To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

In 1716, Christopher Bullock wrote, “Tis impossible to be sure of any thing but death and taxes.” Two centuries later, researchers keep trying to disprove the first, while Washington DC seems intent on proving the second.

However, through the law of unintended consequences, Congress made it possible for you to make your kids millionaires without them having to pay a dime in taxes!

What’s even better, it’ll cost you less than $20,000 per kid!

Like most parents, we do everything we can to help our three kids succeed. This includes putting them through college, which these days is a six-figure expense per student in most decent schools.

Still, this is a good investment based on information from the Social Security Administration that says a college degree increases lifetime earnings by more than $630,000, and a graduate degree may be worth over $1,100,000.

While a college degree can generate a lifetime return of 500% or more, I’ve come up with a hack that significantly tops that lifetime return on your investment.

What You Need to Help Your Child Become A Millionaire

To make this work, you need just three things.

- A business willing to hire your teen(s), paying enough to make at least $5500 a year working part-time

- Your teens’ willingness to work while in school and their agreement to invest $5500 of earnings each year without touching it until retirement (this is a tough one, which is why you need the next and final piece)

- Since most teens aren’t big on delayed gratification, you need $2750 a year for seven years, to gift your teen $0.50 of spending money for each dollar she invests

How Does It Work?

When Congress passed the Taxpayer Relief Act of 1997, they established the Roth IRA. In this individual retirement arrangement, you contribute after-tax money, but no taxes are ever due on withdrawals in retirement. The critical part is that contributions must come from income earned on work.

Now before you object, “you said this is without paying taxes and now you say contributions have to be after tax!” — that’s why I said you need a teen, who will likely not earn enough to owe income tax and who has a very long time until retirement.

- From age 16 until graduating from college at age 22, your teen work and earn at least $5500 each year

- You help your teen open a Roth IRA (e.g., with a low-cost, no-load S&P 500 index fund or a good target-date retirement mutual fund)

- Each payday, your teen invest her entire paycheck, until the year’s total hits the Roth IRA contribution limit (currently $6000 in 2021)

- Unless your teen is happy delaying spending any of those earnings for a few decades (yeah, right!), you offer a match of $0.50 spending cash for each dollar sent to the IRA

- If needed, you help your teen file annual tax returns that will most likely show no tax owed

What’s the Result?

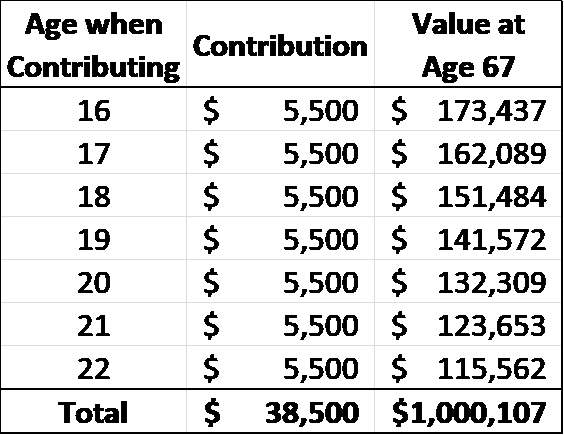

I created the following (very simplified) table with an assumed average annual return a tiny bit over 7% (US stock market annual returns have averaged about 10% since before the Great Depression), and a retirement age of 67. As you can see, with $5500 annual contributions from age 16 to 22, your teen would have over million at retirement.

That’s it! Your teen contributes $38,500. You partially match that at a total cost of $19,250. Your teen retires as a millionaire even with no other retirement investment; and since it’s a Roth, withdrawals in retirement are tax-free so this is worth much more than the same million dollars in a tax-deferred account.

What’s the Catch?

There are of course a couple of caveats (aren’t there always?), but they’re not too bad. First, stock market returns aren’t guaranteed; but over a 45-to-52-year period, they should be reasonably safe.

Second, inflation will nibble at the dollar, so a million bucks will be worth a lot less 52 years from now than they’re worth today. Still, it’ll be a whole lot more than most people have when they (want to) retire these days.

Not a bad return for less than a single year’s cost of attendance at a good state university, wouldn’t you say?

Disclaimer

This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor