To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Credit card debt in the US topped a trillion dollars, $1.08T as of a few weeks ago, according to debt.org. That’s over 26% of the $4T-plus total US consumer debt. On average, each household with credit card debt owes nearly $8400 on their average of four-plus credit cards.

If you’re part of those statistics, do you really know all the costs you pay? Check it out…

The Most Obvious – Cost of Interest Payments

First and most obvious, is the financial cost of paying interest on balances. At the current average interest rate of 17.25%, you’d pay $119 monthly interest charges on the $8400 average balance. If your balance stayed the same (and are you sure it would?), this would translate to $1428 a year!

Somewhat Less Obvious – Your Credit Score Takes a Hit, and You Probably Don’t Realize How Big a Hit

You’ve heard of the FICO score, right?

That’s the credit score most lenders use to decide if they’ll lend you money, and if so, at what interest.

You might even know that about 30% of the score is related to how much of your credit you use. Your “credit utilization” is simply the ratio between your current balance and what you’d owe if you maxed out all your credit lines.

If you’ve been paying attention, you know that keeping your ratio under 30% preserves your credit score, right? Wrong!

How Credit Scores Are Really Affected by Credit Card Balances

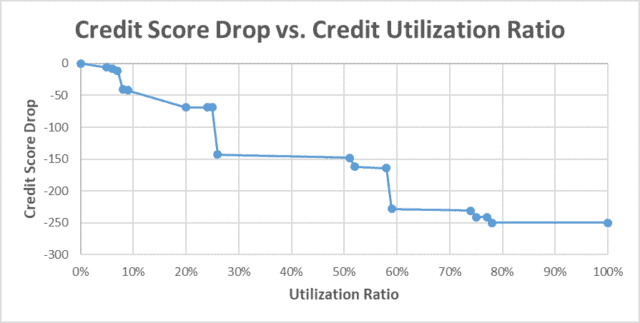

Say your credit score starts out in great shape, perhaps over 800, with nothing owed on any card. Here’s a credit score simulator example showing what happens as you gradually borrow on your cards. See how quickly things start going south, and how bad they get by the time you’re maxed out…

A Simulated Credit Score Exercise

Up to 7% you gradually lose 11 points. Not that bad right? But then, increasing by a mere 1% more you suddenly lose another 29 points. Increase your debt ratio to 20% and your score slowly slides down a point or two for each additional percentage point. There, things stabilize up to 25%.

Never mind, you think, my credit is still excellent. But then, you borrow a measly extra percentage point. Your ratio hits 26%, and your score drop off a cliff, losing 74 points! Your credit has dropped completely past “good” straight to “fair” – ouch!

You slide down a fraction of a point in score per percentage point increase from there to 51%, but then your score drops 14 points when the ratio increases to 52%. Your score stays nearly constant up to 58%, and you’re thinking things won’t get much worse.

Wrong. Hitting 59% causes another massive 64-point drop, and your credit is officially considered “Poor!”

Now that you’ve hit the bottom of the credit barrel, it’s all over. Your score meanders down a fraction of a point per percentage-point ratio increase up to 74%, then takes another 10-point hit at 75%, stabilizes for a bit, and takes a last 9-point hit at 78%.

That’s it. You’ve lost a cumulative 250 points, or 29.4% of your maximum possible score. At this point your ratio simply can’t increase further, so it can’t do any more damage. Even if started out with a pristine score of 850, you’re now at 600, 30 points into the “bad credit” basement.

Here’s What Happens to You When Your Credit Score Tanks

Lest you think this is just a numerical exercise, there are major consequences to having poor credit:

- You may not be able to get any more credit, and some of your current card issuers may reduce your credit limit (increasing your debt ratio, kicking your score in the gut when it’s down)

- As a result, you probably won’t be able to get a mortgage to buy a home, an auto loan to buy a car, or a business loan to start a business

- If you’re approved for credit, you’ll pay higher interest

- Utility companies (electric, gas, water, etc.) may be require you to give a deposit, so they’re not out of luck if you stop paying

- If you want to switch (or start with a new) cell phone carrier, you may be out of luck

- Landlords may not approve your rent applications

- Some employers may not hire you

You Probably Know This, but May not Have Connected It – Stress!

As your credit card debt grows, you’re digging yourself further and further into the hole. Your financial capacity to deal with any unexpected expenses (think car repairs, a visit to the dentist, taking a kid to urgent care, etc.) shrinks. Along with that comes major stress, and that’s before the really bad stuff happens to you, like losing a job…

Least Obvious – Opportunity Cost

If you don’t carry a significant balance on your cards, and an opportunity comes knocking on your door, you can use the available credit. This could be to launch a new business, to pay for a course that teaches you valuable skills, etc. Anything that improves your earning ability. If your cards are all maxed out, good luck with that.

Further, the interest you pay on balances carried on your credit cards is money down the toilet. If you didn’t have to pay that interest (remember the $1428/year example number above?) you could set aside that money and invest it for a rainy day or for your retirement. Heck, you could even use some of it to take your family on a vacation or buy Christmas gifts without going into debt!

How to Avoid Credit Card Debt or Get out of It If You Already Owe a Bunch

As covered here, some of the worst ways to use your credit cards are:

- Buying stuff on credit for which you wouldn’t pay cash, especially stuff you can’t really afford

- Not making at least the minimum payment on each card every month

- Carrying a balance on your cards when you can borrow at lower interest rates (e.g., from Lending Club)

So, first, don’t do any of these (or the other poor ways of using cards).

Next, go over your credit card statements and circle any purchase that you really could have done without. Then commit to yourself not to buy more of the same next month, or the month after, or… well, you get the idea.

After that, figure out what you have around the house that you haven’t used or even seen in more than a year, and that you wouldn’t miss if it was gone forever. Sell it on Craigslist, eBay, or any other way, and use the money to pay down your credit card balance.

Finally, figure out a good side hustle or second job, at least temporarily, so you can knock off your credit card debt and stop pouring good money down the interest drain.

You might also consider if a debt payoff planner app could be a useful tool to help you optimize how you decide which debts to repay first.

The Bottom Line

Carrying a large balance on your credit cards costs you a lot more than just the money you pay in interest. It hurts your credit score (making it harder and more expensive to buy a home or car, start a new business, get new cell phone service, rent an apartment, and even get a job). It stresses you out, with the impact that has on your quality of life and important relationships. Finally, it means opportunities bypass you from which you might have otherwise benefited.

Turning things around, if your debt ratio is on the wrong side of a massive drop, a tiny reduction in debt can make a huge difference. If you’re at 59% or 26%, if your combined credit limit is say $30,000, reducing your debt by as little as $300 might increase your credit score by over 60 points! How’s that for motivation?

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor