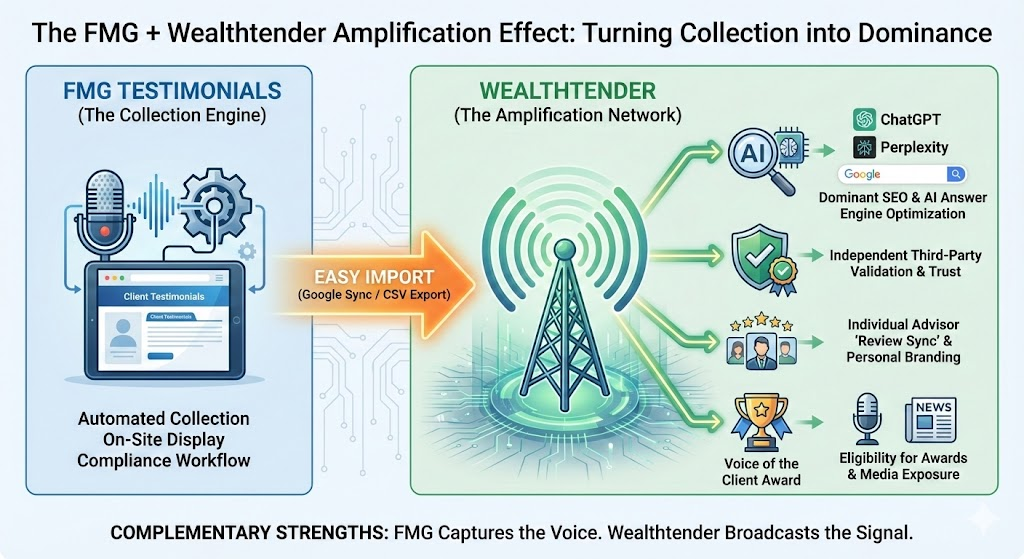

In 2026, FMG clients are gaining access to a robust testimonial collection and publishing tool designed for regulatory compliance, and optionally capable of increasing Google Reviews. That’s a solid foundation to stand apart. FMG clients positioned for the greatest success in 2026 and beyond won’t stop there. They will unlock the full potential of their testimonials with Wealthtender’s online review features to maximize AI visibility, reach more qualified prospects, increase lead conversions, and grow faster.

FMG’s recent acquisition of Testimonial IQ (now rebranded as FMG Testimonials) is a positive development for financial advisors and wealth management firms that use FMG’s platform. If you’re an FMG client, you may now have access to FMG Testimonials, a thoughtfully-designed platform to compliantly collect client testimonials and display social proof on your website, potentially at no additional cost as part of your existing FMG subscription.

FMG Testimonials is a purpose-built, compliance-first solution that handles the testimonial collection workflow well. If you’re using it today or planning to do so, you’re off to a strong start and ready to set yourself apart from the ~90% of financial advisors not using testimonials to build trust with prospects.

But here’s the question you need to ask yourself: Once I’ve collected client testimonials, how can I be sure I’m maximizing their value to grow my business?

Collecting a testimonial and publishing it on your website is a great first step. What many advisors miss is step two: amplifying that social proof so it reaches far beyond your existing website audience into search engines, AI tools, find-an-advisor directories, and everywhere that thousands of consumers are actively searching online for a financial advisor right now.

This article is for FMG clients who want to generate the greatest ROI from the testimonials they’ve gathered. It explains how Wealthtender works alongside FMG Testimonials as the amplification layer that ensures your hard-earned testimonials achieve the broadest possible marketing impact to reach more prospects, increase lead conversions, and grow your firm faster.

Note: On February 4, 2026, FMG announced its acquisition of Testimonial IQ and rebranded the platform to “FMG Testimonials”. Much of the information on this page reflects publicly available information about Testimonial IQ prior to the acquisition. Wealthtender will update this article as new details become know about relevant changes or new features introduced by FMG. In the meantime, if you’re evaluating FMG Testimonials and Wealthtender, we encourage you to schedule a demo call with FMG and schedule a demo call with Wealthtender prior to ensure you have the most up-to-date information about both platforms and increase the likelihood you choose the right platform(s) to support your objectives.

Key Takeaway:

FMG Testimonials helps advisors compliantly collect, manage and publish client feedback on their websites and gather more Google Reviews.

Wealthtender maximizes the power of your testimonials to reach the most prospects, increase lead conversions and grow your firm faster with industry-leading SEO/AEO (Answer Engine Optimization) benefits, plus discoverability in the most popular find-an-advisor directory featuring verified client reviews.

FMG clients who pair FMG Testimonials with Wealthtender are positioned to generate the greatest ROI from testimonials to grow their business.

Table of contents

- The Gap Between Collecting a Testimonial and Maximizing Its Impact

- How FMG Clients Can Publish Their Reviews on Wealthtender

- The Wealthtender Advantage: Five Ways We Ensure Your Reviews Work Even Harder for You

- Wealthtender Digital Marketing Benefits Beyond Testimonials

- The Wealthtender Value Proposition: What You’re Getting for $79/month (or Less)

- FAQs: Evaluating FMG Testimonials and Wealthtender

- Should You Pair FMG Testimonials with Wealthtender?

The Gap Between Collecting a Testimonial and Maximizing Its Impact

Think about what happens when a client submits a glowing testimonial through FMG Testimonials. The platform collects it, routes it through a compliance workflow, and, once approved, displays it on your website. That’s exactly what it’s designed to do, and it does it well.

Testimonials published on your website accelerate the trust-building process with people who have already found their way to you. And with proper schema markup offered by FMG, your published testimonials have an increased likelihood of appearing in answers generated by AI search tools like ChatGPT, Gemini, Google AI Overviews and Perplexity.

But across all types of businesses, the most impactful way to harness the real power of testimonials is to ensure they exist as online reviews published on reputable third-party review platforms with the authority, structure, and consumer traffic to ensure you’re discoverable by consumers and gain the greatest likelihood of appearing in AI search tools. Wealthtender was built specifically to bridge this gap for financial advisors and wealth management firms with an approach designed for SEC/FINRA compliance.

Of course, the team at FMG recognizes the importance of third-party review sites as well, which is one of the reasons why FMG Testimonials provides an optional feature after clients submit a testimonial inviting them to sign into their Google account where they can also submit their testimonial as a Google Review on the advisory firm’s Google Business Profile.

For firms not comfortable with the potential regulatory risks of Google Reviews, FMG Chief Evangelist Samantha Russell recommends Wealthtender as an industry-specific third-party review platform for publishing reviews compliantly. While a direct integration from FMG Testimonials into Wealthtender doesn’t (yet) exist, Wealthtender can import testimonials collected through the FMG Testimonials platform today via a straightforward export/import process.

How Wealthtender Reviews Compare to Google Reviews

It goes without saying that online reviews and client testimonials are powerful marketing assets. But not all review platforms are created equal, especially when navigating the regulatory requirements that govern advisor marketing.

Beyond regulatory matters, the rapid adoption of AI tools like ChatGPT used by consumers to find and research advisors has shifted traffic away from Google Reviews to reputable, independent review platforms like Wealthtender.

The table below compares Wealthtender Reviews (Certified Advisor Reviews™) and Google Reviews head-to-head to help you make an informed decision about which platform(s) deserves your time and focus to achieve your goals compliantly.

| Feature | Wealthtender (Certified Advisor Reviews™) | Google Reviews |

|---|---|---|

| Regulatory Compliance | ✅ Every published review displays the three clear and prominent disclosures required by the SEC Marketing Rule for testimonials and endorsements, with flexibility to include additional FINRA disclosures when/if applicable. | ❌ Reviews automatically published upon submission without disclosures and no ability to prevent prohibited content or misstatements of facts from being published; Limited ability to request removal of problematic reviews. |

| Firm Compliance | ✅ Flexibility to align review collection and publication workflows with firm policies and procedures | ❌ No ability to control who can submit reviews or what gets published |

| Ability to Promote Reviews | ✅ Reviews can be promoted compliantly across advisor websites, social media, and marketing materials with tools provided by Wealthtender | ❌ Cannot tell prospects to “check out our Google Reviews” without triggering adoption/entanglement regulatory risk |

| Personal vs. Firm Visibility | ✅ Amplifies both individual advisor AND firm reputation in search results and AI tools | ❌ Reviews only appear when searching firm name, not individual advisor names; Negligible visibility in AI tools |

| AI-Powered Discovery | ✅ Reviews accessible and frequently cited by ChatGPT, Gemini, Perplexity, Claude, and other AI tools | ❌ Limited visibility in AI-powered search tools; Google’s own AI tool, Gemini, doesn’t fetch Google Reviews (as of November 2025) |

| Industry Recognition | ✅ Eligible for Wealthtender Voice of the Client Awards™ that strengthen SEO and AEO (Answer Engine Optimization (AEO) | ❌ No industry-specific awards or recognition programs |

| Review Import/Export | ✅ Import tool converts Google Reviews into Wealthtender Certified Advisor Reviews that can be compliantly published and promoted | ❌ No integration with third-party platforms, though Wealthtender Reviews often appear in ‘Reviews from the Web’ section of Google Business Profiles |

| Marketing Tools | ✅ Testimonial Marketing Studio and website widgets make it easy to compliantly promote testimonials | ❌ No marketing tools or compliant display options |

| Search Engine Visibility | ✅ Appears in Google, Bing, and all major search engines, sending positive trust signals to help advisors rank higher | ⚠️ Useful for Local SEO; Only appears in Google search results specific to the firm name, not individual advisors |

| Content Control | ✅ Review approval and modification process ensures red flag issues such as promissory language and misstatements are easily addressed and rectified | ❌ No ability to edit or approve reviews before publication; Limited ability to request review removal |

| Client Privacy | ✅ Individuals submitting reviews on Wealthtender choose how they want their name to appear publicly, including the option to be publicly anonymous; Advisors always maintain the ability to easily anonymize or semi-anonymize client names | ⚠️ Google Reviews often display a client’s full name, because most Americans use their full name as the public name used by Google; With your client list publicly visible, risks of scams exploiting this information increase and your clients could be targeted by other businesses |

| Best For | Financial advisors and wealth management firms that want a compliant solution to collect online reviews and promote testimonials with optimal SEO/AEO benefits. | Financial advisors and wealth management firms comfortable with uncertain regulatory risk and confident in their ability to withstand regulatory scrutiny. |

For an in-depth discussion and comparison of Wealthtender Reviews and Google Reviews, please refer to this article: Wealthtender vs. Google Reviews: Which Platform Should Financial Advisors Choose?

How FMG Clients Can Publish Their Reviews on Wealthtender

Until a direct integration is completed between FMG Testimonials and Wealthtender, there are two easy ways that FMG clients can publish their testimonials as online reviews displayed on Wealthtender to maximize their reach and SEO/AEO effectiveness.

Option 1: Import Your Google Reviews to Wealthtender

If you’re using FMG Testimonials to collect Google Reviews, one of its signature features, you may already be sitting on a library of client reviews that can be directly imported to Wealthtender.

Why Import Google Reviews to Wealthtender:

Beyond the heightened regulatory risks of Google Reviews, their visibility and effectiveness outside the Google search ecosystem is limited.

Google Reviews provide local SEO benefits when consumers use Google to search specifically for a firm by name or proximity, but they fall flat when it comes to AI visibility. While this may change in the future, Google Reviews have limited visibility in AI-powered search tools, including Google’s own Gemini AI platform (as of early 2026).

On the other hand, reviews published on Wealthtender, including those imported from Google, are indexed by search engines that power AI tools, making them far more likely to appear in ChatGPT, Gemini, Perplexity, Claude, Copilot and beyond.

Learn more benefits of importing Google Reviews to Wealthtender

Wealthtender’s Google Reviews Import Tool allows you to bring in reviews from your Google Business Profile and, through Wealthtender’s certification process, convert them into Certified Advisor Reviews™ by adding the required regulatory disclosures so they can be compliantly promoted. The result is a public Wealthtender profile populated with your verified client reviews and required disclosures, optimized for maximum search visibility.

T.J. van Gerven, CFP®

Memento Financial PlanningThis is the fastest path for FMG clients who have already collected Google Reviews directly and/or through FMG Testimonials.

A Note on Compliance:

Wealthtender has written extensively about the regulatory considerations and potential risks of soliciting Google Reviews. While FMG Testimonials is designed to help manage this process compliantly, advisors should work with their compliance teams to confirm their comfort level with Google Reviews.

Wealthtender’s import tool is designed to convert Google Reviews into compliant testimonials with accompanying disclosures to satisfy SEC Marketing Rule requirements. Refer to these related resources, including Wealthtender Reviews vs. Google Reviews and Google Business Profiles for Financial Advisors, for more context.

Option 2: Export from FMG Testimonials and Import to Wealthtender

If you have testimonials collected through the FMG Testimonials platform that are not published to Google (or if you prefer to avoid Google Reviews for compliance reasons) there is a second path available.

When your clients submit testimonials through the FMG Testimonials platform, they grant permission for their feedback to be used in marketing efforts. This permission extends to publishing those reviews through other compliant marketing channels, including your Wealthtender profile(s). You can export reviews from FMG Testimonials into a spreadsheet and Wealthtender will import them to your Wealthtender profile(s), where they will then go through Wealthtender’s standard certification process for publication once your regulatory disclosures are added.

This path is particularly useful for advisors and wealth management firms that want the full discovery and AI visibility benefits of a Wealthtender profile without starting a separate review collection campaign from scratch.

In either case, the Wealthtender team is available to help walk you through the process. Book a Zoom Call with Wealthtender to get started.

The Wealthtender Advantage: Five Ways We Ensure Your Reviews Work Even Harder for You

Once your reviews are published on Wealthtender, they become powerful assets that strengthen your digital marketing strategy and boost your online reputation. Here are five ways your reviews work even harder for you by publishing them on Wealthtender:

1. Stronger Domain Authority Than Advisor Websites

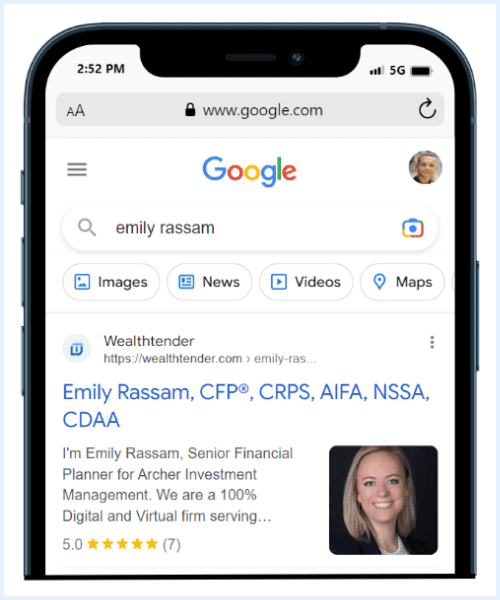

It’s nothing personal, we promise! While you’ve been busy serving your clients, since 2019, we’ve been focused on optimizing Wealthtender for visibility in search engines like Google, and more recently AI search tools like ChatGPT, Gemini, Perplexity, Copilot and Claude. And we’re happy to report that our efforts are paying off for the hundreds of advisors and wealth management firms featured on Wealthtender.

When your client testimonials live on your firm’s website, even a beautifully built FMG website, they’re constrained by that site’s domain authority and traffic which makes it harder to rank for competitive search terms.

Wealthtender is visited by more than 500,000 consumers annually and has earned a domain authority score of 42 (Source: Moz; As of February 2026), significantly higher than the vast majority of individual advisor websites. When your client reviews appear on your Wealthtender profile(s), they benefit from the SEO/AEO strength that Wealthtender has accrued over several years, with benefits that include:

- Your reviews published on Wealthtender send positive trust signals to search engine algorithms

- Your Wealthtender profile(s) appear in search results more frequently and prominently

- Your name surfaces in AI answers you might never reach through your website alone

2. SEO and AEO Power That Your Website Can’t Replicate Alone

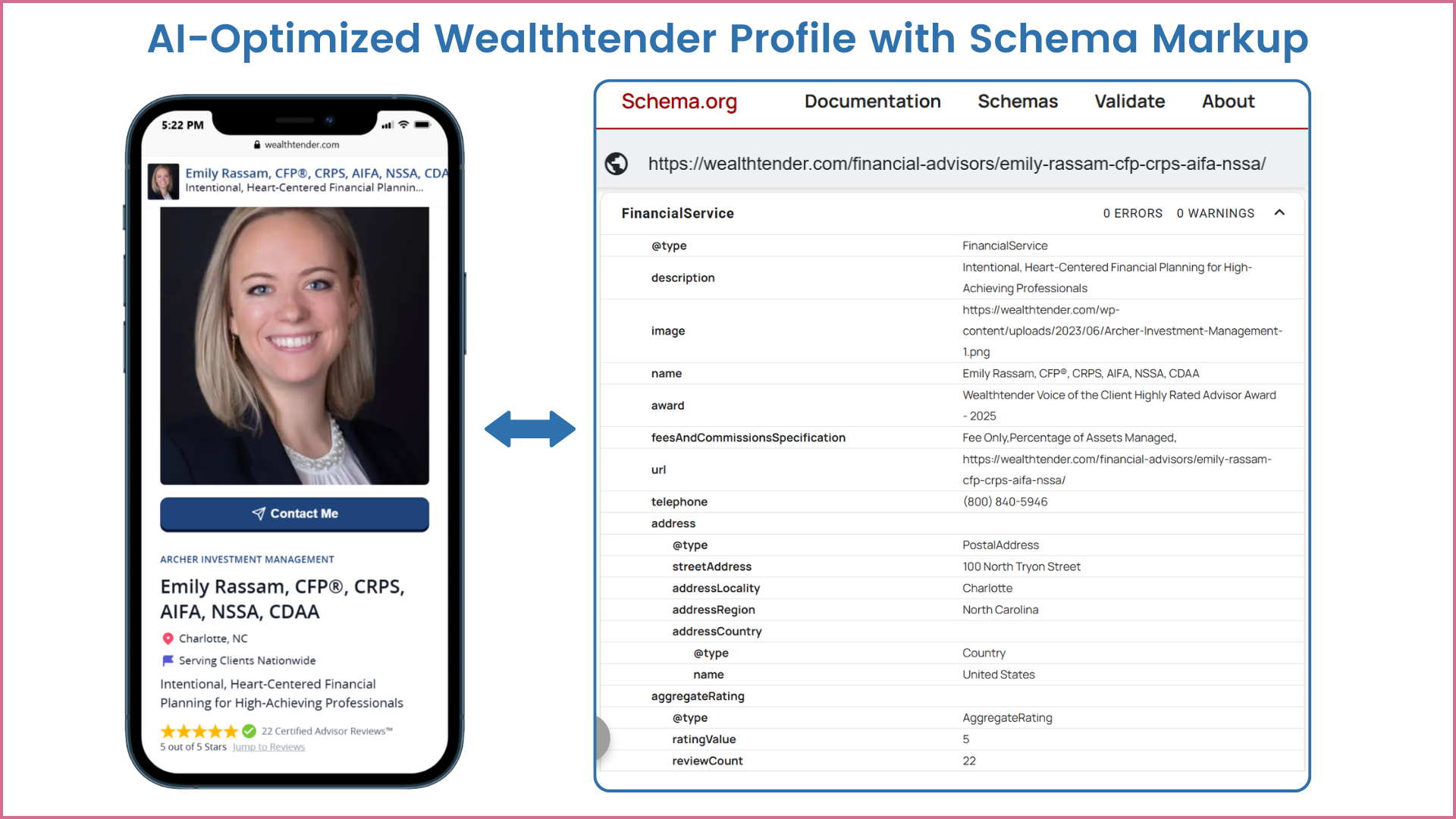

Wealthtender applies structured data schema markup to every advisor profile and review. In non-technical terms, “schema” is the language that tells search engines and AI tools what your content means. This also ensures your star ratings can appear directly in Google search results, and your Wealthtender profile is formatted in a way that makes it easier for AI search tools to surface you in AI-generated answers.

This matters enormously today, which is why if you have an FMG-hosted website, you’ll benefit from schema markup there, too. AI-powered tools like ChatGPT, Gemini, Perplexity, and Google’s AI Overviews are quickly becoming the primary way consumers discover and evaluate financial advisors, and these tools draw heavily on structured third-party data from high-authority sources like Wealthtender.

Reviews on your own website are most valuable for converting prospects once they know who you are. Reviews on Wealthtender are most valuable for helping prospects, Google and AI search tools find your reviews in the first place.

“AI-powered search engines like ChatGPT, Perplexity, and Google’s AI Overviews are now factoring reviews into how they recommend businesses. Your reviews are more than social proof — they’re a ranking signal that determines whether AI will surface your firm to prospects or not.” — FMG Testimonials product page

FMG has made this point compellingly in its own marketing as reflected above. Wealthtender’s infrastructure is specifically designed to turn this insight into action: Your reviews, structured and published on Wealthtender, a high-authority platform with schema markup, become the third-party signals that AI tools recognize and reward.

(Right) Screenshot of Schema Markup Validator tool verifying schema implementation on Emily Rassam’s profile, used by AI tools.

3. The Credibility Multiplier of Third-Party Review Platforms

There’s a psychological reality in how consumers evaluate online reviews: Testimonials displayed on business websites are inherently less credible than reviews published on independent third-party platforms. This isn’t a criticism of testimonials published on business websites (you should absolutely publish testimonials on your website), it’s simply human nature. A restaurant’s own website claiming it’s the best in the city lands differently than reviews published on a trusted, independent platform.

Wealthtender is the leading independent review platform for financial advisors, purpose-built for SEC and FINRA compliance, with editorial standards, a certification process, and a consumer-facing directory that gives every review its own context and weight. When prospects read an online review on Wealthtender, they can take comfort knowing it’s been collected and displayed through an independent platform with its own standards, not just handpicked by the advisor.

Third-party credibility is something advisor websites simply can’t replicate, and it’s why professional profiles on review platforms like Wealthtender (for financial advisors) and Zocdoc or Healthgrades (for physicians) instill greater confidence among consumers and AI search tools alike.

4. Wealthtender Voice of the Client™ Awards: Recognition That Compounds Your Visibility

Advisors who publish reviews on Wealthtender and consistently receive exceptional client feedback become eligible for Wealthtender Voice of the Client™ Awards, the industry’s only award program based entirely on verified client reviews rather than assets under management or revenue.

To qualify for a Highly Rated financial advisor or firm award, advisors/firms must achieve an average rating of 4.75 or higher (on a 1–5 scale) from a minimum number of eligible client reviews within a defined timeframe. Upon qualification and acceptance, these awards are published on Wealthtender advisor and firm profiles with “award schema”, sending additional trust signals to search engines and AI tools, and giving advisors a legitimately earned credential they can display proudly, knowing it reflects genuine client satisfaction rather than a pay-to-play recognition program.

Unlike traditional advisor award programs that reward size, Wealthtender’s Voice of the Client Awards offer advisors and firms of all sizes an equal opportunity to gain recognition for a metric that matters most to consumers – client satisfaction. A boutique solo RIA with exceptional client relationships can earn the same recognition as advisors at a national firm, and in many cases, surface more prominently in online search results because of it.

5. Review Sync™: Amplifying Every Advisor at Your Firm

For wealth management firms with multiple advisors, Wealthtender’s Review Sync™ feature extends the SEO/AEO benefits of firm-level reviews to each advisor featured on Wealthtender, recognizing the important role of individual advisors as brand ambassadors for their firm.

Here’s why this matters: Research shows that clients write reviews about their experiences with individual advisors much more often than their experiences with the “firm”. Wealthtender’s 2025 Voice of the Client Study found that when clients mention names in their reviews, they are nearly 25 times more likely to highlight an individual advisor than just the firm name.

Consumers searching for advisors are doing the same, they’re searching Google or prompting ChatGPT to research individual advisors by name, comparing profiles, and reading personal reviews to learn more about the individual advisors who they might hire to become their trusted confidant for the next decade or longer. Just as consumers don’t prioritize reviews about hospitals when choosing a new primary care physician, consumers preparing to hire financial advisors want to know firsthand what clients have to say about their experience with the professional who they’ll build a relationship with at the firm.

Review Sync™ allows firm-collected reviews to automatically add reviews to each advisor’s individual Wealthtender profile once disclosures are confirmed. This means every advisor at your firm gets the SEO/AEO benefit of the firm’s review track record, strengthening each advisor’s individual professional brand and making them more discoverable when prospects search by name.

Each advisor is a brand ambassador for your firm. Wealthtender gives every advisor an SEO/AEO-optimized profile and public presence that reinforces the caliber of the client experiences your team delivers with your reviews available across all advisor profiles.

Wealthtender Digital Marketing Benefits Beyond Testimonials

The online review features and testimonial amplification benefits described above are the most relevant complements when combining Wealthtender with FMG Testimonials, but they’re only part of the value proposition Wealthtender offers to advisors and wealth management firms. For FMG clients who add Wealthtender to their marketing stack, here’s a glimpse of what else comes with it.

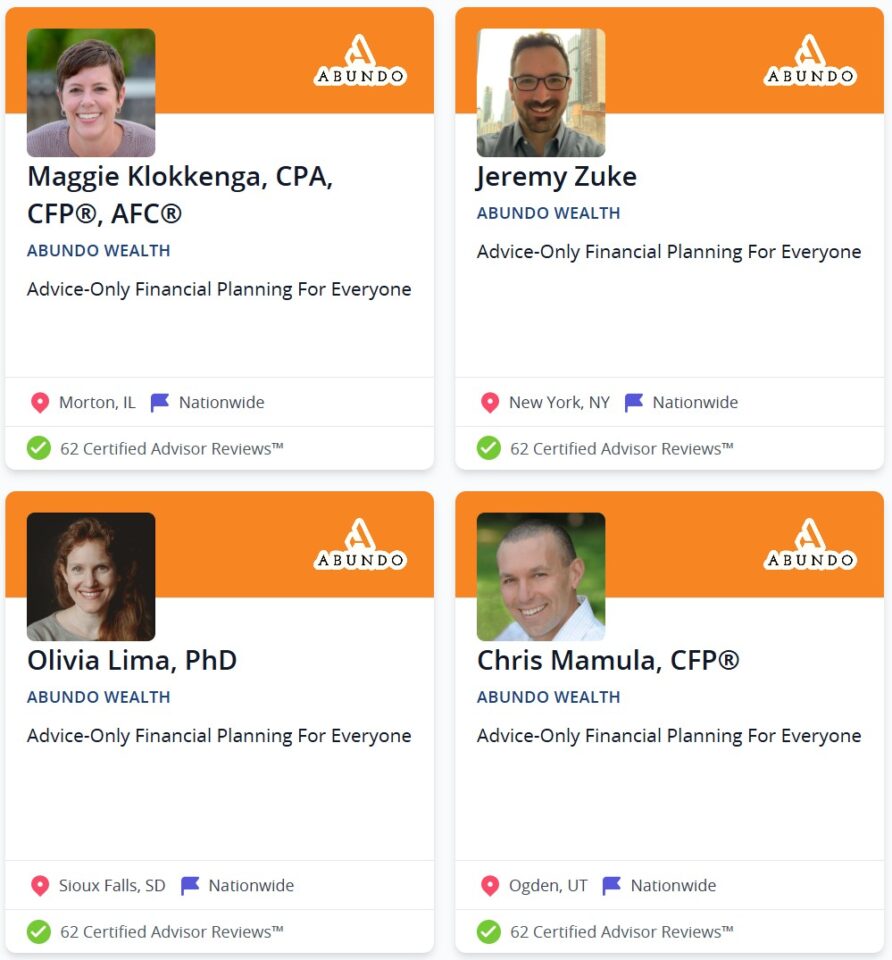

Discovery in Local and Specialist Directories

Wealthtender publishes a diverse range of consumer-facing guides and directories, local advisor directories by city, specialist directories by niche (e.g., physicians, tech employees, divorce, business owners, corporate executives and employees), and life-stage guides, visited by the nearly 500,000 consumers who visit Wealthtender annually, and frequently cited in Google search results and AI-generated answers. Advisors featured in these guides gain visibility with prospects who are actively in the hiring decision process and who are unlikely to find them through their firm’s website alone.

Here are a few examples of actual messages received by advisors from prospects who found them on Wealthtender:

Actual messages received by advisors from prospects who found them on Wealthtender:

“We’re interested in learning more about your retirement planning services. Our portfolio is between $5-7M, we are 60 and 61, and live in…”

“My wife and I are looking for an advisor to help with equity and options. We are corporate professionals with options/RSUs in …”

“We are in Austin and retiring in a few weeks… selling our business. I would like to schedule a meeting with you and very likely proceed to …”

“I am an engineer at Google. I would appreciate the opportunity to schedule a brief introductory call …”

“I am looking for a fee based financial planner that specializes in real estate.”

“I am a physician with investments in my hospital practice, retirement accounts, real estate, and…”

“We live in CA and have a net worth around $5.5M. Please contact me if you are interested in working with us…”

“I am looking for a flat fee financial advisor. I found your contact information on Wealthtender.”

“I came across your profile and would like to explore working with you for divorce-related financial planning…”

AI-Optimized FAQs

Wealthtender’s AI-Optimized FAQ feature allows advisors to publish up to ten frequently asked questions on their profile, with FAQ schema markup automatically applied. This structured format helps search engines and AI tools like ChatGPT, Gemini, and Perplexity identify and surface your expertise in response to consumer queries, positioning you as a credible, cited source in AI-generated answers.

Wealthtender’s approach to AI-Optimized FAQs aligns with guidance offered by FMG and Samantha Russell, who emphasize the value of FAQ schema on advisor websites and third-party profiles for AI visibility.

Media Visibility: Get Quoted in Top Publications

Wealthtender’s media quote feature offers PR services for advisors via weekly requests from journalists at leading consumer and industry publications seeking expert quotes from financial advisors for their articles. Advisors who respond gain citations and backlinks in nationally recognized outlets, building the kind of third-party authority that both prospects and AI tools recognize as a credibility signal.

This is a type of visibility that goes beyond testimonials. It’s not about reviews; it’s about becoming the advisor that media outlets turn to, which compounds your overall digital authority over time.

The Wealthtender Value Proposition: What You’re Getting for $79/month (or Less)

Wealthtender subscription plans start at $49 per month for a single advisor, offering the the industry’s most powerful online review benefits for maximum AI visibility and prospect discoverability at the lowest-cost of all established advisor testimonial platforms. For FMG clients taking advantage of FMG Testimonials, the question is straightforward: does the incremental $49 to $79 monthly cost of Wealthtender deliver enough additional value to be worth your investment?

The answer depends on how you think about the importance of optimizing your reputation and visibility with prospects, Google, and AI search tools. Wealthtender’s consumer-facing directory and review platform, AEO schema infrastructure, domain authority, Voice of the Client Awards, review amplification features, media quote opportunities, and specialist directories to increase your changes of getting found and contacted by prospects first are capabilities complementary to FMG Testimonials and that advisor websites cannot replicate on their own.

For individual advisors focused on inbound discovery – being found by prospects who don’t already know you – Wealthtender is the most cost-effective investment available, trusted today by more than 800 financial advisors, wealth management firms and national advisor networks. For wealth management firms, Wealthtender offers unparalleled value, with SEO/AEO-optimized firm and advisor profiles, plus impactful digital marketing benefits for a fraction of what it would cost to achieve comparable results through any other channel.

Wealthtender has been rated “Extraordinary”, the highest tier, in the T3 Advisor Software Survey in both 2023 and 2024, and was recognized as a Winner of the InvestmentNews 5-Star Technology Award in 2025. Everything about Wealthtender has been designed with a compliance-first approach to provide advisors and wealth management firms that take compliance and marketing seriously with a credible, digital marketing partner to accelerate their growth. See what financial professionals say about Wealthtender.

“Wealthtender is one of the best decisions we have made as a firm. I wish we had done it sooner.”

Gerry Barrasso

President & Founder

United Financial Planning Group

FAQs: Evaluating FMG Testimonials and Wealthtender

Q: What is the history of FMG Testimonials?

FMG Testimonials began its life as Testimonial IQ, an independent platform founded in Denver, Colorado, and backed by investors including Techstars, the Frazier Group, and SWAN Ventures. Testimonial IQ was built from the ground up for financial advisors regulated by the SEC and/or FINRA, with a compliance-first approach to collecting testimonials and features to invite clients to submit testimonials as Google Reviews.

The platform earned industry recognition, including WealthManagement’s Top Compliance Tech designation in 2024. Its founder and CEO, Andrew Johnson, built the product around a single mission: “help financial advisors turn happy clients into new business without creating compliance headaches.”

FMG acquired Testimonial IQ in December 2025 and announced the rebrand to FMG Testimonials on February 4, 2026. The acquisition was designed to integrate Testimonial IQ’s review and testimonial tools into FMG’s broader marketing platform, used by more than 80,000 advisors, as part of FMG’s larger strategy around Answer Engine Optimization and organic growth for wealth management firms. The rebranded FMG Testimonials retains the same compliance-first workflows and is available both as a standalone product and as part of FMG’s integrated marketing suite.

Q: Does Wealthtender plan to launch a direct integration with FMG Testimonials?

It’s a great question, and one we get excited about to offer financial advisors and wealth management firms even more value from both platforms. Our team at Wealthtender is actively exploring integrations with complementary platforms, and an integration with FMG Testimonials is absolutely on the radar.

Our shared commitment to compliance-first solutions and conviction across the leadership teams of FMG and Wealthtender regarding the power of testimonials and online reviews uniquely positions our two firms to collaborate on industry education initiatives, cross-promotion of complementary tools and integrations that benefit our mutual clients.

As FMG clients begin to implement FMG Testimonials, they could benefit from having testimonials collected within the FMG platform systematically published on Wealthtender with the applicable regulatory disclosures. An integration like this would streamline the export/import process described earlier in this article and make it seamless for advisors to get the amplification benefits of Wealthtender without any additional effort.

We hope to have meaningful progress on an FMG Testimonials integration to share with advisors in 2026. In the meantime, the Google Reviews import option and the manual export/import approach described above are both available and our team is happy to support FMG clients through either process.

Q: Does Wealthtender offer website development and hosting for financial advisors?

No. If you need a high-quality advisor website, we’d point you back toward FMG for their highly regarded website hosting services. Wealthtender is a digital marketing platform focused on helping advisors build credibility, get discovered by prospects, and grow their business through compliant reviews, media visibility, and SEO/AEO-optimized profiles. Website design and hosting is not part of our platform.

FMG has built an excellent reputation in advisor website development and hosts thousands of advisor websites with professional design, compliance tools, content libraries, and now the fully integrated FMG Testimonials capability. If you’re looking for an all-in-one marketing platform that includes a professionally designed website along with testimonial collection tools, FMG is a strong choice, and you can layer Wealthtender on top of that foundation to amplify your reviews and strengthen your AI visibility and discovery presence everywhere consumers are looking for advisors online.

Q: I’m an FMG client using FMG Testimonials. What should I do first to combine FMG Testimonials with Wealthtender?

You’re off to a great start with FMG! Here are ideas to amplify the power of FMG Testimonials with Wealthtender:

- Join Wealthtender. Sign up for Wealthtender in 2 minutes and your profile is created for you using information from your FMG-hosted website and social media profiles like LinkedIn.

- Check your Google Reviews. If you’ve been using FMG Testimonials to collect Google Reviews, you may already have a library ready to import to Wealthtender. Wealthtender’s Google Reviews import tool makes this straightforward.

- Import or transfer your reviews. Work with the Wealthtender team to import Google Reviews or, if you prefer not to use Google Reviews, export your FMG Testimonials reviews and import them through Wealthtender’s certification process.

- Activate AI-Optimized FAQs. With the Marketing Pro plan, add up to ten FAQs to your Wealthtender profile with FAQ schema automatically applied to further strengthen your AI visibility.

- Sign up for media and specialist directory opportunities. Respond to journalist requests for quotes and choose specialist directories where you’ll be featured to get found by your ideal clients.

Ready to get started? Book a Zoom call with Wealthtender or learn more at wealthtender.com/financial-advisor-marketing.

Q: Do I need both FMG Testimonials and Wealthtender?

If you’re evaluating FMG Testimonials and Wealthtender, we encourage you to schedule a demo call with FMG and schedule a demo call with Wealthtender to make a fully informed decision and ensure you have the most up-to-date information about both platforms to increase the likelihood you choose the right platform(s) to support your objectives.

If you’re an FMG client and FMG Testimonials is included in your subscription, it’s a capable, compliant tool for collecting client testimonials and publishing them on your website, and you shouldn’t feel obligated to pay for additional tools unless they provide meaningful incremental value.

That said, FMG Testimonials and Wealthtender offer powerful complementary benefits when combined. FMG Testimonials is focused on the collection and display of testimonials within your existing marketing workflow, your website, optionally increasing the collection of Google Reviews, your email campaigns, and your compliance oversight process. Wealthtender is focused on amplification and discovery, ensuring your reviews are visible to consumers who haven’t found you yet, through an authoritative compliance-first review platform visited by 500,000 consumers annually, with SEO/AEO-optimized profiles, and additional digital marketing tools that extend well beyond reviews.

If your goal is to get testimonials published compliantly on your website, strengthen your AEO and potentially increase your Google Reviews, FMG Testimonials handles that well. If your goal is to rank higher in Google search, maximize your AI visibility and credibility in ChatGPT, Gemini, Perplexity and beyond, attract new clients through online discovery, and gain access to additional digital marketing benefits, Wealthtender adds features complementary to FMG Testimonials. The question of whether both are worth it comes down to your growth priorities, and with Wealthtender’s most popular plan offered at $59/month, the low cost is designed to make that an easy call.

Should You Pair FMG Testimonials with Wealthtender?

FMG Testimonials is a solid, compliance-first platform for collecting and managing client testimonials, increasing Google Reviews, and strengthening AEO. But the job isn’t done when a testimonial is approved, published on your website, or submitted as a Google Review. The advisors and wealth management firms experiencing the greatest success today are the ones whose reviews are working everywhere online, on their own site, yes, but also on independent high-authority platforms that consumers and AI tools trust as credible, third-party sources.

Wealthtender was built to be that platform for financial advisors. Wealthtender turns your client testimonials, including those collected through FMG Testimonials and Google Reviews, into powerful marketing assets and trust signals that reach new prospects through search engines, AI tools, consumer-facing directories, and beyond that no single advisor website can generate on its own.

Your clients have taken the time to express their appreciation for all that you do. They know the impact their words can make to prospective clients who were once in their shoes. By combining FMG Testimonials with Wealthtender, you can ensure the voices of your clients generate the greatest potential impact to your online presence and result in you getting found and hired by the right prospects at the right time, based on fit and real client feedback.

Want to see how individual advisors and leading wealth management firms are successfully using Wealthtender to grow their business? Visit Wealthtender.com/grow or schedule a demo to learn how you can start converting more prospects into clients with the industry’s first digital marketing platform for AI-optimization and compliant online reviews.

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.