To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Admit it. You know we all love to read articles like these:

- This Is the Average 401(k) Balance. How Does Yours Compare? (The Fool)

- The Average 401(k) Balance by Age (BankRate)

- The Average 401(k) Balance by Age, Income Level, Gender, and Industry (Business Insider)

- The Average 401(k) Balance by Age (NerdWallet)

- The Average 401(k) Balance by Age — And 18 Ways to Catch Up (Quicken)

They speak to our intense desire to compare our accumulation to those of everyone else.

They speak to the hidden fear that we haven’t saved enough (or, for those who have done well, the hidden glee).

Understandable? Of course!

Human? Sure!

Helpful? Not so much and maybe even dangerous. Here’s why…

Problem 1

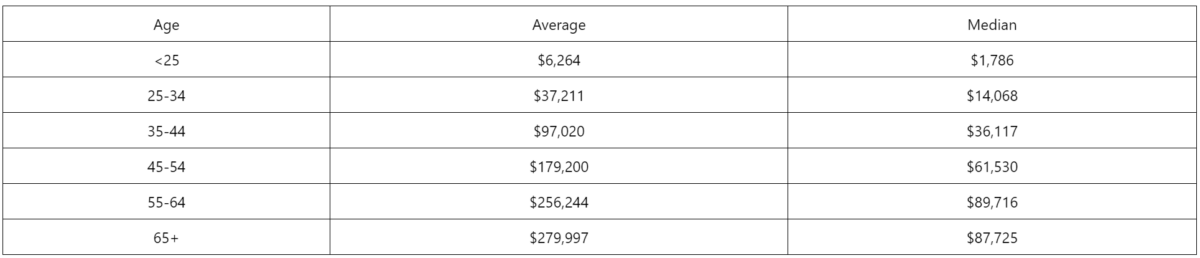

In Vanguard’s 2022 annual How America Saves report, they provide (page 47, figure 55) a table showing 2021 average and median balances in Vanguard defined-contribution plans (e.g., 401(k) plans) by participant demographics, including age groups.

Comparing your 401(k) balance to the median, or even the average 401(k) balance of Americans risks making you feel great even if your balance may be far too low relative to what you’ll need.

For example, if you follow the 4% rule (which isn’t as good as other tools), the median balance for ages 65+, at $87,725, can provide a safe annual withdrawal of just over $3500!

That’s a measly $292 a month!

Even the average, skewed high to $279,997 by outlier 401(k) millionaires, can provide just $12,000 a year, or $1000 a month.

Say you’re in the 65+ age group and have twice as much as the average (over six times as much as the median) for your age group.

You might feel very pleased with yourself.

However, even with this high balance relative to others, you can expect just $24,000 a year or $2000 a month – hardly enough for a luxurious (or even comfortable) retirement.

Problem 2

Retirement needs and wants vary hugely between people.

As Larson Patty, Financial Planner at Rothman Investment Management says, “Your expenditures in retirement are unique to you – lifestyle expectations vary dramatically from person to person.”

If your fixed costs are high, your retirement budget will likely be far higher than your friend whose fixed costs are more modest.

For example, if you retire in San Francisco and still have a mortgage, your housing costs will be dramatically higher than someone living in a small town in a state with less insane real estate prices.

If you love to travel, dine in fancy restaurants, and drive new luxury cars, your budget will similarly be far higher than that of someone who doesn’t care to leave his town, prefers eating at home, and drives a reliable but modest car.

As a result, comparing your 401(k) balance to those of others without also comparing spending levels can give you a very inaccurate picture of your relative situation.

You could have $1 million in your 401(k) but be in far worse financial shape than someone with $400,000 in her 401(k) if you need to draw $100,000 a year (10% of your balance) while she draws just $20,000 (4% of her balance).

Problem 3

Your 401(k) balance is just one piece of your retirement-planning puzzle.

More than likely you also have:

- IRA(s)

- Taxable portfolio

- Savings account(s)

If you’re in the older cohort who’ve started Required Minimum Distributions, your 401(k) balance may be dropping fast, with much of that drop going to your taxable portfolio and/or accounts.

Patty agrees, “Focusing on averages can be dangerous. Ultimately the balance of your 401(k) is just one asset in a complex basket of assets unique to you.”

Beyond those, you’ll almost certainly receive Social Security retirement benefits that reduce the size nest egg you’ll need to fund your retirement.

You might even have an annuity or two.

If you planned well, you might have one or more rental properties that will keep money flowing in past your last day at work.

Certainly, all other things being equal, having more in your 401(k) is better than having less, but all other things are rarely equal.

The Bottom Line

Articles about 401(k) balances are like the magician who pulls your attention to his right hand while his left pulls a sleight-of-hand trick.

Entertaining, right?

But it pulls your attention away from where it needs to be if you want to see what’s really going on.

While it may be intriguing and even a little fun to compare your 401(k) balance to those of others, the above problems may cause you to draw very misleading conclusions.

If your balance is high relative to the median or even the average, you may mistakenly think you’re in good shape.

If your balance is relatively low, you might conclude you’re in terrible shape even if that’s more pessimistic than warranted.

The best advice is to craft a complete financial plan (with the help of a pro if needed) and look at your complete financial picture relative to your goals and priorities. Let others worry about the irrelevant comparison of their 401(k) balances to everyone else’s. You’ll look at the only relevant metric – your balances relative to what your plan says they should be. As Patty puts it, “Look holistically at your full financial picture. Make a financial plan to balance current consumption with your needs, wants, and wishes for the future.”

Kevin M. Arquette, CFP®, Wealth Manager, Managing Partner, Wealthpoint Financial Planning agrees, “Comparing ourselves to others is a common habit, whether it’s about their larger house, their success at work, or their frequent vacations. However, this type of comparison isn’t helpful because it doesn’t consider our unique circumstances. To accurately assess our financial or life situation, we should focus on our personal goals and whether we’ve saved enough to achieve the lifestyle we desire. The financial planning process seeks to answer the question, ‘Am I on track to reach my goals?’ That’s done by analyzing your current financial status and comparing it with your desired financial future.”

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor who can meet with you online, or you prefer to find a nearby financial planner, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

–

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor