of time in case there are questions or complications.

Step 2: Choose a Financial Institution: You can open a Roth IRA at most banks, credit unions, or investment companies. Look for institutions that offer low fees and good investment options. Some popular choices include Vanguard, Fidelity, Schwab, and you would be well served at either of those. You can also work with a financial advisor like Wise Stewardship Financial Planning who can help you choose the right place and investments.

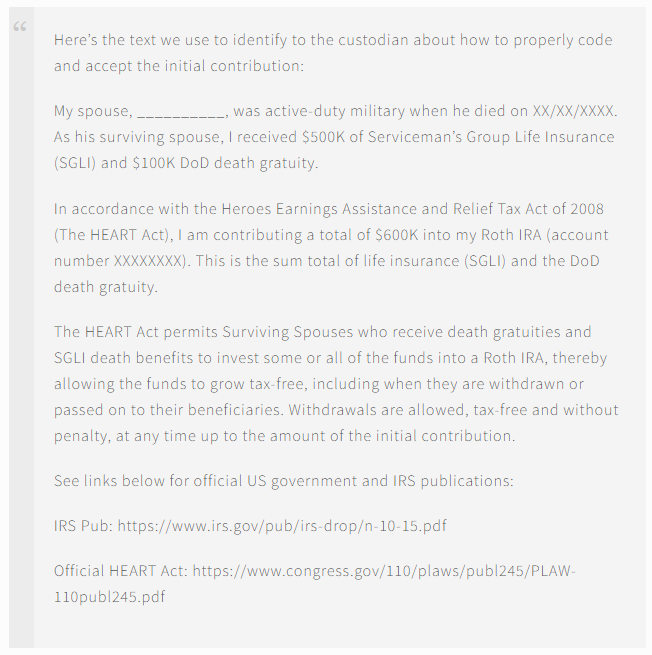

Step 3: Open Your Roth IRA Account: When you open the account, tell them you want to make a HEART Act contribution. Don’t be surprised if the representative on the phone doesn’t know what that is. Instead, typically use written correspondence with references to legislation and IRS publications. You may need to provide documentation showing that you received qualified military death benefits. Typically though, the custodian knows you have to keep the proof in case of IRS questions so they rely on your application.

Step 4: Make the Contribution: You can contribute up to the full amount of your qualified military death benefits. This includes both SGLI ($500,000) and Death Gratuity ($100,000) for a total of up to $600,000. You don’t have to contribute the full amount (but it is generally best practice to fund it all at once) if you don’t want to or if you need some of the money for other purposes. But in most cases even if you plan to use some of the funds as discussed above, you can withdraw the original contribution amounts as needed with no taxes and penalties.

Step 5: Choose Your Investments: Once the money is in your Roth IRA, you need to invest it. Leaving it in cash or a savings account won’t give you the growth you need. Consider a diversified mix of stock and bond funds based on your age and risk tolerance.

Step 6: Keep Good Records: Save all documentation about your contribution, including records of your SGLI and Death Gratuity payments, and your Roth IRA contribution paperwork. You’ll need this for your tax records, especially for withdrawals of the contribution basis prior to your age 59 1/2.

Other Things to Think About

Making the decision to put your SGLI and Death Gratuity benefits into a Roth IRA is a big choice, and it’s normal to feel overwhelmed. As someone who has walked this path of grief and brain fog myself, I understand the things that can cloud your thinking during grief.

When I became a widower after my wife Sarah passed away, I experienced firsthand what grief brain fog feels like. Simple decisions became difficult. I would forget where I put my keys, struggle to remember conversations, and feel exhausted even after a full night’s sleep. More than nine out of 10 widows experience this brain fog, according to studies by Modern Widows Club, so if you’re feeling this way, you’re not alone.

During my grief journey, I learned that making major financial decisions while dealing with brain fog and the pain of loss requires extra care and support. That’s why it’s so important to think through all aspects of this decision before you act.

How This Fits with Your Other Financial Goals: Before putting all of your benefits into a Roth IRA, consider your complete financial picture. Do you have an emergency fund with 3-6 months of expenses? Are there any immediate debts you need to pay off? What other life insurance or retirement and investement accounts are also available for needs now and in the future?

You don’t have to put the entire $600,000 into the Roth IRA. You might choose to put $400,000 into the Roth IRA and keep $200,000 for immediate needs and emergency funds. Or you might put in the full amount if you have other resources to cover your short-term needs. The key is making a thoughtful decision that fits your unique situation.

Think About Your Timeline: The Roth IRA is most powerful when you can let the money grow for many years. If you’re younger, this opportunity is even more valuable because you have more time for compound growth. If you’re closer to retirement age, you will still benefit greatly, especially considering the tax-free legacy you can leave to your children.

When Professional Help Makes Sense: During my own grief journey, I learned that sometimes we need to lean on others for support. Just as I relied on my family, church, fellow widowed spouses, and an invaluable grief counselor to help me move forward, you might benefit from professional financial guidance during this difficult time.

A financial planner who understands grief and military benefits can help you work through the brain fog and make decisions that align with your values and goals. They can help you see the big picture when everything feels overwhelming and ensure you’re making choices that honor your spouse’s memory while securing your future.

Don’t Rush, But Don’t Wait Too Long: You have one year to make this decision, but that doesn’t mean you should wait until the last minute. Grief has a way of making time feel strange – some days crawl by while months seem to disappear. Set a target date well before your deadline so you have time to think through your options without pressure.

Remember, there is no “moving on” from grief – it will always be a part of you. But there is moving forward and taking the next step. Making wise financial decisions during this time is one way to honor your spouse’s sacrifice while building security for your future.

Key Takeaways and Your Next Steps

Your SGLI and Death Gratuity benefits represent more than just insurance money – they represent your spouse’s final gift to you and your family. Through the HEART Act, you have a unique opportunity to turn this gift into lasting financial security that can benefit you and your children for decades to come.

Here’s what you need to remember:

- You can contribute up to $600,000 ($500,000 SGLI + $100,000 Death Gratuity) to a Roth IRA under the HEART Act

- This money will grow tax-free for the rest of your life and can be passed tax-free to your children

- You have one year from receiving these benefits to make this contribution

- The earlier you do this, the more powerful the long-term growth becomes

The potential is enormous. This isn’t just about money – it’s about creating the financial freedom to live the life your spouse would have wanted for you and your family.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Daniel Kopp, CFP®, MA | Wise Stewardship Financial Planning

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor