Is a Financial Advisor Who Offers Subscription Pricing Right for You?

Over the last several years, Americans have grown accustomed to subscription-based pricing, from streaming television services like Netflix to cell phone apps and software.

And today, a number of financial advisors are offering financial planning services with subscription-based pricing, charging their clients a monthly, quarterly, or annual subscription fee.

These services can range from $50 per month to $500 per month (or more), depending on the level of service and support provided.

Most of these subscription-based financial advisors will charge a one-time fee upfront to get started, then a recurring subscription fee for ongoing services you receive throughout the year.

Depending on the level of service you sign up for, there are usually “packages” that offer a limited amount of annual meetings, financial plan and/or portfolio reviews and 1:1 time with your advisor. Typically, the more you pay, the more access and guidance you’ll have available to you from your advisor.

How to Find the Best Subscription-Based Financial Advisors for You

📍 Click on a pin in the map view below to discover financial advisors who offer subscription pricing and can work with you to develop a personalized financial plan. Or click the Grid option to view these advisors in a directory.

📍Double-click or pinch pins to view more.

Expert Insights: What are the Benefits of Hiring a Subscription-Based Financial advisor?

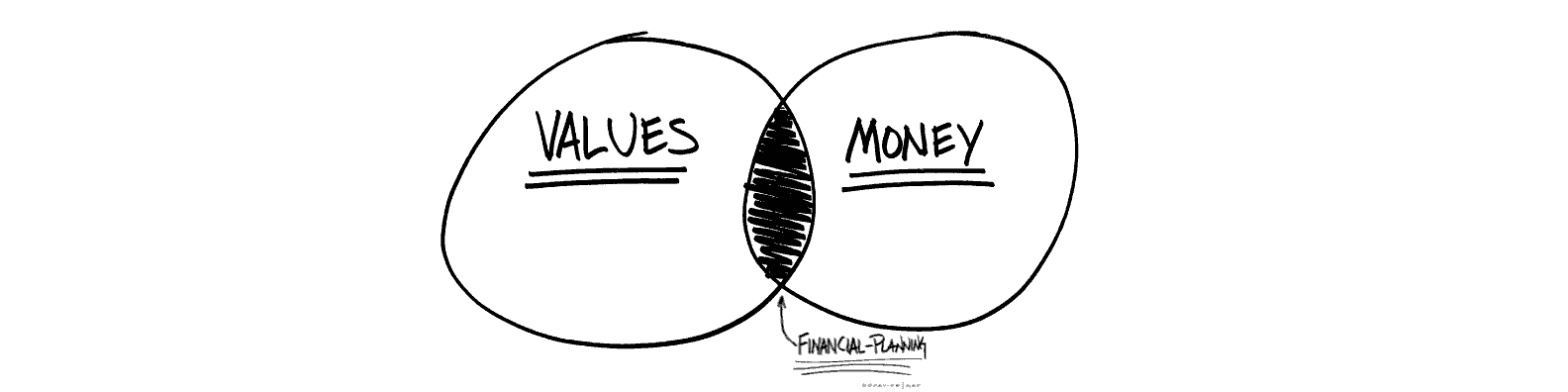

The subscription model creates a win-win for clients and advisors. The client is getting a true fiduciary relationship with no limit to financial products and the advisor is being compensated for their knowledge.

Sean Polley, CWM® | Polley Wealth Management

Are You a Subscription-Based Financial Advisor?

👋 Hi there! We’re excited to help more people understand the benefits of working with subscription-based financial advisors. And we want to help connect people to the best financial advisors for their individual needs. If you are a subscription-based financial advisor, we encourage you to join our growing community of financial advisors featured on Wealthtender so we can add you to this guide soon. Click here to learn more and get started.

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian