Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Answering 7 crucial questions…

If you’ve ever thought of life insurance, it was probably colored by the instinctive unease of thinking about your mortality – the fact that one day you’ll no longer be among the living.

After all, that’s the main reason to buy life insurance – making sure that your passing, as traumatic an emotional loss as it’s likely to be for your loved ones, won’t also be a financial catastrophe.

There are many financial responsibilities life insurance can help cover:

- Replacing income: With you gone, a significant part of your family’s income will likely also go away.

- Paying off debts: Paying a mortgage, student loans, auto loans, credit card balances, etc., likely makes up a large part of your family’s budget. Paying these off reduces ongoing income needs.

- Succession planning for a business: If you’re a key person in a business, life insurance can provide capital to mitigate problems caused by your passing, e.g., hiring a (possibly higher-cost) replacement.

- Compensating heirs: If your estate comprises assets difficult to split equally, especially if your heirs don’t get along, life insurance can compensate those who don’t get a fair share of such assets.

- Estate taxes: If your estate is large enough to trigger estate taxes, especially if it comprises mostly illiquid assets (e.g., real estate and/or businesses), a death benefit can cover estate taxes without forced selling of assets at a difficult and potentially inopportune time.

- Funeral expenses: Your passing will likely be traumatic for those you leave behind. Covering the significant expenses of your funeral and burial avoids making a terrible time even worse.

- College expenses: If you have young children and haven’t set aside enough to cover the full cost of college attendance, life insurance can let them attend their preferred schools.

- Charitable giving: If you’re keen on leaving a larger bequest for a charity or your alma mater than your estate allows, a life insurance policy can make that possible.

However, life insurance policies can also help in a variety of ways while you’re still alive, including:

- Long-term care (LTC): If you lose your ability to carry out for yourself two or more of the six so-called Activities of Daily Living (ADLs: bathing, eating, dressing, transferring (e.g., in/out of bed/chair), continence, and toileting), you’ll need expensive help with these. LTC coverage is often available as a rider on life insurance policies (increasing premiums).

- Loan collateral: Some policies can be used to secure loans that would otherwise be more expensive or not available.

- Access to loans: Permanent (not term) life insurance policies typically have a “cash value” associated with them that can be borrowed from.

- Tax-free retirement income: This is what Life Insurance Retirement Plans (LIRPs) are all about, as explained below.

What Is a LIRP?

Any permanent life insurance policy with a cash value component that will help fund your retirement serves as a LIRP. Since you can borrow or withdraw from the policy’s cash value after age 59½ with no taxes owed except on gains, LIRPs have many of the tax benefits of a Roth IRA. Since term life policies have no cash value, they cannot be LIRPs.

With a LIRP, you pay in more than the required policy premiums, thereby building your cash value faster. Letting that value grow until retirement lets the LIRP be used as part of your retirement planning. LIRPs aren’t formally retirement plans in a legal sense. However, they can serve a similar purpose with similar tax benefits.

How Does Cash Value Work in a Permanent Life Insurance Policy?

As mentioned above, the part of each permanent life insurance policy’s premium payment exceeding what’s needed to cover your death benefit builds up the policy’s cash value – a sort of tax-deferred savings account under your name and linked to the policy. Your policy type determines how returns on that value are calculated.

This may be a set fixed interest rate, or a variable return linked to a market-based index such as the S&P 500, albeit with a ceiling above which returns go to the insurer and a floor that preserves your principal.

The cash value is usually used to pay your premium for you (once it’s high enough) and/or to increase the death benefit. However, once it reaches an amount set by your policy, you can withdraw and/or borrow against a portion of your cash value (typically up to 90%). As long as the withdrawals and/or loans aren’t more than the amounts you paid into your cash value, these withdrawals/loans can provide tax-free retirement income.

One caveat is that if you borrow and die before paying it back, this will decrease the death benefit to your beneficiaries.

How Can You Use a LIRP in Retirement?

First, you build up a large cash value by over-funding your policy.

Then, once you retire, you borrow against (typically up to 90% of) the cash value that built up over your working career. As long as you don’t exceed the policy’s limit, you can borrow any amount(s) you want whenever you want.

For example, if you spend more than your Social Security benefits, portfolio returns, and/or other income sources will cover, you can borrow from your LIRP as needed to cover the gap (e.g., monthly, annually, or periodically). This can be especially helpful if you want to avoid selling shares at depressed prices during a market crash. Then, when the market recovers, you can use excess portfolio returns to pay back the LIRP loans.

Once you die, the insurer will first repay itself for any outstanding balances and accrued interest from the policy’s cash value. If that’s not enough, they’ll take the rest out of the death benefit before paying it out to your beneficiaries.

What Are a LIRP’s Pros and Cons/Limitations?

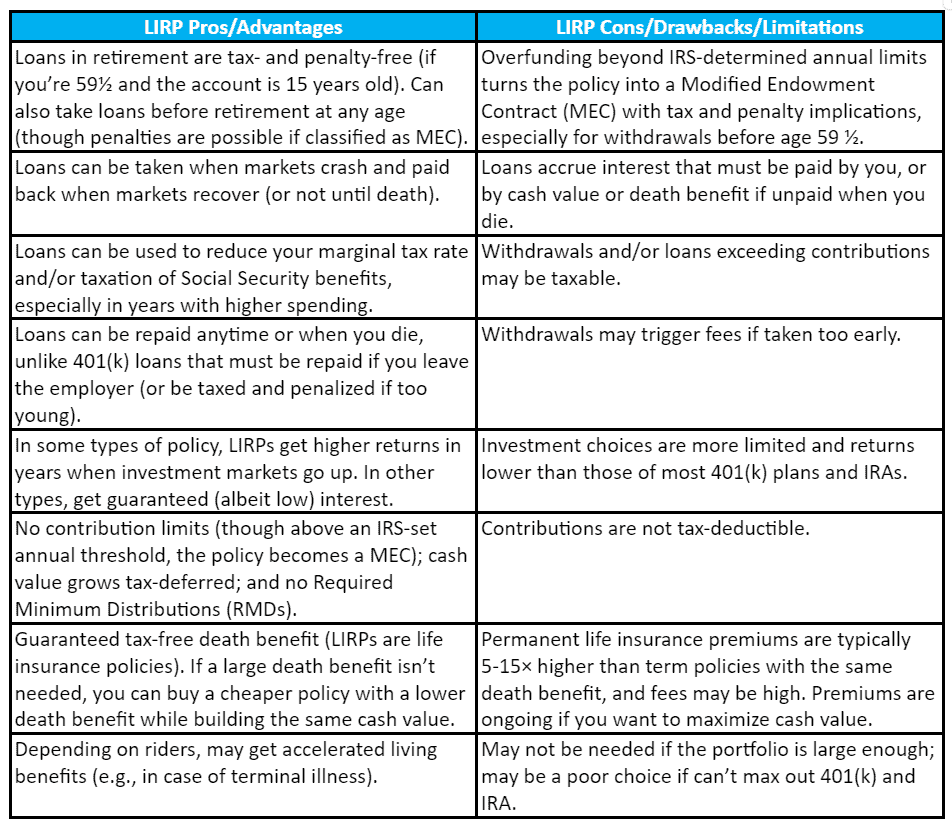

As with all things, LIRPs have both pros and cons or limitations, summarized in the following table.

Are LIRPs Better Than a 401(k) or IRA?

401(k) plans and IRAs have significant advantages for funding your retirement. These include tax benefits (tax-deferred traditional accounts or tax-free growth for Roth accounts) and possible employer matching contributions for 401(k) plans.

LIRPs, on the other hand, are funded with after-tax dollars like a Roth, but earnings are tax-deferred like in a traditional retirement plan, offering the worst of the two – traditional and Roth.

These dedicated retirement plans also typically offer a wide variety of investment options, and many have far higher average annual returns than offered by any life insurance policy.

For these reasons, most people would be better off maxing out contributions to their 401(k) and/or IRA before considering putting money into a LIRP.

When Might a LIRP Make Sense?

The situation that makes a LIRP most beneficial is if you’re already maxing out all tax-advantaged retirement plans available to you, e.g., 401(k)/403(b)/457(b) plans, IRAs, and possibly Health Savings Accounts (HSAs), but want a higher income in retirement than those will allow.

The younger you are, the lower life insurance premiums become for the same death benefit, making LIRPs less expensive.

If you expect to need to provide for your beneficiaries more than your estate will allow regardless of your age at death (e.g., you have one or more disabled children), that makes the case for the LIRP even more compelling since you need a permanent life insurance policy.

This is not the case for most people whose financial obligations and responsibilities decrease over the years as they pay off their mortgage and other debts, their children become independent adults, and their portfolio may grow enough to cover their widow(er)’s needs.

Jorey Bernstein, Executive Director, Wealth Manager, and Founder, Bernstein Investment Consultants, agrees, “A LIRP can be valuable to a client’s retirement portfolio when used appropriately. These policies let you save for retirement in a tax-advantaged way while also providing life insurance protection. LIRPs make the most sense for clients who maximize contributions to standard retirement accounts, own a business, or want to diversify their assets and leave tax-free money to heirs. However, LIRPs have higher fees and less liquidity than other investment vehicles. We always analyze a client’s full financial picture when making recommendations. For the right investor, LIRP can provide supplemental funds to help meet retirement income goals.”

What Are Your Other Options?

Assuming you need life insurance and recognize the need to fund your eventual retirement, and unless you fall into the above-mentioned category of people who’d benefit most from a LIRP, your best alternative is likely to buy term life insurance coverage and invest as much as you can in tax-advantaged plans like an IRA and/or 401(k), especially to capture your employer’s full contribution match. Note that the Roth versions are better than traditional accounts for most.

If you want to invest more than the contribution limits allow, consider low-cost deferred annuities and/or tax-efficient investing through a taxable account as alternatives to the LIRP.

Aside from their lower premiums, term policies, as their name implies, have a set term; they can also be dropped without surrender charges or other complications that often arise when canceling permanent life insurance policies.

The Bottom Line

LIRPs are far more complicated than 401(k) plans and IRAs and come with a raft of pros and cons (see the table above).

For some people, LIRPs provide a good way to set aside more money for tax-deferred growth than formal retirement accounts allow. LIRPs can provide guaranteed interest or variable index-linked returns with a floor that secures their principal and a ceiling beyond which the insurer takes excess returns.

This is especially helpful for people who also expect to always need insurance to provide for beneficiaries such as disabled children who cannot fend for themselves, even as adults.

For most of us, it’s better to buy the right amount of term life insurance only for as long as the death benefit will be needed and invest as much as we can in our 401(k) plans and IRAs. Although contributions to these are limited by the IRS, most people can rarely max those contributions.

And if you don’t expect to need permanent life insurance, even if you regularly max out your formal retirement plans, you may be better served by a tax-efficient taxable portfolio and/or deferred annuities than a LIRP.

Finally, since LIRPs are insurance policies and come with a host of complexities and costs, consult your financial advisor and life insurance agent before making such a major decision.

As Jeremy Keil, CFP, CFA, Financial Planner with Keil Financial Partners, says, “Cash-value life insurance may make sense as an alternative to bonds or CDs since the insurer generally invests in bonds so returns are usually bond-like. Often with LIRPs, the salesperson will tell you that you get ‘market-like returns’ with no chance of losing money. For some reason, they rarely mention the fact that you don’t get dividends from an indexed universal life policy, or that there are commissions, costs, fees, and surrender penalties for exiting the contract. Before buying life insurance, especially an indexed universal policy, do some research, e.g., through theiulexperiment.com and perhaps hire a fee-only insurance advisor to help you make the right decision.”

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor or prefer to find a financial advisor near you, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor