To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The trap that gets even financial experts and banks

In the mid-1950s, my parents bought their first house using a fixed-rate 15-year mortgage. The payments were exorbitant – almost half of my dad’s take-home pay. By the time they paid off the loan in the late 1960s, the same payment cost only as much as a nice dinner out for the family!

How did that happen, and what can that “ancient history” teach you that can save your retirement plan?

The Insidious Effects of Inflation

If you’ve read much about retirement planning, you know that the earlier you start setting money aside and investing for retirement, the better. That’s because your investment returns compound over time. However, investment returns aren’t the only things that compound over time. Inflation does too, and not to our benefit.

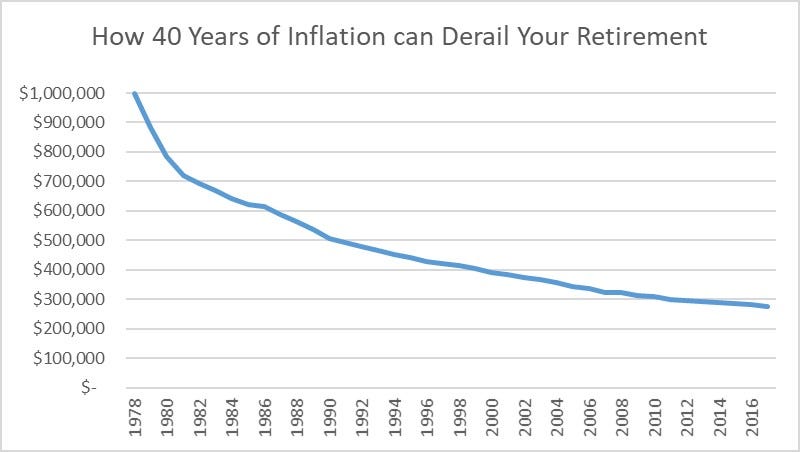

As you can see above, if you took $1 million in 1978 and stashed it under a mattress, 40 years later that million would buy less than $300,000 worth of goods as measured in 1978 dollars.

That’s an extraordinary loss of more than 70% of purchasing power over 40 years! What might shock you even more, inflation averaged just a bit over 3% per year over that 40-year period! That’s how insidious inflation can be.

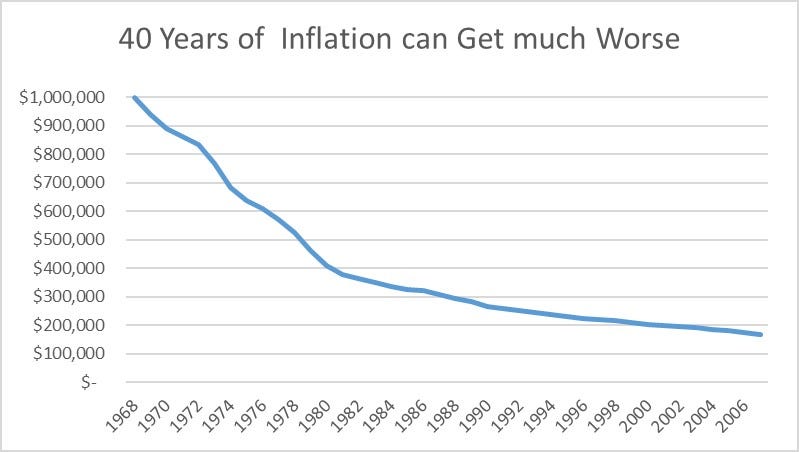

But it could actually be much worse. Had you started that 40-year period just a decade earlier, in 1968, as seen below, you would have lost over 83% of your purchasing power!

Even the Experts and Banks Usually Don’t Get this Right

As my parents’ story demonstrates, their lender didn’t account for inflation in the terms of their loan. That’s how their payment went from almost half of a monthly salary to barely the cost of a restaurant meal for five.

Similarly, if you happened to take out a 30-year fixed mortgage around the summer of 2016, you might have scored an annual interest rate of under 3.5%. If inflation goes back to its long-term average, your inflation-adjusted interest could be nearly 0%, and the investors who bought your loan might actually lose money!

If you look at the pretty projections created by financial planners, almost none of them account for inflation. They’ll talk about how much you’ll set aside each year, how you’ll split investments between different asset classes, how much each asset class may return, etc. Then they’ll give you a wonderfully large number of dollars that you should reach by the time you’re ready to call it a career.

What they will rarely if ever mention, mostly because they don’t think about it, is that the $1M+ nest egg their plan projects for you will likely be worth pennies on the dollar by the time you’re ready to start spending it!

How to Beat Inflation with Your Personal Retirement Planning

Neither you nor I have any control over inflation (even the Fed has a hard time managing that!). The only thing we can do is account for it in our planning. If you expect to retire in 40 years, make a retirement budget in today’s dollars, but then multiply it by 1.03^X (that’s 1.03 to the power of X), where X is how many years you have before you retire. Finally, to get from this projected-inflation-corrected budget to your nest egg target, multiply it by 25 (per the famous “4% rule”).

For example, if your retirement budget is $50,000 in today’s dollars, you should plan on building a nest egg that’s 25 times that amount, or $1,250,000 in today’s dollars. However, if retirement is 40 years away and inflation averages about the same 3% as it did over the past century, you’d need $50,000 × 25 × 1.03^40 or just under $4.1M, counting in the dollars of the year you’ll retire.

That looks super daunting, doesn’t it? However, with the nominal historic return of the stock market at ~10% per year, investing just over $8,000 a year in stocks (and increasing that contribution by the rate of inflation each year) for 40 years will get you there.

If you take into account that even with its problems, Social Security will probably pay out about 80% of your promised benefits, an inflation-adjusted $6,000 annual retirement set-aside just might be enough to do the job.

The Bottom Line of Accounting for Inflation

If your retirement plan fails to account for inflation, you might think that you need a lot less than what you will actually need. This could completely derail your retirement, requiring you to drastically decrease your spending, or risk running out of money before you run out of lifetime.

If you pay a financial planner to help you craft a retirement plan, ask them what inflation numbers they’re assuming, and what you could realistically expect to spend in today’s dollars from the nest egg they project for you.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor