Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The SECURE Act 2.0 makes 529 plans more attractive vehicles for saving and investing, both for higher education and beyond, like a Roth IRA.

I’ve written about them before. 529 plans are a great way to save for your kids’ college education, offering valuable tax benefits. And if your kids do get a college degree, they’ll make as much as $900,000 more over their lifetime, according to Social Security Administration research.

That by itself can help your children become millionaires.

The problem is that if you set aside thousands of dollars a year from when your child is born, you face the risk that many tens of thousands of dollars may end up “stranded” in your kid’s 529 plan.

How Money Can Get Stranded in a 529 Plan

Say your daughter gets enough scholarship money that she doesn’t use up the full balance of her 529 plan. Or, she may decide not to go to college at all.

In these scenarios, you have a few options, but none of them is great.

- If your daughter went to college but didn’t need (all) her 529 funds, she may want to use the remainder for graduate school. However, only 37% of college graduates continue on to get graduate degrees, so the odds are against this.

- You can change the beneficiary (to another child, a grandchild, your spouse, yourself, a brother, a sister, a father or mother-in-law, a step-sibling, a first cousin or spouse, a niece or nephew or spouse, an aunt or uncle, etc.). However, it may be impossible to find one of these relatives who still wants to go to school, doesn’t already have their own 529 plan, and to whom you want to provide this sort of financial support, so this isn’t as helpful as one would hope.

- You can bite the bullet and use the 529 balance for your kid’s non-qualified expenses, in which case they’ll pay their regular income tax rate plus a 10% penalty. Again, not great.

But with the new Setting Every Community Up for Retirement Enhancement (SECURE) Act 2.0 signed into law by President Biden at the start of 2023, there’s a fresh way to use money stranded in 529 plans to make your kid a wealthy retiree.

What the SECURE 2.0 Act Now Permits Regarding 529 Money

The new law has a provision that lets parents transfer 529 money to the beneficiary’s Roth IRA. However, this isn’t a blank check. It comes with some significant restrictions, including:

- You can only transfer up to $35,000 in total.

- The transfers are subject to the IRS’s annual Roth IRA contribution limits ($6500 in 2023).

- The 529 plan must have been open for at least 15 years (but if you opened it when your daughter was born, that’s already handled by the time she goes to college or declines to do so).

- You can’t transfer contributions made in the most recent five years or any earnings from those (however, if you simply wait five years past your most recent contribution, this too, is resolved).

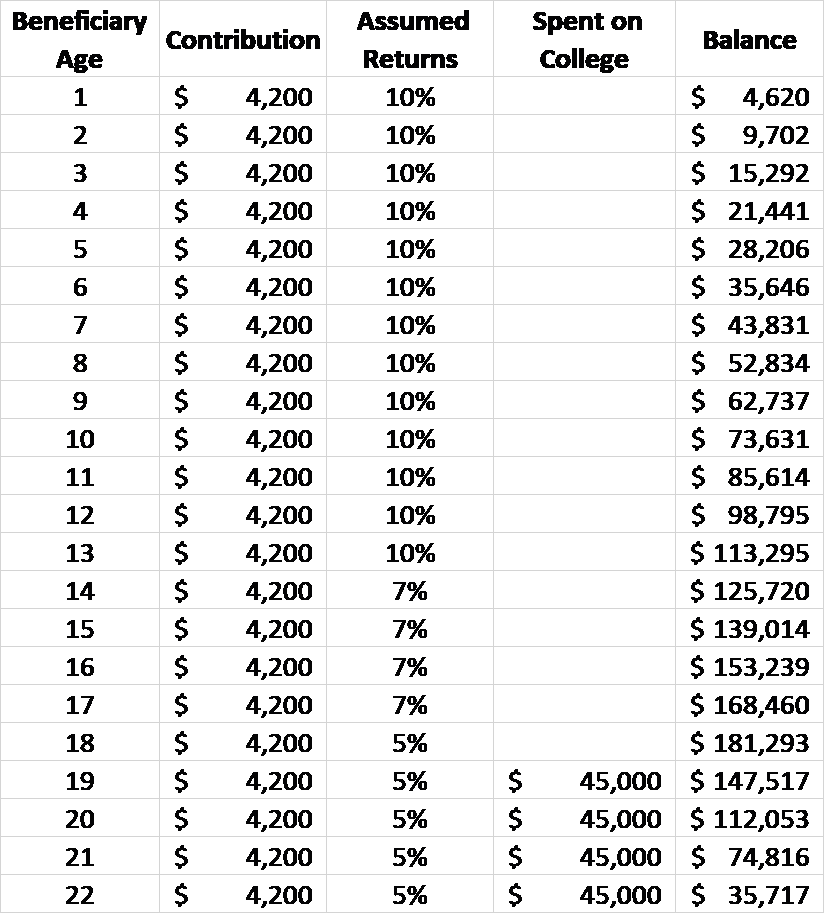

The following table shows an illustration of how things could develop under the following assumptions:

- You start funding a 529 plan when your daughter is born, adding $4200 each year.

- You invest it, e.g., in stock mutual funds returning an annual 10% until she turns 14.

- You then shift to lower-risk funds, accepting a 7% return until she turns 18 and starts attending college.

- You then reduce risk further, accepting a 5% return until she graduates.

- She attends a school where the annual cost of attendance is $45,000 (in qualified expenses).

As you can see, this scenario leaves just over $35,000 “stranded” in the 529 plan when your daughter graduates (and of course, I made sure my assumptions led to that result, but it’s a plausible illustration).

Under the new rules, here’s what you can do with that money…

Turning $35k of Stranded 529 Money into Tax-Free Millions in Retirement Money

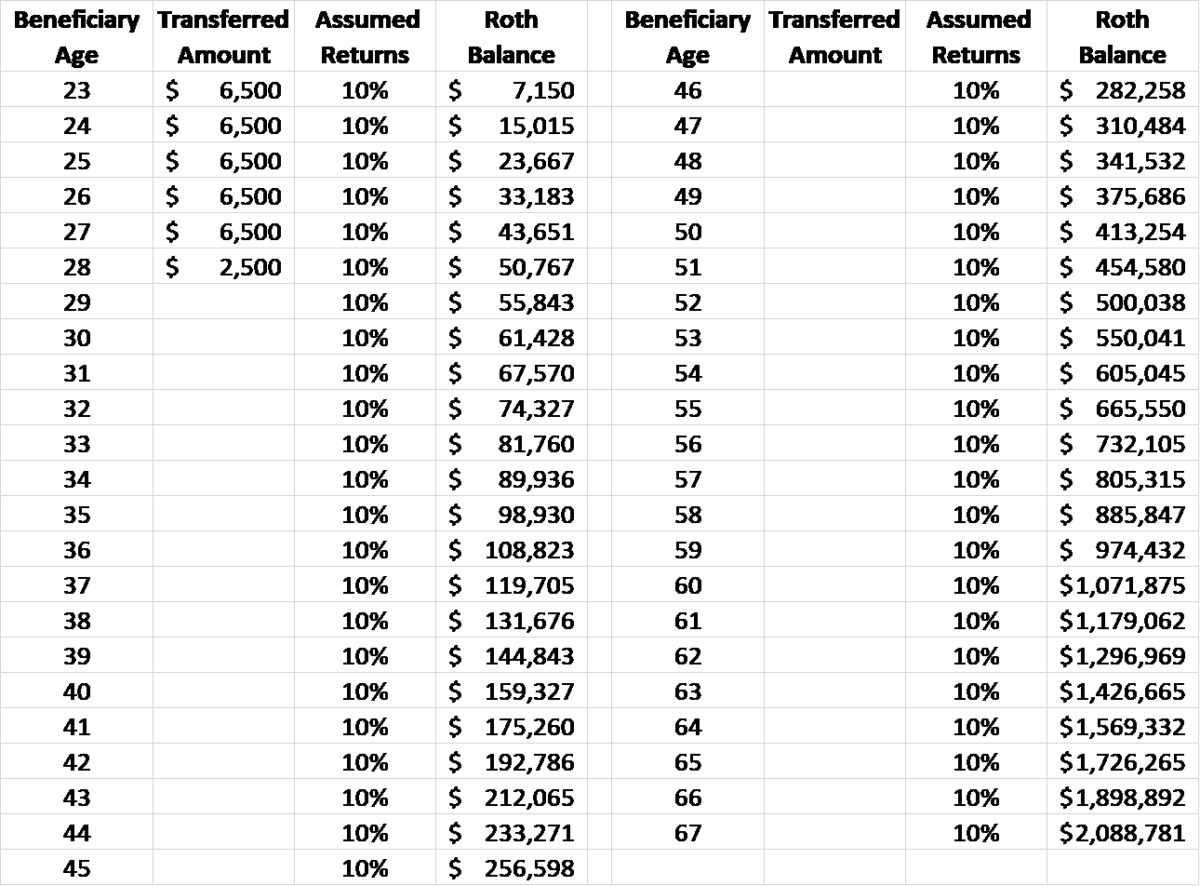

So, continuing with the above illustrative scenario, you decide to take the government up on its new program and transfer money from the 529 plan into a new Roth IRA your daughter opens for that purpose.

Following the restrictions, you only transfer the allowed annual amount, currently $6500, each year for five years, and then just $2500 more in the sixth year since that brings you to the $35,000 total limit.

Since your daughter is just starting her career, it’s safe to say she wouldn’t have been able to fully fund her IRA anyhow. If she has enough excess earnings, she can put those into her employer’s 401(k) plan.

Your daughter invests all this money in stock mutual funds, with an assumed annual return of 10%.

The following table shows how her Roth IRA balance grows over time until she turns 67, by which time the IRA is worth nearly $2.1 million.

Even better, since this is a Roth IRA, she never has to pay a dime in taxes on any withdrawals, and as icing on the cake, if she has more retirement income than she needs from other sources, she doesn’t ever have to take a dime out in Required Minimum Distributions (RMDs).

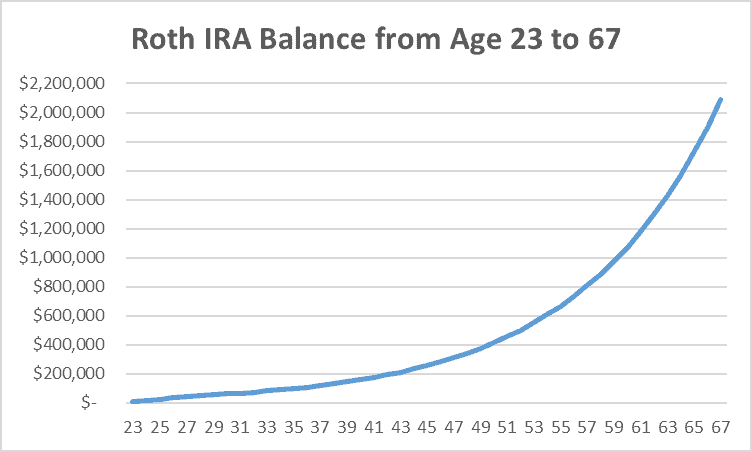

In case you’re a more visual person, here’s the same data in graph form.

What Do the Pros Think?

Bradley Hilton, Founder of Sonas Financial Planning, says, “This new provision is so fascinating to me. I get asked all the time by parents how they can fund a Roth IRA for their children. Well, unless their child has earned income, they’re usually out of luck.

“However, this new provision allows them to not only save for their child’s education but now to also give him or her a leg up on retirement savings! This can be both a wonderful additional retirement savings strategy for children and a welcome release valve for over-funded 529s.”

David Barfield, CFP®, Founder / Financial Planner, Datapoint Financial Planning, LLC adds, “Many of my clients are in their early parenthood years, have high incomes, and are saving north of 25% of gross household income toward financial independence.

“I’m often asked about 529 plans…how much to save, how long to save, and whether a taxable brokerage account earmarked for college would be preferable to a 529. The fear I hear the most is around over-saving for college and stranding money in 529 accounts.

“Typically, I advise clients to save to 529s early on but to transition to taxable brokerage accounts later before 529 account balances grow too large. It’s more art than science, and the number of kids factors in as well. This new provision takes a little of the uncertainty out of the equation by giving my young clients comfort in knowing they can transfer at least some of the remaining unused 529 dollars to a Roth IRA for the kids’ benefit.”

Doug ‘Buddy’ Amis, CFP®, President and CEO, Cardinal Retirement Planning, Inc. thinks this new provision is a great idea. He says, “In my experience working with families, education funding and financial stability are two typical goals. This provision can help make 529 contributions more versatile like a Swiss Army knife, potentially increasing their priority in a funding plan/budget due to this long-term versatility.

“I was relieved to see that there is an upper limit connected to the 529 plan conversions; this limits the benefits that higher income couples and higher net worth families can accrue in a 529 plan system that has created so-called ‘Dynasty 529 Plans’ that can fund education for multiple generations tax-free.”

Finally, Christopher J. Berry, JD, CFP®, CELA®, founder of Castle Wealth Group says, “The people who most benefit from this new provision are those who:

- “Have already paid for their children’s higher education expenses and have funds remaining in their 529 plan;

- “Are in a lower tax bracket now than they expect to be in the future, and thus would benefit from paying taxes on the conversion at a lower rate;

- “Want greater flexibility in how they use the money in the 529 plan —transferring those funds into a Roth IRA allows them to be used for any purpose, not just higher-education expenses;

- “Want to pass on retirement savings to their heirs — Roth IRAs are tax-free when passed on to beneficiaries, whereas 529 plans may be subject to taxes and penalties when inherited.

“Note that transferring 529 funds to a Roth IRA may not be right for everyone, so it’s a good idea to consult with a financial advisor or tax professional before making such a transfer.”

The Bottom Line

First, as a caveat, few people can afford to place $4200 a year into their kid’s 529 plan each year from their birth until they graduate from college. I certainly wasn’t in such a position for any of my kids.

Not even with the state tax break you get from Maryland.

Second, this scenario requires your daughter to keep her hands off the Roth IRA money for decades, despite having the legal authority to take out any contributions (yours or hers) tax- and penalty-free once the account has been open for five years.

However, if your situation is anything like my illustrative case, SECURE 2.0 just gave you a way to turn $35,000 stranded in a 529 plan into potential millions in tax-free retirement money for your kid.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor