Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

If you’re like most people, you’ve at least given some thought to whether you’ll be able to retire and how to try and get from where you are now to retirement.

If you’re like most people, you’re also unlikely to retire comfortably.

These Risks Mean Your Retirement Could Be Less Comfortable Than You Hoped

Let’s start with Social Security.

For simplicity, let’s assume you’ll be single when you retire. US News & World Report quotes US Census data showing over 31% of men and 55% of women aged 65 or older are single, so it’s almost likely as not to be the case.

According to DQYDJ, the median income of 67-year-olds is $50k, so let’s assume that’s what you’ll make before retirement.

Using the Social Security Administration (SSA) formula, your retirement benefit at full retirement age would be about $24k a year (and we’ll ignore the pesky 20% drop in benefits likely to happen around 2034).

However, you’ll have at least some money set aside by retirement age, right?

Sure, but how much?

Also, according to DQYDJ, the median net worth (excluding home equity) for people in their early 60s is $90k. Using the “4% rule,” you’ll be able to safely draw $3.6k in your first year of retirement from such a portfolio.

Adding that to your estimated Social Security retirement benefit, you’d need to live on about $28k/yr.

Financial professionals estimate your retirement spending should be 80% of your pre-retirement budget (since you won’t need to save for retirement, your taxes will be lower, and you won’t need to cover work-related costs like commuting), so you’d like to live on $40k (80% of your current $50k income).

But you’ll only have $27k a year.

That’s more than a 30% additional “haircut” to your budget beyond the expected 20% decrease.

Ouch!

What Can You Do to Improve Your Retirement (with a Lower Risk of Running Out)?

You can do any of the following 7 simple (though not necessarily easy) things to reduce your retirement risks:

1. Increase Your Income so You Can Save More for Retirement

This can be through learning new skills to increase your salary potential, taking on a second job, and/or starting a side hustle. If you can increase your income, your savings amounts will go up even if you don’t change your savings rate.

That leads us to the next idea…

2. Increase Your Savings Rate so You Can Save More for Retirement

Ramit Sethi of “I Will Teach You to Be Rich” fame suggests setting aside at least 10% of your income to (short-term) savings and 20% to (long-term) investments.

This has the dual benefit of increasing how much you retire on, while also reducing your standard of living so retirement is less expensive.

Can’t fathom the idea of getting to a 30% savings rate?

If you follow my advice, you’ll be able to do it without feeling any expense-cutting pain!

Just allocate at least half (I prefer 2/3) of each salary increase and/or bonus toward retirement. Over time, this could increase your savings rate, potentially to 50% or more, with zero pain.

3. Change from the Outdated Static 4% Rule to the Dynamic “Guardrail Approach”

Using the guardrail approach, you can safely draw 25% more (initial draw of 5% rather than 4% of your nest egg) and cut your risk of running out of money by a factor of 3!

The gist of the method is to annually adjust your prior-year draw by inflation (like with the 4% rule). However, you then recalculate what percentage the new draw is of your then-current portfolio. If the fraction is over 6%, trim it by a tenth. If it’s under 4%, boost it by a tenth.

4. Reduce Your Fixed Expenses as Much as Possible in Retirement

For any given budget, if nearly all of it is fixed costs (think mortgage/rent, utilities, insurance, etc.) that you can’t easily change, you don’t have much flexibility to reduce spending whenever your portfolio takes a hit due to a market crash.

On the flip side, if your expenses are mostly discretionary, you can trim spending rather easily to avoid selling too many shares in a down market. Then, when the market recovers, you can go back to spending more.

Research shows that going from a nearly all-fixed budget to a nearly all-flexible one lets you increase your safe draw more than 3-fold.

5. Purchase Fixed Income with a Portion of Your Portfolio

A new report titled Paving the Way to Optimized Retirement Income was released by asset manager BlackRock and the Bipartisan Policy Center (BPC), a Washington-based think tank. The report suggested that people saving for retirement can increase their retirement spending and reduce their risk of running out of money by purchasing fixed income (e.g., annuities) with a portion of their portfolio.

The report presents a case study where a 35-year-old worker making $44k, setting aside 5% for retirement, and who already has a $19k nest egg. If the worker purchases annuities with part of his annual savings, such that by retirement that investment is 30% of his nest egg, the report claims a 5% average increase in safe retirement spending and a 5% average reduced risk of running out of money.

6. Delay Retirement and Claiming Social Security to Age 70

As Nationwide reports, 25% of near-retirees are now planning to delay social security, and another 15% don’t expect to ever be able to retire.

The extra time lets you continue to save another few years, gives your existing portfolio more time to compound, and reduces the length of retirement you need to fund.

Meanwhile, Your Social Security benefit will increase by 8% for each year you delay claiming past your full retirement age, up to age 70. If you were born in 1960 or later, that works out to a 24% benefit boost for life. Even better, you still get cost-of-living adjustments each year.

The above-mentioned BlackRock/BPC report also mentions that delaying retirement and claiming Social Security by two years (the report assumed delaying from age 65 to age 67), the increase in safe spending went up another 16%, and the risk of running out dropped by a similar 16%.

7. Consider a Reverse Mortgage

If you own your home, you may be able to convert your equity into a lifetime income stream through a so-called reverse mortgage. This is where a lender pays you an agreed monthly amount for life (or until you sell the home).

The lender gets repaid the pre-agreed amount when you die (or sell the house), but no matter how long that takes and how much they paid you over that time, they don’t get more than the proceeds of selling the house.

This is a complex product, so you’d be well served to consult a professional before pursuing it.

Do Annuities Stack Up to Investing in Stocks and Bonds?

Using the Schwab income annuity calculator, we can estimate what income you could get from a single-premium immediate or deferred annuity. For our comparison, let’s assume the income is for a single man living in Maryland, and that the income will start when he reaches age 67.

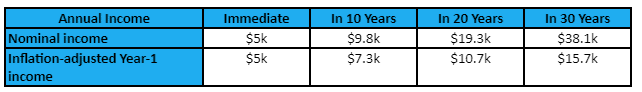

For a $100k investment, the estimated annual payouts are as follows (“single life only” and assuming a 3% annual inflation rate for the next 30 years). We assume here only that single $100k investment.

The lower row shows the estimated purchasing power in today’s dollars of the income in the first year when the retiree hits age 67. Inflation will continue to erode the purchasing power of that income each additional year of retirement.

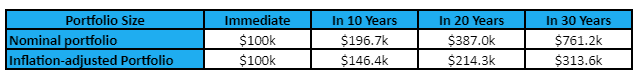

Next, let’s look at the growth of $100k invested in a mix of stocks and bonds that returns 7% a year. Here too, we assume no additional investment.

Using the 5% safe draw from the Guardrails Approach, here are the Year-1 draws from these portfolios.

Comparing the two options’ inflation-adjusted incomes, we find:

- For immediate income, the annuity wins $7.7k vs. $5.0k – over 50% higher!

- For a 10-year deferment, the annuity still comes out ahead, $9.8k vs. $7.3k – a healthy 34% edge.

- For a 20-year deferment, the annuity still comes out ahead, $11.7k vs. $10.7k – a slight 9% edge.

- For a 30-year deferment, the annuity loses out, $11.3k vs. $15.7k – a 28% underperformance!

For all but the longest deferment periods, single-premium fixed annuities offer a higher income for any given investment amount, but for immediate annuities, that edge is greatest.

This agrees with the advice of Michael Hunsberger, ChFC®, Owner, Next Mission Financial Planning, LLC, who says “Guaranteed income is important in retirement as the Blackrock/BPC study suggests, allowing retirees to feel more comfortable spending because they know they have money coming in every month. I typically advise clients to maintain flexibility by purchasing an annuity when they need it and to not use it as a savings vehicle during their accumulation period.”

However, that just compares income from the two sources at Year 1 of retirement. Using the guardrails approach to safely draw from a portfolio over decades lets your income gradually rise to match inflation, while annuity payments don’t increase. Over a 20+ year retirement, this could dramatically degrade the benefit of annuities.

Chris Chen, CFP®, CDFA®, Insight Financial Strategists agrees, noting, “The insurance industry has been on a roll trying to sell more annuities. However, most annuity contracts out there aren’t inflation-adjusted, such that with a standard contract and the long-term average inflation of 3.5%, benefits drop by half over 20 years (nearly half of those retiring at 65 will live past 85). This means retirees counting on annuities will have a lot less income over time than they expected. Somehow, this issue continues to be unaddressed by insurance companies.”

Caleb Vering, Associate Wealth Advisor, Farnam Financial, doesn’t think annuities are a slam-dunk case either, saying, “Annuities, while they may sound good on their face, have many disadvantages investors should consider. High fees, lower returns than stocks, and complex rules. They also often limit liquidity and make it difficult to draw on your savings if, for example, you had a large medical expense to cover in retirement.” Jorey Bernstein, Executive Director, Wealth Manager, and Founder, Bernstein Investment Consultants agrees with all these points, adding, “That’s why it’s crucial to get personalized advice and explore all your options before making big decisions about your retirement savings.”

P. Timothy Uihlein, CFP®, MBA, Partner, Managing Director, and Senior Wealth Manager at Vincere Wealth Management, also isn’t convinced annuities are the answer, suggesting an alternative, “Fixed-income instruments won’t necessarily prevent you from running out of money. While they can help and add diversification, I’d argue a bond or CD ladder is often a better alternative than an annuity, especially from a cost standpoint.”

A final drawback is that the annuity leaves nothing behind to heirs (unless you pick some other option such as “single life with 10 year certain,” “single life with 20 year certain,” “single life with cash refund,” etc., any of which reduces your annual income.

However, if you’re single and have no heirs, that may not concern you.

Apply These Tips to Reduce Your Retirement Risks

If you’re like most people, a comfortable retirement isn’t a given for you.

You’ll need to do much more than most people do to build up a nest egg big enough to support a comfortable retirement with a low risk of running out of money and experiencing poverty in your old age.

This article describes 7 simple (but not easy) paths to escape that fate and reduce your retirement risks, including the possibility of using a portion of your nest egg to buy a low-cost single-premium fixed annuity, guaranteeing a portion of your retirement budget will always be covered.

Typically, for a retiree to be financially safe, it’s best to minimize fixed expenses and maximize fixed income, at least to a point.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

What to Read Next:

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor