Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

529 plans have many benefits, including some that are overlooked by most people. Here are 10 profitable ways to use 529 plans.

When my youngest daughter was in college, we used a 529 plan to help gain tax advantages from costs we’d incur anyway.

As a recently minted grandfather, I’m taking another close look at 529 plans and how they can help us over the much longer term.

What Are 529 Plans?

These plans are popular education-related tax-advantaged savings and investment accounts that can help you save for college and other educational expenses for kids, grandkids, or even you and your spouse.

However, many people are unaware of a range of advanced strategies, many of which the wealthy use, but that can benefit the middle class, too.

1. The Grandparent Loophole

This little-known loophole lets grandparents use a 529 plan to help their grandkids without reducing financial aid eligibility.

Here’s how.

The Free Application for Federal Student Aid (FAFSA) is used by most universities and colleges to estimate families’ financial needs, a major factor in need-based scholarships and direct subsidized student loans. The federal government pays your interest on these need-based loans while the student is in school, six months after graduation, and during a deferment period.

The FAFSA process determines the student’s “expected family contribution” or EFC, toward the cost of attendance. The higher the EFC relative to the cost of the specific school, the lower the need-based financial aid the school will offer.

The EFC is affected by the following factors, in descending order of impact:

- The student’s income

- The student’s assets

- The family’s income

- The family’s assets (excluding primary residence, cars, retirement accounts, etc.)

529 plans are considered the assets of their owner, not their beneficiary (the two may be, but usually are not the same).

A new, simplified FAFSA is expected to go live this October for the 2024/25 academic year, with only a third as many questions as the current form. Although it isn’t final yet, it seems that distributions from 529 plans owned by people outside of the student’s custodial household, including grandparents, will not increase the EFC.

| FAFSA Rules | 529 Assets | 529 Distributions |

| Grandparent, current | Not reportable | Reportable as untaxed student income, up to 50% of distribution added to EFC |

| Grandparent, planned | Not reportable | Not reportable |

| Parent, current & planned | Reportable, 5.64% of assets added to EFC | Not reportable |

Note, however, that about 200 private schools use a different system, the CSS Profile, instead of or in addition to the FAFSA when determining what need-based financial aid they will offer. For such schools, this grandparent loophole may not apply.

2. Estate-Planning Benefits of 529 Plans

According to the IRS, in 2023, a gift of up to $17,000 per giver per recipient is excluded from gift tax reporting and gift taxes.

This means that a married couple can give $34,000 a year to each recipient. Contributions to 529 plans are considered “completed gifts” to the beneficiary, so if the contributions are below the above limit, they are excluded from gift tax and generation-skipping tax (GST) considerations.

Since the owner of the 529 plan retains ownership of the plan assets, you can change the beneficiary to someone else, including yourself. If you pass away with funds still in the plan, a new account owner (e.g., your spouse, child, etc.) will take over, and the assets will remain outside your taxable estate.

Since you can contribute to multiple 529 plans for multiple beneficiaries over many years, 529 plans can help you legally remove millions of dollars from your taxable estate. Since there’s no limit on the number of plans (each with a single beneficiary), you can use this to effectively create a multi-generation family educational endowment, since 529 plan beneficiaries can be changed at any time among family members.

If your estate is large enough, and you have say 12 grandchildren, you can contribute with your spouse over $400k per year each year. Say you start when you’re 50 and live to age 80, that’s over $12 million!

3. Tax Benefits of 529 Plans

Earnings on investments within 529 plans are not taxable at the federal level, and most states don’t tax them either.

This can be incredibly helpful over time.

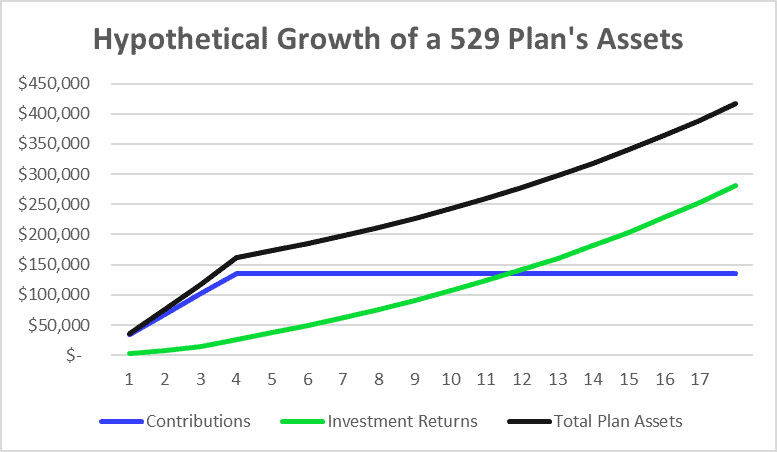

Here’s the hypothetical growth of a 529 plan over the 18 years from a beneficiary’s birth to their 18th birthday, assuming $34k annual contributions for just four years, and an annual investment return of 7%.

The total contributions are just $136k of the plan’s 18th-year balance of over $416k, whereas the (mostly or fully tax-free) investment returns are more than double that, at over $280k.

This makes 529 plans effectively “educational Roth IRAs.”

Dawn Mabery Chestnut, CFP, MSPFP, MPAS, CFEI, Mabery Consulting, LLC, says, “I’ve used this tax strategy with clients. However, as I tell them, some states, like Connecticut, allow a state tax deduction only if they use that state’s 529 rather than another state’s.”

However, even if you didn’t set aside a dime until college time, you may still be able to benefit from the tax advantages of a 529 plan.

Here’s how…

Most states offer state-tax credits or deductions for 529 contributions. Some states (e.g., Maryland) even allow you to claim the benefits over several years if your contributions were higher than the state-set annual limit on tax benefits.

This means that rather than simply paying college costs, you can contribute the money to a new 529 plan and then withdraw the money to cover tuition and other qualified educational expenses in the same year. Check your state rules as to any minimum duration the money must spend in the account to qualify for the tax benefit.

4. Use a 529 Plan to Get a Discount on Your Own Tuition

Expanding on the above idea, if you’re about to go to college and will pay your own way, here’s a way to get your state to effectively give you a discount!

Assuming you live in one of the 30 states offering 529-plan tax benefits, you open a 529 plan with yourself as the beneficiary.

Then, rather than just paying tuition, park the money first in your 529 plan for your state-specific minimum time before withdrawing it and using it to pay tuition.

Grant R. Maddox, CFP, AWMA, CSRIC, Hampton Park Financial Planning suggests, “To take advantage of this, check if your state allows a state tax deduction or credit for 529 plan contributions to their state-specific plan. If so, make a contribution to your state’s plan to receive the state tax benefit, then use the money toward your tuition. Effectively, this gives you a small discount on your tuition.”

5. Super-Funding 529 Plans

Another often-overlooked rule is that you can super-fund a 529 plan with five years’ worth of contributions upfront without gift tax and GSTx consequences, as the gift is counted as averaging out over a five-year period. However, you will need to file a form notifying the IRS of your choice to do this.

This means you and your spouse can contribute up to $170k per beneficiary in a single year!

This can be especially helpful if you live in one of four states that offer a tax deduction on the full amount of 529 contributions (Colorado, New Mexico, South Carolina, and West Virginia), and you have a large bonus, a one-time income boost, or even a Required Minimum Distribution (RMD) from retirement accounts that far exceeds your spending needs.

Note that if the donor (or one of the joint donors) passes away before the fifth year, a portion of the original contribution will no longer qualify for the gift tax and GST exclusion.

6. Using 529 Plans to Help Pay Student Loans

529 plans can be used to pay for more than just tuition and fees.

Other qualified expenses include books and school supplies; computers, software, subscriptions, broadband Internet; etc. as long as these are for college.

Another less well-known use for 529 plans is to pay student loans. Maddox says, “Many folks aren’t aware that you can use a 529 account to pay up to $10,000 in your lifetime toward student loans.”

7. 529 Plans Can Pay for More than College

Another qualified way to use 529 plans is to cover up to $10k per year per beneficiary of the cost of K-12 schooling, which can include private school tuition.

Cecil Staton, CFP, CSLP, President & Wealth Advisor at Arch Financial Planning, LLC says this is something he often recommends to his clients, “Many dentists and physicians I work with want to send their children to private schools for K-12 education. As part of their savings plan, we’ll use a 529 plan to pre-fund the early years of schooling. Sometimes, we also use the super-funding technique mentioned above to contribute beyond the annual gift exclusion amount while their children are very young.”

You can also use 529 plans to pay for cooking classes, language classes, apprenticeships to learn new career skills, etc.

8. Penalty-Free 529 Plan Withdrawals for Non-Qualified Expenses

Normally, withdrawing funds from a 529 plan and using them for a non-qualified expense triggers a 10% penalty and taxes on the earnings portion of the distribution. There may also be state-tax implications.

There is one exception though.

Many students receive tax-free scholarships or grants. This reduces the student’s “adjusted qualified education expenses.”

In this situation, you can withdraw up to the amount of the scholarship for any purpose without penalty (you’ll still owe taxes on the earnings portion of the withdrawal unless it is used for a qualified expense).

9. Tapping 529 Plans for Non-Qualified Expenses Despite the Penalty and Taxes

Sure, paying taxes and a 10% penalty on withdrawals from a 529 plan is no fun.

However, that doesn’t mean it’s never a good idea.

Say the student graduates but can’t find a job for a whole year (unfortunately, this isn’t uncommon). Withdrawals from the 529 plan to pay for, e.g., rent and food for that year would be subject to the 10% penalty and income taxes on the earnings portion of each distribution, but if the student has no other income, his or her tax rate would be very low, so even with the 10% penalty this may be a good option.

Another possibility is if the plan owners hit hard times, they can draw money out of the plan to cover non-qualified expenses, taking the 10% penalty and tax hit while their tax rate is (temporarily) low.

10. Converting 529 Funds to Roth IRA Funds

As of this year, the Setting Every Community Up for Retirement Enhancement (SECURE) 2.0 Act introduced another interesting way to use (some) 529 plan funds.

Under certain conditions, you can convert some 529 plan assets into Roth IRA contributions. The conditions include:

- The 529 plan must have been open for at least 15 years

- The Roth IRA must be in the name of the 529 beneficiary

- Funds converted must have been in the 529 plan for at least five years

- The recipient must have earned income at least as high as the converted amount(s) in the conversions year(s)

- Converted amounts count against the recipient’s cumulative annual Roth IRA contribution limits

- The converted amounts are subject to a $35k lifetime limit

Importantly, the regular Roth IRA income limits do not apply.

Here’s the ideal way to use this new rule…

- When your kid or grandkid is born, open a 529 plan

- Make contributions (super-funding or not) that are expected to grow significantly beyond the beneficiary’s expected college expenses

- When the beneficiary turns 16 (and the 529 has been open for over 15 years), have them work and earn at least as much as the then-current annual Roth IRA contribution limit

- That year, open a Roth IRA for the 529 beneficiary

- Each year from that point and until you hit the lifetime SECURE 2.0-determined conversion limit, convert the Roth contribution limit amount from the 529 into the beneficiary’s Roth IRA

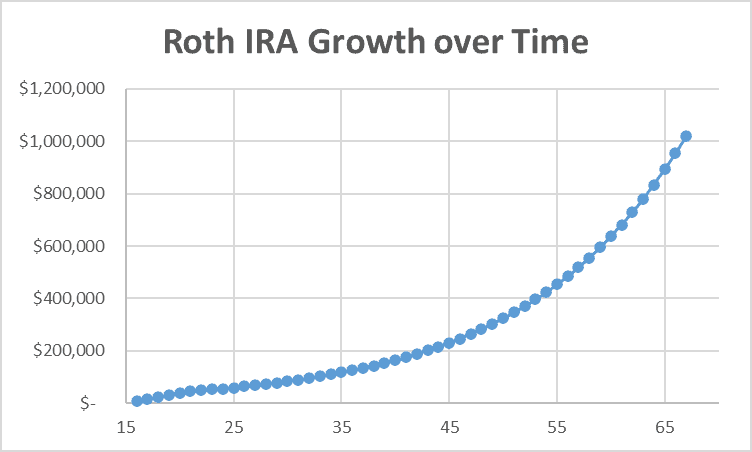

With today’s numbers, you could convert $6500 a year for five years, and another $2500 in the sixth year. Assuming a 7% annual return on investment, by the time the beneficiary reaches age 67, the Roth would be worth over $1 million tax-free dollars!

Jonathan Bird, CFP, CWS, wealth advisor at Farnam Financial is a fan, saying, “The new Roth rollover adds a great feature to 529 plans. It used to make sense to slightly underfund a 529 to avoid excess account balances that would face a 10% penalty and earnings taxation. The new Roth rollover rule provides a safety net for those excess funds. Now those excess funds can benefit your children’s retirement.”

A Few Caveats

There are a few things to be aware of.

- While there are no annual limits on 529 plan contributions, there are state-by-state lifetime aggregated contribution limits, ranging from $235k to $550k.

- Contributions that exceed the gift tax and GST exclusion may also trigger tax consequences.

- For Roth IRAs, the beneficiary owns the account, so he or she could simply withdraw the money and blow it on a fancy car or anything else they wish.

- Finally, tax law changes all the time. This means that the tax benefits and rules on using 529 plans and Roth IRAs may change in the future.

Check with your financial advisor or accountant to make sure you comply with any existing or new rules.

The Bottom Line

529 plans have many benefits, including some that are overlooked by most people. The above are 10 profitable ways to use 529 plans, many of which are simple and easy.

However, since tax laws change all the time, and even now there are state-to-state differences in some aspects, consult your financial professional to make sure you comply with all relevant laws and regulations.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor who can meet with you online, or you prefer to find a nearby financial planner, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

–

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor